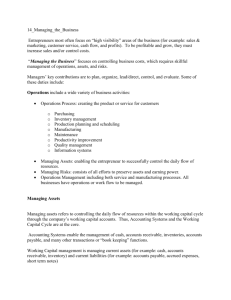

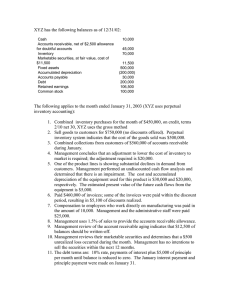

DySAS Center for CPA Review 2F & 3F Mitra Building, San Pedro Street, Davao City Tel. No. (082) 224-43-20: E-mail Address – dysasrev@yahoo.com Practical Accounting 1 John C. Frivaldo, CPA, MBA FIRST PRE-BOARD EXAMINATIONS December 20, 2008 @ 8:00 – 10:00 am =========================================================== INSTRUCTIONS: Mark the letter of your choice with a VERTICAL LINE on the answer sheet provided. ERASURES NOT ALLOWED. 1. Mega Company purchased from Ora Company a P2,000,000, 8% 5-year note that required five equal annual year-end payments of P500,900. The note was discounted to yield a 9% rate to Mega. At the date of purchase, Mega recorded the note at its present value of P1,948,500. What should be the total revenue earned by Mega over the life of this note? (a) P504,500 (b) P556,000 (c) P800,000 (d) P900,000 B Total payments (500,900 x 5) Present value of note Total interest revenue P2,504,500 1,948,500 P 556,000 National Bank grants a 10-year loan to Abbo Company in the amount of P1,500,000 with a stated interest rate of 6%. Payments are due monthly and are computed to be P16,650. National Bank incurs P40,000 of direct loan origination cost and P20,000 of indirect loan origination cost. In addition, National Bank charges Abbo a 4-point nonrefundable loan origination fee. 2. National Bank, the lender, has a carrying amount of: (a) P1,440,000 (b) P1,480,000 (c) P1,500,000 (d) P1,520,000 B Note receivable P1,500,000 Direct origination cost 40,000 Total P1,540,000 Nonrefundable origination fee (1,500,000 x 4%) 60,000 Carrying value P1,480,000 The direct origination cost incurred by the bank is a deferred charge to be amortized over the term of the loan. The indirect origination cost incurred by the bank is an outright expense. The nonrefundable origination fee charged by the bank against the borrower is unearned income on the part of the bank and deferred financing charge on the part of the borrower to be amortized over the term of the loan. 3. Abbo, the borrower, has a carrying amount of: (a) P1,440,000 (b) P1,480,000 (c) P1,500,000 Note payable Nonrefundable origination fee Carrying value (d) P1,520,000 A P1,500,000 ( 60,000) P1,440,000 4. Impeccable Corporation manufactures and sells electrical generators. On January 1, 2000, it sold an electrical generator costing P700,000 for P1,000,000. The buyer paid P100,000 down and signed a P900,000 non-interest bearing note payable in three equal installments every December 31. Assume the prevailing interest rate for a note of this type is 12%. What is the interest income that should be recognized for the year 2000? (a) P86,465 (b) P108,000 (c) P179,460 (d) P59,820 A Face value Present value (300,000 x 2.4018) Unearned interest income Interest income – 2000 (720,540 x 12%) P900,000 (720,540) P179,460 P86,465 5. Roth Company received from a customer a 1 – year, P500,000 note bearing annual interest of 8%. After holding the note for 6 months, Roth discounted the note at a nearby bank at an effective interest rate of 10%. What amount of cash did Roth received from the bank? (a) P540,000 (b) P523,810 (c) P513,000 (d) P495,238 C Maturity value [500,000 + (500,000 x 8%)] Discount (540,000 x 10% x 6/12) Net proceeds P540,000 ( 27,000) P513,000 6. On June 30, 2003, Ray Company discounted at the bank a customer’s P60,000, 6-month, 10% note receivable dated April 30, 2003. The bank discounted the note at 12%. Ray’s proceeds from this discounted note amounted to: (a) P56,400 (b) P57,600 (c) P60,480 (d) P61,740 C Maturity value [60,000 + (60,000 x 10% x 6/12)]P63,000 Discount (63,000 x 12% x 4/12) ( 2,520) Net proceeds P60,480 X Corporation factored P6,000,000 of accounts receivable to A Corporation on October 1, 2004. Control was surrendered by X Corporation. A Corporation accepted the receivables subject to recourse for nonpayment. A Corporation assessed a fee of 3% and retains a holdback equal to 5% of the accounts receivable. In addition, A Corporation charged 15% interest computed on a weighted-average time to maturity of the receivables of 54 days. The fair value of the recourse obligation is P90,000. 