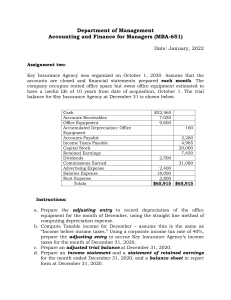

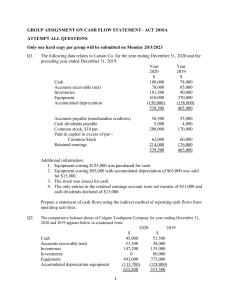

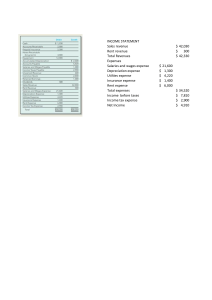

1) Wowowee Corporation 2nd year in business posted a net income of 70,000,000 for the year ended December 31, 2012. The following data are extracted from the books of accounts Depreciation 32,000,000 Decrease in accounts payable 3,400,000 Increase in prepaid expenses 1,500,000 Forex Loss 22,400,000 Dividends paid 25,500,000 The Company should report as cash provided by operations in its cash flow statement for the year ended December 31, 2012 at A. 100,100,000 B. 119,500,000 C. 100,400,000 D. 126,300,000 Use the fol following lowing informatio information n for the next two (2) questions: The statement of financial position data of Davao Company at the end of 2020 and 2019 follow: Cash Accounts receivable (net) Inventory Prepaid expenses Buildings and equipment Accumulated depreciation—buildings and equipment Land Accounts payable Accrued expenses Notes payable—bank, long-term Mortgage payable Share capital, P10 par Retained earnings (deficit) 2020 P 125,000 2019 P 175,000 Increase (Dec (Decrease) rease) (P50,000) 300,000 350,000 225,000 225,000 75,000 125,000 50,000 125,000 ( 75,000) 450,000 (90,000) 375,000 (40,000) 75,000 50,000 450,000 200,000 250,000 P1,635,000 P1,285,000 P350,000 P 340,000 60,000 P 275,000 90,000 P65,000 ( 30,000) 200,000 (200,000) 150,000 1,045,000 795,000 250,000 40,000 P1,635,000 (75,000) P1,285,000 115,000 P350,000 150,000 Land was acquired for P250,000 in exchange for ordinary shares, par P250,000, during the year; all equipment purchased was for cash. Equipment costing P25,000 was sold for P10,000; book value of the equipment was P20,000 and the loss was reported as an ordinary item in net income. Cash dividends of P50,000 were charged to retained earnings and paid during the year; the transfer of net income to retained earnings was the only other entry in the Retained Earnings account. Based of the foregoing information, compute for the following. 1) Net cash provided by operating activities. B. 130,000 A. 120,000 C. 140,000 D. 165,000 2) Net cash provided by (used in) financing activities. A. 150,000 provided B. 350,000 provided C. 100,000 used D. 250,000 used 1) Mimzee Corporation had net income for 2020 of P3,000,000. Additional information is as follows: Depreciation of plant assets Amortization of intangibles Increase in accounts receivable Increase in accounts payable Mimzee’s net cash provided by operating activities for 2020 was A. 4,560,000 B. 4,440,000 C. 4,320,000 D. 1,200,000 240,000 420,000 540,000 1,680,000 2) During 2020, Greta Company earned net income of P192,000 which included depreciation expense of P39,000. In addition, the Company experienced the following changes in the account balances listed below: Decrease Decreasess Increases Accounts receivable 6,000 Accounts payable 22,500 Prepaid expenses 16,500 Inventory 18,000 Accrued liabilities 12,000 Based upon this information what amount will be shown for net cash provided by operating activities for 2020? A. 246,000 B. 232,500 C. 142,500 D. 133,500 3) The net income for the year ended December 31, 2020, for Oliva Company was P1,200,000. Additional information is as follows: Depreciation on plant assets 600,000 Amortization of leasehold improvement 340,000 Provision for doubtful accounts on short term receivable 120,000 Provision for doubtful accounts on lo ng term receivable 100,000 Interest paid on short term borrowings 80,000 Interest paid on long term borrowings 60,000 Based solely on the information give above, what should be the net cash provided by operating activities in the statement of cash flows for the year ended December 31, 2020? A. 2,260,000 B. 2,360,000 C. 2,340,000 D. 2,500,000 4) Net cash flow from operating activities for 2020 for Spencer Corporation was P300,000. The following items are reported on the financial statements for 2020: Cash dividends paid on ordinary shares 20,000 Depreciation and amortization 12,000 Increase in accounts receivables 24,000 Based on the information above, Spencer’s net income for 2020 was B. 296,000 C. 264,000 A. 312,000 D. 256,000 5) The following information on selected cash transactions for 2020 has been provided by Mancuso Company: Proceeds from sale of land Proceeds from long-term borrowings Purchases of plant assets Purchases of inventories Proceeds from sale of Mancuso ordinary shares 160,000 400,000 144,000 680,000 240,000 What is the cash provided or used by investing activities for the year ended December 31, 2020 as a