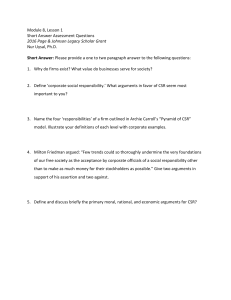

Corporate Social Responsibility in Bangladesh: Insurance Sector 1|Page Notre Dame University Bangladesh Report on Corporate Social Responsibility in Bangladesh: Insurance Sector Submitted by: 212010019- Saima Sayed Isha 212010015Mehzabin Kulsum 212010016- Din Pathan 212010004- Amirul Islam Submitted to: Israt Jahan Piya Lecturer Department of Business Administration Notre Dame University Bangladesh Dhaka-1000 Date of Submission Date: May 17,2023 2|Page Abstract The aim of this report was to assess the effectiveness of Corporate Social Responsibility (CSR) practices of some local companies operating in Bangladesh. The report specMet Lifeally focused on the extent to which companies practicing CSR complied with socialize activities. The report involved identMet Lifeation of companies providing CSR, obtaining information about the details of the CSR practices adopted at these companies (though looking at their website and an assessment of how well these companies complied with socialize activities. The report found that most CSR practicing companies practiced CSR in their own specMet Life way, and that few companies have separate units for providing CSR or get advice from CSR experts. It was often unclear how much money companies spend on CSR and it also found that many of these companies, whilst providing CSR, did not comply with the law in providing socialize activities to their employees. 1. Introduction Corporate Social Responsibility (CSR) is a signMet Lifeant aspect of modern business practices, encompassing a wide range of activities focused on creating positive social and environmental impacts. This article will explore the history, theoretical frameworks, benefits, components, and future directions of CSR, as well as the challenges and criticisms it faces. CSR refers to the voluntary efforts of businesses to contribute to sustainable development by addressing social, environmental, and economic issues. Early forms of CSR emerged in the 19th century, with philanthropic efforts by business owners to improve the lives of their employees and communities. The concept of CSR has since evolved to include a broader range of ethical, environmental, and social considerations. CSR has transformed signMet Lifeantly over the years, with a growing emphasis on sustainability and stakeholder engagement. In the 20th century, CSR began to focus on issues such as employee welfare, consumer rights, and environmental protection. Today, CSR encompasses a wide range of sustainable business practices, including ethical sourcing, emissions reductions, and community engagement. Several factors have contributed to the rise of CSR, including increasing public awareness of social and environmental issues, demand from consumers and investors for business practices, and recognition of the potential benefits of CSR for businesses. These drivers have encouraged companies to integrate CSR into their core strategies and operations, fostering a culture of responsibility and accountability. Bangladesh is a developing country. Because of global competitiveness and demand, the CSR practices and standards are being implemented in Bangladesh. Bangladesh practices CSR in both public and private sectors. Now the insurance sectors not out of the area of business world because it has direct or indirect relationship to the government, non-government and business sector. Corporate Social Responsibility practices by insurance have become an important part of modern business world. 3|Page 2. Objectives of the Study The present study has been conducted with a view to achieve the following objectives: i. to analyze the content of CSR expenditures reporting by Insurance in Bangladesh; ii. to identify the CSR expenditures areas of Insurance in Bangladesh; iii. to examine whether the insurance reported CSR expenditures according to Bangladesh Insurance guidelines; and iv. to make some recommendations for guiding further CSR development of Insurance. 3. Methodology of the Study The methodology of the study includes nature of the study, selection of the sample size, methods of data collection, and data analyses and presentations. 4.1 Nature of the Study It is descriptive research, because the aim of the present study to understand reporting practices of CSR expenditures of Insurance according to the guidelines provided by Bangladesh Insurance. 