7. X Corporation will receive and record cash of: (a) P5,296,850 (b) P5,386,850 (c) P5,476,850 Accounts receivable Factor’s holdback (6,000,000 x 5%) Factoring fee (6,000,000 x 3%) Interest (6,000,000 x 15% x 54/365) Cash received from factoring (d) P5,556,850 B P6,000,000 ( 300,000) ( 180,000) ( 133,150) P5,386,850 8. Assuming all receivables are collected, X Corporation’s cost of factoring the receivables would be: (a) P313,150 (b) P180,000 (c) P433,150 (d) P613,150 A Factoring fee Interest Total cost of factoring P180,000 133,150 P313,150 9. Sigma Company began operations on January 1, 2004. On December 31, 2004, Sigma provided for uncollectible accounts based on 1% of annual credit sales. On January 1, 2005, Sigma changed its method of determining its allowance for uncollectible accounts by applying certain percentages to the accounts receivable aging as follows: Days past invoice date Percent uncollectible 0 – 30 1 31 – 90 5 91 – 180 20 Over 180 80 In addition, Sigma wrote off all accounts receivables that were over 1 year old. The following additional information relates to the years ended December 31, 2005 and 2004: 2005 2004 Credit sales P3,000,000 P2,800,000 Collections (including recovery) 2,915,000 2,400,000 Accounts written off 27,000 none Recovery of accounts previously written off 7,000 none Days past invoice date at 12/31: 0 – 30 300,000 250,000 31 – 90 80,000 90,000 91 – 180 60,000 45,000 Over 180 25,000 15,000 What is the provision for uncollectible accounts for the year ended December 31, 2005? (a) P39,000 (b) P31,000 (c) P38,000 (d) P11,000 B 0 – 30 (300,000 x 1%) 31 – 90 (80,000 x 5%) 91 – 180 (60,000 x 20%) Over 180 (25,000 x 80%) Required allowance – 12/31/2005 P 3,000 4,000 12,000 20,000 P39,000 Allowance – 12/31/2004 (2,800,000 x 1%) Recovery in 2005 Uncollectible accounts expense Total Writeoff in 2005 Required allowance – 12/31/2005 P28,000 7,000 31,000 P66,000 27,000 P39,000 10. From inception of operations to December 31, 2003, Murr Corporation provided for uncollectible accounts receivable under the allowance method, provisions were made monthly at 2% of credit sales, bad debt written off were charged to the allowance account, recoveries of bad debts previously written off were credited to the allowance account, and no year-end adjustments to the allowance account were made. Murr’s usual credit terms are net 30 days. The balance in the allowance for doubtful accounts was P120,000 at January 1, 2004. During 2004, credit sales totaled P9,000,000, interim provisions for doubtful accounts were made at 2% of credit sales, P90,000 of bad debts were written off, and recoveries of accounts previously written off amounted to P15,000. Murr installed a computer facility in November 2004 and prepared an aging of accounts receivable for the first time as of December 31, 2004. A summary of the aging is as follows: Classification by Balance in Estimated % month of sale each category uncollectible November – December 2004 P2,000,000 2% July – October 600,000 10% January – June 400,000 25% Prior to 1/1/2004 200,000 75% P3,200,000 Based on the review of collectibility of the account balances in the “prior to 1/1/2004” aging category, additional receivables totaling P60,000 were written off as of December 31, 2004. Effective with the year ended December 31, 2004, Murr adopted a new accounting method for estimating the allowance the allowance for doubtful accounts at the amount indicated by the year-end aging analysis of accounts receivable. What is the year-end adjustment to the allowance for doubtful accounts as of December 31, 2004? (a) P305,000 (b) P180,000 (c) P320,000 (d) P140,000 D November – December (2,000,000 x 2%) July – October (600,000 x 10%) January – June (400,000 x 25%) Prior to 1/1/2004 (200,000 – 60,000 x 75%) Required allowance – 12/31/2004 P 40,000 60,000 100,000 105,000 P305,000 Allowance – 1/1/2004 Recoveries Doubtful accounts expense Total Writeoffs (90,000 + 60,000) Required allowance – 12/31/2004 P120,000 15,000 320,000 P455,000 150,000 P305,000 Correct doubtful accounts expense Recorded amount (2% x 9,000,000) Increase in doubtful accounts P320,000 180,000 P140,000 Doubtful accounts Allowance for doubtful accounts P140,000 P140,000 11. When examining the accounts of Brute Company, you ascertain that balances relating to both receivables and payables are included in a single controlling account called receivables control that has a debit balance of P4,850,000. An analysis of the make-up of this account revealed the following: Debit Credit Accounts receivable – customers P7,800,000 Accounts receivable – officers 500,000 Debit balances – creditors 300,000 Postdated checks from customers 400,000 Subscriptions receivable 800,000 Accounts payable for merchandise P4,500,000 Credit balances in customers’ accounts 200,000 