Managerial Accounting and Cost

Concepts

Chapter 2

PowerPoint Authors:

Susan Coomer Galbreath, Ph.D., CPA

Charles W. Caldwell, D.B.A., CMA

Jon A. Booker, Ph.D., CPA, CIA

Cynthia J. Rooney, Ph.D., CPA

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

2-2

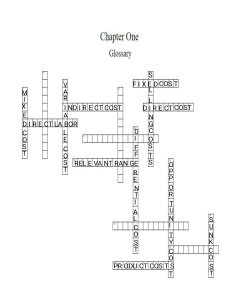

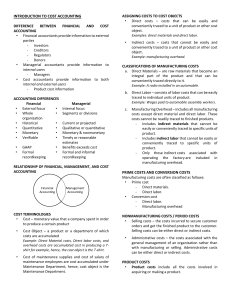

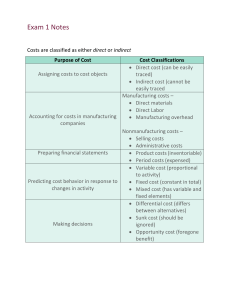

Summary of the Types of Cost

Classifications

Financial

Reporting

Predicting Cost

Behavior

Assigning Costs

to Cost Objects

Making Business

Decisions

2-3

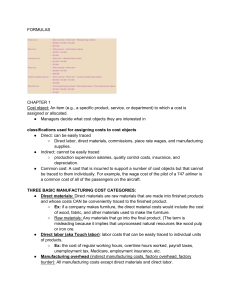

Assigning Costs to Cost Objects

Direct costs

Indirect costs

• Costs that can be

easily and conveniently

traced to a unit of product

or other cost object.

• Costs that cannot be

easily and conveniently

traced to a unit of product

or other cost object.

• Examples: direct

material and direct labor

• Example: manufacturing

overhead

Common costs

Indirect costs incurred to support a number

of cost objects. These costs cannot be

traced to any individual cost object.

2-4

Classifications of Manufacturing Costs

Direct

Materials

Direct

Labor

The Product

Manufacturing

Overhead

2-5

Direct Materials

Raw materials that become an integral

part of the product and that can be

conveniently traced directly to it.

Example: A radio installed in an automobile

2-6

Direct Labor

Those labor costs that can be easily

traced to individual units of product.

Example: Wages paid to automobile assembly workers

2-7

Manufacturing Overhead

Manufacturing costs that cannot be easily

traced directly to specific units produced.

Examples: Indirect materials and indirect labor

Materials used to support

the production process.

Examples: lubricants and

cleaning supplies used in the

automobile assembly plant.

Wages paid to employees

who are not directly

involved in production

work.

Examples: maintenance

workers, janitors, and

security guards.

2-8

Nonmanufacturing Costs

Selling

Costs

Administrative

Costs

Costs necessary to secure the

order and deliver the product.

Selling costs can be either

direct or indirect costs.

All executive, organizational,

and clerical costs.

Administrative costs can be

either direct or indirect costs.

2-9

Cost Classifications for Preparing

Financial Statements

Product costs include

direct materials, direct

labor, and

manufacturing

overhead.

Cost of Good Sold

Inventory

Period costs include all

selling costs and

administrative costs.

Expense

Sale

Balance

Sheet

Income

Statement

Income

Statement

2-10

Prime Costs and Conversion Costs

Manufacturing costs are often

classified as follows:

Direct

Material

Direct

Labor

Prime

Cost

Manufacturing

Overhead

Conversion

Cost

2-11

Variable Cost

Total Texting Bill

A cost that varies, in total, in direct proportion to

changes in the level of activity. Your total texting

bill may be based on how many texts you send.

Number of Texts Sent

2-12

Variable Cost Per Unit

Cost Per Text Sent

However, variable cost per unit is constant. The cost per

text sent may be constant at 5 cents per text message.

Number of Texts Sent

2-13

The Activity Base (Cost Driver)

Machine

hours

Units

produced

A measure of what

causes the

incurrence of a

variable cost

Miles

driven

Labor

hours

2-14

Fixed Cost

Monthly Cell Phone

Contract Fee

A cost that remains constant, in total, regardless of

changes in the level of the activity. Your monthly contract

fee for your cell phone may be fixed for the number of

monthly minutes in your contract.

Number of Minutes Used

Within Monthly Plan

2-15

Fixed Cost Per Unit

Monthly Cell Phone

Contract Fee

However, if expressed on a per unit basis, the average fixed cost per

unit varies inversely with changes in activity. The average fixed cost

per cell phone call made decreases as more calls are made.

Number of Minutes Used

Within Monthly Plan

2-16

Types of Fixed Costs

Committed

Discretionary

Long-term, cannot be

significantly reduced in

the short term.

May be altered in the

short term by current

managerial decisions

Examples

Examples

Depreciation on Buildings

and Equipment and Real

Estate Taxes

Advertising and

Research and

Development

2-17

The Linearity Assumption and the

Relevant Range

Total Cost

Economist’s

Curvilinear Cost

Function

Relevant

Range

A straight line

closely

approximates a

curvilinear

variable cost

line within the

relevant range.

Accountant’s Straight-Line

Approximation (constant

unit variable cost)

Activity

2-18

End of Chapter 2

0

0