4.2. Selection of Sample Size There are several private and public conventional commercial insurance, insurance and investment insurance in Bangladesh who perform the CSR activities but the involvement of these insurance is not considered due to objects matter of this research. There are 4 insurance company: 1. Met life insurance Ltd 2. Progoti life insurance Ltd 3. Padma life insurance Ltd 4. Jibon Bima life insurance Ltd 4|Page 4.3. Methods of Data Collections Data were collected from secondary sources. Annual reports are considered appropriate documents for analysis. Annual report is a common and widely acceptable. CSR reporting practices using annual reports the key sources of information. Data also collected from policy paper, report paper, articles, websites, journals, newspapers, web portal etc. 4.4 Data Analyses and Presentations Collected data have been processed and analyzed by using descriptive statistical tools in order to make the study more informative, reliable and useful. Insurance's attention on financial inclusion of less privileged population segments and underserved economic sectors promotion of health education and cultural/recreational activities for advancement and wellbeing of underprivileged population segments promotion of environment friendly projects adoption of energy efficient, carbon footprint reducing internal processes and practices in own offices and establishments was going on. Besides continuance and extension of preceding activities in these areas, following newer drives are seen in CSR reports of different insurance: Organizing a day long training program on ScientMet Life Methods of Crop Cultivation and Plant Protection for the farmers. Farmers received theoretical knowledge and practical training on Modern ScientMet Life Methods & Techniques of Crop Cultivation and plant protection for lice. Maize Mustard, Banana, Vegetables and other High Value crops. Arranging training session in homestead gardening, agriculture and providing seeds, training on fisheries, livestock and poultry rearing for marginalized women. Each of them is also provided basic accounting and business management skills as well as sector-specMet Life technical knowledge. Taking responsibility for bearing all educational expenses up to HSC level for the two sons of late Liacot All, who lost his life while trying to save a young lady attacked by miscreants in Dhaka. Handing over Saplings to students as part of environment awareness campaign among the students Contributing a cooling system for the newborn babies of Khulna Shishu Hospital. Awarding companies for their outstanding CSR activities that created jobs, brought education to poor children and spread awareness on nature conservation. 5|Page Highlights of CSR activities: Unlike insurances, CSR expenditure of is concentrated more in the 'Art & Culture (26.71%) sector in 2019, Prominent CSR activities are: Almost all distributed blankets and warm clothes among cold-hit people of the country during winter. A homestead tree plantation project in Chittagong Hill Tracts has been sponsored. Skill development program has been conducted jointly with Fareast Knitting and Dyeing Industries Limited ILO Bangladesh Directorate of Technical Education, Gazipur Technical School and College, and CARE Bangladesh. Continuing education support to poor and underprivileged children in slum arear hearing impaired. children underprivileged children with disabilities etc Arranging free medical camp for underprivileged people Insurance company Ltd CSR activites Education Health Environment Sectores HRD Women Empowerment Others 6|Page Table: Area wise total direct CSR expenditures of Insurance (Amount in million Taka) Areas Met % of total CSR expenditure Progo ti 4.72 % of total Padma % of total CSR CSR expenditure expenditure Education 175.24 21.89 Health 226.04 28.24 Humanitarian & Disaster Relief 323.90 40.47 Sports 26.60 3.32 0.57 0.99 Arts, Literature & Culture 5.12 0.64 0.07 0.13 Environment 21.42 2.68 3.47 6.02 Others 22.11 2.76 - Total 800.43 100 57.67 Jibon Bima % of total CSR expenditure 10.83 8.19 9.7 4.93 15.27 3.28 5.69 154.5 78.59 4.11 2.92 45.55 78.98 12.4 6.31 80.3 56.97 - 0 26.02 18.46 6.7 3.41 11.75 8.34 0.5 0.25 3.5 2.48 0 12.8 6.51 - 0 100 196.6 100 140.95 100 Sources: Annual Report of Sample Insurance -2019 From the total direct CSR expenditures only one insurance; Insurance Market expend above 20% of their total fund in education sector. Jibon bima Life Insurance Limited expends above 10% but other two insurance Progoti Life Insurance Limited and Padma Life Insurance Limited expend below 10% which is 8.18% and 4.93% respectively. Met life Insurance expend highest amount (78.59%) in health program, Padma Life expend 28.24% others are below 10% of their total CSR expenditures. All the sample insurance expends highest amount in disaster management; in amount Met Life expend 323.9 (40.47%) of total CSR expenditure, but in figure Jibon Bima and Padma reported 80.3 and 78.98 percent of their total CSR expenditure. Only Jibon Bima expends lowest amount of the sample insurance which is 6.31% of its CSR expenditure. There is no direct CSR expenditure reporting on sports of Padma. From the rest insurance only, Jibon Bima reported 18.46% others two are reported below 4%. In art and culture only Met Life reported 8.34% and others are below 4% of their total CSR expenditure. Environment as CSR issues Progoti Life, Met Life, Jibon Bima Life, Padma Life reported only 6.02%, 2.68%, 2.48% and 0.25% of their total CSR expenditure. Table 