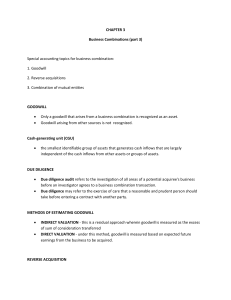

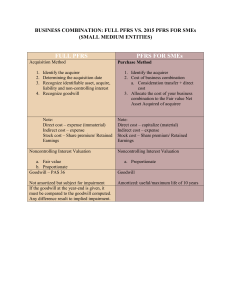

Junior Philippine Institute of Accountants Discussion Reviewer in Advanced Accounting Business Combination Disclaimer: This handout is not meant to replace the prescribed book of the college. No part of this handout may be reproduced or sold for personal gain without permission from the preparers but may be reproduced for academic purposes only. Special thanks are dedicated to all of the professors and students, in the UST-AMV College of Accountancy, and to God. Preparers: Edilmar R. Fontanilla , CPA Mark Stephen A. Asido, CPA Sources: IFRS 3 – Business Combination IFRS 10 – Consolidated Financial Statements IAS 39 – Financial Instruments, Recognition and Measurement IFRS 9 – Financial Instruments Intermediate Accounting vol. 2 – Empleo and Robles Advanced Accounting vol. 2 – Dayag Theory of Accounts vol. 2 - Valix UST-AMV College of Accountancy Professors Definition of Terms (IFRS 3 – Business Combination): 1. Acquiree - The business or businesses that the acquirer obtains control of in a business combination 2. Acquirer - The entity that obtains control of the acquiree 3. Acquisition date - The date on which the acquirer obtains control of the acquiree. 4. Business combination - A transaction or other event in which an acquirer obtains control of one or more businesses. Transactions sometimes referred to as “true mergers” or “mergers of equals” are also business combinations as that term is used in this IFRS. 5. Contingent Consideration - Usually, an obligation of the acquirer to transfer additional assets or equity interests to the former owners of an acquiree as part of the exchange for control of the acquiree if specified future events occur or conditions are met. However, contingent consideration also may give the acquirer the right to the return of previously transferred consideration if specified conditions are met. 6. Fair value - is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. 7. Non-controlling interest - The equity in a subsidiary not attributable, directly or indirectly, to a parent Page 1 of 11 Junior Philippine Institute of Accountants Discussion Reviewer in Advanced Accounting Business Combination MODES OF BUSINESS COMBINATION: 1. Merger. This is where an acquirer wholly purchases a company. As a result, the acquiring company will remain as a LEGAL entity while the acquired company will be totally dissolved. This can be viewed as (A+B=A), where A is the acquirer and B is the acquiree. 2. Stock Acquisition. This mode of business combination is where the acquirer purchases certain shares of a company for the purpose of obtaining control. According to IFRS 10 (Consolidated Financial Statements), an investor controls an investee when it is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee. According to US GAAP, an entity obtains control when it holds more than 50% over the investee company. Thus, a parent-subsidiary relationship exists. However, there can be no both entities having control in each other. It must be settled among the entities who has the controlling interest and if it cannot be settled, IFRS 11 (Joint Arrangement) will apply. (Note: A 100% stock acquisition is not a merger. In a 100% stock acquisition, the legal entity of the acquiree will still remain unlike in a merger where the acquiree is dissolved after acquisition.) TABLE 1.1 Comparison between Merger and Stock Acquisition Nature of entity Merger Acquirer – Legal Entity/Surviving Company Acquiree – Dissolved Entity Nature of Business Purchase of Net Assets Combination Eliminating Entries Books of the subsidiary Stock Acquisition Parent – Legal Entity/Separate Entity Subsidiary – Legal Entity/Separate Entity Consolidation – Single Entity Purchase of Stocks Working Papers DATE OF ACQUISITION COST OF INVESTMENT The cost of investment is the consideration given to the owners of the acquired company for the purchase of net assets (Merger) or stocks (Stock Acquisition) of the acquiree, this amount may include a control premium in case of a stock acquisition. It may comprise of one or a combination of the following: 1. 2. 3. 