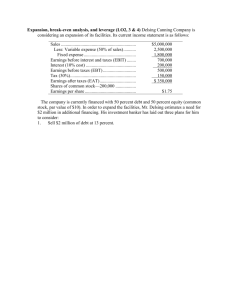

Corporate Finance ACS Program W9 Leverage & Capital Structure Introduction to Capital structure 1. Increase the Income from assets 2. Decreasing the cost of capital 3. Maximizing the net cash flow There are only two ways in which a business L 5. Get the new Debt Financing 6. Increase the assets 7. Increase the Income 1. The first is debt. The essence of debt is that you promise to make fixed payments in E Assets can make money : Liabilities & Equities 4. Reinvest in Equity the future (interest payments and repaying principal). If you fail to make those payments, you lose control of your business. 2. The other is equity. With equity, you do get whatever cash flows are left over after you have made debt payments. Leverage Leverage • Leverage results from using borrowed capital as a funding source when investing to expand the firm's asset base and generate returns on risk capital. When cost of operations (COGS and Opex) are largely fixed, small changes of revenue will to much larger in EBIT • Leverage is an investment strategy of using borrowed money—specifically, the use of various financial instruments or borrowed capital—to increase the potential return of an investment. • Leverage can also refer to the amount of debt a firm uses to finance assets Relationship between EBIT and EPS. Tax depend on profit. Interest and preferred dividend usually fixed. When its large, small changes in EBIT produce larger changes in EPS Leverage High business risk industry tends to maintain a lower financial risk Lower business risk industry tends to have a higher financial risk Breakeven Analysis Breakeven Analysis (cost-volume-profit) is used to : • To calculate the OBP, cost of goods sold and operating expenses must be categorized as fixed or variable. • To determine the level of operations necessary to cover all costs • To evaluate the profitability associated with various levels of sales • Variable costs vary directly with the level of sales and are a function of volume, not time. The firm’s operating breakeven point (OBP) is the level of sales necessary to cover all operating expenses • Examples would include direct labor and shipping. • Fixed costs are a function of time and do not vary with sales volume. • Examples would include rent and fixed overhead At the OBP, operating profit (EBIT) is equal to zero. Breakeven Analysis Algebraic Approach • Using the following variables, the operating portion of a firm’s income statement may be recast as follows: P Q FC VC • = = = = sales price per unit sales quantity in units fixed operating costs per period variable operating costs per unit 𝐹𝐶 Letting EBIT = 0 and solving for Q, we get: 𝑄 = 𝑃 − 𝑉𝐶 𝐸𝐵𝐼𝑇 = 𝑃 𝑥 𝑄 − 𝐹𝐶 − (𝑉𝐶 𝑥 𝑄) Breakeven Analysis Algebraic Approach • Example: Omnibus Posters has fixed operating costs of $2,500, a sales price of $10/poster, and variable costs of $5/poster. Find the OBP. 2500 𝑄= = 500 𝑝𝑜𝑠𝑡𝑒𝑟𝑠 10 − 5 • This implies that if Omnibus sells exactly 500 posters, its revenues will just equal its costs (EBIT = $0). EBIT = (P x Q) - FC - (VC x Q) EBIT = ($10 x 500) - $2,500 - ($5 x 500) EBIT = $5,000 - $2,500 - $2,500 = $0 Breakeven Analysis Graphic Approach Total Revenue EBIT at Various Levels of Quantity Sold Total Costs Total FC 14,000 Quantity Total Total Total Total Sold Revenue Costs FC VC 0 0 2,500 2,500 0 500 5,000 5,000 2,500 2,500 0 1,000 10,000 7,500 2,500 5,000 2,500 1,500 15,000 10,000 2,500 7,500 5,000 2,000 20,000 12,500 2,500 10,000 7,500 2,500 25,000 15,000 2,500 12,500 10,000 3,000 30,000 17,500 2,500 15,000 12,500 12,000 (2,500) revenue/costs ($) EBIT 10,000 