02: CSR Expenditures as % after tax Profit (Amount in million) % Rank Name of Insurance Met Life After Tax Profit Total direct CSR Expenditures 3029.08 800.43 26.42 1 Progoti Life 2072.59 57.67 2.78 4 Padma Life 2220.11 196.6 8.86 3 Jibon Bima Life 798.39 140.95 17.65 2 Sources: Annual Report of Sample Insurance -2019 7|Page The table shows percentage share sample insurance use from their total after tax profit in direct CSR expenditures. MET LIFE expend highest amount of their CSR fund from after tax profit which is 26.42%, JIBON BIMA LIFE expend 17.65% others are reported below 10%. Table: Trends of Direct CSR Expenditures reported by Insurance (Amount in million) Name of 2018 2019 2020 2021 Insura Amount Amount Change % Amount Change % Amount Change % nce Met Life Progoti Life Padma Life Jibon Bima Life 410.7 309.1 (24.78) 476.4 54.12 524.5 10.10 24.5 52.9 115.92 53.2 0.57 65.1 22.37 20.9 31.3 49.76 84.1 168.69 17.8 (78.83) 80.9 90.4 11.74 126.9 40.38 119.6 (5.77) Sources: Annual Report of Sample Insurance -20121 and Review of CSR initiatives in Insurance -2021by BB. The above table shows the trends of CSR expenditures of last five years. It’s revealed that insurance is gradually increasing their CSR expenditures year by year. MET LIFE expend 24.78% less in the increasing year of 2012 than 2011 but rest of the year it reported more than its previous year. PADMA LIFE and JIBON BIMA LIFE reported their CSR expenditures more than its last years except 2014, in this year they expend 78.83% and 5.77% less respectively than the year 2013. In year 2015 PADMA LIFE expend 1004.49% more than the year 2014. Only PROGOTI LIFE frequently increase their CSR expenditures of the last 5 years positively. From the study it found that all the sample insurance directly reported CSR expenditures in the area of education, health, disaster management, arts, literature & culture, environment according to Bangladesh Insurance guidelines. In Bangladesh Insurance guideline insurance need to be expend 30% of its total CSR expenditures in education sector but, only Met Life and Jibon Bima expend 21.89% and 10.83% respectively and others are below 10%. In the study year only PADMA LIFE and Met Life reported health related CSR expenditures according to Bangladesh Insurance guidelines. Met Life, Jibon Bima and Progoti Life reported sign Met Life ant amount of their total CSR expenditures on disaster management issue. But Padma Life is lagging behind this program. From the study it is found that there are no CSR expenditures reporting practices of sports in Padma Life. Only Jibon Bima reported 18.46% and others are below 4% of their total CSR budget in sports, which mentioned that Insurance don’t consider sports as a leading countryside of CSR. Environment is the least emphasized sectors of CSR by the insurance; only Progoti Life reported 6.02% of their total CSR expenditures amount and others are below 4%. It should be noted that insurance not considered environment as their priority CSR program. The study also revealed that insurance reported in art and culture but it is not signing Met Life. insurance’s trying to increase its CSR involvement gradually. Though only MET LIFE expend one fourth of its after-tax profit in CSR expenditures inthe year 2018. 8|Page Financial Sector Corporate Social Responsibility (CSR) engagements: Indicative Guidelines for expenditure allocations and end use oversight 1. Introduction Initiated by BangladeshInsurance(B8) in 2008, the CSA mainstreaming campaign in Bangladesh's financial sector has enthused allInsurances and financial institutions into a broad range of direct and indirect CSR engagements including humanitarian relief and disaster response, widening of advancement opportunities for disadvantaged population segments with support in areas of healthcare, education and training greening initiatives arresting environmental degradation and so forth. Direct and indirect budgetary CSR commitments ofInsurances and financial institutions have increased several fold since 2008, the already substantial and further increasing levels of financial involvements in CSR engagements have understandably raised concerns about ensuring allocation of the budgetary resources on an arm's length basis free of insider interests connected to members of the boards and senior managements, as also about proper end use monitoring, the following Indicative Guidelines for allocation and end use monitoring of CSR engagements of the financial sector, drawn up in a consultative process withInsurances, financial institutions and their CSR stakeholders, are accordingly being sued, effective forthwith. These indicative guidelines are intended to cover only the CSR support initiatives in the communities outside theInsurances and financial institutions: not those to do with upgrading of working conditions, health and safety measures, gender fairness etc. for own employees that are covered by relevant labor laws and regulations. BB's GreenInsuranceing & CSR department and its Offsite and Onsite supervision departments will keep track of adherence ofInsurances and financial institutions to these indicative guidelines, at part of routine assessments of their quality of governance and internal controls. 