4. Price paid in cash; Noncash assets (At fair market value) Shares of stocks (at the fair market value of shares of the acquirer) Bonds (IFRS 9 will apply) a. If FVPL or FVOCI – at Fair Value of the bonds b. If AC – at Amortized Cost 5. Contingent Consideration Note: Contingent Consideration is different to a contingent liability but it can be in a form of cash, noncash, stocks, bonds etc. When the cost of investment is determined, this shall be compared with the fair value of the net assets of the acquiree. The acquiree’s assets and liabilities are acquired at its fair value and it should be IDENTIFIABLE. Page 2 of 11 Junior Philippine Institute of Accountants Discussion Reviewer in Advanced Accounting Business Combination The fair value of identifiable assets of the acquiree should include, assets that are not yet recorded in the books but determined that it has a fair value at the date of acquisition and it should NEVER include the Goodwill recorded in the books. This is because, goodwill unlike intangible assets, lacks identifiability. Also, any contingent assets shall NOT be considered as part of the fair value of identifiable net assets. The fair value of liabilities may, however, include Contingent liabilities. (Note: Net Identifiable assets is different from identifiable assets.) MERGER Any difference of the Cost of Investment and the Fair value of the identifiable net assets of the acquiree is attributable to Goodwill or Gain on Acquisition (Gain on Bargain Purchase). This goodwill or gain on acquisition may be adjusted further during the measurement period. Note: In a merger, the goodwill from business combination is recorded in the books of the surviving company and not in the working papers. The old books of the acquiree will be closed and all the assets and liabilities (at fair value) of the dissolve entity will be recorded in the books of the acquiring company. Illustration: On January 1, 2017, POGO CAT Corporation acquired the net assets of SUSHI CAT Company for P900,000. The acquirer also issued 100,000, P10 par common stock and bonds of 10% P700,000. In addition, the acquirer will pay the acquiree a consideration of P930,000 when the revenue for the year exceeds P2,000,000. There is 40% probability that this consideration will be paid. The fair value of the common stock of POGO CAT and SUSHI CAT are P14 and P12.5, respectively. The book values and fair values of the acquirer and acquiree immediately before the business combination are presented below: POGO CAT Corporation Book Value Fair Value SUSHI CAT Company Book Value Fair Value Cash Trade and Other Receivables Merchandise Inventory Building, net Land Goodwill Total Assets P2,020,000 454,000 570,000 1,905,000 790,000 250,000 P5,989,000 P2,020,000 530,000 630,000 1,985,000 P820,000 - P335,000 360,000 441,000 1,420,000 750,000 170,000 P3,476,000 P335,000 380,000 456,000 1,235,000 833,000 - Trade and Other Payables Contingent Liabilities Common Stock, P10 par Additional Paid-in Capital Retained Earnings Total Liabilities and Equity P450,000 1,800,000 2,550,000 1,189,000 P4,489,000 P510,000 P240,000 P540,000 1,200,000 970,000 766,000 P3,476,000 P540,000 327,000 In this problem, we should first determine the COST OF INVESTMENT which will be computed as follows: Price Paid Shares of Stocks (100,000 x P14) Bonds at face value Contingent consideration (P930,000 x 40%) Total P900,000 1,400,000 700,000 372,000 P3,372,000 Page 3 of 11 Junior Philippine Institute of Accountants Discussion Reviewer in Advanced Accounting Business Combination This amount will be compared to the fair value of the net identifiable assets acquired on which excess will be attributable to a goodwill/(gain on acquisition) as the case may be. Take note that the assets considered is at its fair value and should exclude goodwill. The liabilities, on the other hand, should also be recorded at fair value and even the contingent liability will also be considered. Note that the amount of cash in the books are always equal to its fair value. The fair value of the net identifiable assets are computed as follows: Cash Trade and other receivables Merchandise Inventory Building, net Land Less: Trade and other payables Contingent Liability FAIR VALUE OF IDENTIFIABLE NET ASSETS P335,000 380,000 456,000 1,235,000 833,000 (540,000) (327,000) P2,372,000 As a result, the business combination resulted at a goodwill of P1,000,000 (P3,372,000 – P2,372,000). This amount will be reported as a non-current asset in the books of the surviving company. If the business combination resulted at a gain on acquisition, such amount will be taken to profit and loss in the Statement of Comprehensive income which will be eventually closed to the retained earnings. However, in the scenario, it resulted in a goodwill and the entries in books will be as follows: Trade and other Receivables 380,000 Merchandise Inventory 456,000 Building, net 1,235,000 Land 833,000 Goodwill 1,000,000 Cash (P335,000-P900,000) Trade and other payables Contingent Liability Common Stock Bonds Estimated Liability for Contingent Consideration 565,000 540,000 327,000 1,400,000 700,000 372,000 ACQUISITION RELATED COSTS According to IFRS 3, Acquisition-related costs are costs the acquirer incurs to effect a business combination. Generally, acquisition-related costs are expensed in the periods which the costs are incurred and the services are received. But in exception, cost to issue debt and equity securities share be recognized in accordance with IAS39 and IFRS 9. The following are examples of acquisition-related costs. 