result of the above information? A. 16,000 B. 256,000 C. 160,000 D. 800,000 6) Selected information from Dinkel Company’s 2020 accounting records is as follows: Proceeds from issuance of ordinary shares Proceeds from issuance of bonds Cash dividends on ordinary shares paid Cash dividends on preference shares paid Purchase of treasury shares Sale of ordinary shares to officers and employees not included above 400,000 1,200,000 160,000 60,000 120,000 100,000 Dinkel’s statement of cash flows for the year ended December 31, 2020, would show net cash provided (used) by financing activities of B. 220,000 used C. 160,000 provided D. 1,360,000 provided A. 60,000 provided 7) During 2020, Stout Inc. had the following activities related to its financial operations: Carrying value of convertible preference shares in Stout, converted into ordinary shares of Stout Payment in 2020 of cash dividend declared in 2019 to preference shareholders Payment for the early retirement of long-term bonds payable (carrying amount P2,220,000) Proceeds from the sale of treasury shares (on books at cost of P258,000) 360,000 186,000 2,250,000 300,000 The amount of net cash used in financial activities to appear in Stout’s statement of cash flows for 2020 should be A. 1,590,000 B. 1,776,000 C. 2,136,000 D. 2,148,000 Use the fol following lowing informatio information n for the next two (2) questions: Napier Company provided the following information on selected transactions during 2020: Purchase of land by issuing bonds Proceeds from issuing bonds Purchases of inventory Purchases of treasury shares Loans made to affiliated corporations Dividends paid to preference shareholders 250,000 500,000 950,000 150,000 350,000 400,000 Proceeds from sale of equipment 50,000 8) The net cash provided (used) by investing activities during 2020 is A. 50,000 provided B. 300,000 used C. 550,000 used D. 1,250,000 used 9) The net cash provided by financing activities during 2020 is A. 550,000 provided B. 650,000 provided D. 900,000 provided C. 800,000 provided Use the fol following lowing informatio information n for the next two (2) questions: Smiley Corporation’s transactions for the year ended December 31, 2020 included the following: Purchased real estate for P550,000 cash which was borrowed from a bank. Sold available-for-sale investments for P500,000. Paid dividends of P600,000. Issued 500 ordinary shares for P250,000. Purchased machinery and equipment for P125,000 cash. Paid P450,000 toward a bank loan. Reduced accounts receivable by P100,000. Increased accounts payable by P200,000. 10) Smiley’s net cash used in investing activities for 2020 was A. 675,000 B. 375,000 C. 175,000 D. 50,000 11) Smiley’s net cash used in financing activities for 2020 was A. 50,000 B. 250,000 C. 450,000 D. 500,000 12) Stoned Company reported sales on an accrual basis of P109,000. If accounts receivable increased P31,000 and the allowance for doubtful accounts increased P10,000 after a write off of P3,000, what amount of collection does Stoned have? A. 75,000 B. 65,000 C. 85,000 D. 91,000 13) BCAA Company prepares its statement of cash flows using the direct method for operating activities. For the year ended December 31, 2020, BCAA Company reports the following activities: Sales on account 1,300,000 Cash sales 740,000 Decrease in accounts receivable 610,000 Increase in accounts payable 72,000 Increase in inventory 48,000 Cost of goods sold 975,000 What is the amount of cash collections from customers reported by BCAA for the year ended December 31, 2020? B. 1,910,000 C. 2,650,000 D. 1,430,000 A. 2,040,000 14) The following information was taken from the 2020 financial statements of Jenny Corporation: Inventory – January 1, 2020 Inventory – December 31, 2020 Accounts payable – January 1, 2020 Accounts payable – December 31, 2020 Sales Cost of goods sold 90,000 120,000 75,000 120,000 600,000 450,000 If the direct method is used in the 2020 statement of cash flows, what amount should Jenny report as cash payments to suppliers? A. 435,000 B. 465,000 C. 495,000 D. 525,000 Use the fol following lowing informatio information n for the next two (2) questions: Bubbles Corporation reported net income of P420,000 for the current period. Changes occurred in several statement of financial position accounts as follows: Equipment 35,000 Increase Accumulated depreciation 56,000 Increase Notes payable 42,000 Increase Additional information: During the year, Bubbles sold equipment costing P35,000, with accumulated depreciation of P16,800, for a gain of P7,000 In December of the current