BEP 8,000 6,000 4,000 2,000 - Omnibus Posters has fixed operating costs of $2,500, a sales price of $10/poster, and variable costs of $5/poster. Find the OBP. 500 1,000 sales (posters) 1,500 2,000 Operating and Financial Leverage Effect of Leverage on Income Statement Net Sales Variable Cost (60% of sales) Fixed Cost EBIT Interest Expense EBT Tax (30%) Net Income Base Case Normal 700,000 420,000 200,000 80,000 20,000 60,000 18,000 42,000 Operating and Financial Leverage Effect of Leverage on Income Statement Worse Case Sales decrease 10% Net Sales 630,000 Variable Cost (60% of sales) 378,000 Fixed Cost 200,000 EBIT 52,000 Interest Expense 20,000 EBT 32,000 Tax (30%) 9,600 Net Income 22,400 - 46.67% Base Case Best Case Normal Sales Increase 10% 700,000 770,000 420,000 462,000 200,000 200,000 80,000 108,000 20,000 20,000 60,000 88,000 18,000 26,400 42,000 61,600 46.67% Operating and Financial Leverage Degree of Operating Leverage • Operating leverage = the potential use of fixed operating costs to magnify the effects of changes in sales on the firm’s EBIT Effective operating cost • The degree of operating leverage (DOL) measures the sensitivity of changes in EBIT to changes in Sales. • Only companies that use fixed costs in the production process will experience operating leverage. Operating and Financial Leverage Degree of Operating Leverage Worse Case Sales decrease 10% Net Sales 630,000 Variable Cost (60% of sales) 378,000 Fixed Cost 200,000 EBIT 52,000 Interest Expense 20,000 EBT 32,000 Tax (30%) 9,600 Net Income 22,400 EBIT Decrease 35% Base Case Best Case Normal Sales Increase 10% 700,000 770,000 420,000 462,000 200,000 200,000 80,000 108,000 20,000 20,000 60,000 88,000 18,000 26,400 42,000 61,600 EBIT Increase 35% DOL = % Change in EBIT = 35% = 3.50 % Change in Sales 10% Because of the presence of fixed costs in the firm’s production process, a 10% increase in Sales will result in a 35% increase in EBIT. Note that in the absence of operating leverage (if Fixed Costs were zero), the DOL would equal 1 and a 10% increase in Sales would result in a 10% increase in EBIT. 𝐷𝑂𝐿 = 𝑆𝑎𝑙𝑒𝑠 −𝑉𝐶 𝑆𝑎𝑙𝑒𝑠 −𝑉𝐶 −𝐹𝐶 700 −420 = 700 −420 −200 = 3.50 Operating and Financial Leverage Degree of Operating Leverage Company A Company B Net Sales Variable Cost (60% of sales) Fixed Cost 55,000 33,000 10,000 30,000 18,000 5,000 Net Sales - VC Net Sales - VC - FC 22,000 12,000 12,000 7,000 1.83 1.71 DOL 𝐷𝑂𝐿 = 𝑆𝑎𝑙𝑒𝑠 − 𝑉𝐶 𝑆𝑎𝑙𝑒𝑠 − 𝑉𝐶 − 𝐹𝐶 If both companies experience 20% increase in sales, ……… EBIT of Company A will increase 36.6% EBIT of Company B will increase 34.2% Operating and Financial Leverage Degree of Financial Leverage • Financial leverage = potential use of fixed financial costs to magnify the effects of changes in EBIT on the firm’s EPS • The degree of financial leverage (DFL) measures the sensitivity of changes in EPS to changes in EBIT. • Only companies that use debt or other forms of fixed cost financing (like preferred stock) will experience financial leverage. Operating and Financial Leverage Degree of Financial Leverage Worse Case Sales decrease 10% Net Sales 630,000 Variable Cost (60% of sales) 378,000 Fixed Cost 200,000 EBIT 52,000 Interest Expense 20,000 EBT 32,000 Tax (30%) 9,600 Net Income # shares EPS 22,400 42,000 0.53 EPS Decrease 46.67% Base Case Best Case Normal Sales Increase 10% 700,000 770,000 420,000 462,000 200,000 200,000 80,000 108,000 20,000 20,000 60,000 88,000 18,000 26,400 42,000 42,000 1.00 61,600 42,000 1.47 EPS Increase 46.67% DFL = % Change in EPS = 46.67% = 1.33 % Change in EBIT 35.00% In this case, the DFL is greater than 1 which indicates the presence of debt financing. In general, the greater the DFL, the greater the financial leverage and the greater the financial risk. 