Accounting Principles & Financial Statements Overview

advertisement

CHAPTER

2

Principles of

Accounting

1 of 57

CHAPTER 2 OUTLINE

2.1 Basic Principles in Accounting

2.2 Financial Statements

2.3 Analysis of Financial Statements

2.4 Basic Principles of Depreciation

2.5 Depreciation Methods

2 of 57

Professor R. Jassim

2.1

Engineering Economy

BASIC PRINCIPLES IN ACCOUNTING

Principles

• Record only facts that are expressed in monetary value

• A business is an entity that is independent of its shareholders’ personal wealth

• The value of the business is based on the assumption that it is a going concern,

i.e. it will operate indefinitely

• The value of the assets is recorded at cost; the value of capital assets must be

adjusted for use and deterioration

• Revenues must be matched with associated operating expenses for each

accounting period

3 of 57

Professor R. Jassim

2.1

Engineering Economy

BASIC PRINCIPLES IN ACCOUNTING

Accounting

•

The process of estimating and recording financial changes in an organization along

with subsequent monitoring and analysis of this information.

Financial Accounting

•

Concerned with recording and analyzing the financial data of a business. The

object is to provide information to both internal management and external parties

who wish to make decisions about an enterprise.

Investors

•

Anyone who currently owns or may invest in the organization will use accounting

information to ask questions about the profitability of the company.

Creditors

•

A person or group to whom the organization is indebted (e.g. bank, supplier).

4 of 57

Professor R. Jassim

2.1

Engineering Economy

BASIC PRINCIPLES IN ACCOUNTING

Assets

•

Goods owned by the business (e.g. cash, inventory, real estate, machinery).

Liabilities

•

Elements owed by the business (e.g. accounts payable, taxes payable, bank

loans, mortgages).

Shareholders’ Equity

•

•

•

Net worth of the business to its owners. Consists of:

Amount received by issuing shares “capital”, original value is “par value”

Past profits reinvested into the business, “accumulated retained earnings”

Assets = Liabilities + Shareholders’ Equity

5 of 57

Professor R. Jassim

2.1

Engineering Economy

BASIC PRINCIPLES IN ACCOUNTING

Revenue

•

Generated from the sale of products and/or services.

Operating Expenses

•

Expenses incurred in fabricating products and/or providing services to

appropriate markets; generally associated with the purchase of consumable

items used to generate revenue over the current accounting period, i.e. the

short-term.

Profits

•

•

•

Net amount available for:

Distribution to shareholders as “dividends”

Reinvesting in the business (retained earnings)

Profits = Revenues – Operating Expenses

Capital Expenditures

•

Expense generally associated with the purchase of non-consumable items used to

generate revenue over several accounting periods, i.e. the long-term.

6 of 57

Professor R. Jassim

2.2

Engineering Economy

FINANCIAL STATEMENTS

Income Statement

The Income Statement shows all revenues and operating expenses associated

with a specific accounting period. The Income Statement is also known as the

Statement of Earnings. It summarizes revenues, expenses, profits before taxes,

taxes paid and profits after taxes.

Figure 2.1

Income Statement

7 of 57

Professor R. Jassim

2.2

Engineering Economy

FINANCIAL STATEMENTS

Income Statement

Revenue Items

Sales

Other

• dividends received from other companies

• interest on investments

• proceeds from the sale of assets

8 of 57

Professor R. Jassim

2.2

Engineering Economy

FINANCIAL STATEMENTS

Income Statement

Operating

Expense Items

Cost of

goods sold

•

•

•

•

raw materials

labour

power

depreciation

Other

• administrative and marketing expenses

• insurance

• property taxes

9 of 57

Professor R. Jassim

2.2

Engineering Economy

FINANCIAL STATEMENTS

Statement of Earned Surplus

The Statement of Earned Surplus (also known as the Statement of Retained

Earnings) shows the changes in the (Accumulated) Retained Earnings account

from the end of the previous accounting period to the end of the current period.

