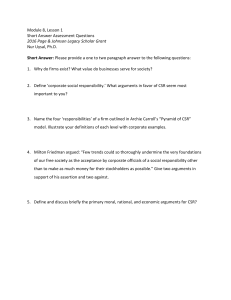

INTERNSHIP REPORT IN FINANCE As a partial fulfillment of the degree of Bachelor in business administration TITLE: THE RELATIONSHIP BETWEEN CORPORATE SOCIAL RESPONSIBILITY AND CORPORATE FINANCIAL PERFORMANCE BY OMAR AMEUR ACADEMIC ADVISOR Dr. MANARA TOUKABRI PROFESSIONAL SUPERVISOR HAIFA JABRI HEAD OF TREASURY DEPARTMENT – TOTALENERGIES TUNISIE ACADEMIC YEAR 2020 – 2021 APPROVAL APPROVED BY ACADEMIC ADVISOR 30/06/2021 Manara Toukabri Name Signature Date PROFESSIONAL SUPERVISOR 29/06/2021 Haifa Jabri Name Signature Date Signature Date ACADEMIC EVALUATOR Name DECLARATION I certify that I am the author of this report and that any assistance I have received in its preparation is fully acknowledged and disclosed in this report. I have also cited any source from which I used data, ideas, or words, either quoted or paraphrased. Further, this report meets all the rules of quotation and referencing in use at TBS, as well as adheres to the fraud policies listed in the TBS honor code. No portion of the work referred to in this report has been submitted in support of an application for another degree or qualification to this or any other university or academic institution. 30/06/2021 Omar Ameur Student Name Signature Date ABSTRACT This paper examined the impact of debt to equity ratio, leverage, and CSR Rating on profitability of the Group TotalEnergies. This study employed the company’s data during the period of 2019 – 2021. Altogether, the 10 observations regarding the accounting based financial performance and the 44 observations regarding the market based financial performance were used in the study. Three ordinary-least-squares models were applied to analyze the impact of CSR Rating of the company on the profitability. The first and second regression model reveals that the higher D/E ratio was observed to have the negative effect on the company’s ROA and ROE; However, higher CSR Rating was observed to have a positive impact on the company’s ROA and ROE and the results were statistically significant. The result of the final regression model reveals that the higher company CSR Rating appeared favorable to the market performance and was found to have positive effects on the market profitability measure: TTE stock price. This finding could help companies to take an effective action to improve their CSR Rating to reach higher profitability. . Keywords: Corporate Social Responsibility, Return on equity, Return on Assets, Leverage, Profitability, Market performance Jel Classification: A20, A22, A30 Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 4 ACKNOWLEDGEMENT First, praises and thanks to Allah, the Almighty, for his showers of blessings throughout my research work to complete the research successfully. I would like to express my deep and sincere gratitude to my research supervisor, Dr. Manara TOUKABRI ., Ph.D., Professor, Finance Department, Tunis Business School, Tunis, for giving me the opportunity to do research and providing invaluable guidance throughout this research. Her dynamism, vision, sincerity and motivation have deeply inspired me. She has taught me the methodology to carry out the research and to present the research works as clearly as possible. It was a great privilege and honor to work and study under her guidance. I am extremely grateful for what she has offered me. I would also like to thank her for her friendship, empathy, and great sense of humor. I am extremely grateful to my parents for their love, prayers, caring and sacrifices for educating and preparing me for my future. In addition, I express my thanks to my sisters for their support and valuable prayers. My Special thanks goes to my best friends for the keen interest shown to complete this thesis successfully. I am extending my thanks to the Finance Major of Tunis Business School, Tunis students for their support during my research work. I also thank all the staff of administration in Tunis Business School for their kindness. I thank the management of TOTALENERGIES Tunisia, Tunis for their support to do this work. I thank Mme. Haifa JABRI, Mme. Zeineb HAFSI and Mme. Raja KHADHRAOUI for their genuine support to complete this thesis successfully. Finally, my thanks go to all the people who have supported me to complete the research work directly or indirectly. Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 5 Table of Contents APPROVAL ............................................................................................................................................ 2 DECLARATION .................................................................................................................................... 3 ABSTRACT ............................................................................................................................................ 4 ACKNOWLEDGEMENT ..................................................................................................................... 5 List of Tables ........................................................................................................................................... 8 List of Figures ......................................................................................................................................... 9 List of Equations ................................................................................................................................... 10 List of Abbreviations ............................................................................................................................ 11 General Introduction ........................................................................................................................... 12 Chapter 1: General Context ............................................................................................................ 13 1. 2. Presentation of the hosting company ........................................................................................ 13 1.1 General introduction .......................................................................................................... 