year, Bubbles purchased equipment costing P70,000 with P28,000 cash and a 12% note payable of P42,000. Depreciation expense for the year was P72,800 1) In Bubbles’ statement of cash flows, net cash provided by operating activities should be A. 476,000 B. 485,800 C. 492,800 D. 499,800 2) In Bubbles current period statement of cash flows, net cash flows used in investing activities should be A. 49,000 B. 30,800 C. 16,800 D. 2,800 3) The following information was taken from the 2022 financial statements of Winchester Corporation: Accounts receivable, January 1, 2022 Accounts receivable, December 31, 2022 Sales on account and cash sales Uncollectible accounts 108,000 152,000 2,190,000 5,000 No accounts were written off or recovered during the year. If Winchester prepares a statement of cash flows using the direct method, what amount should be reported as collected from customers in 2022? B. 2,234,000 C. 2,146,000 D. 2,141,000 A. 2,239,000 4) The following information is available from Ram Corp.’s accounting records for the year ended December 31, 2022: Cash paid to suppliers and employee 1,020,000 Cash dividends paid 60,000 Cash received from customers 1,740,000 Rent received 20,000 Taxes paid 220,000 Net cash flow provided by operating activities for 2022 was B. 460,000 C. A. 440,000 500,000 D. 520,000 5) Stiggins Corporation had the following account balances for 2022: Decembe Decemberr 31 67,200 24,600 84,000 Accounts Payable Prepaid Rent Expense Accounts Receivable (net) January 1 58,200 37,200 66,600 Stiggins’ 2022 profit is P450,000. What amount should Stiggins include as net cash provided by operating activities in its 2022 statement of cash flows? A. 436,200 B. 445,200 C. 453,600 D. 454,200 Use the fol following lowing informatio information n for the next two (2) questions: Broly Company uses the direct method to prepare its statement of cash flows. The company had the following cash flows during the current year: Cash receipts from the issuance of ordinary shares 400,000 Cash receipts from customers 200,000 Cash receipts from dividends on long-term investments 30,000 Cash receipts from repayment of loan made to another company 220,000 Cash payments for wages and other operating expenses 120,000 Cash payments for insurance 10,000 Cash payments for dividends 20,000 Cash payments for taxes 40,000 Cash payment to purchase land 80,000 6) The net cash provided/used in operating activities is B. 40,000 provided A. 60,000 provided C. 30,000 provided D. 20,000 provided 7) The net cash provided by (used in) investing activities is A. 220,000 provided B. 140,000 provided C. 60,000 provided D. 80,000 used 8) The net cash provided by (used in) financing activities is 2) The following information is available from Sand Corp.’s accounting records for the year ended December 31, 2009: Cash received from customers Rent received Cash paid to suppliers and employees Taxes paid Cash dividends paid P870,000 10,000 510,000 110,000 30,000 Net cash flow provided by operations for 2008 was A. 260,000 B. 250,000 C. 230,000 D. 220,000 Solution: Cash received from customers ............... P870,000 Add(Deduct) Rent received ......................................... 10,000 Cash paid to suppliers and employees .. (510,000) Taxes paid ............................................. (110,000) ***The answer is 260,000. Dividend payment is not included because it is a SHE item and therefore included under financing activities. 3) Mademoiselle Co. has provided the following 2009 current account balances for the preparation of the annual statement of cash flows: ACCOUNTS .................. January 1 ........ December 31 Accounts receivable ...... P11,500 .......... P14,500 Allowance for U/A .......... 400 .............. 500 Prepaid rent expense .... 6,200 .......... 4,100 Accounts payable ........... 9,700 .......... 11,200 Mademoiselle’s 2009 net income is P75,000. Net cash provided by operating activities in the statement of cash flows should be B. 72,700 C. 74,300 D. 75,500 A. 75,700 Net Income...................................................................75,000 Add(Deduct) Changes in Working Capital Accounts: Increase in Accounts Receivable..................................