𝐷𝐹𝐿 = 𝐸𝐵𝐼𝑇 80 = = 1.33 𝐸𝐵𝐼𝑇 − 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 80 − 20 Operating and Financial Leverage Degree of Financial Leverage 𝐷𝐹𝐿 = 𝐸𝐵𝐼𝑇 108 = = 1.23 𝐸𝐵𝐼𝑇 − 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 108 − 20 𝐸𝐵𝐼𝑇 52 𝐷𝐹𝐿 = = = 1.62 𝐸𝐵𝐼𝑇 − 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 52 − 20 In this case, we can see that the DFL is related to the expected level of EBIT. However, the DFL declines if the firm performs better than expected. Note also, however, that the DFL will rise if the firm performs worse than expected. Operating and Financial Leverage Degree of Total Leverage (DTL) Worse Case Sales decrease 10% Net Sales 630,000 Variable Cost (60% of sales) 378,000 Fixed Cost 200,000 EBIT 52,000 Interest Expense 20,000 EBT 32,000 Tax (30%) 9,600 Net Income # shares EPS 22,400 42,000 0.53 EPS Decrease 46.67% Base Case Best Case Normal Sales Increase 10% 700,000 770,000 420,000 462,000 200,000 200,000 80,000 108,000 20,000 20,000 60,000 88,000 18,000 26,400 42,000 42,000 1.00 61,600 42,000 1.47 EPS Increase 46.67% DTL = % Change in EPS = % Change in Sales 46.7% 10% = 4.67 In this case, the DTL is greater than 1 which indicates the presence of both fixed operating and fixed financing costs. In general, the greater the DTL, the greater the financial leverage and the greater the operating leverage. Operating and Financial Leverage Degree of Total Leverage (DTL) The relationship between the DTL, DOL, and DFL is illustrated in the following equation: DTL = DOL x DFL Applying this to our example at a sales level of $770, we get: DTL = 3.50 x 1.33 = 4.67 Which is the same result we obtained using either the point or interval estimates at that sales level. Capital Structure Outline • The Capital Structure Question and The Pie Theory • Maximizing Firm Value versus Maximizing Stockholder Interests • Financial Leverage and Firm Value: An Example • Modigliani and Miller: Proposition II (No Taxes) • Taxes Capital Structure and the Pie • The value of a firm is defined to be the sum of the value of the firm’s debt and the firm’s equity. V=B+S • B is the market value of the debt • S is the market value of the equity • If the goal of the firm’s management is to make the firm as valuable as possible, then the firm should pick the debt-equity ratio that makes the pie as big as possible. S B Value of the Firm Stockholder Interests There are two important questions: 1. Why should the stockholders care about maximizing firm value? Perhaps they should be interested in strategies that maximize shareholder value. 2. What is the ratio of debt-to-equity that maximizes the shareholder’s value? As it turns out, changes in capital structure benefit the stockholders if and only if the value of the firm increases. Financial Leverage, EPS, and ROE Consider an all-equity firm that is contemplating going into debt. (Maybe some of the original shareholders want to cash out.) Current Assets Proposed 20.000 20.000 0 8.000 20.000 12.000 Debt to Equity Ratio 0% 60% Interest Rate n/a 8% Shares outstanding 400 240 50 50 Debt Equity Share Price EPS and ROE Under Current Structure Recession Expected Expansion $1,000 $2,000 $3,000 0 0 0 $1,000 $2,000 $3,000 EPS $2.50 $5.00 $7.50 ROA 5% 10% 15% ROE 5% 10% 15% EBIT Interest Net income Current Shares Outstanding = 400 shares EPS and ROE Under Proposed Structure Recession Expected Expansion $1,000 $2,000 $3,000 640 640 640 Net income $360 $1,360 $2,360 EPS $1.50 $5.67 $9.83 ROA 1.8% 6.8% 