Add:

Less:

Balance at start of current period

Net Income (Loss) of period

Dividends declared during period

Balance at end of period

Example 2.1- Major Electric Company (Fig. 2.1)

Earned Surplus at Nov. 2009

174 700

Add:

Net Income for 2010

304 200

Less:

Withdrawals for 2010

286 500

Source

Use

Earned Surplus at 31 October $ 192 400

10 of 57

Professor R. Jassim

2.2

Engineering Economy

FINANCIAL STATEMENTS

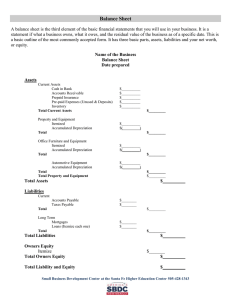

Balance Sheet

The Balance Sheet is a snapshot of a firm’s financial position at a particular point

in time, i.e. the end of the current accounting period. It summarizes assets,

liabilities and owner equity.

It is a list of the business’ assets as well as the claims against those assets by:

• Creditors – the liabilities

• Owners – the Shareholders’ Equity

Assets

Current assets typically can be converted into cash within one year. Examples are:

• Cash

• Accounts receivable

• Inventory

Fixed assets (or, capital assets) have a life greater than one year. Examples are:

• Plant and equipment

• Buildings and land

11 of 57

Professor R. Jassim

2.2

Engineering Economy

FINANCIAL STATEMENTS

Liabilities

Current Liabilities are those that are normally paid within a year. Examples are:

• Accounts payable

• Taxes or wages payable

• Bank loan payable

Long-term liabilities are money owed later than in the current year. Examples are:

• Loans

• Mortgages

Shareholders’ Equity

Capital Stock – Value at par of stock issued to shareholders

Preferred Stock – “Par” value (original issue price) of preferred stock issued to

shareholders

(Accumulated) Retained Earnings – Accumulated profits reinvested in the

business, i.e. those not distributed to the shareholders in the form of dividends.

Also referred to as Earned Surplus.

Book Value per Share =

Net worth - Preferred stock

# common shares

12 of 57

Professor R. Jassim

2.2

Engineering Economy

FINANCIAL STATEMENTS

Figure 2.2

Balance Sheet

13 of 57

Professor R. Jassim

2.2

Engineering Economy

FINANCIAL STATEMENTS

Cash Flow Statement

The Cash Flow Statement shows the sources and the uses of cash over the current

accounting period

Sources

•

•

•

•

•

Net Income

Depreciation

Decrease in assets

Increase in liabilities

Increase in capital (shares)

Uses

•

•

•

•

•

Loss

Increase in assets

Decrease in liabilities

Repurchase of shares

Dividends

14 of 57

Professor R. Jassim

2.2

Engineering Economy

FINANCIAL STATEMENTS

Example 2.2

Assume a net income of 3 840 and a withdrawal of 2 500.

Assets

Year 1

Year 2

Change

Cash

4 440

5 560

X

Accounts Receivable

1 500

750

Source 750

150

414

Use 264

Savings Bond

3 000

4 000

X

Prepaid Rent

800

1 200

Use 400

9 890

11 924

6 000

9 500

Use 3 500

600

1 550

Source 950

5 400

7 950

$15 290

$19 874

Current Assets

Stationary Supplies

Total Current Assets

Fixed Asset

Equipment at Cost

Less Accumulated Depreciation

Total Net Fixed Assets

Total Assets

15 of 57

Professor R. Jassim

2.2

Engineering Economy

FINANCIAL STATEMENTS

Example 2.2

Liabilities & Shareholders’ Equity

Year 1

Year 2

Change

4 000

200

Use 3 800

250

Source 250

2 560

Source 1 444

750

Source 750

Current Liabilities

Accounts Payable

Wages Payable

Income Taxes Payable

1 116

Prepaid Consulting Fees

Total Current Liabilities

5 116

3 760

Long-term Liabilities

Bank Loan

4 600

Total Long-term liabilities

Source 4 600

4 600

Shareholders’ Equity

Capital Stock

10 000

10 000

0

174

1 514

X

Total Shareholders’ Equity

10 174

11 514

Total Liabilities & Shareholders’ Equity

$15 290

$19 874

Accumulated Retained Earnings

16 of 57

Professor R. Jassim

2.2

Engineering Economy

FINANCIAL STATEMENTS

Example 2.2

Operating Activities

Net Income

3 840

Depreciation

950

Accounts Receivable

750

Increase in other current assets

Accounts Payable

Increase in other current liabilities

-264 + -400 = (664)

(3 800)

2 444

3 520

Financing Activities

Bank loan

Withdrawal

4 600

(2 500)

2 100

Investment Activities

Purchase of fixed assets

(3 500)

Change of Cash = 3 520 + 2 100 -3 500 = $2 120

17 of 57

Professor R. Jassim

2.2

Engineering Economy

FINANCIAL STATEMENTS

Example 2.3- Accumulated Retained Earnings

Accumulated retained earnings, end of 19X1

(20 000)

Accumulated retained earnings, end of 19X2

50 000

Dividend paid in 19X2

10 000

What was the Net Income in 19X2?