1. Directly attributable costs – these costs include professional fees paid to accountants, legal consultations and other fees for services to effect the business combination such as finder’s fee and brokerage fees. To be quickly reminded of the examples, these can be costs for services that are attributable to persons who are not necessarily employees of the company. These cost are treated as an EXPENSE. 2. Indirectly attributable costs – these costs includes general and administrative expenses which are, from the term itself, not directly related to the business combination. These costs are normally salaries of employees, depreciation expenses and other normal company expenses. The cost are also EXPENSED. Page 4 of 11 Junior Philippine Institute of Accountants Discussion Reviewer in Advanced Accounting Business Combination 3. Cost to issue equity securities (Share Issuance Costs) – these costs includes costs that are necessary for the issuance of securities which may include cost of registering stocks, cost of printing, issuing stock certificates and other related transaction costs as referred to IAS39 and IFRS 9. *In the new interpretation of the Philippine Interpretations Committee (PIC), these costs are treated in the following order: 1. Debit to APIC from previous issuance 2. Debit to APIC from sources other than the previous issuance 3. Retained Earnings. 4. Cost of registering and issuing debt securities –these include adviser’s fee, underwriting costs and brokerage fees. These costs are treated as bond issue costs. MEASUREMENT PERIOD During the measurement period, the provisional amounts and the goodwill or gain on bargain purchase recognized at the date of acquisition shall be retrospectively adjusted as long as the following criteria are satisfied. 1. The measurement period shall not exceed one (1) year from the acquisition date. 2. The reasons for the changes in the provision are facts and information already existing (also known as old or existing events) at the acquisition date. Note: But once that the changes in the provisional amounts happened after one (1) year from acquisition date or the reason of the changes are pertinent to facts and information that are inexistent (NEW EVENTS) from the acquisition date, the treatment of these changes are reflected in the profit or loss. Examples of new events are as follows: 1. Achievement of certain revenue or profit; 2. Achievement of a market share and other economic achievements; 3. Amortization of bonds if the contingent consideration are in the form of bonds or other financial liabilities in amortized cost; 4. Changes in the fair value in cases of contingent consideration in form of stocks or bonds measured at fair value. Note: Mere changes due to errors of estimation of contingent consideration are NOT considered as new events. However, such changes should be retroactively adjusted in the goodwill or gain on acquisition arising from business combination. An example of this is when an entity measured a contingent consideration in form of bonds at amortized cost. Normally an entity cannot initially determine the exact rate to be used. In this case, the entity might estimate a temporary effective rate and since it is just an estimation, this might change over a period of time. Such changes will be considered as old events. Note: The goodwill or gain on acquisition may change several times as long as it satisfies the criteria as mentioned above. Page 5 of 11 Junior Philippine Institute of Accountants Discussion Reviewer in Advanced Accounting Business Combination STOCK ACQUISITION As far as the topic is concerned, the consideration given up to effect the business combination in a stock acquisition is the same as the consideration given in a merger as previously discussed. But in a stock acquisition, as the term itself, is the purchase of the stocks to gain control over an entity. Note that in a stock acquisition, the parent acquires stocks from the shareholders of the subsidiary and not directly from the company. If the acquired company issued shares to the acquirer resulting to a control of the purchaser, the effect is a reverse acquisition. As a result, the purchaser gained control over the company. To start with a stock acquisition, the following must be determined: 1. 2. 3. 4. 5. The acquiring company and the company whose stock are being acquired; The date of acquisition; The control the acquirer gained as a result of the stock acquisition. The fair value of the net identifiable assets. The method of measuring goodwill and non-controlling interest. METHOD OF MEASURING GOODWILL AND NON-CONTROLLING INTEREST 1. Full-Goodwill Approach or Fair Value Option – in this method, goodwill will be recognized and allocated in the part of the non-controlling interest. 