Cash received in advance from customers for goods not yet shipped 100,000 Expected bad debts 150,000 After further analysis of the aged accounts receivable, you determined that the allowance for doubtful accounts should be P200,000. What is the correct total of current net receivables? (a) P8,950,000 (b) P8,800,000 (c) P8,600,000 (d) P8,850,000 B Accounts receivable – customers (7,800,000 + 400,000) Allowance for doubtful accounts Accounts receivable – officers Debit balances – creditors Total current net receivables P8,200,000 ( 200,000) 500,000 300,000 P8,800,000 12. The following information is available for the Hook company: Amount in Thousands 2001 2002 2003 Charge sales 900 1,100 1,000 Cash sales 600 800 700 Total 1,500 1,900 1,700 Accounts receivable (end of year) 170 230 220 Allowance for doubtful accounts (end of year) 47 30 56 Accounts written off as uncollectible (during the year) 2 50 4 Assuming there was no change in the method used for estimating doubtful accounts, what was the balance in the allowance for doubtful accounts at the beginning of 2001? (a) P 0 (b) P22,000 (c) P45,000 (d) P49,000 B 2001 Allowance – 1/1 22,000 Expense (squeeze) 27,000 Total 49,000 Writeoff 2,000 Allowance – 12/31 47,000 Percentage of charge sales: 2001 33,000/ 1,100,000 2002 30,000/ 1,000,000 2003 3% x 900,000 2002 47,000 33,000 80,000 50,000 30,000 = = = 2003 30,000 30,000 60,000 4,000 56,000 3% 3% 27,000 Expense 13. Rip Corporation showed the following balances on January 1, 2003: Accounts receivables P 600,000 Allowance for doubtful accounts 30,000 The following transactions affecting accounts receivable occurred during the year ended December 31, 2003: Sales – cash and credit P3,280,000 Cash received from cash customers 400,000 Cash received from credit customers, excluding recovery 2,475,000 Cash received from credit customers who took advantage of the 2/10, n/30 terms (included in P2,475,000) 1,470,000 Accounts receivable written off as worthless 20,000 Recoveries of accounts written off 5,000 Credit memoranda for returned credit sales 55,000 Cash refunds to cash customers 10,000 The company uses the percentage of accounts receivable method in determining the allowance for doubtful accounts. What is the net realizable value of accounts receivable on December 31, 2003? (a) P855,000 (b) P900,000 (c) P850,000 (d) P895,000 A Accounts receivable – 1/1 P 600,000 Sales – credit (3,280,000 – 400,000) 2,880,000 Cash received from credit customers, excluding recovery (2,475,000) Sales discounts ( 30,000) Accounts receivable written off as worthless ( 20,000) Credit memoranda for returned credit sales ( 55,000) Accounts receivable – 12/31 P 900,000 Accounts collected with discount (1,470,000/98%)P1,500,000 Cash received 1,470,000 Sales discounts (2% x 1,500,000) P 30,000 Accounts receivable – 12/31 P 900,000 Allowance for doubtful accounts (5% x 900,000) ( 45,000) Net realizable value P 855,000 14. Excel reported P70,000 of inventory on December 31, 2003, based on physical count. Additional information was given as follows: a. Included in the physical count were machines billed to a customer, FOB shipping point, on December 31, 2003. The machines had a cost of P3,000 a had been billed at P5,000. The shipment is ready for pick-up by the delivery contractor. b. Goods were in transit from a vendor. The invoice cost was P8,000 and goods were shipped FOB shipping point on December 31, 2003. c. Work in process costing P500 was sent to an outside processor for finishing on December 30, 2003. d. Goods out on consignment amounted to P4,600 (sales price); shipping costs, P120 (markup is 15% on cost). The correct amount of inventory on December 31, 2003 is: (a) P85,620 (b) P85,500 (c) P82,620 (d) P82,500 C Inventory per count, Jan. 1, 2003 Goods in transit, shipped FOB shipping point Work in process job out for finishing Goods out on consignment [(4,600/ 1.15) + 120] Inventory as adjusted, Dec. 31 2003 P70,000 8,000 500 4,120 P82,620 15. The book value of Good’s inventory at the end of 2003 is P95,000. Included in the amount are the following items: Merchandise in transit, purchased FOB shipping point P6,800 Goods held as consignee 5,000 Goods out on consignment, at cost plus 50% markup on cot plus P100 delivery charge 6,100 The correct amount of inventory is: (a) P83,100 (b) P87,900 (c) P86,200 (d) P88,000 D Inventory per books, December 31 Goods held as consignee Markup on goods out on consignment [6,000 – (6,000/ 1.50)] Inventory as adjusted, December 31 P95,000 ( 5,000) ( 2,000) P88,000 16. Compute for the cost of inventory lost in fire using the data below: Inventory, July 1, 2004 P51,600 Purchases, July 1, 2004 to Jan. 19, 2005 368,000 Sales, July 1, 2004 to Jan. 19, 2005 583,000 Purchase returns 11,200 Purchase discounts taken 5,800 Freight in 3,800 Sales returns 8,600 A fire destroyed the entire inventory except for purchases in transit, FOB shipping point, of P2,000 and goods having a selling price of P4,700 that were salvaged from the fire. The salvaged goods had an estimated value of P2,900. The average gross profit rate on net sales is 40%. (a) P59,760 (b) P56,940 (c) P62,660 (d) P56,860 B Inventory, July 1, 2004 Purchases, July 1, 2004 to Jan. 19, 2005 Purchase returns Purchase discounts taken Freight in Available for sale Cost of goods sold: Net sales (583,000 – 8,600) P574,400 Multiply by cost percentage 60% Estimated ending inventory Goods in transit Salvage value of damaged goods Estimated inventory lost in fire P 51,600 368,000 ( 11,200) ( 5,800) 3,800 P406,400 (344,640) P 61,760 ( 2,000) ( 2,820) P 56,940 17. The following information pertains to Dely Corporation’s 2004 cost of goods sold: Inventory, December 31, 2003 P90,000 2004 purchases 124,000 2004 write-off of obsolete inventory 34,000 Inventory, December 31, 2004 30,000 The inventory written off became obsolete due to an unexpected and unusual technological advance by a competitor. In its 2004 income statement, what amount should Dely report as cost of goods sold? (a) P218,000 (b) P184,000 (c) P150,000 (d) P124,000 C Inventory, December 31, 2003 2004 purchases 2004 write-off of obsolete inventory Inventory, December 31, 2004 Cost of goods sold P90,000 124,000 (34,000) (30,000) P150,000 18. Pine Company prepares monthly income statements. A physical inventory is taken only at year-end; hence, month-end inventories must be estimated. All sales are made on account. The rate of markup on cost is 50%. The following information relates to the month of November: Accounts receivable, November 1 P102,000 Accounts receivable, November 30 153,000 Collection of accounts receivable during November 255,000 Inventory, November 1 183,600 Purchases of inventory during November 163,200 The estimated cost of the November 30 inventory is: (a) P122,400 (b) P142,800 (c) P193,800 (d) P224,400 B Inventory, November 1 P183,600 Purchases of inventory during November 163,200 Cost of goods available for sale P346,800 Accounts receivable, November 30 P153,000 Collection of accounts receivable during November 255,000 Accounts receivable, November 1 (102,000) Sales P306,000 Divided by 150% (50% markup on cost) 50% Estimated cost of goods sold P204,000 Estimated cost of the Nov. 30 inventory (346,800 – 204,000) P142,800 19. A store uses the gross profit method to estimate inventory and cost of goods sold for interim reporting purposes. Past experience indicates that the average gross profit rate is 25% of sales. The following data relate to the month of October: Inventory cost, October 1 P255,000 Purchases during the month at cost 683,400 Sales 856,800 Sales returns 30,600 Using the data above, what is the estimated ending inventory at October 31? (a) P206,550 (b) P214,200 (c) P295,800 (d) P318,750 D Inventory cost, October 1 Purchases during the month at cost Cost of goods sold [(856,800 – 30,600) x 75%] Estimated inventory, October 31 P255,000 683,400 (619,650) P318,750 20. The following items were included in Opal Company’s inventory account at December 31, 2004: Merchandise out on consignment, at sales price, including 40% markup on selling price P28,000 Goods purchased in transit, FOB shipping point 24,000 Goods held on consignment by Opal Company 16,000 Goods out on approval (sales price, P10,000; cost , P8,000) 10,000 By what amount should the inventory at December 31, 2004 be reduced? (a) P29,200 (b) P50,000 (c) P54,000 (d) P78,000 A Markup on merchandise out on consignment (40% x 28,000) Goods held on consignment Markup on goods out on approval (10,000 – 8,000) Total inventory reduction P11,200 16,000 2,000 P29,200 21. The balance in Reed Company’s accounts payable account at December 31, 2000 was P1,225,000 before the following information was considered: - Goods shipped FOB destination on December 21, 20009 from a vendor to Reed were lost in transit. The invoice cost of P45,000 was not recorded by Reed. On December 28, 2000, Reed notified the vendor of the lost shipment. - Goods were in transit from a vendor to Reed on December 31, 2000. The invoice