13 1.2 Mission and Vision .............................................................................................................. 14 Organization ............................................................................................................................... 14 2.1 Business segments.............................................................................................................. 14 2.2 Subsidiaries and affiliates ................................................................................................... 14 2.3 Head office ......................................................................................................................... 15 2.4 Senior management ........................................................................................................... 15 2.5 Executive committee .......................................................................................................... 15 3. Organizational chart: .................................................................................................................. 15 4. Sector of activity: ........................................................................................................................ 16 5. Business Model........................................................................................................................... 18 6. TotalEnergies CSR Rating ......................................................................................................... 19 Chapter 2: The conceptual background ............................................................................................. 21 Introduction ........................................................................................................................................ 21 I. Schools of thoughts on CSR and Business operations ............................................................... 21 1.1 Sceptic view ....................................................................................................................... 21 1.2 Idealistic view..................................................................................................................... 21 1.3 Pragmatic View .................................................................................................................. 22 Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 6 Review of literature .................................................................................................................... 22 II. 2.1 Literature of CSR having a positive impact on profitability .............................................. 23 2.2 Literature for CSR having a negative impact on profitability ............................................ 24 2.3 Literature for CSR having no impact on profitability ........................................................ 24 III. Research methodology ........................................................................................................... 25 Chapter 3: Results and findings .......................................................................................................... 26 Introduction ........................................................................................................................................ 26 I. CSR Rating and accounting based financial performance ..................................................... 26 1. Testable hypotheses ................................................................................................................ 26 2. Model specification ................................................................................................................ 26 3. Analysis and interpretation of findings .................................................................................. 27 3.1 Summary of descriptive statistics and correlation matrix.................................................. 27 3.2 Regression Results .............................................................................................................. 28 II. CSR Rating and TotalEnergies market Performance ............................................................. 31 1. Testable hypotheses ................................................................................................................ 31 2. Model specification ................................................................................................................ 31 3. Analysis and interpretation of findings .................................................................................. 32 3.1 Summary of descriptive statistics and correlation matrix.................................................. 32 3.2 Regression Results .............................................................................................................. 33 Summary and Conclusions .................................................................................................................. 35 Limitations ............................................................................................................................................ 36 Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 7 List of Tables Table 1: Descriptive statistics of response and predictors variables ......................................... 27 Table 2: Correlation matrix of response and predictor variables .............................................. 28 Table 3: Multiple regression equation of ROE on all predictor variables ................................ 29 Table 4: Regression Statistics equation of ROE on all predictor variables .............................. 29 Table 5: Multiple regression equation of ROA on all predictor variables ................................ 30 Table 6: Regression Statistics equation of ROA on all predictor variables .............................. 30 Table 7: Descriptive statistics of response and predictors variables ......................................... 32 Table 8: Correlation matrix of response and predictor variables .............................................. 