Group home work, FINA-252 Submission Deadline: 30 April 2016

advertisement

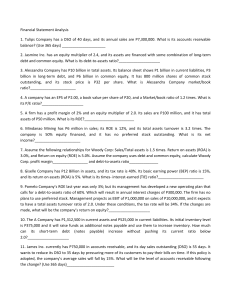

Group home work, FINA-252 Submission Deadline: 30th April 2016 (Must do as a group, Group members would be between 2-5) Question: The following table is the financial statement of ARAMCO for 2012. Based on this financial statement, calculate the following ratios. a. b. c. d. e. f. g. h. i. j. k. l. Current ratio Quick ratio Debt to equity ratio Total liabilities to total tangible assets ratio Interest cover ratio Gross profit margin Net profit margin Return on assets Return on equity Inventory turnover Fixed assets turnover Total assets turnover Year/Events Sales Cost of goods sold Cash Accounts receivable Inventory Total current assets Total fixed assets Accounts payable Notes payable Total current liabilities Long-term debt (liabilities) Shareholders’ equity Tangible assets Intangible assets Total assets depreciation interest Taxes Year 2012 $37,500 $30,000 $9,800 $4,437 $2,869 $17,106 $12,000 $5,700 $5,000 $10,700 $8,500 $12,500 $20,000 $5,500 $25,500 $500 $500 $4,500