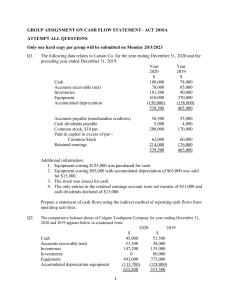

Chapter 17 Statement of cash flows Problem 17-1 Mountain Company reported the following income statement for the year ended December 31, 2019: Sales Cost of goods sold: Inventory – January 1 Purchases Goods available for sale Inventory – December 31 Gross income Expenses: Salaries Rent Insurance Doubtful accounts expense Other expenses Depreciation 4,500,000 750,000 2,850,000 3,600,000 ( 600,000) 3,000,000 1,500,000 600,000 250,000 20,000 30,000 100,000 50,000 Net income 1,050,000 450,000 Additional information December 31 Accounts receivable Allowance for doubtful accounts Inventory Prepaid insurance Accounts payable Accrued salaries payable Equipment Accumulated depreciation 540,000 40,000 600,000 15,000 280,000 50,000 1,200,000 290,000 January 1 440,000 20,000 750,000 10,000 160,000 80,000 1,200,000 240,000 During the year, the entity recognized doubtful accounts expense of P30,000 and wrote off uncollectible accounts of P10,000. Required: Determine the cash flow from operating activities using the direct method and indirect method. Answer: Accounts receivable – January 1 Add: Sales Total Less: Accounts receivable – December 31 Writeoff Collections from customers Accounts payable – January 1 Purchases Total Less: Accounts payable – December 31 Payment to merchandise creditors 440,000 4,500,000 4,940,000 540,000 10,000 550,000 4,390,000 160,000 2,850,000 3,010,000 280,000 2,730,000 Salaries Add: Accrued salaries – January 1 Total Less: Accrued salaries – December 31 Payment for salaries 600,000 80,000 680,000 50,000 630,000 Insurance Add: Prepaid insurance – December 31 Total Less: Prepaid insurance – January 1 Payment for insurance 20,000 15,000 35,000 10,000 25,000 Direct method Cash received from customers Cash payment to creditors Salaries paid Insurance paid Rent paid Other expenses paid Net cash provided by operating activities 4,390,000 (2,730,000) ( 630,000) ( 25,000) ( 250,000) ( 100,000) 655,000 Indirect method Net income Increase in net accounts receivable Decrease in inventory ( 450,000 80,000) 150,000 Increase in prepaid insurance Increase in accounts payable Decrease in accrued salaries payable Depreciation Net cash provided by operating activities ( 5,000) 120,000 ( 30,000) 50,000 655,000 Problem 17-2 Hill Company provided the following comparative statement of financial position. Assets Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Property, plant and equipment Accumulated depreciation 2019 2018 750,000 1,750,000 2,550,000 100,000 5,300,000 (1,150,000) 950,000 1,100,000 1,800,000 150,000 4,300,000 ( 800,000) 9,300,000 7,500,000 1,250,000 50,000 4,750,000 3,250,000 1,000,000 200,000 4,250,000 2,050,000 9,300,000 7,500,000 Liabilities and equity Accounts payable Accrued expenses Share capital Retained earnings Additional information 1. The statement of retained earnings for 2019 showed net income of P1,500,000 and cash dividend paid of P300,000. 2. During the year, the entity purchased equipment for cash and issued share capital for cash. Required: Prepare a statement of cash flows for the current year using the indirect method. Answer: Hill Company Statement of Cash Flows December 31, 2019 Cash flow from operating activities: Net income Increase in accounts receivable Increase in inventory Decrease in prepaid expenses Increase in accounts payable Decrease in accrued expenses Depreciation Cash flow from investing activities: Purchase of equipment Cash flow from financing activities: Issue of share capital Payment of cash dividend Decrease in cash and cash equivalents Cash and cash equivalents – January 1 Cash and cash equivalent – December 31 1,500,000 ( 650,000) ( 750,000) 50,000 250,000 ( 150,000) 350,000 600,000 (1,000,000) 500,000 ( 300,000) 200,000 ( 200,000) 950,000 750,000 Problem 17-3 Sandy Company reported the following comparative statement of financial position at year-end. Assets Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Property, plant and equipment Accumulated depreciation 2019 2018 120,000 370,000 1,090,000 80,000 4,300,000 ( 840,000) 150,000 210,000 860,000 90,000 3,620,000 ( 720,000) 5,120,000 4,210,000 400,000 70,000 35,000 345,000 40,000 15,000 Liabilities and equity Accounts payable Salaries payable Income tax payable Accrued interest payable Bonds payable Share capital Retained earnings Treasury shares 5,000 600,000 3,050,000 1,100,000 ( 140,000) 5,120,000 3,050,000 760,000 4,210,000 The income statement for the year ended December 31, 2019 showed the following: Sales Cost of goods sold: Inventory – January 1 Purchases Goods available for sales Inventory – December 31 4,450,000 860,000 2,630,000 3,490,000 (1,090,000) 2,400,000 Gross income Gain on sales of equipment 2,050,000 60,000 Total income Expenses: Salaries Insurance Rent Depreciation Bad debt writeoff Interest expense 2,110,000 640,000 100,000 350,000 260,000 20,000 40,000 Income before tax Income tax Net income 1,410,000 700,000 200,000 500,000 Additional information 1. Cash dividends of P160,000 were declared and paid during the year. 2. Equipment costing P190,000 and with accumulated depreciation of P140,000 was sold for P110,000 cash. 3. New equipment was purchased for cash. 4. Bonds payable were issued for cash at the face value of P600,000. 5. The treasury shares were purchased at cost P140,000. Required: a. Prepare a statement of cash flows using the direct method. b. Compute the cash flow operating activities using the indirect method. Answer: Sandy Company Statement of Cash Flows December 31, 2019 Cash flows from operating activities: Collections from customers Payments to creditors Salaries paid Insurance paid Rent paid Cash generated from operations Interest paid Income tax paid Net cash provided by operating activities Cash flow from investing activities: Sale of equipment Purchase of equipment Cash flow from financing activities: Issue of bonds payable Payment of cash dividend Payment of treasury shares Decrease in cash and cash equivalents Cash and cash equivalents – January 1 Cash and cash equivalents – December 31 4,270,000 (2,575,000) ( 610,000) ( 90,000) ( 350,000) 645,000 ( 35,000) ( 180,000) 430,000 100,000 ( 870,000) ( 760,000) 600,000 ( 160,000) ( 140,000) ( 300,000 30,000) 150,000 120,000 Indirect method Net income Increase in net accounts receivable Increase in inventory Decrease in prepaid insurance Increase in accounts payable Decrease in salaries payable Increase in income tax payable Increase in accrued interest payable Depreciation Gain on sale of equipment Net cash provided by operations 500,000 ( 160,000) ( 230,000) 10,000 55,000 30,000 20,000 5,000 260,000 ( 60,000) 430,000 Problem 17-4 Forest Company provided the following information for the preparation of a statement of cash flows for the current year: 2019 Cash and cash equivalents Trading securities Accounts receivable, net of allowance Inventory Property, plant and equipment (net) Goodwill Discount on bonds payable Accounts payable Accrued expenses Bonds payable Preference share capital, P100 par, each share Convertible into two ordinary shares Ordinary share capital, P20 par Share premium Retained earnings 2018 603,000 300,000 600,000 900,000 2,000,000 200,000 72,000 300,000 200,000 520,000 840,000 2,100,000 200,000 100,000 4,675,000 4,260,000 490,000 310,000 800,000 800,000 210,000 1,000,000 400,000 820,000 500,000 1,355,000 500,000 700,000 400,000 650,000 4,675,000 4,260,000 Additional information 1. Net income for the current year was P1,705,000. 