Change in accumulated retained earnings:

50 000 - (-20 000) = +70 000

Change in accumulated retained earnings = Net Income (Loss) - Dividend

Net Income = 70 000 + 10 000 = 80 000

18 of 57

Professor R. Jassim

2.2

Engineering Economy

FINANCIAL STATEMENTS

Example 2.4- Net Fixed Assets

Net fixed assets, end of 19X1

540 000

Depreciation claimed in 19X2

40 000

Fixed assets purchased in 19X2

100 000

What was the value of Net Fixed Assets at the end of 19X2?

Net fixed assets, end of 19X2 = Net fixed assets, end of 19X1 Depreciation claimed in 19X2 +

Fixed assets purchased in 19X2

Net Fixed Assets, end of 19X2 = 540 000 - 40 000 + 100 000 = 600 000

19 of 57

Professor R. Jassim

2.2

Engineering Economy

FINANCIAL STATEMENTS

Example 2.5- Change in Cash Position

Decrease in inventory

140 000

Source

Decrease in accounts payable

100 000

Use

Increase in long-term debt

Increase in accounts receivable

50 000

200 000

Source

Use

Classify each item as either a source or use of cash...

Based uniquely on these items, what was the change in the cash position?

Change = Sources - Uses

= 140 000 + 50 000 - (100 000 + 200 000)

= (110 000) i.e., the amount decreased

20 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Financial Indicators

•

Four categories of measures (known as financial indicators and/or ratios) are

used to assess the financial health of a company.

Liquidity

•

Measures the ability of the firm in meeting its short-term financial obligations, i.e.

the company’s short-term solvency.

Leverage

•

Measures the extent to which a business is financed by debt as opposed to equity.

Activity

•

Examines the firm’s effectiveness in using its fixed resources.

Profit

•

Examines the firm’s effectiveness in generating profit.

21 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Liquidity

Working Capital

•

Funds available to sustain a business’ short-term activities

Working Capital = Current Assets - Current Liabilities

Current Ratio

•

Indicates the short-term liquidity of the business.

Current Ratio =

Current Assets

Current Liabilities

Quick Ratio

•

More rigorous assessment of the short-term liquidity of a business. Liquid assets

exclude less liquid assets such as inventories and prepaid expenses.

Quick Ratio =

Liquid Current Assets

Current Liabilities

22 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Leverage

Debt Ratio

•

Indicates the dependency of the firm on creditors; i.e. the amount of non-equity

funds invested in the assets

Debt Ratio =

Liabilities

Liabilities + Shareholders’ Equity

Equity Ratio

•

Measures the financial strength of the firm; it is the complement of the Debt Ratio.

Equity Ratio =

Shareholders’ Equity

Liabilities + Shareholders’ Equity

Debt to Equity Ratio

•

Compares the amount of long-term debt liabilities to equity capital

Debt to Equity Ratio =

Long-term Debt Liabilities

Shareholders’ Equity

23 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Leverage

Times-Interest-Earned Ratio

•

Measures the firm’s ability of paying interest on long-term debt, i.e. the coverage

of interest payments.

Times-Interest-Earned

Before-Tax Profit + Interest Expenses

=

Ratio

Interest Expenses

•

Numerator is also referred to as ``Earnings before interest and taxes`` or EBIT.

24 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Activity

Inventory Turnover Ratio

•

Measures adequacy of inventory level.

•

•

=

Inventory Turnover

Ratio

Cost of Goods Sold

Avg. Inventory of Finished Products

If Cost of Goods Sold is not available, use net sales.

To calculate average: (beginning balance + ending balance)/2

Average Collection Period

•

Measures promptness in collecting receivables.