cost was P60,000 and the goods were shipped FOB shipping point on December 28, 2000. Reed received the goods on January 6, 2001. - Goods shipped to Reed, FOB shipping point on December 20, 2000 from a vendor were lost in transit. The invoice price was P50,000. On January 5, 2001, Reed filed a P50,000 claim against the common carrier. - On December 27, 2000, a vendor authorized Reed to return, for full credit, goods shipped and billed at P35,000 on December 20, 2000. The returned goods were shipped by Reed on December 27, 2000. A P35,000 credit memo was received and recorded by Reed on January 6, 2001. What amount should Reed report as accounts payable in its December 31, 2000 balance sheet? (a) P1,300,000 (b) P1,345,000 (c) P1,235,000 (d) P1,250,000 A Accounts payable per book A B C D Adjusted accounts payable P1,225,000 60,000 50,000 ( 35,000) P1,300,000 Maricar Company, a wholesaler distributor of automotive replacement parts. Initial amounts taken from accounting records are as follows: Inventory at December 31, 2000 (based on physical count) P1,250,000 Accounts payable at December 31, 2000: Vendor Terms Amount Baker 2% 10 days, net 30 P 400,000 Charlie net 30 210,000 Dolly net 30 300,000 Eagle net 30 90,000 Full net 30 Greg net 30 _________ P1,000,000 Sales in 2000 P9,000,000 Additional information is as follows: A. Parts held on consignment from Charlie to Maricar, the consignee, amounting to P159,000 were included in the physical count of goods on December 31, 2000, and in accounts payable at December 31, 2000. B. P20,000 of parts which were purchased from Full and paid for in December 2000 were sold in last week of 2000 and appropriately recorded as sales of P28,000. The parts were included in the physical count of goods on December 31, 2000, because the parts were on the loading dock waiting to be picked up by the customers. C. Parts in transit on December 31, 2000 to customers, shipped FOB shipping point, on December 28, 2000, amounted to P34,000. The customers received the parts on January 6, 2001. Sales of P40,000 including P1,000 freight cost, were recorded by Maricar on January 2, 2001. D. Retailers were holding P210,000 at cost (P250,000 at retail), of goods on consignment from Maricar the consignor, at their stores on December 31, 2000. E. Goods were in transit from Greg to Maricar on December 31, 2000. The cost of the goods was P25,000, and they were shipped FOB shipping point on December 29, 2000. F. A quarterly freight bill in the amount of P2,000 specifically relating to merchandise purchases in December 2000, all of which was still in the inventory at December 31, 2000, was received on January 3, 2001. The freight bill was not included in either the inventory or in accounts payable at December 31, 2000. G. All of the purchases from Baker occurred during the last seven days of the year. These items have been recorded in accounts payable and accounted for in the physical inventory at cost before discount. Maricar’s policy is to pay invoices in time to take advantage of all cash discounts, adjust inventory accordingly, and record accounts payable, net of cash discounts. 22. What is the adjusted balance of inventory on December 31, 2000? (a) P1,250,000 (b) P1,300,000 (c) P1,356,000 (d) P1,200,000 23. What is the adjusted balance of accounts payable on December 31, 2000? (a) P833,000 (b) P858,000 (c) P860,000 (d) P1,000,000 24. What is the adjusted balance of net sales for 2000? (a) P9,300,000 (b) P9,039,000 (c) P9,239,000 (d) P8,880,000 Per book 1 2 3 4 5 6 7 Adjusted Inventory P1,250,000 ( 159,000) ( 20,000) 210,000 25,000 2,000 ( 8,000) P1,300,000 Accounts payable P1,000,000 ( 159,000) B C B Net sales P9,000,000 39,000 ( P 25,000 2,000 8,000) 860,000 _________ P9,039,000 25. Art Company has determined its cash flows from 2004 operating activities as P5,350,000. The cash balance on January 1, 2004 was P6,500,000. During 2004, the company had the following investing and financing activities. Cash dividends of P3,500,000 were declared and paid. An additional P1,400,000 of cash dividends were declared but remained unpaid at the end of the year. Machinery with a book value of P1,750,000 was sold for that amount. Additional machinery of P2,600,000 was acquired for cash to replace the one sold. Note payable of P4,200,000 was taken out of the local bank early in the year. By the end of the year, P1,500,000 of this amount including interest of P300,000 had been repaid. Bonds payable with a book value of P2,500,000 was converted into common stock having par value of P2,000,000. How much should be reported as net cash used in financing activities in the 2002 cash flow statement? (a) P4,700,000 (b) P5,000,000 (c) P1,900,000 (d) P500,000 D Payment of dividends (P3,500,000) Issuance of note 4,200,000 Partial payment of note ( 1,200,000) Net cash used in financing activities (P 500,000) 26. The following is Mart Company’s comparative balance sheet accounts: 2005 2004 Cash 4,800,000 3,000,000 Accounts receivable 2,300,000 2,400,000 Inventories 4,000,000 3,600,000 Property, plant and equipment 12,800,000 6,000,000 Accumulated depreciation (2,300,000) (2,000,000) Investment in Max Company 5,500,000 6,000,000 Loan receivable 2,700,000 Accounts payable 2,000,000 1,800,000 Income tax payable 100,000 500,000 Dividend payable 2,000,000 3,000,000 Capital lease liability 8,000,000 Common stock 10,000,000 10,000,000 Additional paid in capital 1,000,000 1,000,000 Retained earnings 6,700,000 2,700,000 a. On December 31, 2005, Mart acquired 20% of Max Company’s common stock for P6,000,000. Max report net loss of P2,500,000 for the year ended December 31, 2005. No dividend was paid on Max’s common stock during the year. b. During 2005, Mart loaned P3,000,000 to Chase Company, an unrelated company. Chase made the first semi-annual principal repayment of P300,000 plus interest of 10% on October 1, 2005. c. On January 2, 2005, Mart sold equipment costing P1,200,000 with a carrying amount of P700,000, for P800,000 cash. d. On December 31, 2005, Mart entered into a capital lease for an office building. The present value of the annual rental payments is P8,000,000 which equals the fair value of the building. Mart made the first rental payment of P1,200,000 when due on January 2, 2006. e. Mart declared cash dividends in one year and paid the dividends in the subsequent year. Net cash provided by operating activities was: (a) P6,700,000 (b) P7,700,000 (c) P5,700,000 (d) P6,200,000 A Net income (6,700,000 + 2,000,000 – 2,700,000) P6,000,000 Investment loss (2,500,000 x 20%) 500,000 Gain on sale (800,000 – 700,000) (100,000) Depreciation (2,300,000 + 500,000 – 2,000,000) 800,000 Decrease in accounts receivable 100,000 Increase in inventories (400,000) Increase in accounts payable 200,000 Decrease in income tax payable (400,000) Net cash provided by operating activities P6,700,000 27. Trial balances of Ron Company at December 31 are as follows: Debits: 2005 Cash P 875,000 Accounts receivable 825,000 Inventory 775,000 Property, plant and equipment 2,500,000 Unamortized bond discount 112,500 P 2004 800,000 750,000 1,175,000 2,375,000 125,000 Cost of goods sold 6,250,000 9,500,000 Selling expenses 3,537,500 4,300,000 General and administrative expenses 3,425,000 3,782,500 Interest expense 107,500 65,000 Income tax expense 52,500 637,000 Credits: Allowance for uncollectibles P 32,500 P 27,500 Accumulated depreciation 412,500 375,000 Trade accounts payable 625,000 437,500 Income taxes payable 67,500 Deferred income taxes 132,500 115,500 3% callable bonds payable 1,125,000 500,000 Common stock 1,250,000 1,000,000 Additional paid in capital 227,500 187,500 Retained earnings 1,117,500 1,399,500 Sales 13,470,000 19,467,000 Ron purchased P125,000 equipment during 2005. Ron allocated one-half of its depreciation expense to selling expenses and the remainder to general expenses. Ron uses the direct method to prepare its cash flow statement. What amount should Ron report in its cash flow statement for the year ended December 31, 2005 for cash paid for interest? (a) P120,000 (b) P107,500 (c) P95,000 (d) P42,500 C Interest expense Amortization of bond discount Interest paid 107,500 (12,500) 95,000 28. The transactions of Art Company for the year 2005 included the following: Purchase of land for cash (cash was borrowed from bank) 3,000,000 Sale of securities for cash 1,000,000 Dividend declared (of which P1,500,000 was paid during the year) 2,000,000 Issuance of common stock for cash 5,000,000 Payment of bank loan including interest of P200,000 2,200,000 Increase in customer’s deposits 300,000 The 2005 cash flow statement should report net cash provided by financing activities at: (a) P4,500,000 (b) P1,500,000 (c) P4,300,000 (d) P4,800,000 A Borrowed from bank Dividends paid Issuance of common stock Payment of bank loan Net cash provided by financing activities 3,000,000 (1,500,000) 5,000,000 (2,000,000) 4,500,000 29. Data below came from the comparative trial balance of Excel Corporation. The books are kept on the