2. Cash dividend paid during the year totaled P1,000,000. 3. The bonds mature on January 1, 2024. On December 31, 2019 bonds with face of P200,000 were retired at 105. 4. The entity sold 4,000 ordinary shares at P30 per share. 5. The decrease in preference share capital resulted from the exercise of the conversion privilege by preference shareholders. 6. The increase in trading securities is due to increase in market value during the year. Required: Prepare a statement of cash flows for the current year. Answer: Requirements Entries 1. Profit and loss Retained earnings 1,705,000 2. Retained earnings Cash 1,000,000 1,705,000 1,000,000 3. Interest expense (100,000/10) Discount on bonds payable 10,000 Bonds payable Loss on retirement Cash (200,000 x 105) Discount on bonds payable (90,000 x 200 / 1,000) 200,000 28,000 10,000 210,000 18,000 4. Cash (4,000 x 30) Ordinary share capital (4,000 x 20) Share premium 120,000 5. Preference share capital (1,000 x 100) Ordinary share capital (2,000 x 20) Share premium 100,000 6. Trading securities Unrealized gain 100,000 80,000 40,000 40,000 60,000 100,000 7. Accounts receivable Sales 80,000 8. Inventory Cost of sales 60,000 9. Depreciation Accumulated depreciation 80,000 60,000 100,000 100,000 10. Accounts payable Cash 310,000 11. Expenses Accrued expenses 100,000 310,000 100,000 Operating 1. Net income 1,705,000 2. Cash dividend 3. Amortization of discount on bonds payable 10,000 Retirement of bonds payable Loss on retirement 28,000 4. Issuance of ordinary share capital 5. Conversion of preference share into ordinary share – no cash effect 6. Unrealized gain ( 100,000) 7. Increase in accounts receivable ( 80,000) 8. Increase in inventory ( 60,000) 9. Depreciation 100,000 10. Decrease in accounts payable ( 310,000) 11. Increase in accrued expenses 100,000 Net cash provided (used) 1,393,000 Financing (1,000,000) ( 210,000) 120,000 (1,090,000) Forest Company Statement of Cash Flows December 31, 2019 Cash flow from operating activities: Net income Amortization of discount Loss on retirement Increase in accounts receivable Increase in inventory Depreciation Unrealized gain Decrease in accounts payable Increase in accrued expenses Cash flow from financing activities: Issue of ordinary share capital Payment of cash dividend Bond retirement Increase in cash and cash equivalents Add: Cash and cash equivalents – January 1 Cash and cash equivalents – December 31 1,705,000 10,000 28,000 ( 80,000) ( 60,000) 100,000 ( 100,000) ( 310,000) 100,000 1,393,000 120,000 (1,000,000) ( 210,000) (1,090,000) 303,000 300,000 603,000 Problem 17-5 Fearsome Company showed the following comparative statement of financial position: 2019 Cash and cash equivalents Accounts receivable, net of allowance Inventory Investment in Hall Company at equity Land Property, plant and equipment Accumulated depreciation Goodwill Accounts payable Note payable – long term Bonds payable Share capital, P100 par Share premium Retained earnings Treasury shares, at cost 2018 2,350,000 600,000 1,000,000 2,200,000 2,000,000 5,000,000 ( 1,050,000) 400,000 350,000 700,000 850,000 2,000,000 1,500,000 4,000,000 ( 800,000) 400,000 12,500,000 9,000,000 600,000 500,000 1,600,000 5,250,000 2,700,000 1,850,000 - 550,000 2,100,000 4,000,000 1,750,000 1,300,000 ( 700,000) 12,500,000 9,000,000 Additional information 1. The net income for the current year was P3,050,000. 2. Cash dividend paid amounted to P2,500,000. 3. The entity sold equipment costing P200,000, with carrying amount of P50,000, for P70,000 cash. 4. The entity issued 10,000 shares of capital for P150 per share cash. 5. The entity sold all of its treasury shares for P900,000 cash. 6. Individuals holding P500,000 face value bonds exercised their conversion privilege. Each of the 500 bonds was converted into 5 shares of capital. 7. The entity purchased equipment for P1,200,000. 8. Land with a fair value of P500,000 was purchased through the issuance of a long term note. Required: Prepare a statement of cash flows for the current year. Answer: Requirements Entries 1. Profit and loss Retained earnings 3,050,000 2. Retained earnings Cash 2,500,000 3. Cash Accumulated depreciation Equipment Gain on sale of equipment 4. Cash (10,000 x 150) Share capital Share premium 5. Cash 3,050,000 2,500,000 70,000 150,000 200,000 20,000 1,500,000 1,000,000 500,000 900,000 Treasury share Share premium 6. Bonds payable Share capital (2,500 x 100) Share premium 7. Equipment Cash 8. Land 700,000 200,000 500,000 250,000 250,000 1,200,000 1,200,000 500,000 Note payable – long term 9. Cash 500,000 100,000 Accounts receivable 100,000 10. Inventory Cost of sales 150,000 11. Investment in Hall Company Investment income 200,000 150,000 200,000 12. Purchases Accounts payable 50,000 50,000 Operating 1. Net income 2. Cash dividend 3. Sale of equipment Gain on sale of equipment Depreciation 4. Issuance of share capital 5. Sale of treasury shares 6. Conversion of bonds payable into Ordinary share- no cash effect 7. Purchase of equipment 8. Purchase of land by issuing a note - No cash effect 9. Decrease in accounts receivable 10. Increase in inventory 11. Investment income 12. Increase in accounts payable Net cash provided (used) Investing Financing 3,050,000 (2,500,000) 70,000 ( 20,000) 400,000 1,500,000 900,000 (1,200,000) 100,000 ( 150,000) ( 200,000) 50,000 3,230,000 (1,130,000) ( 100,000) Fearsome Company Statement of Cash Flows December 31, 2019 Cash flow from operating activities: Net income Gain on sale of equipment Depreciation Decrease in net accounts receivable Increase in inventory Investment income Increase in accounts payable Cash flow from investing activities: Sale of equipment Purchase of equipment Cash flow from financing activities: Issue of share capital Sale of treasury shares Payment of cash dividend Increase in cash and cash equivalents Add: Cash and cash equivalents – January 1 Cash and cash equivalents – December 31 3,050,000 ( 20,000) 400,000 100,000 ( 150,000) ( 200,000) 50,000 3,230,000 70,000 (1,200,000) (1,130,000) 1,500,000 900,000 (2,500,000) ( 100,000) 2,000,000 350,000 2,350,000 Problem 17-6 Kenwood Company provided the following comparative statement of financial position: 2019 Cash Accounts receivable, net of allowance Inventory Land Property, plant and equipment Accumulated depreciation Patent Accounts payable Accrued expense Bonds payable Share capital, P5 par Share premium Retained earnings Additional information 500,000 1,050,000 1,300,000 1,625,000 2,900,000 ( 450,000) 150,000 1,350,000 1,300,000 1,000,000 1,250,000 1,165,000 1,010,000 2018 450,000 700,000 1,200,000 1,000,000 3,165,000 ( 500,000) 165,000 1,000,000 1,050,000 1,500,000 1,050,000 850,000 730,000 1. The net income for the current year was P1,095,000. 