11.8% ROE 3.0% 11.3% 19.7% EBIT Interest Proposed Shares Outstanding = 240 shares Financial Leverage and EPS 12.00 Debt 10.00 EPS 8.00 6.00 4.00 No Debt Advantage to debt Break-even point 2.00 0.00 1,000 (2.00) Disadvantage to debt 2,000 3,000 EBIT (no taxes Assumptions of the M&M Model • Homogeneous Expectations • Homogeneous Business Risk Classes • Perpetual Cash Flows • Perfect Capital Markets: › Perfect competition › Firms and investors can borrow/lend at the same rate › Equal access to all relevant information › No transaction costs › No taxes Homemade Leverage: An Example Recession EPS of Unlevered Firm 2.50 Earnings for 40 shares 100 Less interest on $800 (8%) 64 Net Profits 36 ROE (Net Profits / $1,200) 3.0% Expected 5.00 200 64 136 11.3% Expansion 7.50 300 64 236 19.7% We are buying 40 shares of a $50 stock, using $800 in margin. We get the same ROE as if we bought into a levered firm. Our personal debt-equity ratio is: 𝐵 800 = = 66,67% 𝑆 1.200 Homemade Un Leverage: An Example Recession EPS of Levered Firm $1.50 Earnings for 24 shares $36 Plus interest on $800 (8%) $64 Net Profits $100 ROE (Net Profits / $1,200) 5% Expected $5.67 $136 $64 $200 10% Expansion $9.83 $236 $64 $300 15% Buying 24 shares of an otherwise identical levered firm along with some of the firm’s debt gets us to the ROE of the unlevered firm. This is the fundamental insight of M&M MM Proposition I (No Taxes) • We can create a levered or unlevered position by adjusting the trading in our own account. • This homemade leverage suggests that capital structure is irrelevant in determining the value of the firm: VL = VU MM Proposition II (No Taxes) RoE = RoC + RoD Proposition II Leverage increases the risk and return to stockholders Rs = R0 + 𝐵 ( ) (R0 𝑆𝐿 - RB) RB is the interest rate (cost of debt) Rs is the return on (levered) equity (cost of equity) R0 is the return on unlevered equity (cost of capital) B is the value of debt SL is the value of levered equity MM Proposition II (No Taxes) The derivation is straightforward: 𝑅𝑊𝐴𝐶𝐶 = 𝐵 𝐵+𝑆 𝐵 𝐵+𝑆 𝑥 𝑅𝐵 + 𝐵+𝑆 𝑆 𝐵 𝑥 𝐵+𝑆 𝐵 𝑆 𝐵 𝑆 𝑥 𝑅𝐵 + 𝑆 𝐵+𝑆 𝐵+𝑆 𝑆 𝑥 𝑆 𝐵+𝑆 𝐵+𝑆 𝑆 𝑥 𝑅𝐵 + 𝑅𝑆 = 𝑥 𝑅𝑆 Then set 𝑅𝑊𝐴𝐶𝐶 = 𝑅0 𝑥 𝑅𝑆 = 𝑅0 𝑥 𝑅𝐵 + 𝑥 𝑅𝐵 +𝑅𝑆 = 𝑆 𝐵+𝑆 𝐵 𝑆 𝑥 𝑅𝑆 = 𝐵+𝑆 𝑆 𝑥 𝑅0 Multiply both side with 𝑥 𝑅0 𝑥 𝑅0 + 𝑅0 𝑅𝑆 = 𝑅0 + 𝐵 𝑆 (𝑅0 - 𝑅𝐵) 𝐵+𝑆 𝑆 Cost of capital: R (%) MM Proposition II (No Taxes) R0 RS R0 RWACC B ( R0 RB ) SL B S RB RS BS BS RB RB Debt-to-equity Ratio B S MM Propositions I & II (With Taxes) • Value of the Firm EBIT x (1 - TC) • Proposition I (with Corporate Taxes) › Firm value increases with leverage VL = VU + TC B • Proposition II (with Corporate Taxes) › Some of the increase in equity risk and return is offset by the interest tax shield 𝑅𝑆 = 𝑅0 + 𝐵 𝑆 (𝑅0 - 𝑅𝐵 ) TC B is leverage increase the value of the firm by the tax shield RB is the interest rate (cost of debt) RS is the return on equity (cost of equity) R0 is the return on unlevered equity (cost of capital) B is the value of debt S is the value of levered equity MM Proposition I (With Taxes) Total Cash Flow to all Share holder : 𝐸𝐵𝐼𝑇 − 𝑅𝐵𝐵 𝑥 1 − 𝑇𝐶 + 𝑅𝐵𝐵 Clearly 𝐸𝐵𝐼𝑇 − 𝑅𝐵𝐵 𝑥 1 − 𝑇𝐶 + 𝑅𝐵𝐵 = 𝐸𝐵𝐼𝑇 𝑥 1 − 𝑇𝐶 - 𝑅𝐵𝐵 𝑥 1 − 𝑇𝐶 + 𝑅𝐵𝐵 = 𝐸𝐵𝐼𝑇 𝑥 1 − 𝑇𝐶 - 𝑅𝐵𝐵 + 𝑅𝐵𝐵 𝑇𝐶 + 𝑅𝐵𝐵 = 𝐸𝐵𝐼𝑇 𝑥 1 − 𝑇𝐶 + 𝑅𝐵𝐵 𝑇𝐶 MM Proposition I (With Taxes) Start with M&M Proposition I with taxes: VL = VU + TC B Since VL = S + B S + B = VU + TC B VU = S + B (1 – TC ) The cash flows from each side of the balance sheet must equal: 𝑆𝑅𝑆 + 𝐵𝑅𝐵 = 𝑉𝑈𝑅0 + 𝑇𝑐𝐵𝑅𝐵 𝑆𝑅𝑆 + 𝐵𝑅𝐵 = [𝑆 + 𝐵 1 − 𝑇𝐶 ] 𝑅0 + 𝑇𝑐𝐵𝑅𝐵 Divide both side by S 𝑅𝑆 + 𝐵 𝐵 𝐵 𝑅𝐵 = [1 + 1 − 𝑇𝐶 ] 𝑅0 + 𝑇𝑐𝑅𝐵 𝑆 𝑆 𝑆 𝑅𝑆 = 𝑅0 + 𝐵 1 − 𝑇𝐶 ] 𝑥 (𝑅0 − 𝑅𝐵) 𝑆 The Effect of Financial Leverage Cost of capital: R (%) RS R0 RS R0 B ( R0 RB ) SL B (1 TC ) ( R0 RB ) SL R0 RWACC B SL RB (1 TC ) RS BSL B SL RB Debt-to-equity ratio (B/S) Total Cash Flow to Investors All Equity Recession $1,000 0 $1,000 $350 Expected $2,000 0 $2,000 $700 Expansion $3,000 0 $3,000 $1,050 $650 $1,300 $1,950 Recession Expected Expansion $1,000 $2,000 $3,000 640 640 640 EBT $360 $1,360 $2,360 Taxes (Tc = 35%) $126 $476 $826 Total Cash Flow $234+640 $884+640 $1,534+640 $874 $1,524 $2,174 $650+$224 $1,300+$224 $1,950+$224 $874 $1,524 $2,174 EBIT Interest EBT Taxes (Tc = 35%) Total Cash Flow EBIT Interest ($800 @ 8% ) Leverage EBIT(1-Tc)+TCRBB Total Cash Flow to Investors All-equity firm S B Levered firm S B The levered firm pays less in taxes than does the all-equity firm. Thus, the sum of the debt plus the equity of the levered firm is greater than the equity of the unlevered firm. This is how cutting the pie differently can make the pie “larger.” -the government takes a smaller slice of the pie! Capital Structure Theory Tax Benefits • Allowing companies to deduct interest payments when computing taxable income lowers the amount of corporate taxes. • This in turn increases firm cash flows and makes more cash available to investors. • In essence, the government is subsidizing the cost of debt financing relative to equity financing. Capital Structure • Capital structure is one of the most complex areas of financial decision making due to its interrelationship with other financial decision variables. • Poor capital structure decisions can result in a high cost of capital, thereby lowering project NPVs and making them more unacceptable. • Effective decisions can lower the cost of capital, resulting in higher NPVs and more acceptable projects, thereby increasing the value of the firm. Capital Structure High business risk industry tends to maintain a lower financial risk Lower business risk industry tends to have a higher financial risk Capital Structure Theory Probability of Bankruptcy • The probability that debt obligations will lead to bankruptcy depends on the level of a company’s business risk and financial risk. • Business risk is the risk to the firm of being unable to cover operating costs. • In general, the higher the firm’s fixed costs relative to variable costs, the greater the firm’s operating leverage and business risk. • Business risk is also affected by revenue and cost stability • The firm’s capital structure - the mix between debt versus equity - directly impacts financial leverage. • Financial leverage measures the extent to which a firm employs fixed cost financing sources such as debt and preferred stock. • The greater a firm’s financial leverage, the greater will be its financial risk - the risk of being unable to meet its fixed interest and preferred stock dividends. Capital Structure Theory Agency Costs Imposed by Lenders • When a firm borrows funds by issuing debt, the interest rate charged by lenders is based on the lender’s assessment of the risk of the firm’s investments. • After obtaining the loan, the firm (stockholders/managers) could use the funds to invest in riskier assets. • If these high risk investments pay off, the stockholders received all benefit, but if do not pay off, the lenders share in the costs. • To avoid this, lenders impose various monitoring costs on the firm. • Examples of these monitoring costs would include: • increase the rate on future debt issues, • denying future loan requests, • imposing loan agreement provisions. Capital Structure Theory Asymmetric Information • Asymmetric information results when managers of a firm have more information about