2. Partial-Goodwill Approach or Proportionate Basis of Goodwill – the goodwill/(gain on acquisition) will only allocated to the controlling interest. If the problem is silent, the Full-Goodwill Approach is used whenever it is applicable. But there are instances that the Full-Goodwill approach is inapplicable. According to IFRS 3, paragraph 32, the acquirer shall recognize goodwill as of the acquisition date measured as the excess of the (a) over (b): a. The aggregate of: 1. Consideration transferred 2. Non-controlling interest b. Fair value of the net assets And if the amount of the Fair value of net assets is in excess of the aggregate amount of the consideration transferred and the non-controlling interest, the business combination will result into a gain on acquisition: Note: In the separate allocation of goodwill, the amount of the fair value of the net assets attributable to the controlling interest can be in excess of the consideration transferred, but, the fair value of the net assets attributable to the non-controlling interest can NEVER be in excess of the FV of the non-controlling interest. If the company resulted into a gain on acquisition, no part of the gain shall be allocated to the non-controlling interest. Reason: The parent acquires the subsidiary because the acquired company has worth to the acquiring company. Thus, we should never assess the fair value of the non-controlling interest lower than the fair value of the net assets attributable to the non-controlling interest. Page 6 of 11 Junior Philippine Institute of Accountants Discussion Reviewer in Advanced Accounting Business Combination Case 1: To further illustrate, assume that JN Corporation acquired MM Company at a price of P4,000,000 for a 80% interest in the company. The fair value of the net identifiable assets of MM amounts to P3,000,000. In this case, the fair value of the non-controlling interest is not given and it is silent on what measurement approach is used. Then we should use the Fair value approach if possible and assume an amount of the fair value of non-controlling interest from the consideration transferred. Controlling Interest(80%) Non-controlling Interest (20%) 4,000,000 1,000,000 (5M x 20%) Consideration transferred and FVNCI FV of Net 2,400,000 (3M x 80%) Assets Goodwill 1,600,000 Total 5,000,000 (4M / 80%) 600,000 (3M x 20%) 3,000,000 200,000 2,000,000 You will notice that the assumed fair value of non-controlling interest is not lower than the fair value of the net assets attributable to the non-controlling interest. Therefore, the amount of the fair value of the non-controlling interest is valid. Total Goodwill from business combination: 2,000,000 Amount of non-controlling interest: 1,000,000 Assume further that the company uses the proportionate basis in measuring the goodwill and the FV of NCI. Controlling Interest(80%) Non-controlling Interest(20%) 4,000,000 600,000 Consideration transferred and FVNCI FV of Net 2,400,000 (3M x 80%) Assets Goodwill 1,600,000 Total 4,600,000 600,000 (3M x 20%) 3,000,000 0 1,600,000 You will notice that the goodwill is only attributable to the controlling interest in case of partial goodwill approach. Total goodwill from business combination: 1,600,000 Amount of non-controlling interest: 600,000 Case 2: Assume that JN Corporation acquired MM Company at a price of P4,000,000 for a 80% interest in the company. The fair value of the net identifiable assets of MM amounts to P3,000,000. The fair value of the non-controlling interest as of the date of acquisition amounts to P650,000. Controlling Interest(80%) Consideration 4,000,000 transferred and FVNCI FV of Net 2,400,000 (3M x 80%) Assets Goodwill 1,600,000 Non-controlling Interest(20%) 650,000 Total 4,650,000 600,000 (3M x 20%) 3,000,000 50,000 1,650,000 There is no need to assume a fair value of non-controlling interest because it is already determined as of the date of acquisition. Total goodwill from business combination: 1,650,000 Amount of non-controlling interest: 650,000 Page 7 of 11 Junior Philippine Institute of Accountants Discussion Reviewer in Advanced Accounting Business Combination Assume further that the company uses the proportionate basis in measuring the goodwill and the FV of NCI. Controlling Interest(80%) Consideration 4,000,000 transferred and FVNCI FV of Net 2,400,000 (3M x 80%) Assets Goodwill 1,600,000 Non-controlling Interest(20%) 600,000 Total 4,600,000 600,000 (3M x 20%) 3,000,000 0 1,600,000 We will still refer to the method used by the entity despite the determined fair value of noncontrolling interest. Case 3: Assume that JN Corporation acquired MM