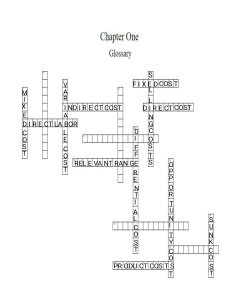

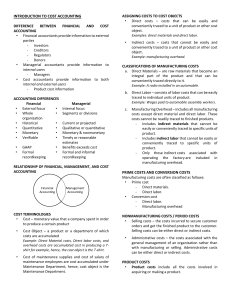

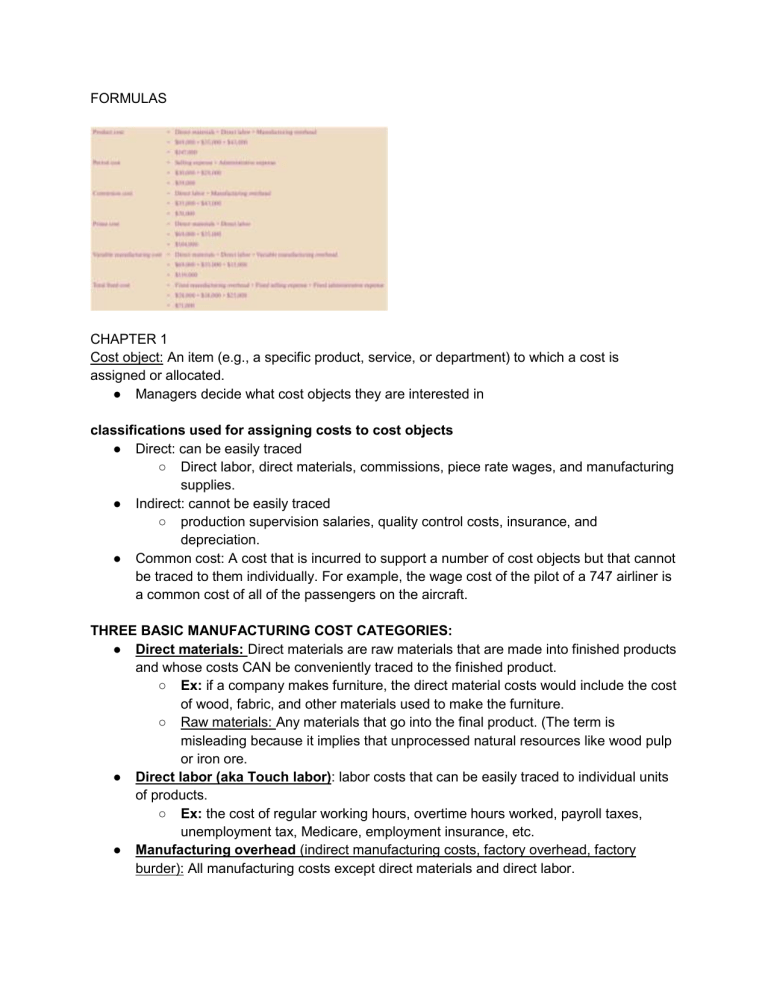

FORMULAS CHAPTER 1 Cost object: An item (e.g., a specific product, service, or department) to which a cost is assigned or allocated. ● Managers decide what cost objects they are interested in classifications used for assigning costs to cost objects ● Direct: can be easily traced ○ Direct labor, direct materials, commissions, piece rate wages, and manufacturing supplies. ● Indirect: cannot be easily traced ○ production supervision salaries, quality control costs, insurance, and depreciation. ● Common cost: A cost that is incurred to support a number of cost objects but that cannot be traced to them individually. For example, the wage cost of the pilot of a 747 airliner is a common cost of all of the passengers on the aircraft. THREE BASIC MANUFACTURING COST CATEGORIES: ● Direct materials: Direct materials are raw materials that are made into finished products and whose costs CAN be conveniently traced to the finished product. ○ Ex: if a company makes furniture, the direct material costs would include the cost of wood, fabric, and other materials used to make the furniture. ○ Raw materials: Any materials that go into the final product. (The term is misleading because it implies that unprocessed natural resources like wood pulp or iron ore. ● Direct labor (aka Touch labor): labor costs that can be easily traced to individual units of products. ○ Ex: the cost of regular working hours, overtime hours worked, payroll taxes, unemployment tax, Medicare, employment insurance, etc. ● Manufacturing overhead (indirect manufacturing costs, factory overhead, factory burder): All manufacturing costs except direct materials and direct labor. ○ ○ ○ From a product costing standpoint manufacturing overhead costs are indirect costs Conversion cost: Direct labor cost plus manufacturing overhead cost. It includes a portion of raw materials know as indirect materials and indirect labor ■ Indirect materials: Small items of material such as glue and nails that may be an integral part of a finished product, but whose costs cannot be easily or conveniently traced to it. ■ Indirect labor: The labor costs of janitors, supervisors, materials handlers, and other factory workers that cannot be conveniently traced to particular products. ■ Depreciation of manufacturing equipment ■ Utility costs ■ Property taxes ■ Insurance premiums NON MANUFACTURING COSTS: ● Selling costs (Order getting or Order filling): All costs that are incurred to secure customer orders and get the finished product or service into the hands of the customer. ○ Can be direct or indirect ○ Ex: Advertising, shipping, sales, sales travels, sales commissions, sale salaries, costs of finished good warehouses. ● Administrative costs (Selling, general or administrative costs) (SG&A): All executive, organizational, and clerical costs associated with the general management of an organization rather than with manufacturing or selling. ○ Can be direct or indirect : ○ Ex: Executive compensation, general accounting, legal counseling, secretarial, public relations, etc. COST CLASSIFICATIONS FOR PREPARING FINANCIAL STATEMENTS: Ojo: Costs are recognized as expenses in the income statement in the period that benefits from the cost. Ojo: The matching principle is based on the accrual concept that costs incurred to generate a particular revenue should be recognized as expenses on the same period that the revenue is recognized. ● Product costs (Inventoriable costs): All costs that are involved in acquiring or making a product. In the case of manufactured goods, these costs consist of direct materials, direct labor, and manufacturing overhead. Also see Inventoriable costs. ○ When units of products are sold their cost is released from inventories as expenses and matched against sales on the income statement. ○ A manufacturer's product cost flows through the inventory accounts in the balance sheet. Including: (Prior to being recorded