Liquidation Based Valuation: Chapter on Business Liquidation

advertisement

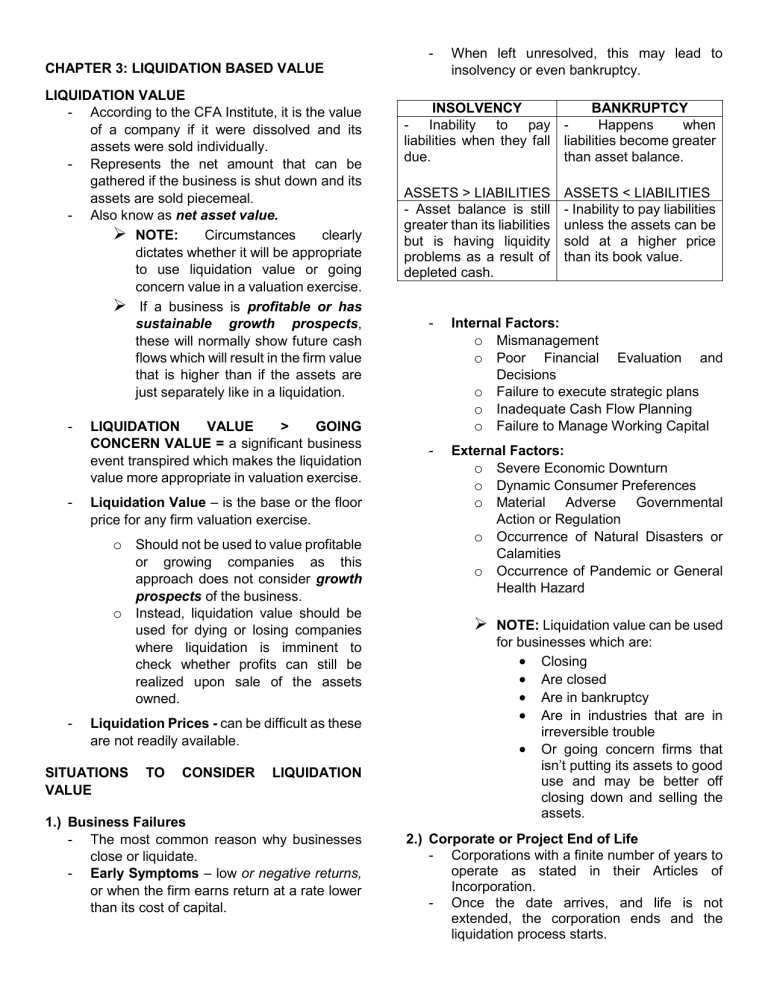

CHAPTER 3: LIQUIDATION BASED VALUE LIQUIDATION VALUE - According to the CFA Institute, it is the value of a company if it were dissolved and its assets were sold individually. - Represents the net amount that can be gathered if the business is shut down and its assets are sold piecemeal. - Also know as net asset value. NOTE: Circumstances clearly dictates whether it will be appropriate to use liquidation value or going concern value in a valuation exercise. If a business is profitable or has sustainable growth prospects, these will normally show future cash flows which will result in the firm value that is higher than if the assets are just separately like in a liquidation. - - LIQUIDATION VALUE > GOING CONCERN VALUE = a significant business event transpired which makes the liquidation value more appropriate in valuation exercise. Liquidation Value – is the base or the floor price for any firm valuation exercise. o Should not be used to value profitable or growing companies as this approach does not consider growth prospects of the business. o Instead, liquidation value should be used for dying or losing companies where liquidation is imminent to check whether profits can still be realized upon sale of the assets owned. - Liquidation Prices - can be difficult as these are not readily available. SITUATIONS VALUE TO CONSIDER LIQUIDATION 1.) Business Failures - The most common reason why businesses close or liquidate. - Early Symptoms – low or negative returns, or when the firm earns return at a rate lower than its cost of capital. When left unresolved, this may lead to insolvency or even bankruptcy. INSOLVENCY BANKRUPTCY - Inability to pay Happens when liabilities when they fall liabilities become greater due. than asset balance. ASSETS > LIABILITIES - Asset balance is still greater than its liabilities but is having liquidity problems as a result of depleted cash. ASSETS < LIABILITIES - Inability to pay liabilities unless the assets can be sold at a higher price than its book value. - Internal Factors: o Mismanagement o Poor Financial Evaluation and Decisions o Failure to execute strategic plans o Inadequate Cash Flow Planning o Failure to Manage Working Capital - External Factors: o Severe Economic Downturn o Dynamic Consumer Preferences o Material Adverse Governmental Action or Regulation o Occurrence of Natural Disasters or Calamities o Occurrence of Pandemic or General Health Hazard NOTE: Liquidation value can be used for businesses which are: Closing Are closed Are in bankruptcy Are in industries that are in irreversible trouble Or going concern firms that isn’t putting its assets to good use and may be better off closing down and selling the assets. 2.) Corporate or Project End of Life - Corporations with a finite number of years to operate as stated in their Articles of Incorporation. - Once the date arrives, and life is not extended, the corporation ends and the liquidation process starts. - Is corporate end of life is already certain, it is more appropriate to compute terminal value using liquidation value. 3.) Depletion of Scarce Resources - Used in some industries like mining and oil where the availability of scarce resources significantly influences firm value. - These are industries that are highly regulated by the government. - Once the contract with the government expires, or the scarce resource becomes fully depleted, this might signal potential liquidation. GENERAL PRINCIPLES OF LIQUIDATION VALUE - Liquidation value – is the most conservative valuation approach among all o It considers the realizable value of the asset if it is sold now based on current conditions. o This captures any markdowns (or markups) that potential buyers negotiate to buy the assets. - General