2. Administrative setup, budgetary allocation process i. Annual CSR programs in terms of board approved CSR policies of aInsurance/financial institution will be drawn up and implemented by a dedicated CSR unit sit up its head office, or in case of larger programs, by a foundation set up specMet Lifeally for this purpose. Activities of the dedicated CSR units/ foundations will be under oversight of BBS CSR and supervision departments, besides that of theInsurances/financial institutions own internal audit and internal controls. ii. The dedicated CSR unit/foundation will propose budgetary allocations for CSR programs annually for approval of the board of theInsurancefinancial institution; the hoard will approve allocations by appropriations from annual post tax net profits. The proposals for board approval must scrupulously avoid any allocation in favor of any entity directly or indirectly connected with directors, senior management members of theInsurance/financial institution or with the trustees of its CSR foundation iii. AInsurance/financial institution with no post-tax net profit surplus may postpone making fresh CSR program expenditure commitments but should continue honoring previous commitments like educational scholarship for a student's educational course period etc.). CSR engagements in priority sector lending (like agricultural, SME and green financing) should also remain undiminished scale iv. EveryInsurance/financial institution/its foundation shall exercise utmost care in ensuring that the CSR support allocations do not end up aiding of abetting financing of maintains and terrorism. Any suspected event of such abuse of CSR assistance must be reported to law enforcement authorities, stopping the CSR assistance forthwith, failure to do so will attract penal proceedings under AML CFT laws and regulations. 9|Page 3. Expected range/coverage of allocations for CSR initiatives BB DOS Circular No 01 of June 2008 and the subsequent circulars on the subject comprehensively enumerate the expected ranges and areas of CSR engagements of Insurance and financial institutions in the communities they operate in Given the current pattern of relative urgencies of needs in diverse areas, broad adherence to the following allocation pattern will be advisable: (i) Education and job focused vocational training being crucial in widening advancement opportunities for the underprivileged population segments, around thirty percent of total CSR expenditure should be a for scholarships/stipends for students from low income family in reputed academic and vocational training institutions, and for support towards upgrading of facilities in academic and vocational training institutions substantially engaged with students and trainees from the underprivileged rural and urban population segments. Selection processes for scholarships and stipends should elicit enough information to preclude applicants from drawing benefits from multipleInsurances/financial institution sources. (ii) Preventive and curative healthcare support assistance for underprivileged population segments comes next in priority, around twenty percent of total CSR expenditure allocation in this area would be appropriate. Support assistances in this area would include direct grants towards costs of curative treatment of individual patience, towards costs of running hospitals and diagnostic centers engaged substantially in treatment of patients from underprivileged population segments, and towards costs of preventive public health and hygiene initiatives like provision of safe drinking water, hygienic toilet facilities for poor households and for floating population in urban areas, and so forth. (iii) The remainder of direct budgetary CSR expenditure allocations should be used in such other areas as emergency disaster relief, promoting adoption of environmentally sustainable output practices and lifestyles, promoting artistic, cultural, literary, sports and recreational facilities for the underprivileged, upgrading facilities and life savings equipment’s in emergency rescue services like the fire brigades etc. infrastructure improvement for disadvantaged communities in remote far flung areas and so forth. (iv) The above outlined indicative allocation guidelines are for direct budgetary CSR expenditures only. Indirect costs associated with promotion of inclusive financing for productive SME initiatives in agriculture, manufacturing and services, and for environmentally beneficial green projects are partly mitigated by such policy supports as concessional refinance lines, with the remainder to be viewed as investment costs of expanding into newer client bases. 