2. On February 2, the entity issued a 10% stock dividend to shareholders of record on January 15. The market price per share was P15. 3. On March 1, the entity issued 19,000 shares for land. The land had a fair value of P200,000. 4. The entity purchased long term bonds with face of P500,000. A gain on retirement of bonds was reported in the income statement in the amount of P50,000. 5. The entity sold equipment costing P265,000, with carrying amount of P115,000, for P95,000 cash. 6. On September 30, the entity declared and paid a P2.00 per share cash dividend to shareholders of record on August 1. 7. The entity purchased land for P425,000 cash. Required: Prepare a statement of cash flows for the current year. Answer: Requirements Entries 1. Profit and loss Retained earnings 1,095,000 1,095,000 2. Retained earnings (21,000 x 15) Share capital (21,000 x 5) Share premium 315,000 3. Land 200,000 105,000 210,000 Share capital (19,000 x 5) Share premium 4. Bonds payable Cash Gain on bond retirement 5. Cash 95,000 105,000 500,000 450,000 50,000 95,000 Accumulated depreciation Loss on sale of equipment Equipment 150,000 20,000 265,000 6. Retained earnings (250,000 x 2) Cash 500,000 7. Land 425,000 500,000 Cash 425,000 8. Accounts receivable Sales 350,000 9. Inventory Cost of sales 100,000 10. Depreciation (450,000 – 350,000) Accumulated depreciation 100,000 11. Amortization of patent Patent 350,000 100,000 100,000 15,000 15,000 12. Purchases Accounts payable 350,000 13. Expenses Accrued expenses 250,000 350,000 250,000 Operating 1. Net income 2. Stock dividend – no cash effect 3. Issuance of share capital for land – No cash effect 4. Retirement of bonds payable Gain on bond retirement 5. Sale of equipment Loss on sale of equipment 6. Cash dividend 7. Purchase of land 8. Increase in accounts receivable 9. Increase in inventory 10. Depreciation 11. Amortization of patent 12. Increase in accounts payable 13. Increase in accrued expenses Net cash provided (used) Investing Financing 1,095,000 ( 450,000) ( 50,000) 95,000 20,000 ( 500,000) ( 425,000) ( 350,000) ( 100,000) 100,000 15,000 350,000 250,000 1,330,000 ( 330,000) ( 950,000) 1,095,000 ( 50,000) 20,000 ( 350,000) ( 100,000) 100,000 15,000 350,000 250,000 1,330,000 95,000 ( 425,000) ( 330,000) Kenwood Company Statement of Cash Flow December 31, 2019 Cash flow from operating activities: Net income Gain on bond retirement Loss on sale of equipment Increase in net accounts receivable Increase in inventory Depreciation Amortization of patent Increase in accounts payable Increase in accrued expenses Cash flow from investing activities: Sale of equipment Purchase of land Cash flow from financing activities: Retirement of bonds payable Cash dividend Increase in cash and cash equivalents Add: cash and cash equivalents – January 1 Cash and cash equivalents – December 31 ( 450,000) ( 500,000) ( 950,000) 50,000 450,000 500,000 Problem 17-7 Sandra Company provided the following comparative statement of financial position. 2019 Cash and cash equivalents Accounts receivable, net of allowance Inventory Investment in Word Company, at equity Property, plant and equipment Accumulated depreciation Patent, net Accounts payable and accrued liabilities Note payable, long-term debt Deferred tax liability Share capital, P100 par value Share premium Retained earnings 640,000 550,000 810,000 400,000 1,145,000 ( 345,000) 100,000 815,000 600,000 220,000 850,000 230,000 585,000 2018 300,000 515,000 890,000 390,000 1,070,000 ( 280,000) 350,000 950,000 900,000 200,000 650,000 170,000 365,000 1. The net income for the current year is P305,000. 2. The entity paid a cash dividend of P85,000 on October 26. 3. On January 2, the entity sold equipment costing P45,000, with a carrying amount of P28,000 for P18,000. 4. On April 15, the entity issued 2,000 shares of capital for cash at P130 per share. 5. On July 1, the entity purchased equipment for P120,000 cash. 6. The entity acquired a 20% interest in Word Company at the end of 2018. There was no goodwill attributable to the investment. The investee reported net income of P150,000 for 2019 and paid cash dividend of P100,000 on December 31, 2019. Required: Prepare a statement of cash flows for the current year. Answer: Requirements Entries 1. Profit and loss Retained earnings Retained earnings Cash 2. Cash Accumulated depreciation Loss on sale of equipment Equipment 3. Cash 305,000 305,000 85,000 85,000 18,000 17,000 10,000 45,000 260,000 Share capital Share premium 4. Equipment Cash 5. Investment in Word Company Investment income Cash 200,000 60,000 120,000 120,000 30,000 30,000 20,000 Investment in Word Company 20,000 6. Accounts receivable Sales 35,000 7. Cost of sales Inventory 80,000 8. Depreciation Accumulated depreciation 82,000 35,000 80,000 82,000 Accumulated – 2019 Accumulated – 2018 (280,000 – 17,000) Depreciation for 2019 9. Amortization Patent 345,000 263,000 82,000 250,000 250,000 10. Accounts payable Cash 135,000 11. Note payable – long term Cash 300,000 135,000 300,000 12. Income tax Deferred tax liability 20,000 20,000 Operating 1. Net income Cash dividend 2. Sale of equipment Loss on sale of equipment 3. Issue of share capital 4. Purchase of equipment 5. Investment income Cash dividend received from equity Investee 6. Increase in net accounts receivable 7. Decrease in inventory 8. Depreciation 9. Amortization of patent 10. Decrease in accounts payable 11. Payment of long term note 12. Increase in deferred tax liability Net cash provided (used) Investing Financing 305,000 ( 85,000) 18,000 10,000 260,000 (120,000) ( 30,000) 20,000 ( 35,000) 80,000 82,000 250,000 (135,000) (300,000) 20,000 567,000 (102,000) (125,000) 305,000 10,000 ( 30,000) 20,000 ( 35,000) 80,000 82,000 250,000 (135,000) 20,000 567,000 Sandra Company Statement of Cash Flows December 31, 2019 Cash flow