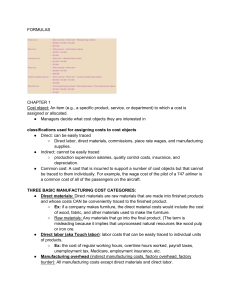

Chapter 1 Managerial Accounting and Cost Concepts ACCT-240 LO1-1 Understand cost classifications used for assigning costs to cost objects: direct costs and indirect costs. A direct cost is directly related, my salary for my company is a direct cost of my company. The cost incurred to produce a tax return would be a direct cost to the client who hired our services. The indirect cost of chicken noodle soup may be the salary of a factory manager or farm manager. LO 1-2 Identify and give examples of each of the three basic manufacturing cost categories. The three manufacturing cost categories are direct materials, direct labor, and manufacturing overhead. o Direct materials include raw materials which are materials that go into a final product and direct materials such as finished products used as a material as an integral part of a new final product. o Direct labor involves labor costs for a product where labor workers have “touched” the product while producing it. o Manufacturing overhead includes all costs aside from direct materials and direct labor. They are indirect costs which can’t be traced to specific products. It includes indirect materials, indirect labor, and other indirect costs that are incurred to operate a manufacturing facility. LO 1-3 Understand cost classifications used to prepare financial statements: product costs and period costs. Product costs are added to the different levels on the balance sheet that a product is at. Period costs include all other costs and are expensed on the IS during the period incurred on the IS. o LO 1-4 Understand cost classifications used to predict cost behavior: variable costs, fixed costs, and mixed costs. In the management example they spoke of understanding how activity levels affect cost. Variable costs are directly affected by activity such as providing more rafting parties in the example for the chapter. Fixed costs aren’t directly tied to activity and may go up or down due to external factors such as a landlord raising rent. If activity becomes high enough a manager may need to increased the fixed costs to account for more production or services provided such as renting another machine or property to account for extreme increases in activity that can’t be upkept by current fixed costs. Mixed costs combined the two and can be calculated under the basic y=mx+b. Fixed cost account for the y axis and the slope increases through different levels of activity at the rate of the variable cost. LO 1-5 Understand cost classifications used in making decisions: relevant costs and irrelevant costs. When looking at the proposed plans we can see that relevant costs are any that change from the original to proposed plans. Irrelevant costs are those that do not change and have no affect moving from one plan to the next. LO 1-6 Prepare income statements for a merchandising company using the traditional and contribution formats. The contribution format of the IS breaks out selling and admin expenses into variable and fixed expenses. The breakdown gives you a better understanding of the expense categories which help with decision making. Section 1-1 Cost Classifications for Assigning Costs to Cost Objects Direct Cost: Is a cost that can be easily and conveniently traced to a specified cost object. o Internal Direct Cost: salary for a position in one company is a direct cost of that company. o External Direct Cost: If a printing company made 10,000 brochures for a specific customer, the cost of paper would be a direct cost to the consumer. Indirect Cost: a cost that cannot be easily and conveniently traced to a specified cost object. o Example: Campbell Soup Factory Factory produces dozens of varieties of canned soup. The factory manager’s salary would be an indirect cost of a particular variety, such as chicken noodle soup. The factory manager’s salary is incurred as a consequence of running the entire family and not to produce any one soup variety. To be traced to a cost object such as a particular product, the cost must be caused by the cost object. o In the example, the manager’s salary is called a common cost of producing the various products of the factory. o Common Cost: is a cost that is incurred to support several cost objects but cannot be traced to them individually. This is a type of indirect cost. Campbell Soup Factory o o Direct Cost: Factory manager’s salary is a direct cost of the manufacturing department. Indirect Cost: Factory manager’s salary is an indirect cost of any variety such as chicken noodle soup. Section 1-2 Cost Classifications for Manufacturing Companies Manufacturing Costs Two direct cost categories: Direct materials and direct labor One Indirect cost category: Manufacturing overhead o Direct Materials Raw Materials: the materials that go into the final product. Does not just include unprocessed natural resources. Raw materials includes any materials that are used in the final product. The finish product of one company can become the raw materials of another company. The wafers produced by a MEMS company can be a raw material in the development of automated cars. Direct Materials: raw materials that become an integral part of the finished product and whose costs can be conveniently traced to the finished product. Ex. Bart purchases seats from Airbus to install in their train carts. (I believe there were some applications of the MEMS product that were directly used in finished products. Thus