Lat04 Jones, Smith, and Tandy are partners in a furniture store... January 1, 20X1, at which time the ledger contained the...

advertisement

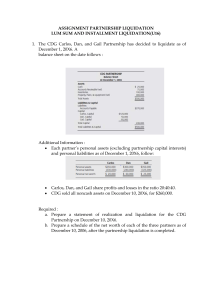

Lat04 Jones, Smith, and Tandy are partners in a furniture store that began liquidation on January 1, 20X1, at which time the ledger contained the following account balances: Debit Credit _________________________________________________________________ Cash $ 15,000 Accounts receivable 20,000 Inventories 65,000 Land 50,000 Buidings 100,000 Accumulated depreciation—buildings $ 40,000 Furniture and fixtures 50,000 Accumulated depreciation—furniture and fixtures 30,000 Accounts payable 80,000 Jones capital (20%) 40,000 Smith capital (30%) 60,000 Tandy capital (50%) 50,000 ________ ________ $ 300,000 $ 300,000 ======= ======= The following transaction and events occurred during the liquidation process: January Inventories were sold for $20,000 cash, collectioans on account totaled $14,000, and half of the amount due to creditors was paid. February Land costing $40,000 was sold for $60,000, the remaining land and buildings were sold for $40,000, half of the remaining receivables were collected, and the remainder were uncollectible. March The remaining liabilities were paid and available cash was distributed to the partners in final liquidation. Required: Prepare a statement of liquidation for the Jones, Smith, and Tandy partnership.