concepts considered in liquidation value are as follows: If the liquidation value is above income approach valuation (based on goingconcern principle) and liquidation comes into consideration, liquidation value should be used. If the nature of the business implies limited lifetime (e.g., a quarry, gravel, fixed-term company etc.), the terminal value must be based on liquidation. All costs necessary to close the operations (e.g., plant closure costs, disposal costs, rehabilitation costs) should also be factored in and deducted to arrive at the liquidation value. Non-operating assets should be valued by liquidation method as the market value is reduced by costs of sale and taxes. Since they are not part of the firm's operating activities, it might be inappropriate to use the same going concern valuation technique used for business operations. If such result is higher than net present value of cash - flows from operating the asset, the liquidation value should be used. Liquidation valuation must be used if the business continuity is dependent on current management that will not stay. Liquidation value method can also be used as benchmark in making investment decisions o When a company is profitable with good industry outlook, the liquidation will typically be lower than the prevailing market price of the share. PROFITABLE: LIQUIDATION < PREVAILING MARKET PRICE o For the firms that are experiencing decline or industry is consistently declining, prevailing share prices might be lower than liquidation value. o If this happens, the rational decision for the business is to permanently close the business and liquidate its assets. NOT PROFITABLE: LIQUIDATION > PREVAILING MARKET PRICE NOTE: if the company can be readily liquidated any time, market price per share should never be below book value per share if all reported assets in the balance sheet is accurate. TYPES OF LIQUIDATION: 1.) Orderly Liquidation - Assets are sold strategically over an orderly period to attract and generate the most money for the assets. - This process will expose assets for sale on the open market, with a reasonable time allowed to find a purchaser, both buyer and seller having knowledge of the uses and purposes to which the asset is adapted and for which it is capable of being used, the seller being compelled to sell and the buyer willing, but not compelled, to buy. 2.) Forced Liquidation - Liquidation process, at which the asset or assets are sold as quickly as possible, such as at an action. CALCULATING LIQUIDATION VALUE - Liquidation value - considers the present value of the sums that can be obtained through the disposal of the assets of the firm in the most appropriate way, net of the sums set aside for the closure costs, repayment of the debts and settlement of all liabilities and net of the tax charges related to the transaction and the costs of the process of liquidation itself. - Liquidation value can be further computed on a per share basis by dividing total liquidation value by outstanding ordinary shares. NOTE: Calculation for liquidation value at closure date is somewhat like the book value calculation, except the value assumes a forced or orderly liquidation value. - - Book value should not be used as liquidation value. o Liquidation value can be obtained based on the potential sales price of the assets being sold instead of relying on the costs recorded in the books. Liquidation value o Is far more realistic as compared to the book value method. o Can be used as a basis for terminal cash flow (instead of going concern terminal cash flow) in a DCF calculation in order to compute firm value in case there are years that the firm will still be operational prior to liquidation. o Estimation of liquidation values will be complex if assets cannot be easily identified or separated; hence, individual valuation may be impractical.