operations and future prospects than do investors. • Asymmetric information can impact the firm’s capital structure as follows: • Suppose management has identified an extremely lucrative (menguntungkan) investment opportunity and needs to raise capital. Based on this opportunity, management believes its stock is undervalued since the investors have no information about the investment. • In this case, management will raise the funds using debt since they believe/know the stock is undervalued (underpriced) given this information. In this case, the use of debt is viewed as a positive signal to investors regarding the firm’s prospects • On the other hand, if the outlook for the firm is poor, management will issue equity instead since they believe/know that the price of the firm’s stock is overvalued (overpriced). Issuing equity is therefore generally thought of as a “negative” signal. Capital Structure So What is the Optimal Capital Structure? • In general, it is believed that the market value of a company is maximized when the cost of capital (the firm’s discount rate) is minimized. • The value of the firm can be defined algebraically as follows: V = EBIT (1 - t) = NOPAT ra ra Where : t = Tax rate NOPAT = Net operating profit after tax ra = weighted average cost of capital (WACC) Optimal Capital Structure • An example of how this might work using actual numbers is demonstrated below: Cost of Capital & Firm Value for Alternative Capital Structures Source of Capital Capital Structure 1 Capital Structure 2 Firm Value ($) 13% $300 Capital Structure 3 12% $250 9% Debt 25% 40% 70% Equity 75% 60% 30% WACC 10% 8% 13% 11% $200 10% $150 $100 8% $50 7% 6% $25% 40% 70% Total Debt/Total Assets Expected Future Annual Cash Flows $ 20 $ 20 $ 20 $ 200 $ 250 $ 160 Firm Value WACC & Firm Value WACC (%) WACC Value EPS-EBIT Approach to Capital Structure • The EPS-EBIT approach to capital structure involves selecting the capital structure that maximizes EPS over the expected range of EBIT. • Using this approach, the emphasis is on maximizing the owners returns (EPS). • A major shortcoming of this approach is the fact that earnings are only one of the determinants of shareholder wealth maximization. • This method does not explicitly consider the impact of risk. www.idx.go.id Hitung value perusahaan dari idx EPS-EBIT Approach to Capital Structure Example The capital structure of JGS, a soft drink manufacturer is shown in the table below. Currently, JGS uses only equity in its capital structure. Thus the current debt ratio is 0.00%. Assume JGS is in the 40% tax bracket. JGS Current Capital Structure Long-term debt $ - Common stock (25,000 shares @ $20) $ 500,000 Total Capital (assets) $ 500,000 JSG's Zero Leverage Financing Plan EPS-EBIT coordinates for JSG’s current capital structure can be found by assuming two EBIT values and calculating the associated EPS as follows: EBIT $ 100,000 Interest $ EBT $ 100,000 $ 200,000 T $ 40,000 $ 80,000 NI $ 60,000 $ 120,000 EPS $ 2.40 $ 4.80 - $ $ 200,000 - $6.00 EPS ($) $5.00 $4.80 $4.00 $3.00 $2.00 $2.40 $1.00 $$100,000 $200,000 EBIT ($) EPS-EBIT Approach to Capital Structure JSG is considering altering its capital structure while maintaining its original $500,000 capital base as shown in the table below: JSG's Alternative Current and Alternative Capital Structures Debt Ratio Total Assets Debt - Equity Int. Rate (%) Annual Int. ($) No. of Shares 0% $ 500,000 $ $ 500,000 0.0% $ - 25,000 30% $ 500,000 $ 150,000 $ 350,000 10.0% $ 15,000 17,500 60% $ 500,000 $ 300,000 $ 200,000 16.5% $ 49,500 10,000 We can use this information to calculate the EPS-EBIT