from operating activities: Net income Loss on sale of equipment Investment income Cash dividend received from equity investee Increase in accounts receivable Decrease in inventory Depreciation Amortization of patent Decrease in accounts payable Increase in deferred tax liability Cash flow from investing activities: Sale of equipment Purchase of equipment Cash flow from financing activities: Cash dividend Issue of share capital Payment of long term note Increase in cash and cash equivalents Cash and cash equivalents – January 1 Cash and cash equivalents – December 31 18,000 (120,000) ( 85,000) 260,000 (300,000) (102,000) (125,000) 340,000 300,000 640,000 Problem 17-8 On December 31, 2019, Kale Company had the following balances in the bank accounts with First Bank: Checking account #101 Checking account #201 Time deposit Commercial papers 90-day treasury bill, due February 28, 2020 180-day treasury bill, due March 15, 2020 1,750,000 ( 100,000) 250,000 1,000,000 500,000 800,000 On December 31, 2019, what amount should be reported as cash and cash equivalent a. b. c. d. 3,400,000 2,000,000 2,400,000 3,200,000 Answer: Checking account #101 Checking account #201 Time deposit 90-day treasury bill, due February 28, 2020 Total cash and cash equivalents 1,750,000 ( 100,000) 250,000 500,000 3,400,000 Problem 17-9 Oakwood Company provided the following data for the current year: Cash balance, beginning of year Cash flow from financing activities Total shareholders’ equity, end of year Cash flow from operating activities Cash flow from investing activities Total shareholders’ equity, beginning of year 1,300,000 1,000,000 2,300,000 400,000 (1,500,000) 2,000,000 What is the cash balance at the end of current year? a. b. c. d. 1,200,000 1,600,000 1,400,000 1,700,000 Answer: Cash balance, beginning of year Cash flow from financing activities Cash flow from operating activities Cash flow from investing activities Cash balance – ending 1,300,000 1,000,000 400,000 (1,500,000) 1,200,000 Problem 17-10 Seawall Company provided the following data for the preparation of the statement of cash flows for the current year: Dividends declared and paid Cash flow from investing activities Cash flow from financing activities 800,000 (2,500,000) ( 800,000) December 31 Cash Other assets Liabilities Share capital Retained earnings 2,100,000 21,000,000 10,500,000 2,000,000 10,600,000 January 1 1,200,000 22,700,000 11,700,000 2,000,000 10,200,000 What amount should be reported as cash flow from operating activities? a. b. c. d. 4,200,000 2,400,000 4,500,000 5,400,000 Answer: Cash – January 1 Cash flow from operating activities (squeeze) Cash flow from investing activities Cash flow from financing activities Cash – December 31 1,200,000 4,200,000 (2,500,000) ( 800,000) 2,100,000 Problem 17-11 Santana Company provided the following information for the current year: December 31 Cash Retained earnings Cash flow from operating activities Cash flow from investing activities Cash flow from financing activities Dividends declared and paid Net income 1,500,000 7,000,000 ? (4,800,000) 1,800,000 2,000,000 3,600,000 January 1 1,000,000 5,400,000 What amount should be reported as cash flow from operating activities? a. b. c. d. 3,500,000 2,500,000 4,500,000 3,600,000 Answer: Cash – January 1 Cash flow from operating activities (squeeze) Cash flow from investing activities Cash flow from financing activities Cash – December 31 1,000,000 3,500,000 (4,800,000) 1,800,000 1,500,000 Problem 17-12 Moon Company reported net income of P5,000,000 for the current year. Depreciation expense was P1,900,000. The following working capital accounts changed: Accounts receivable Nontrading equity investment Inventory Nontrade note payable Accounts payable 1,100,000 increase 1,600,000 increase 730,000 increase 1,500,000 increase 1,220,000 increase Under the indirect method, what net amount of adjustments is required to reconcile net income to net cash provided by operating activities? a. 4,950,000 b. 1,050,000 c. 1,290,000 d. 310,000 Answer: Depreciation expense Increase in accounts receivable Increase in inventory Increase in accounts payable Adjustment to reconcile net income to net cash provided By operating activities 1,900,000 (1,100,000) ( 730,000) 1,220,000 1,290,000 Problem 17-13 Kresley Company reported net income of P750,000 for the current year: The entity provided the following account balances for the preparation of statement of cash flows for the current year: Accounts receivable Allowance for uncollectible accounts Prepaid rent expense Accounts payable January 1 December 31 115,000 4,000 62,000 97,000 145,000 5,000 41,000 112,000 What is the net cash provided by operating activities for the current year? a. b. c. d. 727,000 743,000 755,000 757,000 Answer: Net income Increase in net accounts receivable (140,000 – 111,000) Decrease in prepaid rent Increase in accounts payable Cash provided by operating activities 750,000 ( 29,000) 21,000 15,000 757,000 Problem 17-14 Kentucky Company reported net income of P1,500,000 for the current year: The entity provided the following changes in several accounts during the current year. Investment in Videogold Company share carried On the equity basis Accumulated depreciation, caused by major Repair to project equipment Premium on bonds payable Deferred tax liability 55,000 increase 21,000 decrease 14,000 decrease 18,000 increase In the statement of cash flows, what is the net cash provided by operating activities? a. b. c. d. 1,504,000 1,483,000 1,449,000 1,428,000 Answer: Net income Increase in investment carried on the equity Amortization of premium on bonds payable Increase in deferred tax liability Cash provided by operating activities 1,500,000 ( 55,000) ( 14,000) 18,000 1,449,000 Problem 17-15 Albay Company provided the following information: Accounts receivable, January 1, net of allowance Of P100,000 Accounts receivable, December 31, net of allowance Of P300,000 Sales for the current year – all on credit Uncollectible accounts written off during the year Recovery of accounts written off Bad debt expense for the year Cash expenses for the year Net income for the year 1,200,000 1,600,000 8,000,000 70,000 20,000 250,000 5,250,000 2,500,000 What is the net cash flow from operating activities? a. b. c. d. 2,100,000 2,350,000 2,080,000 2,150,000 Answer: Net income Increase in accounts payable Net cash provided – operating 2,500,000 ( 400,000) 2,100,000 Problem 17-16 Balcktown Company reported the following account balances: Accounts payable Inventory Accounts receivable Prepaid expenses December 31 January 1 500,000 300,000 800,000 400,000 650,000 250,000 900,000 600,000 All purchases of inventory were on