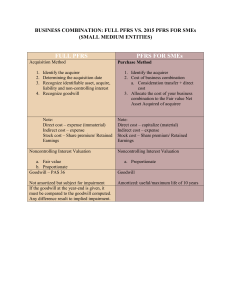

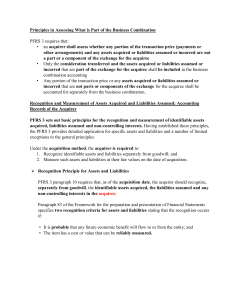

Accounting for Business Combination 2018 by Zeus Millan (Book) Chapter 1: Business Combinations (Part 1) Business combination (PFRS 3) A) B) - Occurs when 1 company acquires another or When 2 or more companies merge into one Afterwards, 1 company gains control over the other Acquirer or Parent - obtains control Acquiree or Subsidiary - company being controlled. PFRS 3, a transaction or other event in which an acquirer obtains control of one or more businesses. Essential Elements 1) Control 2) Business A) Input B) Process C) Output - more than 50% of voting power. (economic resource) ( the result of A and B) Business Combs are carried out at either through 1) Asset Acquisition - Acquirer purchases the assets and assumes the liabilities of the acquiree in exchange for cash or non-cash consideration. - Acquired entity normally ceases to exist as a separate legal or accounting entity. A) Merger A+B = A or B B) Consolidation A+B = C 2) Stock Acquisition - Obtains control by acquiring majority ownership interest (more than 50%) in voting rights of acquiree. - Parents record ownership interest acquired as investment in subsidiary in separated accounting books. - However, the investment is eliminated when the group prepares consolidated financial statements. Abraham D. Chin Accounting for Business Combination 2018 by Zeus Millan (Book) Business Combination may also be described as 1) Horizontal Combination Combination of two or more entities with similar businesses (bank gets another bank) 2) Vertical Combination - Different levels in a marketing chain (manufacturer acquire its suppliers). 3) Conglomerate - With dissimilar businesses (real estate developer acquires bank). Advantages of Business Combination 1) Competition is eliminated or lessened 2) Synergy (results to greater productivity) 3) Increased business opportunities and earning potentials 4) Reduction of operating costs A) Horizontal (unnecessary duplication of costs) B) Vertical (elimination of costs of negotiation) 5) Combinations utilize economies of scale - Increase in productive efficiency - Decrease its average cost per unit 6) Cost savings on business expansion - Expansion may be lessened if we do this instead of putting up a branch 7) Favorable tax Implications - Deferred tax subjects may be transferred in a bus comb; if bus comb is without transfers then it may not be subjected to tax. Disadvantages of Business Combination 1) 2) 3) 4) 5) Brings monopoly that has a negative impact to society Leads to loss of sense of identity of one of them Management may become difficult due to differences internally Overcapitalization, diffusion in market price per share May be subjected to stricter regulation and scrutiny by the government especially if against consumer’s interest. Abraham D. Chin Accounting for Business Combination 2018 by Zeus Millan (Book) PFRS does not apply to 1) Joint Ventures 2) Acquisition of assets and liabs that does not constitute a business 3) Combination under common control Note: Assets acquired and related liabs do not constitute a business then not a business comb Accounting for business combination - Using the acquisition method A) Identify the acquire B) Determine the acquisition date C) Recognize and measure goodwill (1) Consideration transferred (cash, non-cash. Equity instruments, business etc.) (2) Non-controlling interest in the acquiree or minority interest At fair value, interest he doesn’t control (3) Previously held equity interest in the acquiree (only in bus combs achieved in stages) (4) Identifiable assets acquired ad liabs assumed in the combination. Restructuring Provisions - A program that is planned and controlled by management and materially changes either 1) The scope of business undertaken by entity 2) Manner in how the business is conducted - May include the liquidation costs of an entity’s plan 1) To exit an activity of an acquiree 2) To involuntarily terminate acquiree’s employees 3) To relocate non continuing acquiree’s employees - Does not include costs such as 1) Retraining or relocating continuing staff 2) Marketing 3) Investments in new systems and distribution networks Note: 1) This is not generally recognized as part of business combination unless the acquiree has at the acquisition date, an existing liability for restructuring that has been recognized in accordance with PAS 37 Provisions, Contingent Liabilities and Contingent Assets. 2) If it does not meet the definition of a liability at acquisition date, then it is recognized as post combination expenses of the combined entity when the costs are incurred. Abraham D. Chin Accounting for Business Combination 2018 by Zeus Millan (Book) Specific Recognition Principles 1) Operating leases - Acquiree is the lessee ( if acquirer is lessee, he shall not recognize anything) A) Favorable - acquirer shall recognize an intangible asset. B) Unfavorable - recognize a liability. 2) Intangible Assets - Acquirer recognized separately from goodwill, intangible assets acquired in the comb meets either: 1) Separability Criterion 2) Contractual-legal criterion - Examples 1) Market-Related 2) Customer-Related 3) Artistic-Related 4) Contract-Based Contingent Liability is not recognized if it does not meet all requirements of a liability - - Examples of it that assumed in bus comb and is recognized 1) Present obligation from past events 2) Fair value can be measured reliably If it is with improbable outflow of resources embodying eco benefits may nevertheless be recognized if both conditions above were satisfied. Following items shall be recognized and measured at acquisition date under other applicable standards other than PFRS 3 1) Income Taxes PAS 12 2) Employee Benefits PAS 19 3) Indemnification Assets (demand) Exceptions to the measurement principle 1) Reacquired rights 2) Share-based Payment Transactions (PFRS 2) 3) Assets held for sale (PFRS 5, non-current assets held for sale and discontinued operations) Abraham D. Chin