Company at a price of P4,000,000 for a 80% interest in the company. The fair value of the net identifiable assets of MM amounts to P3,000,000. The fair value of the non-controlling interest as of the date of acquisition amounts to P550,000. In this scenario, we cannot use the given fair value of the non-controlling interest because it is lower than the fair value of the net assets attributable to the non-controlling interest. Always be reminded that there should never be a negative goodwill attributable to the non-controlling interest. Even if the company will use the fair value approach, it is inappropriate in this scenario. Therefore we should use the proportionate approach. Consideration transferred and FVNCI FV of Net Assets Goodwill Controlling Interest(80%) Non-controlling Interest(20%) 4,000,000 600,000 Total 4,600,000 2,400,000 (3M x 80%) 600,000 (3M x 20%) 3,000,000 1,600,000 0 1,600,000 Important: In every problem, always and all the time, check if the fair value attributable to the non-controlling interest exceeds in the amount of the fair value of net asset. Case 4: Assume that JN Corporation acquired MM Company at a price of P4,000,000, including a P500,000 control premium, for a 80% interest in the company. The fair value of the net identifiable assets of MM amounts to P3,000,000. Control premium – the excess amount over the market acquisition price that the buyer is willing to pay in order to gain control. It should be accounted for as part of the controlling interest only, therefore we should avoid allocating any part of this control premium in accounting for the fair value of the non-controlling interest. If we will assume an amount of the non-controlling interest, we should exclude the amount of the control premium in the consideration transferred. Consideration transferred and FVNCI FV of Net Assets Goodwill Controlling Interest(80%) Non-controlling Interest(20%) 4,000,000 875,000 [(4,000,000-500,000)/80% x 20%] Total 4,875,000 2,400,000 (3M x 80%) 600,000 (3M x 20%) 3,000,000 1,600,000 275,000 1,875,000 Page 8 of 11 Junior Philippine Institute of Accountants Discussion Reviewer in Advanced Accounting Business Combination If the amount of the control premium in already excluded in the consideration transferred, the whole P4,000,000 will be considered in assuming the fair value of the non-controlling interest. Case 5: Assume that JN Corporation acquired MM Company at a price of P4,000,000, including a P500,000 control premium, for a 80% interest in the company. The fair value of the net identifiable assets of MM amounts to P4,500,000. Consideration transferred and FVNCI FV of Net Assets Goodwill Controlling Interest(80%) Non-controlling Interest(20%) 4,000,000 900,000 Total 4,900,000 3,600,000 (4.5M x 80%) 900,000 (4.5M x 20%) 4,500,000 400,000 0 400,000 In this scenario, we cannot use the assumed fair value of non-controlling interest of P875,000 because it is lower than the fair value of net asset attributable to the non-controlling interest. Therefore, we will use the proportionate approach. STEP ACQUISITION Business combination may be achieved in stages. When a transaction results into gaining of control from no control, because of additional stocks purchased, the event is considered to be a step acquisition. For example, an investment in equity securities or an investment in associate becomes an investment in subsidiary by purchasing additional stocks of the subsidiary. According to IFRS 3, paragraph 42, in a business combination achieved in stages, the acquirer shall remeasure its previously held equity interest in the acquiree at its acquisition-date fair value and recognize the resulting gain or loss, if any, in profit or loss or other comprehensive income, as appropriate. To illustrate further, these are two independent scenarios when a company gains control over an entity in a step acquisition. Case 1: From investment in equity securities to investment in subsidiary Pause Corporation acquires 15% of Stop Company for P500,000 on January 1, 2017. After 5 months, Pause acquired an additional 55% interest for P2,750,000. The fair value of the 30% noncontrolling interest as of this date amounts to P1,600,000. The fair value of the net assets of Stop Company amounts to P4,500,000. In this scenario, the business combination has effected from the purchase of additional stocks for another 55% interest. The P500,000 equity security will be remeasured to P750,000 (P2,750,000/55% x 15%) before the business combination. The gain of P250,000 will be taken to profit or loss if the equity security previously held is measure as fair value through profit or loss. But if it is measured previously at fair value through other comprehensive income, the gain is taken into other comprehensive income. Page 9 of 