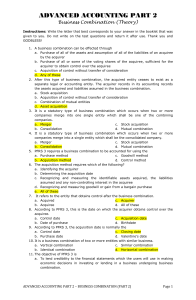

University of San Carlos School of Business and Economics Department of Accountancy AC 4101 Accounting for Business Combinations MW 7:00 - 9:00 PM Sheila Mae Berry A. Alcallaga February 8, 2023 Business combination is a broad term that refers to all forms of combining previously separate business entities. IFRS 3 defines business combination as, “A transaction or other event in which an acquirer obtains control of one or more business. Transactions sometimes referred to as ‘true mergers’ or ‘mergers of equals’ are also business combinations as that term is used in.” When a corporation buys the productive assets of another business organization and incorporates those assets into its own operations, such combinations are considered acquisitions. Business combinations are also acquisitions when one corporation obtains operating control over the productive facilities of another entity by acquiring a majority of its outstanding voting stock. The acquired company need not to be dissolved; that is, the acquired company does not have to go out of existence. IFRS 3 provides guidelines on determining whether the transaction meets the definition of a business combination. Firstly, the business combination must involve the acquisition of a business. Secondly, control within one business entity must be established through various ways such as transferring cash, incurring liability, issuing equity instruments or not issuing consideration at all. Lastly, business combinations can be structured in a variety of ways to satisfy legal, taxation or other objectives. Acquisition method is required by the IFRS 3 in accounting for business combinations. Steps in applying the acquisition method are identifying the acquirer, determining the acquisition date, recognition and measurement of the identifiable assets acquired, the liabilities assumed and any non-controlling interest in the acquirer and recognition and measurement of goodwill or a gain from bargain purchase. The first step of applying this method is determining the acquirer. The acquirer is usually the entity that transfers cash or other assets and issues equity interest where the business combination is effected in this manner. The acquisition date is then determined which is the date on which the acquirer obtains control of the acquirer. Under this method, we record the identifiable assets, liabilities assumed and any non-controlling interest acquired using the fair-value principle at the acquisition date. We measure the cost to the purchasing entity of acquiring another company in a business combination by the amount of cash disbursed, or by the fair value of other assets distributed or securities issued. We expense the direct cost of a business combination other than those for the registration or issuance of equity securities and accordingly charge them against the fair value of securities, usually as a reduction of share premium. We also expense indirect costs such as depreciation, rent and management salaries under the acquisition method. Assets acquired and liabilities assumed in a business combination that arise from contingencies should be recognized at fair value if fair value can be reasonably estimated. If the fair value cannot be reasonably estimated, the asset or liability should be recognized in accordance with the requirements of IAS 37 Provisions, Contingent Liabilities and Contingent Assets. The acquirer also shall recognize goodwill measured as the excess of the (i) aggregate of the value of the consideration transferred, the amount amount of any non-controlling interest (NCI) and in a business combination achieved in stages, the acquisition-date fair value of the acquirer’s previously held equity interest in the acquiree over the (ii) net of the acquisition date fair value amounts of the identifiable assets acquired and the liabilities assumed. Firms should also recognize intangible assets separate from goodwill if they are separable or arise from other contractual rights. An investor may also acquire significant influence over the operating and financial policies of an investee in a series of stock acquisitions, rather than in a single purchase. The acquirer in a step acquisition remeasures any previously held interest at fair value and takes this amount into account in the determination of goodwill. Adjustments to provisional amounts, and the recognition of newly identified assets and liabilities must be made within the ‘measurement period’ which cannot exceed one year from the acquisition date. Other business combinations can be achieved without a transfer of consideration. For example, the acquiree repurchases a sufficient number of its own shares from other investors so that the acquirer will be able to obtain control or the minority veto rights that previously kept the acquirer from controlling the acquiree have lapsed. In this situation, the acquisition-date fair values of the acquirer’ interest is substituted for the consideration transferred in computing for goodwill. On the other hand, if the business combination is affected by the agreement between the acquirer and acquiree to combine their businesses or by a contract, the interest held by the parties other than the acquirer are attributed to NCI, even if the result is that NCI represents 100% interest in the acquiree. In situations where a private entity wants a fast-track to a public listing through acquiring a smaller, publicly listed public entity is known as reverse acquisitions. In this case, the IFRS 3 requires that the acquisition date fair value of the consideration transferred is measured as an amount based on the number of equity interest the legal subsidiary (acquirer) would have had to issue to give the legal parent (acquiree) the same percentage of equity interest in the combined entity that results from the reverse acquisition.