account. Depreciation expense of P900,000 was recognized. Equipment was sold during the year and a gain of P300,000 was recognized The entity provided the following cash flow information: Cash collected from customers Cash paid for inventory Cash paid for other expenses Cash flow from operations 9,500,000 (4,100,000) (1,400,000) 4,000,000 What is the net income for the current year? a. b. c. d. 3,300,000 3,400,000 3,000,000 3,900,000 Answer: Net income (squeeze) Decrease in accounts payable Increase in inventory Decrease in accounts receivable Decrease in prepaid expenses Depreciation Gain on sale of equipment Cash flow from operations 3,300,000 ( 150,000) ( 50,000) 100,000 200,000 900,000 ( 300,000) 4,000,000 Problem 17-17 Rumulus Company reported the following information in the financial statements for the current year: Capital expenditures Finance lease payments Income taxes paid Dividends paid Net interest payments 1,000,000 125,000 325,000 200,000 220,000 What total amount should be reported as supplemental disclosures in the statement of cash flows prepared using the indirect method? a. 1,125,000 b. 1,870,000 c. 545,000 d. 745,000 Answer: Income taxes paid Net interest payment Total amount to be disclosed 325,000 220,000 545,000 Problem 17-18 Stone Company provided the following information at year-end: Accounts receivable Inventory Accounts payable Accrued expenses 2019 2018 620,000 1,960,000 380,000 500,000 680,000 1,840,000 520,000 340,000 The income statement for the current year showed: Net income Depreciation Amortization of patent Gain on sale of land 2,120,000 240,000 80,000 200,000 What amount should be reported as net cash provided by operating activities? a. b. c. d. 2,200,000 2,400,000 2,440,000 2,600,000 Answer: Net income Decrease in accounts receivable Increase in inventory Decrease in accounts payable Increase in accrued expenses Deprecation Amortization of patent Gain on sale of land Cash provided by operating activities 2,120,000 60,000 ( 120,000) ( 140,000) 160,000 240,000 80,000 ( 200,000) 2,200,000 Problem 17-19 Brown Company reported the following information for the current year: Sales Cost of goods sold Distribution costs Administrative expenses Depreciation Interest expense Income tax expense 2,800,000 1,000,000 400,000 350,000 250,000 80,000 280,000 All sales were made for cash and all expenses other than depreciation and bond premium amortization of P20,000 were paid in cash. All current assets and current liabilities remained unchanged. What is the net cash provided by operating activities for the current year? a. b. c. d. 440,000 690,000 670,000 710,000 Answer: Sales Cost of goods sold Distribution costs Administrative expenses Interest expense Income tax expense Amortization of premium bonds payable Cash provided by operating activities 2,800,000 (1,000,000) ( 400,000) ( 350,000) ( 80,000) ( 280,000) ( 20,000) 670,000 Problem 17-20 Matthew Company provided the following information for the current year: Purchase of inventory Purchase of land, with the vendor financing P1,000,000 For 2 years Purchase of plant for cash Sale of plant: Carrying amount Cash proceeds Buyback of ordinary shares 1,950,000 3,500,000 2,500,000 500,000 400,000 700,000 What amount of investing net cash outflows should be reported in the statement of cash flows for the current year? a. b. c. d. 5,600,000 4,600,000 6,550,000 5,300,000 Answer: Purchase of land Vendor financing Cash payment Purchase of plant for cash Cash proceeds Net cash outflows (3,500,000) 1,000,000 (2,500,000) (2,500,000) 400,000 (4,600,000) Problem 17-21 Nellie Company provided the following information at the end of each year: Borrowings Share capital Retained earnings 2019 2018 2,500,000 3,500,000 950,000 800,000 2,000,000 750,000 Borrowings of P300,000 were repaid during 2019 and new borrowings include P200,000 vendor financing arising on the acquisition of a property. The movement in retained earnings comprised profit for 2019 of P900,000, net of dividends of P700,000. The movement in share capital arose from issuance of share capital for cash during the year. What amount should be reported as financing net cash inflows for the current year? a. b. c. d. 2,400,000 2,200,000 2,500,000 2,300,000 Answer: Net increase in borrowings Vendor financing of property Net cash inflow from borrowings Issuance of share capital Dividend paid Net cash flow – financing 1,700,000 ( 200,000) 1,500,000 1,500,000 ( 700,000) 2,300,000 Problem 17-22 Riverside Company provided the following data for the current year: Purchased a building for P1,200,000. Paid P400,000 and signed a mortgage with the seller for the remaining P800,000. Executed a debt-equity swap and replaced a P600,000 load by giving the lender ordinary shares worth P600,000 on the date the swap was executed. Purchased land for P1,000,000. Paid P350,000 and issued ordinary share worth P650,000. Borrowed P550,000 under a long-term loan agreement. Used the cash from the loan proceeds to purchase additional inventory P150,000, to pay cash dividend P300,000 and to increase the cash balance P100,000. 1. What amount should be reported as net cash used in investing activities? a. 1,200,000 b. 2,200,000 c. d. 400,000 750,000 Answer: Cash paid for purchase of building Cash paid for purchase of land Net cash used – investing 400,000 350,000 750,000 2. What amount should be reported as net cash provided by financing activities? a. b. c. d. 350,000 850,000 250,000 550,000 Answer: Proceeds to purchase inventory Increase cash balance Dividend paid Net cash provided by financing activities 150,000 (100,000) 300,000 350,000 Problem 17-23 Karr Company reported net income of P3,000,000 for the current year. The following changes occurred in several accounts: Equipment Accumulated depreciation Note payable 250,000 increase 400,000 increase 300,000 increase During the year, the entity sold equipment costing P250,000, with accumulated depreciation of P120,000 at a gain of P50,000. In December, the entity purchased equipment costing P500,000 with P200,000 cash and a 12% note payable of P300,000. 1. What is the depreciation expense for the year? a. b. c. d. 520,000 400,000 280,000 120,000 Answer: Increase in accumulated depreciation Accumulated depreciation of equipment sold Depreciation 400,000 120,000 520,000 2. What amount should be reported as net cash used in investing activities? a. 350,000 b. 120,000 c. 220,000 d. 20,000 Answer: Sale of equipment (250,000 – 120,000=130,000 + 50,000) Payment of equipment Net cash used in investing activities 180,000 (200,000) ( 20,000) 3. What amount should be reported as net cash provided by operating activities? a. b. c. d. 3,400,000 3,470,000 3,520,000 3,570,000 Answer: Net income Gain on sale of equipment Depreciation Cash flow from operations 3,000,000 ( 50,000) 520,000 3,470,000 Problem 17-24 Reve Company provided the following data for the current year: Gain on sale of equipment Proceeds from sale of equipment Purchase of Ace bonds, face amount, P2,000,000 Amortization of bond discount Dividend declared Dividend paid Proceeds from sale of treasury shares with Carrying amount of P650,000 60,000 100,000 1,800,000 20,000 450,000 380,000 750,000 1. What is net cash provided by financing activities? a. b. c. d. 200,000 270,000 300,000 370,000 Answer: Proceeds from sale of equipment Proceeds from sale of treasury share – Carrying amount Dividend paid Net cash provided by financing activities 100,000 650,000 (380,000) 370,000 2. What is net cash used in investing activities? a. b. c. d. 1,700,000 1,760,000 1,880,000 1,940,000 Answer: Sale of equipment Purchase of equipment – Face amount Net cash used – investing 60,000 (2,000,000) 1,940,000 Problem 17-25 Zoe Company reported net income of P3,400,000 for the current year. The net income included depreciation of P840,000 and a gain on sale equipment of P170,000. The equipment had an original cost of P4,000,000 and accumulated depreciation of P2,400,000. All of the following accounts increased during the current year. Patent Prepaid rent Financial asset at fair value through other Comprehensive income (FVOCI) Bonds payable 450,000 680,000 100,000 500,000 What amount should be reported as net cash flow from investing activities? a. 1,720,000 provided b. 1,220,000 provided c. 540,000 provided d. 380,000 used Answer: Proceeds from sale of equipment Increase in patent Increase in financial asset at FVOCI Net cash provided by investing activities 1,770,000 ( 450,000) ( 100,000) 1,220,000 Original cost Accumulated depreciation Carrying amount Gain on sale of equipment Proceeds from sale of equipment 4,000,000 (2,400,000) 1,600,000 170,000 1,770,000 Problem 17-26 Mountain Company provided the following information: 2019 Cash and cash equivalents Accounts receivable Inventory Prepaid expenses Property, plant and equipment Accumulated depreciation Accounts payable Accrued expenses Note payable – bank (current) Note payable – bank (noncurrent) Ordinary share capital Retained earnings 2018 5,600,000 7,400,000 3,000,000 3,500,000 8,000,000 6,500,000 400,000 600,000 55,000,000 42,000,000 (20,000,000) (16,000,000) 6,000,000 9,500,000 1,500,000 500,000 2,000,000 5,000,000 10,000,000 30,000,000 30,000,000 2,500,000 (1,000,000) Cash needed to purchase new equipment was raised by borrowing from the bank with a long-term note. Equipment costing P2,000,000 and carrying amount of P1,500,000 was sold for P1,800,000. The entity paid cash dividend of P3,000,000 in 2019. 1. What is the net cash provided by operating activities? a. b. c. d. 7,400,000 6,900,000 8,000,000 7,700,000 Answer: Net income Decrease in accounts receivable Increase in inventory Decrease in prepaid expenses Gain on sale of equipment Depreciation Decrease in accounts payable Increase in accrued expenses Net cash provided by operating activities Retained earnings -2019 Retained earnings – 2018 (deficit) Net increase in retained earnings Add: Dividend paid Net income Accumulated depreciation – 2018 Depreciation for 2019 (squeeze) Total Accumulated depreciation on equipment sold (2,000,000 – 1,500,000) Accumulated depreciation – 2019 6,500,000 500,000 ( 1,500,000) 200,000 ( 300,000) 4,500,000 ( 3,500,000) 1,000,000 7,400,000 2,500,000 1,000,000 3,500,000 3,000,000 6,500,000 16,000,000 4,500,000 20,500,000 ( 500,000) 20,000,000 2. What is the net cash used in investing activities? a. b. c. d. 15,000,000 13,200,000 14,800,000 13,000,000 Answer: Payment for new equipment Proceeds from sale of equipment Net cash used in investing activities (15,000,000) 1,800,000 (13,200,000) Property, plant and equipment – 2018 Payment for new equipment (squeeze) 42,000,000 15,000,000 Total Cost of equipment sold Property, plant and equipment – 2019 3. What is the net cash provided by financing activities? a. b. c. d. 57,000,000 ( 2,000,000) 4,000,000 7,000,000 6,000,000 4,000,000 3,000,000 Answer: Proceeds from borrowing on a long-term note payable Dividend paid Payment of current bank note payable (5,000,000 – 2,000,000) Net cash provided by financing activities 10,000,000 ( 3,000,000) ( 3,000,000) 4,000,000 Problem 17-27 Rosalynne Company reported the following statement of financial position at year-end: 2019 Cash Accounts receivable Investments, at cost Plant Accumulated depreciation Accounts payable Share capital Retained earnings 2018 2,750,000 2,000,000 7,000,000 4,600,000 1,000,000 1,750,000 9,000,000 6,500,000 (3,000,000) (2,250,000) 4,750,000 3,750,000 7,500,000 5,000,000 4,500,000 3,850,000 An investment was sold for P1,250,000 during the year. There was no disposal of plant during the year. The net income for the year was P3,000,000, after income tax expense of P1,200,000. A dividend of P2,350,000 was paid on December 31, 2019. 1. What is the net cash provided by operating activities? a. b. c. d. 1,850,000 2,350,000 2,850,000 1,100,000 Answer: Net profit Gain on sale of investment (1,250,000 – 75,000) Increase in accounts receivable Depreciation (3,000,000 – 2,250,000) Increase in accounts payable Net cash provided – operating 3,000,000 ( 500,000) (2,400,000) 750,000 1,000,000 1,850,000 2. What is the net cash used in investing activities? a. 2,500,000 b. 1,250,000 c. 1,750,000 d. 500,000 Answer: Sale of equipment Purchase of plant (9,000,000 – 6,500,000) Net cash used – investing 1,250,000 (2,500,000) (1,250,000) 3. What is the net cash provided by financing activities? a. 2,500,000 b. 2,350,000 c. 650,000 d. 150,000 Answer: Issue of share capital (7,500,000 – 5,000,000) Dividend paid Net cash provided – financing 2,500,000 (2,350,000) 150,000 Problem 17-28 Weaver Company provided the following data: Trade accounts receivable, net Inventory Accounts payable 2018 2019 840,000 1,500,000 950,000 780,000 1,400,000 980,000 Total sales were P12,000,000 for 2019 and P11,000,000 for 2018. Cash sales were 20% of total sales each year. Cost of goods sold was P8,400,000 for 2019. Variable general and administrative expenses for 2019 were P1,200,000. They have varied in proportion to sales, 50% have been paid in the year incurred and 50% the following year. Unpaid expenses are not included in accounts payable. Fixed general and administrative expenses, including P350,000 depreciation and P50,000 bad debt expense, totaled P1,000,000 each year. Eighty percent of fixed expenses involving cash were paid in the year incurred and 20% the following year. Each year there was a P50,000 bad debt estimate and a P50,000 writeoff. Unpaid expenses are not included in accounts payable. 1. What is the cash collected from customers during 2019? a. b. c. d. 12,010,000 12,060,000 11,960,000 11,890,000 Answer: Accounts receivable – 2018 Sales – 2019 Total Less: Accounts receivable – 2019 Writeoff Cash collections in 2019 840,000 12,000,000 12,840,000 780,000 50,000 830,000 12,010,000 2. What is the cash disbursed for purchases during 2019? a. b. c. d. 8,500,000 8,270,000 8,300,000 8,200,000 Answer: Inventory – 2018 Purchase (squeeze) Goods available for sale Less: inventory – 2019 Cost of goods sold 1,500,000 8,300,000 9,800,000 1,400,000 8,400,000 Accounts payable – 2018 Purchases Total Less: Accounts payable – 2019 Cash disbursed for purchase 950,000 8,300,000 9,250,000 980,000 8,270,000 3. What is the cash disbursed for expenses during 2019? a. b. c. d. 1,800,000 1,200,000 1,750,000 1,450,000 Answer: Fixed expenses Depreciation Bad debt expense Fixed expenses paid in 2019 Variable expenses paid in 2019 2019 (1,200,000 x 50%) 2018 (1,100,000 x 50%) Total cash disbursement for expenses 1,000,000 ( 350,000) ( 50,000) 600,000 Variable ratio (1,200,000 / 12,000,000) 2018 variable expenses (10% x 11,000,000) 10% 1,100,000 600,000 550,000 1,750,000 Problem 17-29 Haze Company provided the following information for the current year: Cash Accounts receivable Merchandise inventory Accounts payable January 1 December 31 620,000 670,000 860,000 530,000 ? 900,000 780,000 480,000 The sales and cost of goods sold were P7,980,000 and P5,830,000 respectively. All sales and purchases were on credit. Various expenses of P1,070,000 were paid in cash. There were no other pertinent transactions. 1. What is the amount of collections from customers? a. b. c. d. 7,980,000 8,600,000 7,750,000 8,210,000 Answer: Accounts receivable – January 1 Sales Total Accounts receivable – December 31 Cash collected from customers 2. What is the payment of accounts payable? a. b. c. d. 5,750,000 5,880,000 5,800,000 5,700,000 670,000 7,980,000 8,650,000 ( 900,000) 7,750,000 Answer: Merchandise inventory – January 1 Purchases (squeeze) Available for sale Merchandise inventory – December 31 Cost of goods sold 860,000 5,750,000 6,610,000 ( 780,000) 5,830,000 Accounts payable – January 1 Purchases Total Accounts payable – December 31 Cash paid for accounts payable 530,000 5,750,000 6,280,000 ( 480,000) 5,800,000 3. What is the cash balance on December 31? a. b. c. d. 1,090,000 1,500,000 2,570,000 3,050,000 Answer: Cash – January 1 Cash collected from customers Less: Payments of accounts payable Expense Cash balance – December 31 620,000 7,750,000 5,800,000 1,070,000 1,500,000 Problem 17-30 Mega Company gathered the following information about changes which took place during the current year: Cash Accounts receivable, net Inventory Property, plant and equipment Accumulated depreciation Intangible asset, net of amortization Accrued expenses Accounts payable Note payable – short-term debt Bonds payable ( 150,000) 300,000 1,500,000 500,000 ( 180,000) 275,000 ( 50,000) ( 320,000) ( 700,000) ( 250,000) Ordinary share capital, P10 par Share premium Retained earnings ( 125,000) ( 200,000) ( 600,000) Equipment with had originally cost P200,000 and had a carrying amount of zero was thrown away. Equipment with a cost of P150,000 and accumulated depreciation of P100,000 was sold for P50,000. Some new equipment was purchased during the year. An intangible asset was acquired during the year for 25,000 ordinary shares. Each share was selling for P13 at that time. The entity retired P2,500,000 of 10% bonds at par and issued P2,750,000 of 8% bonds at par. The income statement reported revenue of P7,000,000 and expenses of P5,000,000. 1. What is the net cash provided by operating activities? a. b. c. d. 1,000,000 1,800,000 1,050,000 1,100,000 Answer: Net income (7,000,000 – 5,000,000) Depreciation Increase in accounts receivable Increase in inventory Amortization (325,000 – 275,000) Increase in accrued expenses Increase in accounts payable Net cash provided – operating Net increase in accumulated depreciation Add: Accumulated depreciation of equipment thrown away Accumulated depreciation of equipment sold Total depreciation 2. What is the net cash used in investing activities? a. 850,000 b. 800,000 c. 900,000 2,000,000 480,000 ( 300,000) (1,500,000) 50,000 50,000 320,000 1,100,000 180,000 200,000 100,000 480,000 d. 950,000 Answer: Sale of equipment Purchase of equipment Net cash used – investing 50,000 ( 850,000) ( 800,000) Net increase in PPE Add: Cost of equipment thrown away Cost of equipment sold Purchase of equipment 500,000 200,000 150,000 850,000 Patent acquired (25,000 shares x 13) Less: Increase in intangible asset Amortization 325,000 275,000 50,000 3. What is the net cash used in financing activities? a. b. c. d. 250,000 450,000 950,000 125,000 Answer: Retirement of bonds payable Issuance of bonds payable Dividend paid Proceeds from note payable – short term debt Net cash used – financing (2,500,000) 2,750,000 (1,400,000) 700,000 450,000 Net income Less: Retained earnings Dividend paid 2,000,000 600,000 1,400,000 Problem 17-31 Beal Company reported the following changes in the statement of financial position accounts during the current year: Increase (Decrease) Assets Cash and cash equivalents Short-term investments Accounts receivable, net Inventory Long-term investments Property, plant and equipments Accumulated depreciation 120,000 300,000 80,000 (100,000) 700,000 1,100,000 Liabilities and Shareholders’ Equity Accounts payable and accrued liabilities Dividend payable Short-term bank debt Long-term debt Ordinary share capital, P10 par Share premium Retained earnings ( 5,000) 160,000 325,000 110,000 100,000 120,000 290,000 1,100,000 The following additional information relates to the current year: Net income for the current year was P790,000. Cash dividend of P500,000 was declared. Equipment costing P600,000 and having a carrying amount of P350,000 was sold for P350,000. Equipment costing P110,000 was acquired through issuance of long-term debt. A long-term investment was sold for P135,000. There were no other transactions affecting long-term investments. 10,000 ordinary shares were issued for P22 a share. 