(3,000) Increase in Allowance for Uncollectible Accounts..............100 Decrease in Prepaid Rent..............................................2,100 Increase in Accounts Payable........................................1,500 Net Cash from Operating Activities is...........................75,700 The increase in AR is deducted from net income because it indicates that cash collected is less than sales revenue. The increase in the allowance account is added to net income because it reflects an expense (bad debt expense) which was not a cash payment. The decrease in prepaid rent is added because it too reflects an expense (rent expense) which was not a cash payment (it was an allocation of previously recorded prepaid rent). Finally, the increase in AP is added because it also represents an expense (cost of goods sold) which was not yet paid. 4) Romantic Corp.’s transactions for the year ended December 31, 2009, included the following: Purchased real estate for P550,000 cash which was borrowed from a bank. Sold available-for-sale investment securities for P500,000. Paid dividends of P600,000. Issued 500 shares of common stock for P250,000. Purchased machinery and equipment for P125,000 cash. Paid P450,000 toward a bank loan. Romantic’s net cash used in investing activities for 2009 was B. 375,000 C. A. 175,000 675,000 D. 50,000 Purchase of real estate...................................(550,000) Sale of investment securities...........................500,000 Purchase of machinery and equipment...........(125,000) Total cash used in investing activities...............175,000 The bank borrowing (P550,000), dividend payment (P600,000), issuance of stock (P250,000), and bank loan payment (P450,000) are financing activities. 5) Matatag Corp.’s transactions for the year ended December 31, 2009, included the following: * Paid P450,000 toward a bank loan. * Issued 500 shares of common stock for P250,000. * Purchased machinery and equipment for P125,000 cash. * Purchased real estate for P425,000 cash which was borrowed from a majority stockholder. * Sold available-for-sale investment securities for P325,000. * Paid dividends of P300,000. Matatag’s net cash used in financing activities for 2009 was A. 500,000 B. 1,350,000 C. 75,000 D. 750,000 Payments for bank loans..............................................(450,000) Issuance of 500 shares of common stock......................250,000 Dividends paid this year................................................(300,000) Advances from Stockholder (used to buy real estate)....425,000 Net cash used in financing activities is.............................75,000 6) In 2010, a tornado completely destroyed a building belonging to Hollyfield Corp. The building cost P100,000 and had depreciated value of P48,000 at the time of the loss. Hollyfield received a cash settlement from the insurance company and reported an extraordinary loss of P21,000. In Hollyfield’s 2010 cash flow statement, the net change reported in the cash flows from investing activities section should be a A. 10,000 increase B. 21,000 decrease C. 52,000 decrease D. 31,000 increase Building Cost...............................................100,000 Accumulated Depreciation.............................48,000 Net book value.............................................52,000 Extraordinary loss reported.........................21,000 Net cash flows from investing activities is 31,000. 7) La0 Tze Co. had net cash provided by operating activities of P351,000; net cash used by investing activities of P420,000; and cash provided by financing activities of P250,000. La0 Tze’s cash balance was P27,000 on January 1. During the year, there was a sale of land that resulted in a gain of P25,000 and proceeds of P40,000 were received from the sale. What was La0 Tze’s cash balance at the end of the year? B. C. D. A. 208,000 Answer: P208,000 To calculate the cash balance at the end of the year, you should combine the effects of the changes in operating, investing, and financing activities, and add the beginning cash balance. Net Net Cash Cash provided used from from Operating investing Activities.........P351,000 activities...............(P420,000) Net cash provided by financing activities..............P250,000 ---------------------------------------------------------------------------Net change in Add: Beginning cash ---------------------------------------------------------------------------Ending Cash Balance.............................................P208,000 cash...............................................P181,000 balance..................................P27,000 8) Marikitka Corporation accounting records show the following numbers below at the end of each year: 2012 2011 Borrowings 3,000,000 800,000 Share capital 4,000,000 2,000,000 Retained earnings 1,000,000 800,000 Old debts of 500,000 were repaid during 2012 and new borrowings include 300,000 vendor financing arising on the