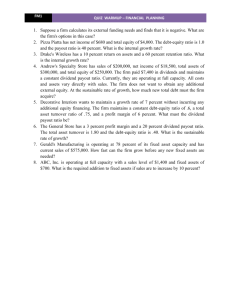

Encoder: Sheryll N. Cunanan Unit XXII – Project Feasibility Studies 1. Which of the following is not an activity covered by feasibility study? a. Activity based accounting of the endeavor leading to a conclusion. b. Collection of data c. Evaluation and analysis of data collected. d. Formulation of recommendation. 2. Among the following major parts of a project feasibility study, which grouping is considered critical? a. Management, financial and social returns b. Technical, financial and environmental aspects c. Economic benefits, management, financial d. Marketing, engineering or technical and financial. 3. Lucky Products, Inc. has the following balance sheet: Current assets Net fixed assets P5, 000 Accounts payable 5, 000 Notes payable Long-term debt Common equity Total assets P10, 000 Total claims P1, 000 1, 000 4, 000 4, 000 P10, 000 Business has been slow; therefore, fixed assets are vastly underutilized. Management believes it can double sales next year with the introduction of a new product. No new fixed assets will be required, and management expects that there will be no earnings retained next year. What is next year’s additional funding requirement? a. P0 b. P4, 000 c. P6, 000 d. P13, 000 4. The 19x5 balance sheet for Mars Pulp and Paper is shown below (millions of pesos): Encoder: Sheryll N. Cunanan Cash Accounts receivable Inventory Current assets Fixed assets Total assets P3.0 Accounts payable 3.0 Notes payable 5.0 Long-term debt P11.0 Common equity P2.0 1.5 3.0 7.5 3.0 P14.0 Total claims P14.0 In 19x5, sales were P60 million. In 19x6, management believes that sales will increase by 20% to a total of P72 million. The profit margin is expected to be 5%, and the dividend payout ratio is targeted at 40%. The firm has excess capacity and no increase in fixed assets will be required. What is the additional funding requirement for 19x6? a. P0.36 million b. P0.24 million c. P0 million d. 0.36 million 5. Refer to Problem 4. Assume no excess capacity excess. How much can sales grow above the 19x5 level of P60 million without requiring any additional funds? a. 12.28% b. 14.63% c. 15.75% d. 17.65% 6. In project feasibility studies, accounts are usually involved in the financial aspect. Included in this portion of the study is a set of statements expressing projected serve as base for the financial projections. The set of expressed statements is called a. Statements of Projected Costs. b. Projected Financial statements c. Statement of Assumptions d. Statement of accounts. 7. The statements below about project feasibility studies are true except: a. Any change which can materially alter the assumptions used in the preparation of the forecast will render it useless. b. It is important for government agencies in order to determine entitlement to government incentives c. It also covers the social desirability aspects of a proposed undertaking. Encoder: Sheryll N. Cunanan d. Since the data and required is a basic step in its preparation, all the necessary and required information will always be available. 8. The relevance of particular cost of a decision is determined by the a. Size of the cost b. Riskiness of the decision c. Potential effect on the decision d. Accuracy and verifiability of the cost. 9. Social regulation is often criticized by industry as inefficient. Firms perceive this inefficiency to be a result of a. The failure to consider the marginal benefits relative to the marginal costs. b. Lenient enforcement policies c. Concern for the quality of life but not the quality of products d. The use of the internal revenue tax code instead of strict compliance penalties 10. Basic steps in the preparation of project study include a. Gathering and collection of project study include necessary and relevant to all aspects of the undertaking b. Evaluation and analysis of the data obtained c. Formulation of conclusions and recommendations d. All of the above 11. In a project feasibility study, which of the following statements is false? a. It is based on available information and opinions of the party involved in the preparation of the study. b. The study is primarily a forecast which always tallies with actual events. c. The characteristics of good feasibility study are comprehensiveness, objectivity and simplicity. d. One of the parties interested in feasibility studies is the stockholder 12. In a project feasibility study, which of the following is true? a. The study is not affected by any significant change in actual business conditions as compared to the assumptions used in making a forecast. b. The study is based