as COGS in the income statement) ■ Raw materials ■ ● Work in progress: Units of product that are only partially complete and will require further work before they are ready for sale to the customer. ■ Finished goods: Units of product that have been completed but not yet sold to customers. ○ When direct materials are used in production they are transferred from raw materials to work in progress ○ Direct labor costs + manufacturing overhead costs + Work in process to convert direct materials into finished goods. Period costs: Costs that are taken directly to the income statement as expenses in the period in which they are incurred or accrued. (All selling and administrative expenses are period costs) COST CLASSIFICATIONS FOR PREDICTING COST BEHAVIOR IN RESPONSE TO CHANGES IN ACTIVITY Cost behavior: The way in which a cost reacts to changes in the level of activity. Cost structure: The relative proportion of fixed, variable, and mixed costs in an organization. Relevant range: The range of activity within which assumptions about variable and fixed cost behavior are valid. ● Variable cost: A cost that varies, in total, in direct proportion to changes in the level of activity. A variable cost is constant per unit. ○ Ex: COGS for a merchandising company, direct materials, direct labor, variable elements of manufacturing overhead. ○ Activity base (cost driver): A measure of whatever causes the incurrence of a variable cost. For example, the total cost of surgical gloves in a hospital will increase as the number of surgeries increases. Therefore, the number of surgeries is the activity base that explains the total cost of surgical gloves. ● Fixed cost: A cost that remains constant, in total, regardless of changes in the level of activity within the relevant range. If a fixed cost is expressed on a per unit basis, it varies inversely with the level of activity. ○ For planning purposes they can be viewed as: ■ ● Committed fixed costs: Investments in facilities, equipment, and basic organizational structure that can’t be significantly reduced even for short periods of time without making fundamental changes. ■ Discretionary fixed costs (managed fixed costs) : Those fixed costs that arise from annual decisions by management to spend on certain fixed cost items, such as advertising and research. Mixed costs (semi variable costs): cost that contains both variable and fixed cost elements. ■ Y = a + bx ■ Y = mixed costs, a = fixed costs, b= variable cost per unit (slope), X = level of activity COST CLASSIFICATIONS FOR DECISION MAKING: The key to deciding is know the difference between Relevant cost: A cost that should be considered when making decisions. Relevant benefit: A benefit that should be considered when making decisions. DIFFERENTIAL COST IN REVENUE ● Differential cost: A future cost that differs between any two alternatives. ○ Always relevant ○ (Incremental cost): An increase in cost between two alternatives. ○ (Decremental cost): A decrease in cost between two alternatives. ● Differential revenue: Future revenue that differs between any two alternatives. (It is a relevant benefit) OPPORTUNITY COST AND SUNK COST Opportunity cost: The potential benefit that is given up when one alternative is selected over another. Sunk cost: A cost that has already been incurred and that cannot be changed by any decision made now or in the future. COST CLASSIFICATIONS AND THEIR PURPOSES ACCOUNTING FOR COSTS IN MANUFACTURING COMPANIES ● Manufacturing costs ○ Direct materials ○ Direct labor ○ Manufacturing Overhead ● Non-manufacturing costs ○ Selling costs ○ Administrative expenses PREPARING FINANCIAL STATEMENTS ● Product costs (inventoriable) ● Period costs (Expensed) PREDICTING COST BEHAVIOR IN RESPONSE TO CHANGES IN ACTIVITY ● Variable costs (proportional to activity) ● Fixed costs (constant in total) ● Mixed costs (has variable and fixed elements MAKING DECISIONS ● Differential costs (differs between two alternatives) ● Sunk cost (should be ignored) ● Opportunity cost (foregone benefit)