Average Collection

Average Accounts Receivable

=

Period

Average Daily Credit Sales

25 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Activity

Fixed Asset Turnover Ratio

•

Measures the sale generating capacity of the fixed assets.

Fixed Asset

Net Sales

=

Turnover Ratio

Average Net Fixed Assets

Total Asset Turnover Ratio

•

Measures the sale generating capacity of all assets.

Total Asset

Net Sales

=

Turnover Ratio

Average Total Assets

26 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Profit

Operating Cost Ratio: Operating Margin

•

Before-tax cost of generating one dollar of sales

Operating

Operating Expenses (Excluding Taxes and Interest Expenses)

=

Cost Ratio

Net Sales

Profit Margin

•

Before-tax profit generating capacity of one dollar of sales.

Profit Margin = 1 - Operating Ratio

Net Profit Ratio

•

Measures the profit generating capacity of one dollar of sales.

Net Profit Ratio = Net Profit

Net Sales

27 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Profit

Return on Total Assets

•

Accounting measure of the return on investment

Return on Total Assets =

Net Profit

Average Total Assets

Return on Equity

•

Accounting measure of the return on equity.

Return on Equity =

Net Profit (less preferred dividend)

Average Common Shareholders’ Equity

28 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Example 2.6- PASCO Limited

Income Statement for the Second Quarter of 1980 (values in ‘000 $)

Net Sales

Other Income

Cost of sales and operating expenses

Selling, general and administrative expenses

Research and development

Exploration expenses

Interest, net of amount capitalized

Currency translation adjustments

720 953

7 259

728 212

487 547

72 349

12 945

6 079

41 506

8 882___________

629 308

Income before income and mining taxes

Income and mining taxes

Net Income

98 904

52 782

46 122

Dividends on preferred shares

Net Income application to common shares

Earnings per common share ($)

6 592

39 530

0.53

29 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Example 2.6

Balance Sheet as of 30 June, 1980 (values in ‘000 $)

Assets

Current Assets

Cash and Securities

71 824

Accounts Receivable

558 232

Inventories

Prepaid Expenses

1 287 310

25 439

Total Current Assets

1 942 805

Property, plant and equipment, net

2 517 057

Cost in excess of net assets acquired (Goodwill)

28 145

Other assets

94 332

Total Assets

4 582 339

30 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Example 2.6

Liabilities

Current Liabilities

Notes payable

374 968

Accounts payable

436 811

Current taxes payable

112 658

Total Current Liabilities

924 437

Long-term Liabilities

Long-term debt

1 015 160

Deferred taxes

453 000

Other long-term liabilities

70 231

Total Liabilities

2 462 828

31 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Example 2.6

Shareholders` Equity

Shareholders` Equity

Preferred Shares

346 948

Common Shares

116 016

Retained Earnings and Capital Surplus

1 656 547

Total Shareholder`s Equity

2 119 511

Total Liabilities

2 462 828

Total Liabilities and Shareholders` Equity

4 582 339

32 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Example 2.6

Liquidity

Working Capital = Current Assets - Current Liabilities

(WC)

= 1 942 805 - 924 437

Should be positive

= 1 018 368

Current Ratio =

(CR)

Current Assets

Current Liabilities

= 1 942 805

924 437

= 2.10

Should be above 2.0

Quick Ratio = Liquid Current Assets

(QR)

Current Liabilities

= 1 942 805 - 1 287 310 - 25 439

924 437

= 0.68

Should be above 1.0

33 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Example 2.6

Leverage

Debt Ratio =

(DR)

Liabilities

Shareholders’ Equity + Liabilities

= 924 437 + 1 015 160 + 453 000 + 70 231

4 582 339

= 2 462 828

4 582 339

Typically ranges from 0.2 to 0.4

= 0.54

Equity Ratio =

(ER)

Shareholders’ Equity

Shareholders’ Equity + Liabilities

= 1 - DR

= 0.46

Typically ranges from 0.6 to 0.8

34 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Example 2.6

Leverage

Debt to Equity Ratio = Long-term Debt Liabilities

(D/E)

Shareholders’ Equity

=

1 015 160

346 948 + 116 016 + 1 656 547

= 1 015 160

2 119 511

Above unity is risky

= 0.48

Times Interest Earned Ratio = Before Tax Profit + Interest Expenses

(TIER)