the example above could be either a raw material or direct material depending on the specification of the wafer. o Direct Labor: labor costs that can be easily traced to individual units of product. (Also called Touch Labor) Example: Assembly line workers “touch” the product while it is being made. o Managers refer to the two manufacturing cost categories as Prime Cost: the sum of direct material cost and direct labor cost. o Manufacturing Overhead: includes all manufacturing costs except direct materials and direct labor. Indirect Costs because they cannot be readily traced to specific products. Includes: Indirect Materials: raw materials, such as the solder used to make electrical connections in a Toshiba TV and the glue used to assemble a chair, whose costs cannot be easily or conveniently traced to finished products. Indirect Labor: refers to employees such as janitors, supervisors, security guards. o These are indirect because their work can’t be conveniently traced to specific units of product. Other Indirect Costs o Depreciation of manufacturing equipment, utility costs, property taxes, insurance premiums THAT ARE INCURRED TO OPERATE A MANUFACTURING FACILITY. o If any of the above categories was incurred to sustain their nonmanufacturing operations they would not be included in manufacturing overhead. Other names: Indirect Manufacturing cost, factory overhead, and factory burden. Conversion Cost: refers to the sum of direct labor and manufacturing overhead. Because those costs are incurred to convert direct materials into finished product. Nonmanufacturing Costs: also called selling, general, and administrative (SG&A) costs, or just selling and administrative costs. o (1) Selling Costs: include all costs that are incurred to secure customer orders and get the finished product to the customer. Order-getting, order-filling costs Ex. Advertising, shipping, sales travel, sales commissions, sales salaries, costs of finished goods warehouses. May be direct or indirect: Advertising campaign dedicated to one product is a direct cost of that product. Advertising campaign for entire company is an indirect cost of each of the products. o (2) Administrative Costs Section 1-3 Cost Classifications for Preparing Financial Statements o Costs are recognized as expenses on the income statement in the period that benefits from the cost. PPI paid for two years must be expensed over two years and not just in the year it is purchased. .5 of the expense recognized each year. The unexpensed payment is carried on the BS as an asset under PPI. Matching Principle is based on the Accrual concept: costs incurred to generate a particular revenue should be recognized as expenses in the same period that the revenue is recognized. Product Costs: Cost incurred to acquire or make something that will eventually be sold should be recognized when the sale takes place. Product Costs: include all costs involved in acquiring or making a product. (Also called Inventoriable Costs) o Product costs are attached to a unit of product for as long as it remains in inventory. When the product is sold the costs are released from inventory as expenses (COGS) and matched against sales on the IS. o Include: direct materials, direct labor, manufacturing overhead. o Flows through three inventory accounts on BS: Raw Materials, WIP, Finished Goods Prior to being recorded in COGS in the IS. Raw Materials: any materials that go into the final product. WIP: units of product that are only partially complete. Finished Goods: completed units not yet sold. o When direct materials are used in production their cost are transferred from raw materials to WIP. Direct labor & manufacturing overhead costs are added to WIP to convert direct materials into finished goods. Once units are completed their costs are transferred from WIP to Finished Goods. When unit is sold the costs are transferred from Finished Goods to COGS. o Product costs are not recorded as expenses on the income statement in the period incurred they are recorded in which the related products are sold. Period Costs: all costs that are not product costs (all selling + admin expenses are treated as period costs) o Sales commissions, advertising, executive salaries, public relations. o Expensed on the IS in the period in which they are incurred using the usual accrual accounting rules. Exhibit 1-2 o Shows the flowthrough in the balance sheet from raw materials to finished goods that are then sold. Different product costs are added at different points as we progress towards the finished product. The period costs are disconnected from the balance sheet and post directly on the income statement in the period in which they are incurred. o Section 1-4 Cost Classifications for Predicting Cost Behavior o Cost Behavior: how a cost reacts to changes in the level of activity. Cost categorized as variable, fixed, or mixed. Cost Structure: the relative proportion of each type of cost in an organization. Variable Costs: Total variable cost increases and decreases in proportion to changes in the activity level. o COGS for a merchandising company, direct materials, direct labor, variable elements of manufacturing overhead, such as indirect materials, supplies, and power, and variable elements of selling and administrative expenses, such as commissions and shipping costs. o Must be with respect to something. Something = Activity Base: a measure of whatever causes the incurrence of a variable cost. (Cost