11 Junior Philippine Institute of Accountants Discussion Reviewer in Advanced Accounting Business Combination The determination of goodwill are as follows: Consideration transferred, previous equity instrument and FVNCI Fair value of net assets Goodwill Controlling interest 55% 2,750,000 Controlling interest 15% 750,000 Non-controlling interest 30% 1,600,000 3,150,000 350,000 1,350,000 250,000 Total 5,100,000 4,500,000 600,000 Case 2: From investment in associate to investment in subsidiary. Pause Corporation has an investment in associate on January 1, 2017 with a book value of P2,400,000. This equity investment represents 25% interest from Stop Company. On March 1, 2017, Stop company declared and gave Pause Corporation a dividend of P250,000. On July 1, 2017, Pause Corporation acquired stocks and gained another 35% interest of Stop Company for P3,850,000 and a business combination took place. The net income of Stop Company for the 6month period amounts to P1,500,000. The fair value of net assets of Stop Company as of the business combination amounts to P10,000,000 while the fair value of the non-controlling interest is P4,200,000. The investment in associate should be adjusted first to its updated book value as of July 1, 2017. The computation are as follows: Investment in Associate Beginning balance 2,400,000 250,000 Dividends received Share in Profit (1,500,000 x 25%) 375,000 Adjusted book value 2,525,000 The adjusted book value will be remeasured to the fair value of P2,750,000 (P3,850,000/35% x 25%). The difference of P225,000 will be taken into the profit and loss portion of the statement of comprehensive income. The goodwill from business combination should be therefore computed as follows: Controlling interest 35% 3,850,000 Controlling interest 25% 2,750,000 Consideration transferred, previous equity instrument and FVNCI Fair value of net assets 6,000,000 (10M x 60%) Goodwill 600,000 Non-controlling interest 40% 4,200,000 Total 4,000,000 (10M x 40%) 200,000 10,000,000 800,000 10,800,000 INITIAL ELIMINATING ENTRIES PERTINENT TO A STOCK ACQUISITION The purpose of eliminating entries in the working papers during a business combination by stock acquisition is to consolidate the companies for the presentation of the consolidated financial statements. The eliminating entries are as follows: 1. To eliminate the equity of the subsidiary Share Capital Share Premium Retained Earnings Investment in Subsidiary Non-controlling interest xx xx xx xx xx Based on control percentage Page 10 of 11 Junior Philippine Institute of Accountants Discussion Reviewer in Advanced Accounting Business Combination 2. To adjust the book value of the net asset of the subsidiary to its fair value Adjustment of an understated asset Adjustment of an overstated liability Adjustment of an understated liability Adjustment of an overstated asset Investment in subsidiary Non-controlling interest xx xx xx xx xx xx Based on control percentage 3a. To recognize a goodwill on business combination. Goodwill Investment in subsidiary Non-controlling interest xx xx xx Based on the attributable goodwill 3b. To recognize a gain on acquisition (gain on bargain purchase Investment in subsidiary Gain on Acquisition xx xx ENTITIES REQUIRED TO PRESENT A SET OF CONSOLIDATED FINANCIAL STATEMENTS The standards did not enumerate directly the entities that are required to present consolidated financial statements, however they have enumerated the conditions when not to present a set of consolidated financial statements. According to IFRS 10, (Business Combination), paragraph 4, an entity that is a parent shall present consolidated financial statements. This IFRS applies to all entities, however, a parent need not present consolidated financial statements if it meets all the following conditions: 1. The parent is a wholly-owned or partially-owned subsidiary of another entity and all its other owners. 2. The debt or equity instruments are not traded in a public market. 3. The parent did not file, nor is it in the process of filing, its financial statements with a securities commission or other regulatory organization for the purpose of issuing any class of instruments in a public market; and 4. The entity has an ultimate parent or any intermediate parent that is produces financial statements that are available for public use and comply with IFRSs, in which subsidiaries are consolidated or are measured at fair value through profit or loss in accordance with the IFRS. Note: According to IFRS 10, paragraph 4B, a parent that is an investment entity (e.g Dealer of securities) shall not present consolidated financial statements if it is required, in accordance with paragraph 31 of this IFRS, to measure all of its subsidiaries at fair value through profit or loss. Page 11 of 11