on available information and opinions of the party involved in the preparation of the study. c. (a) and (b) d. None of the above 13. Sun machines, Inc., has a net income this year of P500 on sales of P2, 000 and is operating its fixed assets at full capacity. Management expects sales to increase by 25 percent next year and is forecasting a dividend payout ratio of 30 percent. The profit margin is not expected to change. If spontaneous liabilities are P500 this year, and no excess funds are expected next year, what is Sun’s total assets this year/ Encoder: Sheryll N. Cunanan a. P1, 000 b. P1, 500 c. P2,250 d. P3, 000 14. An increase in a firm’s inventories will call for additional financing unless the increase is offset by an equal or larger decrease in some other asset account. a. True b. False 15. If the capital intensity ratio (A/S) of a firm actually decreases as sales increase, use of the percentage of sales method will typically overstate the amount of additional funds required, other things held constant. a. True b. False 16. If the dividend payout ratio is 100 percent, all ratios are held constant and the firm is operating at full capacity, then any increase in sales will require additional financing. a. True b. False 17. Which of the following would reduce the additional funds required if all other things are held constant? a. An increase in the dividend payout ratio b. A decrease in the profit margin c. An increase in the capital intensity ratio d. A decrease in the firm’s tax rate 18. One of the first steps in the percentage of sales method of forecasting is to identify those asset and liability accounts which increase spontaneously with retained earnings a. True b. False 19. Robert and Company has a total assets turnover of 0.30 and a profit margin of 10 percent. The president is unhappy with the current return on assets, and he thinks it could be doubled. This could be accomplished (1) by increasing the profit margin to 15 percent and (2) by increasing the total assets turnover. What new total assets turnover ratio, along with the 15 percent profit margin is required to double the return on assets? a. 30% b. 35% c. 40% d. 45% Encoder: Sheryll N. Cunanan 20. Mars and Venus Resa recently leased space in the Plaza Shopping Center and opened a new business, Resa’s Ice Cream Shop. Business has been good but the Resas frequently run out of cash. This has necessitated late payment on certain ice cream orders, which in turn is beginning to cause a problem with suppliers. The Resas plan to borrow from a bank to have cash ready as needed, but first they need to forecast how much cash will be needed. Therefore, they have decided to prepare a cash budget for June, July, and August to determine their cash needs. Ice cream sales are made on a cash basis only. The Resas must pay for their ice cream orders 1 month after the purchase. Rent is P1, 000 per month, and they themselves a combined salary of P2, 400 per month. In addition, they must make a tax payment of P6, 000 in June. The current cash on hand (June 1) is P200, but the Resas have decided to maintain an average balance of P3, 000. Estimated ice cream sales and purchases for June, July, and August are given below. May purchases amounted to P70, 000. June July August Sales P80, 000 20, 000 30, 000 Purchases P20, 000 20, 000 20, 000 What amount of money must be borrowed or have in surplus in each of the month in the budget period (June, July, and August)? a. P2, 200; P5, 600; (P1, 000)* b. P2, 700; P5, 600; (P1, 000)* c. P2, 200; P9, 400; (P1, 000)* d. (P1, 000)*; P4, 700; P500 *The firm projects a cash surplus in this month. 22. The Ken Company is trying to determine an acceptable growth rate in sales, while the firm wants to expand, it does not want to use any external funds to support such expansion due to the particularly high rates in the market now. Having gathered the following data for the firm, what is the maximum growth it can sustain without using additional funds? Encoder: Sheryll N. Cunanan Capital intensity ratio Profit margin Dividend payout ratio Current sales Spontaneous liabilities = = = = = 1.2 10% 50% P100, 000 P10, 000 a. 3.6% b. 4.8% c. 5.2% d. 6.1% 22. If the capital intensity ratio of a firm actually decreases as sales increase, use of the percentage of sales method will typically understate the amount of additional funds required, other things held constant. a. True b. False 23. A firm has the following balance sheet and statistics Cash P10 Accounts payable P10 Accounts receivable 10 Notes payable 20 Inventories 10 Long-term debt 40 Fixed assets 90 Common stock 40 Retained earnings 