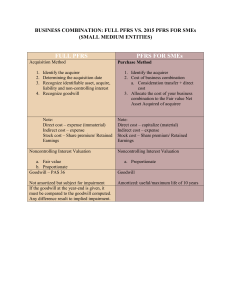

The objective of IFRS 3 Business Combinations is to improve the relevance, reliability and comparability of the information that a reporting entity provides in its financial statements about a business combination and its effects. More specifically, IFRS 3 establishes principles and requirements for how the acquirer: Recognizes and measures the identifiable assets acquired, the liabilities assumed and any non-controlling interest in the acquiree; Recognizes and measures the goodwill acquired in the business combination, or a gain from a bargain purchase; Determines what information to disclose about the business combination. What is the difference between IFRS 3 and IFRS 10? Although it may seem that the IFRS 10 Consolidated Financial Statements and IFRS 3 Business Combinations deal with the same thing, that’s not the whole truth. Both standards deal with business combinations and their financial statements. But while IFRS 10 defines a control and prescribes specific consolidation procedures, IFRS 3 is more about the measurement of the items in the consolidated financial statements, such as goodwill, non-controlling interest, etc. If you need to deal with the consolidation, then you need to apply both standards, not just one or the other. Is it a business combination or not? Any investor who acquires some investment needs to determine whether this transaction or event is a business combination or not. IFRS 3 requires that assets and liabilities acquired need to constitute a business, otherwise it’s not a business combination and an investor needs to account for the transaction in line with other IFRS. A business consists of 3 elements: 1. Input = any economic resource that creates or can create outputs when one or more processes are applied to it, e.g. non-current assets, etc.; 2. Process = any system, standard, protocol, convention or rule that when applied to an input(s), creates outputs, e.g. management processes, workforce, etc. 3. Output = the result of inputs and processes applied to those inputs that provide or can provide a return in the form of dividends, lower costs or other economic benefits directly to investors or other owners. Apply the acquisition method Once the investor acquires a subsidiary, it has to account for each business combination by applying the acquisition method. Now you may ask: what is the difference between the acquisition method and consolidation procedures? I would say that the acquisition method is simply a part of all consolidation procedures you need to perform. So when you prepare your consolidated financial statements, you must start with the correct application of the acquisition method, and then continue with the eliminating the mutual intra-group transactions, etc. The acquisition method involves 4 steps: 1. Identifying the acquirer, 2. Determining the acquisition date, 3. Recognizing and measuring the identifiable assets acquired, the liabilities assumed and any noncontrolling interest in the acquiree; 4. Recognizing and measuring goodwill or a gain from a bargain purchase. Step 1: Identify the acquirer Most of the time, it’s straightforward – the acquirer is usually the investor who acquires an investment or a subsidiary. Sometimes, it is not so clear. The most common example is a merger. When two companies merge together and create just 1 company, the acquirer is usually the bigger one – with larger fair value. However, IFRS 3 provides the application guidance in its appendix, so you might need to check out. Step 2: Determine the acquisition date The acquisition date is the date on which the acquirer obtains control of the acquiree. It is generally the date on which the acquirer legally transfers the consideration (=the payment for the investment), acquires the assets and assumes the liabilities of the acquiree – the closing date. However, it can be earlier or later than the closing date, too. It depends on the contractual arrangements in the written agreement, if something like that exists. Step 3: Recognize and measure the identifiable assets acquired, the liabilities assumed and any non-controlling interest in the acquiree 3.1 Acquired assets and liabilities An acquirer or investor shall recognize all identifiable assets acquired, liabilities assumed and noncontrolling interests in the acquiree separately from goodwill. So please be careful, because sometimes, there’s some unrecognized asset in an acquiree, and an investor needs to recognize this asset if it meets the criteria for the recognition. For example, a subsidiary can have some unrecognized internally generated intangible assets meeting separability criterion. In such a case, an acquirer needs to recognize these assets, too. All assets and liabilities are measured at acquisition-date fair value. Often, investors need to perform “fair value adjustments” at acquisition date, because assets and liabilities are often valued in a different way – either at cost less accumulated depreciation, at amortized cost, etc. However, there are some exceptions from fair value measurement rule: Contingent liabilities (IAS 37)Links to an