acquisition of a property. The movement in share capital arose from issuance of share capital for cash during the year. There was no dividend declared at the beginning and end of the current year. Net change in retained earnings comprises profit for 2012 of 900,000, net of dividend of 700,000. How much is the financing net cash inflows that should be reported in the 2012 Cash Flow statement? A. 3,900,000 B. 3,200,000 C. 3,400,000 D. 4,100,000 9) Heidi uses the direct method to prepare its cash flow statement. Pertinent account balances are: 2009 2008 Prepaid interest expense 200,000 50,000 Property, plant and equipment 5,000,000 4,500,000 Unamortized bond discount 250,000 300,000 Selling expenses 7,200,000 8,600,000 General and administrative expenses 6,850,000 7,565,000 Interest expense 800,000 150,000 Income tax expense 1,000,000 3,000,000 Allowance for uncollectible accounts 65,000 55,000 Accumulated depreciation 900,000 750,000 Income tax payable 1,100,000 1,300,000 Deferred income tax liability 200,000 400,000 Accrued interest payable 300,000 500,000 Heidi purchased P500,000 in equipment during 2009. Heidi allocated one-third of its depreciation to selling and the remainder to administrative. What amount should Heidi report in its 2009 cash flow statement as cash paid for interest? A. 1,100,000 B. 1,150,000 C. 1,200,000 D. 750,000 Interest expense Add: Prepaid interest, end. Interest payable, beg. Total Less: Prepaid interest, beg. Interest payable, end. Amortization of bond disc. Interest paid 800,000 200,000 500,000 700,000 1,500,000 50,000 300,000 50,000 400,000 1,100,000 1) The following information relates to the activities of I Miss You Company. Income tax may be ignored. Net cash flows form operating activities Decrease in trade payables Decrease in inventory Increase in trade receivables Cash proceeds from sale of plant (book value of P25,000) Increase in allowance for doubtful debts What is the profit for the period? A. 698,100 B. 730,100 C. 744,100 D. 767,100 720,000 23,000 11,500 24,600 14,000 1,000 ANSWE ANSWER: R: D Net income Decrease in trade payables Decrease in inventory Increase in trade receivables Loss on sale 25,000 – 1 14,000 4,000 Increase in allowance for doubtful debts Net cash flows form operating activities squeeze 744,100 (23,000) 11,500 (24,600) 11,000 1,000 720,000 2) The following were taken from the incomplete financial data of Sam Company, a calendar year merchandising corporation: Decembe Decemberr 31, 2005 December 31, 2006 Trade accounts receivable 840,000 780,000 Inventory 1,500,000 1,000,000 Accounts payable 950,000 980,000 Accrued gen. & admin. expense 130,000 170,000 Prepaid selling expense 150,000 130,000 PPE, net 1,650,000 1,420,000 Patent 425,000 300,000 Investment in Associate 550,000 720,000 The following additional information were made available: cash payments for selling and administrative expense was 900,000, payments for purchases, net of discounts of 70,000 was 1,530,000. Equipment with a book value of 200,000 was sold for 250,000. There were no acquisitions of PPE and other transactions affecting net income during the period There no acquisitions of investment during the year 2006. If the company reported a net income of 270,000, what is the amount of collections on trade receivables in 2006? A. 2,425,000 B. 2,470,000 C. 3,285,000 D. 3,485,000 Net income Gain on sale of equipment Income from investment in associates Depreciation Amortization of patent Selling and Admin. expenses Gross profit 270,000 ( 50,000) ( 170,000) 30,000 125,000 960,000 1,165,000 Sales Cost of sales Gross profit 3,225,000 2,060,000 1,165,000 Cost of sales: Beg. Inv. Purchases Purchase discounts Ending inventory COS Accounts payable Debit Credit 1,530,000 950,000 70,000 1,630,000 980,000 Cash paid – Selling & Admin PB AE AB AB 1,500,000 1,630,000 ( 70,000) (1,000,000) 2,060,000 Acc Accounts ounts Receivable Debit Credit 840,000 3,825,000 3,200,000 780,000 900,000 150,000 170,000 (130,000) (130,000) Selling & Admin (accrual) 960,000 Property, plant & equipme equipment nt Debit Credit 1,650,000 200,000 sold 30,000 depreciation 1,420,000 3) The following information is available from the financial statements of Wonder Corporation for the year ended December 31, 2022: Net income 396,000 Depreciation expense 102,000 Decrease in accounts receivable 126,000 Increase in inventories 90,000 Increase in accounts payable 24,000 Payment of dividends 54,000 Purchase of investment in financial asset measured at fair value through other comprehensive income 22,000 Decease in income taxes