Interest Expenses

= 98 904 + 41 506

41 506

= 3.4

Around 10 is good, but

at least 3 to 4

35 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Example 2.6

Activity

Inventory Turnover Ratio =

(ITR)

Cost of Goods Sold

Average Inventory of Finished Products

=

487 547

1 287 310

= 0.38 / quarter

= 1.5 / year

Average Collection Period =

(ACP)

Typically between 5 and 10

Average Accounts Receivable

Average Daily Credit Sales

= 558 232 (91)

720 953

= 70.5 days

Industrial average ~ 60 days

36 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Example 2.6

Activity

Fixed Asset Turnover Ratio =

Net Sales

(FTR)

Average Net Fixed Assets

=

720 953

2 517 057

= 0.29 / quarter

= 1.2 / year

Total Asset Turnover Ratio =

(ATR)

Typically between 5 and 6

Net Sales

Average Total Assets

=

720 953

4 582 339

= 0.16 / quarter

= 0.64 / year

Industrial average ~ 2

37 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Example 2.6

Profit

Operating Cost Ratio =

(OR)

Total Operating Expenses (excl. interest on debt and income taxes)

Net Sales

= 629 308 - 41 506

720 953

= 0.82

Profit Margin = 1 - OR

(PM)

= 1 - 0.82

= 0.18

Typically between 0.85 and 0.95

Complement of OR

Net Profit Ratio = Net Profit

( P/S)

Net Sales

=

46 122

720 953

= 6.4%

Typically around 2%

38 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Example 2.6

Profit

Return on Total Assets =

(RTA)

Net Profit

Average Total Assets

= 46 122 (4)

4 582 339

= 4.0 %

Return on Equity =

(ROE)

Typically around 5%

Net Profit (less preferred dividends)

Average Common Shareholders’ Equity

= 39 530 (4)

1 772 563

= 8.9%

Typically around 9%

39 of 57

Professor R. Jassim

2.3

Engineering Economy

ANALYSIS OF FINANCIAL STATEMENTS

Example 2.6

Summary

WC

CR

QR

1 018 368

2.10

0.68

OK

OK

LOW, not enough liquid assets

DR

D/E

TIER

0.54

0.48

3.4

A little HIGH, too many liabilities

OK

LOW, not enough flexibility

ITR

ACP

FTR

ATR

1.5

70.5

1.2

0.6

LOW, inventory too high

A little HIGH, lax collection policy

LOW, fixed-asset intensive business

LOW, asset intensive business

OR

P/S

RTA

ROE

0.82

6.4%

4.0%

8.9%

OK, better than average, good profit margin

OK, much better than average, efficient business

OK, slightly lower than average (low FTR and ATR)

OK, keeping shareholders satisfied

40 of 57

Professor R. Jassim

2.4

Engineering Economy

BASIC PRINCIPLES OF DEPRECIATION

Depreciation

•

•

Depreciation is the process of allocating over time the cost of long-term assets

(i.e. capital expenditures). The period of time over which an asset is

depreciated typically corresponds to its useful life or period of use.

Depreciation is recorded as an expense on the income statement and thus,

reduces the net income reported in any given accounting period. The value of

the long-term assets on the balance sheet is reduced by an equivalent amount.

The remaining value of these assets (i.e. net fixed assets) is referred to as their

book value.

Types of Depreciation

•

•

Depreciation charges recorded in the income statement

Depreciation used for tax purposes

41 of 57

Professor R. Jassim

2.4

Engineering Economy

BASIC PRINCIPLES OF DEPRECIATION

Depreciation charges recorded in the income statement

•

•

Accounting practice provides for the recovery of capital expenditures, thereby

reflecting the true costs of production over time

Method chosen by company accountants and approved by the shareholders

Depreciation used for tax purposes

•

•

•

The income before provision for income taxes shown in financial statements is

seldom the actual tax base used to determine tax liability

As in the case of accounting practice, the government allows the recovery of

capital expenditures over time, i.e. only a fraction of an asset`s value can be

declared as an expense in any given year

Method prescribed by income tax act

42 of 57

Professor R. Jassim

2.4

Engineering Economy

BASIC PRINCIPLES OF DEPRECIATION

Accounting Practice versus Tax Purposes

•

•

An asset cannot be depreciated for more than its net cost, i.e. [IC - SV].