4. End use monitoring of CSR expenditure allocations Every Insurance institution shall be responsible for monitoring of proper utilization of the CSR support assistances for the intended purposes. In case of CSR assistances to institutions/organizations, it would be advisable for the concerned dedicated CSR units/foundations to get into Memorandum of Understanding (MOUS) with the assistance recipients stipulating phased disbursements commensurate with progress in proper end use In cases of assistances to individuals, the dedicated CSR unit/foundation should collect and fille reports/documents sufficient to ascertain proper end use, withholding the assistance in unsatisfactory cases Boards of Insurance institutions should review reports of CSR allocation end use monitoring annually before approving fresh allocations for subsequent years; and all end use monitoring records should be kept available for inspection by internal and external audit . 10 | P a g e Salient CSR activities reported by Insurance company Humanitarian & Disaster Management Taraman Bibi Bir Protik, who receives lifetime support from Met Life, distributed warm clothes along with local elites in Kurigram. The initiative carries the warmth of almost 6,700 employees who have donated warm clothes for the less advantaged people of our country. Apart from donat ing warm clothes, the employees also raised funds to buy blankets to help people survive the winter. Every winter, MET LIFE Banic employees come forward to help humanity as part of for Met Life DAUR-Kallayaner Pathchala". Three teams of Met Life distributed 5,700 blankets and 3,000 warm clothes in the Northern districts Joymuni High school, Bhurungamari, and Shishu Kishore Guchchho Gram Govt. Primary School, Kungram Barbar High School Gongachora, Rangpur and Chalarong Union Parishad, Thakurgaon. Health Met Life has extended support to Society for Education & Care of Hearing-Impaired Children of Bangladesh (HICARE) to purchase Brain Stem Audiometer. Jibon Bima with the assistance of Dokters Van De Wereld (Mden, Netherlands) organized a free plastic surgery camp at Munshiganj Sadar General Hospital for cleft lip. cleft lip palate and burn injured patients. Art & Culture Moinul Ahsan 5aber won the award for his novel Akhon Primal in poetry and novel category: Mashur Arefin for his translation work 'Frantz Kafka Golpo Somogro in essay autobiography, travel story and translation category, and Badrun Nahar for his book Brospatarin Humayun Ahmed Young Writer category Environment Met Life has organized an environmental awareness program for school students on the occasion of World Environment Day Saplings are handed over to students as part of the awareness campaign among the students. In continuation of the environmental aware ness campaign taled Our Environment Our Resource across different schools, DLC and LEADS pointly organized a 3-day poster and rcycle competition and exhibition in 2014, at the Public Library Premises, University of Dhaka. More than 500 students from 12 leading schools of Dhaka participated in the compe tition reflecting their leaming from the campaign on issues such as environmental pollution and mitigation efficient resource utilization and adopting the 3R principle of reduce, reuse and recycle DLC, with support from the CHEL Project of Winrock International (an USAID project), has sponsored a home stead tree plantation project in Chittagong Hill Tracts. 3,250 saplings of fruit-bearing trees will be planted across 250 marginal households from 10 villages in the project area Dudpukuria Co-management Organization, a voluntary co-managed organization endorsed by the forest department and under the network of CREL Project, is acting as the implementing body for this plantation program. In addition to this project, another plantation program is currently underway at Trishal, Mymensingh, in partnership with Kobi Kazi Nazrul Islam University, and Toru Pallab, a voluntary organization managed by renowned environmentalists in Bangladesh. 11 | P a g e Education Progoti Life has taken responsibility for bearing all educational expenses up to HSC level for the two sons of late Lacot Ali, who lost his life while trying to save a young lady attacked by miscreants in Uttara, Dhaka. The Insurance also launched "MTB Bravery Awards at the event, which has been introduced specially to honor people like Lacot Al, and who show great courage with a spirit of self-sacrMet Lifee to save and protect the lives of other people put on peril. Standard Chartered Insurance provided scholarships to top students of Department of Development Studies and Department of Economics, Dhaka University. A total of 60 students were awarded this Governor Scholarship this year. JIBON BIMA has completed training of the 3rd batch under the development project, jointly conducted with Fareast Knitting and Dyeing Industries Limited, LLO Bangladesh Directorate of Technical Education, Gazipur Technical School and College, and CARE Bangladesh. The 19 