payable 16,000 What is Wonder Corporation’s net cash flow from operating activities? A. 440,000 B. 466,000 C. 520,000 D. ANSWE ANSWER: R: D Net income Depreciation expense Decrease in accounts receivable Increase in inventories Increase in accounts payable Decease in income taxes payable Total cash provided by operating activities 542,000 396,000 102,000 126,000 (90,000) 24,000 (16,000) 542,000 Use the fol following lowing informatio information n for the next two (2) questions: f 1) The following were taken from the incomplete financial data of Sam Company, a calendar year merchandising corporation: Decembe Decemberr 31, 2018 December 31, 2019 Trade accounts receivable 840,000 780,000 Inventory 1,500,000 1,000,000 Accounts payable 950,000 980,000 Accrued general and administrative expenses 130,000 170,000 Prepaid selling expense 150,000 130,000 Property, plant and equipment, net 1,650,000 1,420,000 Patent 425,000 300,000 Investment in associate 550,000 720,000 The following additional information were made available: cash payments for selling and administrative expenses was P900,000, payments for purchases, net of cash discount of P70,000 was P1,530,000. Equipment with a book value of P200,000 was sold for P250,000. There were no acquisitions of property, plant and equipment and other transactions affecting net income during the period. There were no acquisitions of investment during 2019. If the company reported a net income before tax of P270,000, what is the amount of collections on trade receivables in 2019? B. 2,470,000 C. 3,285,000 D. 3,485,000 A. 3,255,000 ANSWE ANSWER: R: C Sales Cost of sale 1,500,000 + 1, 1,530,000 530,000 – 1,0 1,000,000 00,000 + 9 980,000 80,000 – 950,000 Gross profit Gain on sale of PPE Share in profit of associate 720,000 – 550,000 Amortization of patent 425,000 – 300, 300,000 000 Depreciation of PPE 1,650,000 – 1,42 1,420,000 0,000 – 200, 200,000 000 Selling expense and admin 900,000 – 130,000 + 1 170,000 70,000 + 15 150,000 0,000 – 130,0 130,000 00 Net income squeeze 3,225,000 (2,060,000) 1,165,000 50,000 170,000 (125,000) (30,000) (960,000) 270,000 Beginning AR Sales Collection Ending AR 840,000 3,225,000 3,285,000 780,000 1) Avedon Company provided the following information for the current year: Sales Cost of goods sold Beginning inventory Purchased Goods available for sale Ending inventory Gross income Gain on sale of equipment Total income Operating expenses: Distribution cost Administrative expenses Income before tax Income tax expense Net income Accounts receivable increased by P400,000 during the year. Prepaid expenses decreased P150,000 during the year. Accounts payable decreased P200,000 during the year. Notes payable-bank increased P400,000 during the year. Accrue expenses increased P300,000 during the year. Taxes payable increased P60,000 during the year. Administrative expenses included depreciation expense of P120,000. What is the net cash provided by operating activities? A 420,000 B. 720,000 . C. 620,000 6,000,000 1,500,000 4,200,000 5,700,000 (1,300,000) 600,000 400,000 D. 4,400,000 1,600,000 100,000 1,700,000 1,000,000 700,000 210,000 490,000 820,000 2) Timothy Company provided the following transactions for the year ended December 31, 2020: Acquired 50% of Carlo Company’s share for P1,800,000 cash which was borrowed from a bank. Issued 5,000 shares for land having a fair value of P3,200,000. Issued 5,000 11% debenture bonds with P1,000 face amount, due 2025, for P3,920,000 cash. Purchased a patent for P2,200,000 cash. Paid P1,200,000 toward a bank loan. Sold financial asset at FVOCI for P800,000. Had net increase in advances from customer of P880,000. What amount should be reported as net cash from financing activities? A 4,520,000 B. 5,400,000 C. 2,720,000 . D. 6,600,000 1) Bubbles Corporation reported net income of P420,000 for the current period. Changes occurred in several statement of financial position accounts as follows: Equipment 35,000 Increase Accumulated depreciation 56,000 Increase Notes payable 42,000 Increase Additional information: During the year, Bubbles sold equipment costing P35,000, with accumulated depreciation of P16,800, for a gain of P7,000 In December of the current year, Bubbles purchased equipment costing P70,000 with P28,000 cash and a 12% note payable of P42,000. Depreciation expense for the year was P72,800 In Bubbles current period statement of cash flows, net cash flows used in investing activities should be A. 49,000 B. 30,800 C. 16,800 D. 2,800 2) Buffaloman Company had the following activities during the current period: