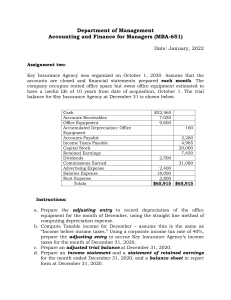

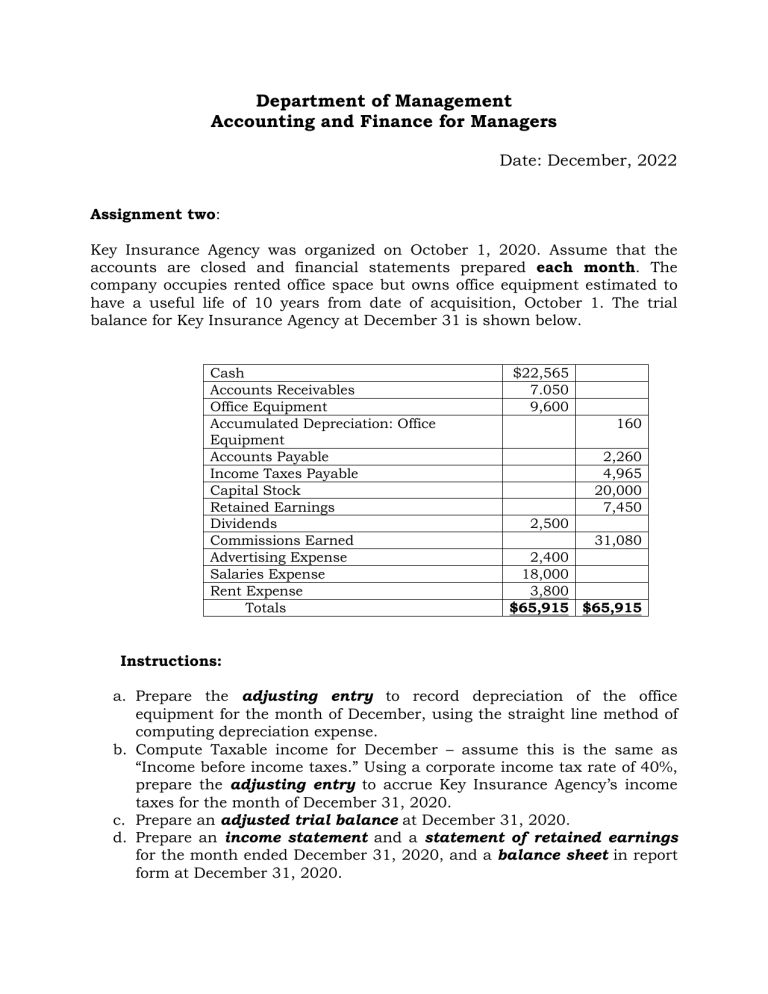

Department of Management Accounting and Finance for Managers Date: December, 2022 Assignment two: Key Insurance Agency was organized on October 1, 2020. Assume that the accounts are closed and financial statements prepared each month. The company occupies rented office space but owns office equipment estimated to have a useful life of 10 years from date of acquisition, October 1. The trial balance for Key Insurance Agency at December 31 is shown below. Cash Accounts Receivables Office Equipment Accumulated Depreciation: Office Equipment Accounts Payable Income Taxes Payable Capital Stock Retained Earnings Dividends Commissions Earned Advertising Expense Salaries Expense Rent Expense Totals $22,565 7.050 9,600 160 2,260 4,965 20,000 7,450 2,500 31,080 2,400 18,000 3,800 $65,915 $65,915 Instructions: a. Prepare the adjusting entry to record depreciation of the office equipment for the month of December, using the straight line method of computing depreciation expense. b. Compute Taxable income for December – assume this is the same as “Income before income taxes.” Using a corporate income tax rate of 40%, prepare the adjusting entry to accrue Key Insurance Agency’s income taxes for the month of December 31, 2020. c. Prepare an adjusted trial balance at December 31, 2020. d. Prepare an income statement and a statement of retained earnings for the month ended December 31, 2020, and a balance sheet in report form at December 31, 2020.