Reference Guide to Using the 3-Stage Dividend Discount Model

advertisement

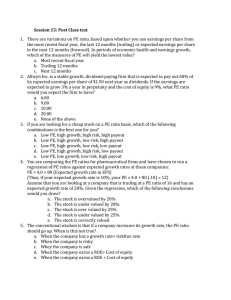

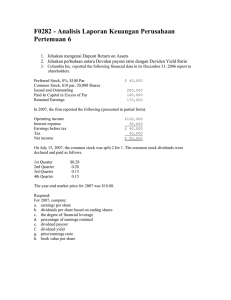

Reference Guide to Using the 3-Stage Dividend Discount Model * The gray cells are the information that is typed in * The red cells are the output cells Outside Estimate Outside Estimate: Can be found on Zacks.com under earnings estimates Historical Growth: EPS from 5 years ago- Can be found on the Value Line survey (use 2004's number) Fundamental Growth Current Estimate EPS: Use Value Line survey Current Dividend/Share: Use Value Line survey Book Value of Equity: Use Value Line survey (Book Value/Share) Outside Estimate: Historical Growth: Fundamental Growth: For these cells you input the weights as a percentage. The numbers should be based on you opinion of how the company will grow and where you should put more weight. Cost of Equity Risk Free Rate: 10 year T-bond which can be found on Yahoo finance on the front page Market Risk Premium: This is your opinion of the current markets return is Beta: Can be found on Value Line survey Discount Rate: Is an output cell. It shouldn't be less than 5% or higher than 15%. If it is there is a chance that some numbers are not right. Second Worksheet Payout Ratio in Stable Phase: Usually the payout ratio increases in the stable phase. It can be calculated by dividing dividends/share by earnings/share for the past five years and then taking the average of those numbers. Length of Growth Stage: Research the stock and use your opinion on how long they will grow. Length of Transitional Stage: This is usually around 5 years but again use you opinion based of your research. Stable Growth Rate: The nominal rate at what the economy is currently growing at. (e.g. 6%)