Exam 3 review

advertisement

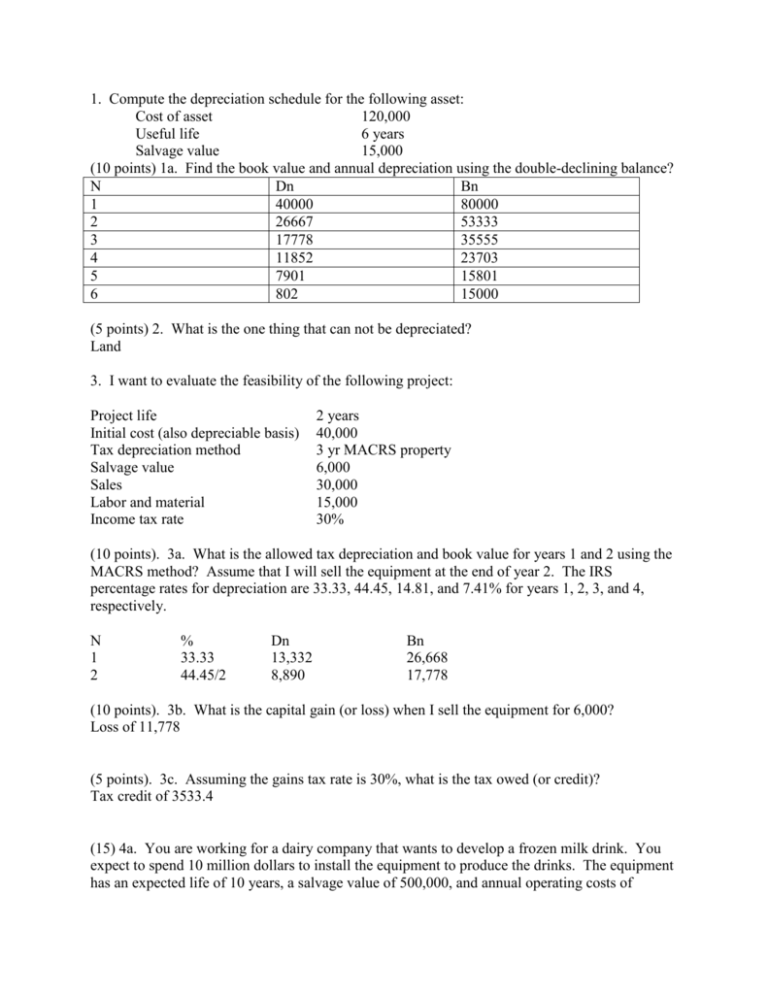

1. Compute the depreciation schedule for the following asset: Cost of asset 120,000 Useful life 6 years Salvage value 15,000 (10 points) 1a. Find the book value and annual depreciation using the double-declining balance? N Dn Bn 1 40000 80000 2 26667 53333 3 17778 35555 4 11852 23703 5 7901 15801 6 802 15000 (5 points) 2. What is the one thing that can not be depreciated? Land 3. I want to evaluate the feasibility of the following project: Project life Initial cost (also depreciable basis) Tax depreciation method Salvage value Sales Labor and material Income tax rate 2 years 40,000 3 yr MACRS property 6,000 30,000 15,000 30% (10 points). 3a. What is the allowed tax depreciation and book value for years 1 and 2 using the MACRS method? Assume that I will sell the equipment at the end of year 2. The IRS percentage rates for depreciation are 33.33, 44.45, 14.81, and 7.41% for years 1, 2, 3, and 4, respectively. N 1 2 % 33.33 44.45/2 Dn 13,332 8,890 Bn 26,668 17,778 (10 points). 3b. What is the capital gain (or loss) when I sell the equipment for 6,000? Loss of 11,778 (5 points). 3c. Assuming the gains tax rate is 30%, what is the tax owed (or credit)? Tax credit of 3533.4 (15) 4a. You are working for a dairy company that wants to develop a frozen milk drink. You expect to spend 10 million dollars to install the equipment to produce the drinks. The equipment has an expected life of 10 years, a salvage value of 500,000, and annual operating costs of 1,000,000. If your company has a MARR of 10%/yr and you expect to produce 750,000 cases of product, what is the minimum selling price for each case of milk drink. $3.46/case (5) 4b. Your company purchased land for the plant at a cost of 1 million dollars and the plant cost 9 million dollars to build. What is the depreciable basis? 9,000,000 (15) 4c. If the entire plant is classified as a three year property, what is the tax depreciation and book value each year? The percentages are 33.33, 44.45, 14.81, and 7.41 for years 1, 2, 3, and 4 respectively. n % Dn 1 33.33 2,999,700 2 44.45 4,000,500 3 14.81 1,332,900 4 7.41 666,900 5. I want to evaluate the feasibility of the following project: Project life Initial cost (also depreciable basis) Tax depreciation method Salvage value Sales Labor and material Income tax rate Bn 6,000,300 1,999,800 666,900 - 2 years 40,000 3 yr MACRS property 6,000 30,000 15,000 30% (10 points). 5a. What is the allowed tax depreciation and book value for years 1 and 2 using the MACRS method? Assume that I will sell the equipment at the end of year 2. The IRS percentage rates for depreciation are 33.33, 44.45, 14.81, and 7.41% for years 1, 2, 3, and 4, respectively. N 1 2 % 33.33 44.45/2 Dn 13,332 8,890 Bn 26,668 17,778 (10 points). 5b. What is the capital gain (or loss) when I sell the equipment for 6,000? Loss of 11,778 (5 points). 