Tech ID#

TEST #3 (Practice) Answer Key

Name

ES 316 Engineering Economics

Spring 2020

To solve questions, refer to the compound interest tables. You need to show the problem solving process.

Otherwise, your score will be zero.

PART I: Short Questions (10x4=40 points)

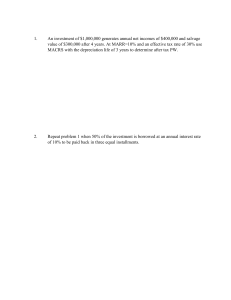

1. Find the expected EUAW from the financial data provided in the table below for a new equipment. Because of

the uncertainty of technology being used in this equipment, it has not been possible to get the initial cost accurately.

The annual benefit, however, is estimated to be $25,000 with a possible equipment life of 5 years. The salvage value

is expected to be 10% of the initial cost. MARR = 5%

First Cost, $

Probability

$60,000

0.25

$80,000

0.35

$100,000

0.30

$120,000

0.10

Expected first cost = [60,000 (0.25) + 80,000 (0.35) + 100,000 (0.30) + 120,000 (0.10) = $85,000

Expected salvage value = 85,000 (0.10) = $8,500

Expected EUAW = 25,000 – [85,000 (A/P, 5%, 5) − 8,500 (A/F, 5%, 5)]

= 25,000 – [85,000 (0.2310) − 8,500 (0.1810)] = $6903.5

2. A project has the following costs and benefits. What is the payback period?

Year

0

1-2

3

4-10

Costs

$65,000

$15,000

$5,000

Benefits

$50,000

$10,000 in each year

Costs equate to the benefits by end of year 8. Payback of 8 years.

1

ES 316 Engineering Economics

Spring 2020

3. Jain Mart is to depreciate an asset bought for $500,000 using the SOYD method over a life of 8 years. If the

depreciation charges in year 3 was $80,000, determine the salvage value used in computing the depreciation charges

in year 3.

SOYD = 8 (8+1) / 2 = 36

Depreciation in year 3: (8 – 3 + 1) (500,000 – X) / 36 = 80,000

X = 500,000 - 80,000 (36 / 6) = $20,000

4. An automated assembly line is purchased for $300,000. The company has decided to use units-of-production

depreciation. At the end of 5 years, the line will be scrapped for an estimated $100,000. Using the following

information, determine the depreciation schedule for the assembly line.

Year

Production Level (units)

Depreciation

1

5,000

20,000

2

10,000

40,000

3

15,000

60,000

4

15,000

60,000

5

5,000

20,000

Total production = 50,000 units

UOP depreciation in year “n” = (Production in year n /50,000)*($300,000 - $100,000)

2

ES 316 Engineering Economics

Spring 2020

PART II: Long Questions (20x3=60 points)

1. Data for four mutually exclusive alternatives are given in the table below. Assume a life of 10 years and a

MARR of 10%. Use the present worth index in private sector.

Initial Cost

EUAB

Salvage Value

Alt. A

Alt. B

Alt. C

$7,000

$1,500

$2,000

$5,000

$1,000

$500

$1,500

$500

$0

Alt. D

Do Nothing

$0

$0

$0

1.1. What is the ∆B /∆C ratio for the first increment, (C-D)?

ΔB/ΔC = (500 − 0) / [1500 (A/P, 10%, 10)]

= 500 / [1,500 (0.1627)] = 2.05

1.2. What is the ∆B /∆C ratio for the second increment, (B-C)?

ΔB/ΔC = [(1,000 − 500) + 500 (A/F, 10%, 10)] / [(5,000 − 1,500) (A/P, 10%, 10)]

= [500 + 500 (0.0627)] / [3,500 (0.1627)] = 0.93

1.3. What is the ∆B /∆C ratio for the third increment, (A-C)?

ΔB/ΔC = [(1,500 − 1,000) + 2,000 (A/F, 10%, 10)] / [(7,000 − 1,500) (A/P, 10%, 10)]

= [500 + 2,000 (0.0627)] / [5,500 (0.1627)] = 0.70

1.4. What is the best alternative using B/C ratio analysis?

The better alternative between” C” and “D” was found to be “C”.

On the next increment, it was found that “C” was better.

On the final increment, it was found that “C” was better. Therefore, “C” is the ultimate winner.