Driver) o Direct labor-hours, machine-hours, units produced, units sold. Cost Drivers examples: # of miles driven by salespersons, number of pounds of laundry cleaned by a hotel, number of calls handled by technical support staff at a software company, # of beds occupied in a hotel. In this class, the activity base under consideration is the total volume of goods and services provided by the organization. If it is something other than total output it will be specified. Ex: Noocksack Expeditions: provides daylong whitewater rafting. Provides all equipment and experienced guides, serves gourmet meals. Meal expense from caterer is $30/person/daylong excursion As activity increases the per unit does not change as variable cost is expressed on a per unit basis. o Variable cost at fixed price/guest and fixed costs of rented property. o Step Variable Costs: Can be adjusted quickly as conditions change May include total salaried employee expense Fixed Cost: a cost that remains constant, in total, regardless of changes in the level of activity. o Depreciation, insurance, property taxes, rent, supervisor salaries. o Administrative salaries, advertising, depreciation of nonmanufacturing assets. o Not affected by changes in activity unless influenced by outside force such as landlord increasing rent. Can be either: Committed Fixed Costs: organizational investments with a multiyear planning horizon that can’t be significantly reduced even for short periods of time without making fundamental changes. Ex: investments in facilities and equipment, real estate taxes, insurance premiums, salaries of top management Committed fixed costs remain largely unchanged in the short term because the costs of restoring them later are likely to be far greater than any short-run savings that might be realized. Discretionary Fixed Costs: (Managed Fixed Costs) arise from annual decisions by management to spend on certain fixed cost items. Advertising, research, public relations, management development programs, internships for students. Can be cut for short periods of time with minimal damage to long run goals of the org. The Linearity Assumption and the Relevant Range o Relevant Range: the range of activity within which the assumption that cost behavior is strictly linear is reasonably valid. o Ex. Mayo Clinic Rent Machine 20k/month Capacity 3k test/month o ’ Relevant range is limited by capacity test limit for each machine. For each rental the relevant range is expressed as 3k units @ price for one rented machine. Salaried Step-Variable Costs: Step costs often are adjusted quickly as conditions change. For the example if a raise was added their fixed salaries would quickly change. Mixed Costs: contains both variable and fixed cost elements (semi variable costs) o $3 per rafting party variable cost and $25k license fee Y = a + bX Y = Total mixed cost a = Total fixed cost b = Variable cost per unit of activity X = Activity level Section 1-5 Cost Classifications for Decision Making o Relevant costs and benefits should be considered when making decisions. o Irrelevant costs and benefits should be ignored when making decisions. Differential Cost and Revenue o Differential Cost: a future cost that differs between any two alternatives. Incremental Cost: Increase in cost from one alternative to another. Decremental Cost: decrease in cost from one alternative to another. May be fixed or variable. o Note: Other expenses is an irrelevant cost because it has no effect on the decision. o Differential Revenue: future revenue that differs between any two alternatives. Example of relevant benefit. Any future benefit that does not differ between alternatives is irrelevant and should be ignored. Opportunity Cost and Sunk Cost o Opportunity Cost: is the potential benefit that is given up when one alternative is selected over another. o If I decide to take summer off instead of working, I would lose out on that months’ salary. Sunk Cost: cost that has already been incurred and that cannot be changed by any decision made now or in the future. If I buy a nonrefundable summer ticket to Europe than I won’t be able to get that cost back by any decisions made in the future. Section 1-6 Using Different Cost Classifications for Different Purposes o Prepare traditional and contribution format ISs for a merchandising company: companies that do not manufacture the products that they sell to customers. o Traditional IS: external reporting purposes. Rely on cost classifications for preparing financial statements to depict the financial consequences of past transactions. Product and period costs o Contribution IS: internal management purposes. Use cost classifications for predicting costs behavior to better inform decisions affecting the future. Variable and fixed costs. The Traditional Format IS vs Contribution Format IS o Traditional Cogs reports product costs. o Contribution Selling and admin expenses report Period costs. o The Contribution format IS breaks out selling and admin expenses into variable and fixed expenses which aids in planning, controlling, and decision making. o o Homework Given: Sales of $360,000, Gross Margin of $140,000, Contribution Margin of $110,000, and Total Selling & Administrative Exp. of $60,000, net income using the traditional income statement format equals Blank______. o Gross Margin = Revenue – COGS o Net Income = Sales – COGS – Total Expenses o 360k = (360k – 140k) - $60k Contribution Margin is not used in this example.