coordinates as shown on the following slide: EPS-EBIT Approach to Capital Structure Capital Structure 30% Debt Ratio EBIT $ 100,000 60% Debt Ratio $ 200,000 $ 100,000 $ 200,000 Interest $ 15,000 $ 15,000 $ 49,500 $ EBT $ 85,000 $ 185,000 $ 50,500 $ 150,500 T $ 34,000 $ 74,000 $ 20,200 $ 60,200 NI $ 51,000 $ 111,000 $ 30,300 $ 90,300 EPS $ 2.91 $ $ 3.03 $ 9.03 6.34 49,500 EPS-EBIT Analysis EPS (0% Debt) EPS (30% Debt) EPS (60% Debt) EPS($) $10.00 $8.00 $6.00 $4.00 $2.00 $0.00 ($2.00) $- $100,000 $200,000 ($4.00) EBIT($) Choosing the Optimal Capital Structure • The following discussion will attempt to create a framework for making capital budgeting decisions that maximizes shareholder wealth -- i.e., considers both risk and return. • Perhaps the best way to demonstrate this is through the following example: Assume that JSG is attempting to choose the best of several alternative capital structures -- specifically, debt ratios of 0, 10, 20, 30, 40, 50, and 60 percent. Furthermore, for each of these capital structures, the firm has estimated EPS, the CV of EPS, and required return Estim ated Share Value Resulting from Alternative Capital Structures for JSG Com pany Debt Expected Estim ated Estim ated Estim ated Ratio EPS CV of EPS Requ. Return Share Price 0% $ 2.40 0.71 11.5% $ 20.87 10% $ 2.55 0.74 11.7% $ 21.79 20% $ 2.72 0.78 12.1% $ 22.48 30% $ 2.91 0.83 12.5% $ 23.28 40% $ 3.12 0.91 14.0% $ 22.29 50% $ 3.18 1.07 16.5% $ 19.27 60% $ 3.03 1.40 19.0% $ 15.95 Other Influences on Capital Structure Choice Flexibility Maintaining financial flexibility simply means that a company would like to give itself slack in terms of being able to raise additional capital to support working capital requirements if desirable investment opportunities arise. As a result, most firms try to ensure that they have excess borrowing capacity available by keeping debt levels at manageable levels. Timing The sale of securities by most firms depend not only on the investment opportunities available but also on the the cost of capital at a particular point in time. Successful companies usually try to forecast and take advantage of changing market conditions to lower their overall cost of raising funds. Other Influences on Capital Structure Choice Corporate Control Many firms avoid the issuance of new equity because it may cause existing controlling shareholders to lose their ability to influence the direction of the company. As a result, most companies are reluctant to issue new shares of stock and instead issue debt when additional funds are needed. Maturity Matching Many firms also try to match the maturity of their source of financing with the maturity of the assets they are using the funds to finance. As a result, the capital structure of a firm is determined in part by the types of investments it makes. Summary: No Taxes • In a world of no taxes, the value of the firm is unaffected by capital structure. • This is M&M Proposition I: VL = VU • Proposition I holds because shareholders can achieve any pattern of payouts they desire with homemade leverage. • In a world of no taxes, M&M Proposition II states that leverage increases the risk and return to stockholders. Rs = R0 + 𝐵 ( ) (R0 𝑆𝐿 - RB) Summary: Taxes • In a world of taxes, but no bankruptcy costs, the value of the firm increases with leverage. • This is M&M Proposition I: VL = VU + TC B • Proposition I holds because shareholders can achieve any pattern of payouts they desire with homemade leverage. • In a world of taxes, M&M Proposition II states that leverage increases the risk and return to stockholders. 𝐵 𝑅𝑆 = 𝑅0 + 1 − 𝑇𝐶 ] 𝑥 (𝑅0 − 𝑅𝐵) 𝑆