external site.; Income taxes (IAS 12)Links to an external site.; Employee benefits (IAS 19)Links to an external site.; Indemnification assets; Reacquired rights; Share-based payment transactions (IFRS 2)Links to an external site.; Assets held for sale (IFRS 5)Links to an external site.. 3.2 Non-controlling interest Non-controlling interest is the equity in a subsidiary not attributable, directly or indirectly, to a parent. For example, when an investor acquires 100% share in a company, then there’s no non-controlling interest, because the investor owns subsidiary’s equity in full. However, when an investor acquires less than 100%, let’s say 80%, then there’s non-controlling interest of 20%, as the 20% of subsidiary’s net assets belong to someone else. IFRS 3 permits 2 methods of measuring non-controlling interest: 1. Fair value, or 2. The proportionate share in the recognized acquiree’s net assets. Selection of method for measuring non-controlling interest directly impacts the amount of goodwill recognized, as you can see in the illustrative example below Step 4. Step 4: Recognize and measure goodwill or a gain from a bargain purchase. Goodwill is an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized. It is calculated as a difference between: The aggregate of: o The fair value of the consideration transferred; o The amount of any non-controlling interest; o In a business combination achieved in stages: the acquisition-date fair value of the acquirer’s previously-held equity interest in the acquiree; and The acquisition-date amounts of net assets in an acquiree. The goodwill can be both positive and negative: If the goodwill is positive, then you shall recognize it as an intangible asset and perform annual impairment test; If the goodwill is negative, then it is a gain on a bargain purchase. You should: o Review the procedures for recognizing assets and liabilities, non-controlling interest, previously held interest and consideration transferred (i.e. check whether they are error-free); o Recognize a gain on bargain purchase in profit or loss. Consideration transferred is measured at fair value, including any contingent consideration. Subsequent change in a consideration transferred is accounted for depending on the initial recognition of the contingent consideration. Example: Goodwill and non-controlling interest under IFRS 3 Mommy Corp. acquires 80% share in Baby Ltd. for the cash payment of CU 100 000. On the acquisition date, the aggregate value of Baby’s identifiable assets and liabilities in line with IFRS 3 is CU 110 000. The fair value of non-controlling interest (the remaining 20% share) is CU 25 000. This amount was determined with the reference of market price of Baby’s ordinary shares before the acquisition date. I have calculated goodwill and non-controlling interest using both methods mentioned in Step 3 and the results are in the following table. Please note the differences: Additional guidance to specific transactions Besides the above rules on application of the acquisition method, IFRS 3 provides guidance about the following transactions: A business combination achieved in stages: The acquirer shall re-measure its previously held equity interest in the acquiree at its acquisitiondate fair value and recognize the resulting gain or loss, if any, in profit or loss or other comprehensive income, as appropriate. Acquisition costs: Costs of issuing debt or equity instruments are accounted for under IAS 32 Financial Instruments: Presentation and IAS 39 Financial Instruments: Recognition and MeasurementLinks to an external site./IFRS 9 Financial InstrumentsLinks to an external site.. All other costs associated with an acquisition must be expensed. Pre-existing relationships If the acquirer and acquiree were parties to a pre-existing relationship, this must must be accounted for separately from the business combination. Reacquired rights A reacquired right recognized as an intangible asset shall be amortized over the remaining contractual period of the contract in which the right was granted. An acquirer that subsequently sells a reacquired right to a third party shall include the carrying amount of the intangible asset in determining the gain or loss on the sale. Contingent liabilities: Yes, acquirer recognizes a contingent liability in a business combination, contrary to IAS 37, even when the outflow of economic benefits to settle it is remote.After initial recognition and until the liability is settled, cancelled or expires, the acquirer shall measure a contingent liability recognized in a business combination at the higher of the amount determined in accordance with IAS 37, and the amount initially recognized less cumulative amortization in line with IAS 18 RevenueLinks to an external site.. Indemnification assets Indemnification assets recognized at the acquisition are subsequently measured on the same basis of the indemnified liability or asset, subject to contractual impacts and collectibility. Indemnification assets are only derecognized when collected, sold or when rights to it are lost. Standard IFRS 3 prescribes a number of disclosures, too.