3

ES 316 Engineering Economics

Spring 2020

2. A new equipment is being considered at a local company at a cost of $200,000. The operation and maintenance

costs of this equipment are estimated to be $20,000 per year. Salvage value is expected to be $40,000 at the end of

its useful life. The life of this equipment is estimated to vary anywhere from 5 to 7 years with the associated

probabilities as shown in the table below. Assume an interest rate is 10%.

Life, Years

Probability

5

0.3

6

0.4

7

0.3

2.1. what is the expected EUAC for this equipment?

EUAC for a 5-year life = 200,000 (A/P, 10%, 5) + 20,000 – 40,000 (A/F, 10%, 5)

= 200,000 (0.2638) + 20,000 – 40,000 (0.1638) = $66,208

EUAC for a 6-year life = 200,000 (0.2296) + 20,000 – 40,000 (0.1296) = $60,734

EUAC for a 7-year life = 200,000 (0.2054) + 20,000 – 40,000 (0.1054) = $56,864

Expected EUAC = 0.3 (66,208) + 0.4 (60,734) + 0.3 (56,864)

= $61,215.2

2.2. Determine the associated risk measure in this equipment investment in terms of standard deviation.

Standard deviation, σ = [EV (X2) – {EV(X)}2]1/2

= [0.3 (66,208)2 + 0.4 (60,734)2 + 0.30 (56,864)2 – {61,215.2}2]1/2 = $3,640.2

3. New Mexico Tech purchased a computer (5-year MACRS property) at a cost of $2,000.

3.1. Develop the MACRS percentage rates (rt) for the asset with a cost basis of $100. Note the switch from

DDB to SL can be done in Year 4.

Year

1

2

3

4

5

6

Calculation

(1/2) (2/5) (100 – 0) = 20.00

(2/5) (100 – 20.00) = 32.00

(2/5) (100 – 52.00) = 19.20

(2/5) (100 – 71.20) = 11.52

11.52

(1/2) (11.52) = 5.76

MACRS percentage rate (rt)

20.00

32.00

19.20

11.52

11.52

5.76

3.2. The computer was sold after 3 years for $700. Determine the depreciation recapture on this equipment.

The accumulated depreciation through year 3 = (0.20 + 0.32 + 0.192) (2,000) = $1,424

Book value at the end of year 3 = 2,000 – 1,424 = $576

Depreciation recapture = 700 – 576 = $124

4

ES 316 Engineering Economics

Spring 2020

PART III: Extra Credit Questions (10x2=20 points)

1. A robot has just been installed at a cost of $81,000. It will have no salvage value at the end of its useful life.

Savings per year

$18,000

$20,000

$22,000

Probability

0.2

0.7

0.1

Useful life (years)

12

5

4

Probability

1/6

2/3

1/6

1.1 What is the joint probability distribution for savings per year and useful life?

1.2 What is the rate of return for most likely scenario? Use interpolation with the interest rates of 7% and 8%.

Most likely: NPW = 0 = -81,000 + 20,000 (P/A, i, 5)

i) Try i = 7%: NPW = -81,000 + 20,000 (4.100) = 1,000

ii) Try i = 8%: NPW = -81,000 + 20,000 (3.993) = -1,140

RoR = 7% + [1,000/(1,000 + 1,140)] (8% - 7%) = 7.47%

5

ES 316 Engineering Economics

Spring 2020

2. The tree in Fig. P10-41 has probabilities after each chance node and PW values for each terminal node. What

decision should be made? What is the expected value?

At decision node D2 we must decide between Pick Z1 and Pick Z2 based on PW:

PW(C4) = (0.2) ($12,000) + (0.8) ($9,000) = $9,600

PW(C5) = (0.3) ($14,000) + (0.7) ($4,000) = $7,000

Pick Z1, greatest PW of $9,600

At decision node D1 we must decide between Pick X, Y, or Z based on PW:

PW(C1) = (0.2) ($15,000) + (0.5) ($12,000) + (0.3) ($9,000) = $11,700

PW(C2) = (0.4) ($16,000) + (0.6) ($8,000) = $11,200

PW(C3) = (0.3) (-$10,000) + (0.7) ($9,600) = $3,720

So, PW is greatest if we Pick X

6