The depreciation method establishes the depreciation charges over the period of

use.

Accounting practice: the total amount to be depreciated over the period of use of the

asset, i.e. TDC, is set to: IC – SV (This represents the net cost of the asset)

• This yields a terminal book value (book value at end of period of use) equal to

the salvage value.

• Should the actual salvage value differ from the one anticipated at the time of

purchase, an adjustment is made to the books at the time of disposal.

Tax purposes: the amount to be depreciated over the period of use of the asset is

set to: IC (i.e. the full cost of the asset)

• This is meant to produce a terminal tax book value of zero

At the time of disposal:

•

If TDC exceeds (IC-SV), the excess is TAXED by the government

•

If (IC-SV) exceeds TDC, the excess is written off as a loss

•

No adjustment is necessary when the two amounts are equal

43 of 57

Professor R. Jassim

2.4

Engineering Economy

BASIC PRINCIPLES OF DEPRECIATION

Effect of Depreciation on Net Income

Revenue

1000

1000

- Operating

Expenses

400

400

- Depreciation

•

•

•

•

+ 100

100

Taxable Income

600

500

- Tax @ 40%

240

-40

200

NET INCOME

360

- 60

300

Deduction increased by 100

Decrease taxable income by 100

Tax saving of 40

Decrease net income by 60

44 of 57

Professor R. Jassim

2.4

Engineering Economy

BASIC PRINCIPLES OF DEPRECIATION

Consideration

•

•

•

•

Initial Cost = IC

Estimated Salvage Value = SV

Period of Use = n years

Rate of Usage = constant or variable

Terminology

•

•

•

•

Depreciation charge in year j = DCj

Accumulated depreciation charges up to year j = ADCj

Book Value (end-of-year j) = IC-ADCj = BVj

Total depreciation charges claimed over period of use = TDC

Amount to be Depreciated

•

•

Accounting Practice: IC-ADCj

Tax Purposes: IC

45 of 57

Professor R. Jassim

2.4

Engineering Economy

BASIC PRINCIPLES OF DEPRECIATION

Example 2.7

•

•

•

Initial Cost of Asset = $ 80 000

Estimated Salvage Value = $ 10 000

Period of Use = 5 years

Year

DC

ADC

BV

1

10 000

10 000

70 000

2

15 000

25 000

55 000

3

10 000

35 000

45 000

4

20 000

55 000

25 000

5

15 000

70 000

10 000

46 of 57

Professor R. Jassim

2.5

Engineering Economy

DEPRECIATION METHODS

Straight-Line Depreciation (SLD)

•

•

Depreciation charge is constant

Specify depreciation rate ( r) per year or depreciation period (n)

• R = 1/n

• When r is specified, n is not necessarily a whole value

e.g. 30% per year

Depreciation rate of 30% in years 1,2,3 and 10% in year 4

Example 2.8

•

IC = $ 1000

SV = $ 200

n = 8 years

Year

DC

ADC

BV

1

100

100

900

2

100

200

800

3

100

300

700

4

100

400

600

5

100

500

500

6

100

600

400

7

100

700

300

8

100

800

200

47 of 57

Professor R. Jassim

2.5

Engineering Economy

DEPRECIATION METHODS

Example 2.8

Figure 2.3

Straight Line Depreciation

48 of 57

Professor R. Jassim

2.5

Engineering Economy

DEPRECIATION METHODS

Declining-Balance Depreciation (DBD)

•

•

•

•

•

Depreciation charge is a proportion of the asset`s current value,

Government established depreciation rate ( r) per year

Annual depreciation charge is determined by multiplying book value by

depreciation rate

As the depreciation rate fixes the terminal book value, this value may not

correspond to the estimated salvage value.