trainces of Batch 3 were provided with completion certMet Lifeates and appointment letters at Fareast as Machine Operators. Sports Living Legend of Cricket Mr. Sachin Tendulkar and MET LIFE Insurance's officials handed over a cheque to authorities of Noapara Govt. Primary School of Rupganj Narayanganj on behalf of the Insurance. The Insurance arranged an exclusive cricket clinic for the children at Gulshan Youth Club Ground in the city. A total of 120 children participated in the meet Renowned cricketer Shakib Al Hasan joined the cricket clinic and provided valuable tips to them. Financial Inclusion In 2014, Met Life Foundation provided a funding of USD50,000/ BOT1837.sun.co to ActionAid Bangladesh (AAB) to implement its Enterprise Development through Mobilizing Women's Collective program to improve the access and control of economic resources and public services for rural marginalized women 770 marginalized women participants in this program have been mobilized into 35 groups from two district Gaibandha and Lalmonirhat. The participants are receiving training in home stead gardening, agriculture and providing seeds, training on fisheries, livestock and poultry rearing. Each of the entrepreneurs is also provided basic accounting and business management skills as well as sector-specMet Life technical knowledge. Others PADMA LIFE Insurance will build a gate named 'Freedom and Democracy' at the Klikhet entrance of the University of Dhaka at a cost of taka one crore as part of Insurance's corporate social responsibility. In this connection, a bilateral Memo mandum of Understanding (MoU) between PADMA LIFE Insurance Ltd and Dhaka University Alumni Association (DAA) was signed recently at a simple ceremony held at the DUMA conference room of the university. Met Life launched Met Life Microentrepreneur ship Awards (MMA) program for the tenth consecutive time to recognize and honor leadership entrepreneurial skills and best practices of individual microentrepreneurs in Bangladesh. The goal of this award is to promote micro enterprise and increase awareness of the financial service needs of micro entrepreneurs. More importantly, the aim of this initiative is to recognize the success stories of and put the spotlight on local microentrepreneurs who are helping to lift the economic fortunes of their communities, and bringing more capital into their developing economies. Insurance Company has donated Tk 1.15 million to Mother Teresa Research Council for purchasing new clothes and food item to be distributed among the destitute leprosy patients for observing Ed. Insurance Company handed over cheque of Tk 10:00 million to Bangladesh Mohda Samity for construction of their building. As a medium to encourage and honor effective and innovative corporate social initiatives that are positively impacting the development of our country, the bank awarded three companies this year for their outstanding CSR activities that created jobs, brought education to poor children and spread awareness on nature conservation. 12 | P a g e Conclusions Now a day's CSR is the mandatory activities of the business forms of Bangladesh especially in the insurance Ing industry. Islam is a religion, which maintains tranquility in human being as well as economic and social development. Insurance was developed to carry over this holy theme of Islam. As a nature of Insurance all over the world are being engaged in various CSR expenditures activities for getting the responsibility of protecting its stakeholders. Insurance of Bangladesh are not legged behind this concept. This study shows that the sample Islamic Insurance are following the guidelines recommended by Central Insurance but it is not perfect and up to the marks and also the reporting practices of CSR expenditures are differed from insurance to insurance. So, the insurance should follow and reported their CSR expenditures according to the prescribed form of Bangladesh Insurance to its annual report. Also, Bangladesh Insurance needs more monitoring over Insurance ' CSR activities. The result of the study also depicted that the sample insurance ‟ most important contribution in the area of environment, sports and art & culture are not notable. Hence insurance should increase their contribution in those areas. Though utmost efforts have been given to reveal the sector wise CSR expenditures of the sample insurance, they should expend more on CSR issues from their after-tax profit. This study is based on secondary data on a small sample size. In this study only considered the CSR expenditures reporting practices others variables are not used to identify the CSR reporting of insurance of Bangladesh. The result of the study cannot focus the real scenario of all Insurance of Bangladesh. A further report can be done considering more insurance as sample and identify the impact of CSR expenditure on business branding of Insurance in Bangladesh and impact of CSR contribution on the economic gain. 13 | P a g e