10 P120 P120 Fixed assets are being used at 80 percent of capacity; sales for the year just ended were P200; sales will increase P10 per year for the next 4 years; the profit margin is 5 percent; and the dividend payout ratio is 60 percent. What are the total outside financing requirements for the entire 4 years? (Assume that fixed assets cannot be sold.) a. P4.00 b. P2.00 c. –P0.80 (surplus) d. –P14.00 (surplus) 24. Calculate the total assets of Hero Paint given the following information: Sales this year = P3, 000; increase in sales projected for next year = 20 percent; net income after tax this year = P250; dividend payout ratio = 40 percent; projected excess funds available next year = P100; accounts payable = P600; notes payable = P100; and accrued wages and taxes = P200. (Note: the company is operating at full capacity.) a. P3, 000 b. P2, 200 c. P2, 00 Encoder: Sheryll N. Cunanan d. P1, 200 25. A firm’s profit margin is 5 percent, its debt/assets ratio is 56 percent, and its dividend payout ratio is 40 percent. If the firm is operating at less than full capacity, then sales could increase to at least some extent without the need for external funds, but if it is operating at full capacity with respect to all assets, including fixed assets, then any growth in sales will require external financing. a. True b. False 26. Which of the following actions would reduce the firm’s need for external capital (each to be considered independently, other things held constant)? a. An increase in the dividend payout ratio b. A decrease in the profit margin c. A decrease in average collection period d. An increase in expected sales growth 27. The Nelson Company has a balance sheet showing the following account amounts as of December 31, 19x7: Cash Accounts receivable Inventory Net fixed assets P10 Accounts payable 40 Accruals P15 5 50 Notes payable 100 Bonds payable Common stock Retained earnings P200 20 20 20 120 P200 Last year (19x6) the firm generated sales of P2, 000 with a profit margin of 10 percent and a dividend payout ratio of 50 percent. It has been operating its fixed assets at 80 percent of capacity. It expects to increase sales by P750 with a decrease in the profit margin to 3 percent and an increase in the dividend payout ratio to 60 percent. What needs for additional funds will Nelson have? a. P700 b. –P3.00 c. P34.50 d. –P9.50 28. Any firm with a positive growth rate will require some amount of external funding. a. True b. False 29. Two firms were generating the same sales with the same capital intensity ratios. However, one firm was operating below capacity. If the two firms expect the same growth in sales in the next period, it is more likely that the firm operating at full capacity will need additional funds, other things held constant. Encoder: Sheryll N. Cunanan a. True b. False 30. You are the owner of a small business which has the following balance sheet: Current assets Net fixed assets Total assets P5, 000 Accounts payable 10, 000 Accruals Long-term debt Common equity P15, 000 Total claims P1, 000 1, 000 5, 000 8, 000 P15, 000 Fixed assets are fully utilized. Next year you expect sales to increase by 50 percent. You also expect to retain P2, 000 of next year’s earnings within the firm. What is next year’s additional funding requirement? a. No additional funds are required b. P3, 500 c. P4, 500 d. P5, 500 31. The percentage of sales method assumes that the key ratios are constant, which means, for example, that if you plotted a graph of inventories versus sales, the regression line would be linear and would have a positive Y – intercept. a. True b. False 32. The percentage of sales forecasting method produces accurate results unless which of the following conditions is (are) present? a. Fixed assets are ”lumpy” b. Strong economies of scale are present c. Excess capacity exists because of a temporary recession d. A, b, and c all make the percentage of sales method inaccurate. 33. A firm’s financial plan must be consistent with the firm’s a. Strategic plan b. Operating plan c. Corporate objectives d. All of the above. 34. Pro forma financial statements are used to asses a firm’s historical performance. a. True b. False 35. The percentage of sales forecasting technique is type of simple linear regression in which the regression line is constrained to pass through the origin. a. True b. False. Encoder: Sheryll N. Cunanan UNIT XXI – Suggested Answers 1. 2. 3. 4. 5. 6. 7. A D B D D C D 8. 9. 10. 11. 12. 13. 14. C D D B B C A 15. 16. 17. 18. 19. 20. 21. A A D B C A B 22. 23. 24. 25. 26. 27. 28. B D D B C A B 29. 30. 31. 32. 33. 34. 35. A C B D D B A