DBD is an anomaly, NOT for accounting purpose, see below for illustration, this is common

error, only tax purpose. However asset market price of assets at disposal is another issue,

will be dealt with in Ch 7

Example 2.9

•

Year

DC

ADC

BV

IC = $ 5500

SV = $ 500

n = 5 years

Dep rate =

30%

1

1 650

1650

3850

2

1155

2805

2695

3

808.5

3613.5

1886.5

4

565.95

4179.45

1320.55

Accounting:

Taxation:

5

820.55

5000

500

5

396.165

4575.615

924.385

49 of 57

Professor R. Jassim

2.5

DEPRECIATION METHODS

Solving for r

•

Engineering Economy

IC = $ 5500

SV = $ 500 n

= 5 years

Trend of DBD

5500 (1 - r)5 = 500

(1 - r)5 = 500 / 5500 = 0.0909

r = 0.381 or 38.1%

This is only for algebraic illustration –

illegal for Government

Figure 2.4

Declining Balance Depreciation

50 of 57

Professor R. Jassim

2.5

Engineering Economy

DEPRECIATION METHODS

Sum-of-the-Years`-Digits Depreciation (SYDD)

•

•

•

Depreciation charge decreases over time

Specify depreciation period

Depreciation rate changes every year

rj =

n − j +1

n

j

1

•

The full net cost of the asset (IC-SV) is depreciated

51 of 57

Professor R. Jassim

2.5

Engineering Economy

DEPRECIATION METHODS

Example 2.10

• IC = $ 5500

• SV = $ 500

• n = 5 years

Sum = 1 + 2 + 3 + 4 + 5 = 15

r1 = 5 / 15 DC1 = 5/15 (5000) = 1666.67 BV1 = 3833.33

r2 = 4 / 15 DC2 = 4/15 (5000) = 1333.33 BV2 = 2500

r3 = 3 / 15 DC3 = 3/15 (5000) = 1000

BV3 = 1500

r4 = 2 / 15 DC4 = 2/15 (5000) = 666.67 BV4 = 833.33

r5 = 1 / 15 DC5 = 1/15 (5000) = 333.33 BV5 = 500

52 of 57

Professor R. Jassim

2.5

Engineering Economy

DEPRECIATION METHODS

Unit of Production Depreciation (UPD)

•

•

•

Depreciation charge varies with intensity of use, i.e. they are proportional to

production

Specify use in total units produced or hours operated rather than in years

Depreciation rate is given per unit produced or hour operated

r=

•

IC-SV

Total units produced or hours operated

The full net cost of the asset (IC-SV) is depreciated

53 of 57

Professor R. Jassim

2.5

Engineering Economy

DEPRECIATION METHODS

Example 2.11

•

•

•

IC = $ 5500

SV = $ 500

n = 5 years

Production

Yr 1 – 3000

Yr 2 – 2000

Yr 3 – 2000

Yr 4 – 1500

Yr 5 – 1500

Total production: 10 000

Net cost: 5500 - 500 = 5000

r = 5000 / 10 000 = 0.50 / unit

DC1 = 3000 (0.50) = 1500

BV1 = 4000

DC2 = 2000 (0.50) = 1000

BV2 = 3000

DC3 = 2000 (0.50) = 1000

BV3 = 2000

DC4 = 1500 (0.50) = 750

BV4 = 1250

DC5 = 1500 (0.50) = 750

BV5 = 500

54 of 57

Professor R. Jassim

2.5

Engineering Economy

DEPRECIATION METHODS

Example 2.12

Comparison of depreciation methods

IC: 200 000

Terminal book value: 25 000

n: 10 years

Straight-line rate: 1 / 10 = 0.1 or 10%

Declining-balance rate: 1 − 10 25 / 200 = 0.1877 or 18.77%

This is only for algebraic illustration – illegal for Government

Sum-of-the-years’-digits rates:

S j, j = 1,10 = 55

r1 = 10 / 55

r2 = 9 / 55

r3 = 8 / 55

…

r10 = 1 / 55

55 of 57

Professor R. Jassim

2.5

Engineering Economy

DEPRECIATION METHODS

Example 2.12

DEPRECIATION CHARGE ('000 $)

40

Declining-balance

30

Sum-of-the-years'-digits

Straight-line

20

SLD – constant

SYDD – linear decrease

10

0

1

2

3

4

5

6

7

8

9

10

YEAR

56 of 57

Professor R. Jassim

2.5

Engineering Economy

DEPRECIATION METHODS

Example 2.12

200

BOOK VALUE ('000 $)

Straight-line

150

Sum-of-the-years'-digits

100

SLD – linear decrease

Declining-balance

50

0

At

1

purchase

2

3

4

5

6

7

8

9

10

YEAR

57 of 57