1. What amount should be reported as net cash provided by operating activities? a. 1,600,000 b. 1,040,000 c. 920,000 d. 705,000 Answer: Net income Increase in inventory Decrease in accounts payable Gain on sale of long-term investment (135,000 – 100,000) Depreciation expense (600,000 – 350,000) Cash provided by operating activities 790,000 ( 80,000) ( 5,000) ( 35,000) 250,000 920,000 2. What amount should be reported as net cash used in investing activities? a. b. c. d. 1,005,000 1,190,000 1,275,000 1,600,000 Answer: Purchased of short-term investments Sale of long-term investments Purchased of PPE Sale of equipment Net cash used in investing activities ( 300,000) 135,000 (1,190,000) 350,000 (1,005,000) PPE net increase Cost of equipment sold Equipment acquired through issuance of long term debt Cash paid for PPE 700,000 600,000 ( 110,000) 1,190,000 3. What amount should be reported as net cash provided by financing activities? a. 20,000 b. 45,000 c. 150,000 d. 205,000 Answer: Cash dividend paid (500,000 – 160,000) Proceeds from short-term debt Issuance of ordinary share (10,000 x 22) Net cash provided in financing activities ( 340,000) 325,000 220,000 205,000 Problem 17-32 New World Company recorded the following transactions during the current year. Net income was P2,900,000, which included P300,000 loss resulting from the condemnation of land by the city government. The entity received P3,300,000 for the land carried at P3,600,000. Patent account increased by P560,000 during the year, representing acquisition of P680,000 and amortization of P120,000. Property, plant and equipment had a net increase of P2,200,000. Accumulated depreciation: Ending balance Beginning balance 4,200,000 3,270,000 Cash dividends of P250,000 were declared and paid. Treasury shares with par value of P400,000 were acquired for P620,000 cash. Convertible bonds issued at face amount of P2,000,000 were converted into share capital during the year. The par value of the share capital issued was P1,500,000. All current assets and current liabilities, other than cash remained unchanged during the year. Working capital increased by P200,000 during the year. 1. What amount should be reported as net cash provided by operating activities? a. 2,900,000 b. 4,250,000 c. 4,130,000 d. 3,950,000 Answer: Net income Amortization patent Accumulated depreciation Net cash provided by operating activities 2,900,000 120,000 930,000 3,950,000 2. What amount should be reported as net cash used in investing activities? a. b. c. d. 2,500,000 2,620,000 3,180,000 2,200,000 Answer: Condemnation of land – loss Gain on sale of land (3,300,000 – 3,600,000) Property, plant and equipment Net cash used in investing activities ( 300,000) 300,000 (2,200,000) (2,200,000) 3. What amount should be reported as net cash used in financing activities? a. 620,000 b. 250,000 c. 870,000 d. 0 Answer: Proceeds from issuance of share capital (1,500,000 -2,000,000) Cash dividends paid Treasury share Net cash used in financing activities 500,000 ( 250,000) 620,000 870,000 Problem 17-33 1. All can be classified as cash and cash equivalents, except a. b. c. d. Redeemable preference share due in 60 days Treasury bill due for repayment in 90 days Equity investments Bank overdraft 2. When an entity purchased a three-month Treasury bill, how would the purchase be treated in preparing the statement of cash flow? a. b. c. d. Not reported An outflow for financing activities An outflow for lending activities An outflow for investing activities 3. In a statement of cash flows, if used equipment is sold at a gain, the amount shown as cash inflow from investing activities equals the carrying amount of the equipment a. b. c. d. Plus the gain Plus the gain and less the amount of tax Plus both the gain and the amount of tax With no addition or subtraction 4. In a statement of cash flows, if used equipment is sold at a loss, the amount shown as a cash inflow from investing activities equals the carrying amount of the equipment a. b. c. d. Less the loss and plus the amount of tax Less both the loss and the amount of tax Less the loss With no addition or subtraction 5. In a statement of cash flows using indirect method, a decrease in prepaid expense is a. b. c. d. Reported as an outflow and inflow of cash Reported as an outflow of cash Deducted from net income Added to net income 6. In a statement of cash flows, depreciation is treated as an adjustment to net income because depreciation a. Is a direct source of cash b. Reduces income but does not involve cash outflow c. Reduces net income and involves an inflow of cash d. Is an inflow of cash for replacement of asset 7. Using indirect method for operating activities, an increase in inventory is presented as a. b. c. d. Outflow of cash Inflow and outflow of cash Addition to net income Deduction from net income 8. Which of the following should not be disclosed in the statement of cash flows using the indirect method? a. b. c. d. Interest paid Income taxes paid Cash flow per share Dividends paid on preference shares 9. Dividends received from an equity investee should be presented in the statement of cash flows as a. b. c. d. Deduction from cash flows from operating activities Addition to cash flows from investing activities Addition to cash flows from operating activities Deduction from cash flows from investing activities 10. In a statement of cash flows, which of the following should be reported as cash flow from financing activities? a. b. c. d. Payment to retire mortgage note Interest payment on mortgage note Dividend payment Payment to retire mortgage note and dividend payment Problem 17-34 1. Which statement about the method of preparing the statement of cash flows is true? a. The indirect method starts with income before tax. b. The direct method is known as the reconciliation method. c. The direct method is more consistent with the primary purpose of the statement of cash flows. d. All of these statements are true. 2. Which of the following is not disclosed in the statement of cash flows when prepared under the direct method? a. b. c. d. The major classes of gross cash receipts and gross cash payments The amount of income taxes paid A reconciliation of net income to net cash flow from operations A reconciliation of ending retained earnings to net cash flow from operations 3. Required disclosures of a statement of cash flows prepared using the direct method include a reconciliation of net income to net cash provided by a. b. c. d. Operating activities Financing activities Investing activities Operating, financing and investing activities 4. Noncash investing and financing activities are a. Reported only if the direct method is used. b. Reported only if the indirect method is used. c. Disclosed in a note or separate schedule accompanying the statement of cash flows. d. Not reported. 5. Supplemental disclosures required only when the using the indirect method include a. b. c. d. Reconciling net income with operating activities. Amounts paid for interest and taxes. Amounts deducted for depreciation and amortization Significant noncash investing and financing activities.