5c. Assuming the gains tax rate is 30%, what is the tax owed (or credit)? Tax credit of 3533.4 5d. With an income tax rate of 30%, what is my taxable income and income tax owed in year 1? Taxable income = 30,000-13,332-15,000 = 1,668 Tax owed = 500.4 (15) 6. A computerized machining center has been proposed for a small manufacturing company. The machine has an initial cost of 120,000. If it is installed it will generate annual revenues of 100,000 and an additional 10,000 labor cost per year would be incurred. The machining center would be classified as a 3-year MACRS property. The salvage value after 3 years will be 5,000 and the marginal tax rate of the company is 40%. Should the equipment be installed if the MARR of the company is 15%? Year 0 1 2 3 Income Statement Revenues 100,000 100,000 100,000 Labor 10,000 10,000 10,000 Rate 33.33 44.45 14.8/2 Depreciation 39,996 53,340 8,880 Taxable income 50,004 36,660 81,120 Income taxes 20,002 14,664 32,448 Net income 30,002 21,996 48,672 Net income 30,002 21,996 48,672 Depreciation 39,996 53,340 8,880 Expenses Cash Flow Statement Operating activities Investment activities Investment (120,000) Salvage 5,000 (loss of 12,784) Credit 5,114 Gains tax Net cash flow -120,000 69,998 75,336 67,666 NPW positive, good A project has the following cash flows. What is the internal rate of return for the following project? If the minimum attractive rate of return is 10%, is this a good project? n Cash flow 0 -10,000 1 7,000 2 7,000 25.7%, good. 7. I am working on converting biomass to ethanol. We think we could build a plant over a two year period and produce 70 million gallons of ethanol per year for 10 years. Assume that the annual expenses to produce ethanol are $85 million this takes into account all feedstock costs, labor, energy, etc.). The plant will take 2 years to build and I will spend 100 million dollars each year. Ignoring salvage value, at a minimum attractive rate of return (MARR) of 10% compounded annually, what is the minimum ethanol selling price ($/gal)? $1.70/gal 8. Assume you have to buy a new car. You have decided it should be a Toyota Camry or a Camry hybrid. The mileage is based on city driving, the best case for hybrids. Assume the car will be driven 12,000 miles per year. Assume the car will last 6 years and your interest rate is 8%/compounded annually. What price of gasoline is required to be indifferent to the cars? Initial cost Mileage (miles/gallon) Salvage value $4.53/gal Hybrid 26,150 33 15,000 Regular 18,645 21 10,000 9. You have the choice of two pumps (centrifugal or axial) with a rated size of 10 kW. The price of electricity is $0.05/kWh. Both motors have a useful life of 10 years and will have no salvage value. The minimum acceptable rate of return is 8%, which motor do you chose? Centrifugal Axial Purchase price 1,300 1,600 Efficiency 80% 83% Annual operating costs 130 160 (taxes, insurance, etc.) How many hours per year would the pumps need to operate to be indifferent to which pump is purchased? 3247 hr/yr