accrual basis. Included in the operating expenses are depreciation of P3,100 and amortization of P1,400. December 2005 2004 Accounts receivable 220,000 245,000 Interest receivable 800 1,700 Inventories 420,000 405,000 Prepaid insurance 3,800 1,900 Accounts payable 364,000 345,000 Other operating expenses payable 18,000 15,000 Net sales 1,200,000 Interest revenue 6,500 Cost of goods sold 800,000 Insurance expense 48,000 Other operating expenses 95,000 Cash paid for operating expenses during the year is: (a) P137,400 (b) P87,500 (c) P139,600 (d) P102,500 A Other operating expenses Increase in operating expenses payable Insurance expense Increase in prepaid insurance Depreciation Amortization Cash paid for operating expenses 95,000 ( 3,000) 48,000 1,900 ( 3,100) ( 1,400) 137,400 30. Land on January 1, 2003 balance sheet was recorded at P6,000,000. Selected information in the year 2003 from the statement of cash flows follows: Net income P20,000,000 Depreciation expense 3,000,000 Loss on sale of land 200,000 Proceeds from sale of land 1,400,000 Investing and financing activities not affecting cash: Issued preferred stock for land 2,400,000 The value of the land to be disclosed in the balance sheet as of December 31, 2003 is: (a) P6M (b) P7M (c) P8.4M (d) P6.8M D Balance of land, Jan. 1, 2003 Preferred stock issued for land Cost of land sold (1,400,00 + 200,000) Balance of land, Dec. 31, 2003 P6,000,000 2,400,000 (1,600,000) P6,800,000 31. Dione Company employs several consulting companies. Some of the companies require payments in advance for performing services while others bill Dione after services are rendered. Dione also leases office space to several law firms. Some law firms are required to pay rent in advance for using their offices while others are allowed to their offices before paying rent. Dione uses the conventional accrual basis of accounting. The amount of cash paid to consulting companies during 2004 was P6,400,000 and the amount of rent revenue earned from leasing office space was P7,800,000. Selected information obtained from the company’s comparative balance sheet is shown below: 2004 2003 Prepaid consulting fees 200,000 500,000 Accrued consulting fees 700,000 200,000 Rent receivable 600,000 800,000 Unearned rent revenue 1,000,000 400,000 Under the direct method, the 2004 cash flow statement should report cash received from leasing office space at: (a) P8,600,000 (b) P7,800,000 (c) P8,200,000 (d) P7,000,000 A Rent revenue earned Rent receivable, 2002 Rent receivable, 2001 Unearned rent revenue, 2002 Unearned rent revenue, 2001 Cash received from leasing P7,800,000 ( 600,000) 800,000 1,000,000 ( 400,000) P8,600,000 32. The balance sheet at December 31 of Love Company showed a cash balance of P200,000. An examination of the books disclosed the following: a. Cash sales of P15,000 from January 1 to 7, were predated as of December 28 to 31, and charged to the cash account. b. Customer’s checks totaling P5,000 deposited with and returned by the bank, NSF, on December 27, were not recorded in the books. c. Checks of P6,500 in payment of liabilities were prepared before December 31, and recorded in the books, but withheld by the treasurer. d. Customer’s postdated checks totaling P4,300 are being held by the cashier as part of cash. The company’s experience shows that postdated checks are eventually realized. e. The cash account includes P30,000 being reserved for the purchase of a mini-computer which will be delivered soon. How much cash balance is to be shown on the December 31 balance sheet? (a) P152,200 (b) P166,500 (c) P192,200 (d) P200,000 A Cash balance, per book Cash sales for January 1 to 7 NSF checks Undelivered check Customer’s postdated checks Cash for purchase of a computer Adjusted cash balance P200,000 ( 15,000) ( 5,000) 6,500 ( 4,300) ( 30,000) P152,200 33. The balance sheet at December 31,2004 of Lore Company showed a cash balance of P105,600. An examination of the books disclosed the following: a. The sales book was left open up to January 5, 2005 and cash sales totaling P15,000 were considered as sales in December 2004. b. Checks of P9,300 in payment of liabilities were prepared before December 31, 2004, recorded in the books, but not mailed or delivered to payees. c. Customer’s postdated checks totaling P7,800 deposited with but returned by bank, NSF, on December 27, 2004. Return was not recorded in the books, P1,500. d. The cash account includes P40,000 earmarked for the purchase of an office equipment which will be delivered soon. How much cash balance is to be shown on the December 31, 2004 balance sheet? (a) P105,600 (b) P60,500 (c) P58,400 (d) P50,600 D Cash balance, per book Cash sales for January NSF checks Undelivered check Customer’s postdated checks Cash for purchase of office equipment Adjusted cash balance P105,600 ( 15,000) ( 1,500) 9,300 ( 7,800) ( 40,000) P 50,600 34. The balance sheet at December 31 of Live Company showed a cash balance of P91,750. An examination of the books disclosed the following: a. Cash sales of P12,000 from January 1 to 5, 2005 were predated as of December 28 to 31, 2004 and charged to the cash account. b. Customer’s checks totaling P4,500 deposited with and returned by the bank, NSF, on December 27, 2004 were not recorded in the books. c. Checks of P5,600 in payment of liabilities were prepared before December 31, 2004 and recorded in the books, but withheld by the treasurer. d. Personal checks of officers, P2,700, were “redeemed” on December 31, 2004, but returned to cashier on January 2, 2005. e. The cash account includes P20,000 being reserved for the purchase of an office machine which will be delivered soon. How much cash balance is to be shown on the December 31 balance sheet? (a) P91,750 (b) P69,150 (c) P54,750 (d) P90,350 C Cash balance, per book P 91,750 Cash sales for January ( 12,000) NSF checks ( 4,500) Undelivered check 5,600 Customer’s postdated checks ( 3,400) Personal checks of officers ( 2,700) Cash for purchase of a computer ( 20,000) Adjusted cash balance P 54,750 Items 30 to 34: On October 7, 2004, the cash book of Davao Company showed the following entries: Receipts Checks September 30 (overdraft) P 0 P5,000 October 1 Tuesday 1,200 1,600 2 Wednesday 3,000 2,400 3 Thursday 800 1,000 4 Friday 6,000 3,400 5 Saturday 4,000 2,500 Cash receipts are deposited at the beginning of every Monday, Wednesday and Friday and in each case includes the receipts of the preceding two working days. The bank statement at the close of October 5 showed: Balance, September 30 – overdraft P6,500 Deposits 7,000 Checks (includes all checks issued prior to October 4 and also a check for P300 belonging to Cebu Co., erroneously charged to Davao account 5,800 A check for P256 issued on October 5 had been canceled by the company but the bookkeeper has not made any entry for this. Additional information: undeposited collections – October 31, P10,000; outstanding checks – October 31, P5,644. 35. The book balance as at October 5, 2004 should be: (a) (P900) (b) (P3,900) (c) P1,100 (d) P1,200 A (d) P1,100 B (d) P1,000 C (d) P500 D 39. The adjusted book and bank balances as at October 5, 2004 should be: (a) P5,644 (b) P644 (c) P1,144 (d) P344 B Balance per book, September 30 Receipts (October 1 to 5) Checks (October 1 to 5) Balance per book, October 5 (P5,000) 15,000 (10,900) (P 900) 36. The bank balance as at October 5, 2004 should be: (a) (P3,900) (b) (P5,300) (c) P1,200 Balance per bank, September 30 Deposits Checks Balance per bank, October 5 (P6,500) 7,000 ( 5,800) (P5,300) 37. The undeposited collections as at September 30, 2004 should be: (a) P4,000 (b) P3,000 (c) P2,000 Undeposited collections – October 31 Bank receipts Book receipts Undeposited collections – September 30 P10,000 7,000 (15,000) P 2,000 38. The outstanding checks as at September 30, 2004 should be: (a) P200 (b) P300 (c) P400 Outstanding checks – October 31 P 5,644 Bank disbursements (5,800 – 300) 5,500 Book disbursements (10,900 – 256) (10,644) Outstanding checks – September 30 P 500 Unadjusted balance per bank, Oct.5(P5,300) Undeposited collections 10,000 Outstanding checks ( 5,644) Bank error ( 300) Adjusted balance per bank, Oct. 5 (P 644) 40. The balance sheet of Happy Company as of December 31, 2004 showed a cash balance of P68,225, which was determined to consist of the following: Petty cash fund P 360 Cash in Metro, per bank statement, with a check for P600 still outstanding 33,675 Notes receivable in the possession of a collecting agency 2,500 Undeposited receipts, including a postdated check for P1,050 and a traveler’s check for P1,000 17,800 Bond sinking fund – cash 12,750 IOUs signed by employees 495 Paid vouchers, not yet recorded 645 Total P68,225 At what amount should cash on bank and in bank be reported on Happy’s balance sheet? (a) P50,185 (b) P53,475 (c) P62,935 (d) P66,225 A Petty cash fund Cash in Metro (33,675 – 600) Undeposited receipts (17,800 – 1,050) Total P 360 33,075 16,750 P50,185 * end of the examination – practical accounting 1*