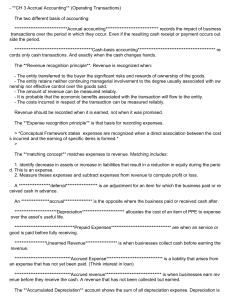

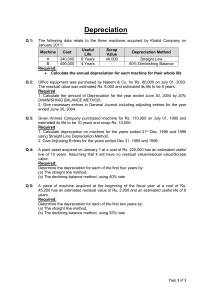

ACT 130 1.T Company acquired machinery on January 1. Cost 855,759,220 Residual value 100,000 Estimated useful life 5 Question: What is the depreciation expense for the year? Solution: Deprecible amount 855,659,220 Estimated useful life 5 Depreciation expense 171,131,844