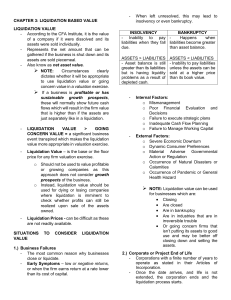

Liquidation Value • • • The net value of a company's physical assets if it were to go out of business and the assets sold. It is to see if the shareholders are going to receive anything after liabilities have been paid off with the proceeds from selling all its Assets (at a discount often, because it must be done quickly). Liquidation Valuation = Tangible Assets’ Auction Value (often at a % discount from FMV) – Liabilities o Liquidation value is the likely price of an asset when it is allowed insufficient time to sell on the open market, thereby reducing its exposure to potential buyers, making it at a discount price % (< Fair Market Value). o When working with liquidation value calculations, an investor should exclude the intangible assets, such as goodwill, brand recognition, and intellectual property (– they are things like patents, brands and the business reputation, so where there is no physical presence ➔ 100% of intangibles not included). Usually lower than Book Value < Liquidation value < Salvage Value 1. Book value is an asset's original cost, less any accumulated depreciation and impairment charges that have been subsequently incurred. 2. Salvage value or Scrap Value is the estimated value of an asset after its useful life is over and, therefore, cannot be used for its original purpose. o The liquidation value is estimated for PP&E, real estate, and inventory owned by the firm. However, if a company is sold rather than liquidated, both the liquidation value and intangible assets determine the company's going-concern value. ! Potential investors will assess the liquidation value of a company before investing. Investors want to know how much of their funds would be returned in the event of bankruptcy. Ex: Book Value = 400 Liab = 150 Assets liq value (auction value) = 380 Thus, Liquidation Value = 380-150 = $230M