32 Table 9: Multiple regression equation of TTE on all predictor variables ................................. 33 Table 10: Regression Statistics equation of TTE on all predictor variables ............................. 33 Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 8 List of Figures Figure 1: TotalEnergies New Logo ........................................................................................... 14 Figure 2: TotalEnergies organizational chart ............................................................................ 15 Figure 3: TotalEnergies vs G&O industry CSR Rating ............................................................ 19 Figure 4: TotalEnergies CSR Dimensions Score ...................................................................... 20 Figure 5: TotalEnergies Sustainability criterion dimensions .................................................... 20 Figure 6:TTE vs TotalEnergies CSR Rating ............................................................................. 31 Figure 7: TTE vs ^XOI stock price change ............................................................................... 34 Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 9 List of Equations Equation 1: Regression Model 1 ............................................................................................... 26 Equation 2: Leverage Formula .................................................................................................. 27 Equation 3: Return on assets formula ....................................................................................... 27 Equation 4: Return on Equity formula ...................................................................................... 27 Equation 5: Debt to Equity ratio formula .................................................................................. 27 Equation 6: Regression model 2 ............................................................................................... 31 Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 10 List of Abbreviations - CSR: Corporate Social Responsibility - CFP: Compagnie Française des Pétroles - LPG: Liquefied Petroleum Gas - LNG: Liquefied Natural Gas - CEO: Chief Executive Officer - CFO: Chief Financial Officer - CSA: Corporate Sustainability Assessment - CSP: Corporate Social Performance - ROE: Return On Equity - ROA: Return On Assets - D/E: Debt to Equity Ratio - STD: Standard Deviation - TTE: TotalEnergies Stock Price - XOI: AMEX Oil Index Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 11 General Introduction Corporate social responsibility (CSR) could also be defined as “the commitment of business to contribute to sustainable economic development, working with employees, their families, the area people and society at large to enhance their quality of life” (World Business Council for Sustainable Development, 2004). There has been increasing pressure on businesses from the social and government organizations to require up financial aid projects. Corporations are investing in CSR projects in a shot to enhance their reputation in society and compete with global corporations. Companies are boosting their CSR expenditure in their annual reports to draw in investors and satisfy various stakeholders like employees, customers, suppliers, government, regulators, distributors, etc. Companies are increasingly using CSR as a marketing tool and to determine a decent rapport with the public. Current corporate performance measures involve corporate social performance. This measure is important to corporate sustainability and reputation. It is also used as a prevention strategy by the businesses to shield them from corporate scandals, unpredicted risks, possible ecological accidents, governmental rules, and regulations, protect noticeable profits, brand differentiation, and better relationship with employees supported volunteerism terms. Most corporations make sure to publish their CSR activities on their websites, sustainability reports, and their advertising campaigns. CSR is additionally practiced because customers, still as governments today, are demanding more ethical behaviors from organizations. In response, corporations are volunteering themselves to include CSR as a part of their business policies, mission proclamation, and values in multiple areas, respecting the labor and environmental laws, while taking care of the various interests of varied stakeholders (Kashyap et al., 2006). The study is organized as follows. Section 1 gives a presentation of the host company and general numbers and information. Section 2 gives details regarding the schools of thought on CSR and business, an in-depth review of literature and the research methodology, and Section 3 states the objectives of the study the analysis and interpretations of results, followed by a summary, conclusion and limitations of the study. Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 12 Chapter 1: General Context Introduction This chapter is devoted to the presentation of the general framework of the research. First, we present the history of the host company, the organization and its business segments, the organizational chart, sector of activity and the business model of TotalEnergies. 1. Presentation of the hosting company 1.1 General introduction The French petroleum company was created in Iraq in 1924, to represent the French interests of the Turkish petroleum company founded jointly by the British and the French in the aftermath of the First World War. Total only became a brand in 1954. It was not until 1985 that the "CFP" adopted the name "Total CFP" before adopting the name "Total" in 1991. The second-largest French oil company after Elf-Aquitaine at the end of the 1980s, TotalEnergies is a group in difficulty with low profitability. At the dawn of the 21st century, TotalEnergies is one of the companies on the Paris stock market that is favored by all financial analysts. Between these two dates, the group has embarked on a process of rationalization of its activities on a large scale. In the oil and gas sector, the refocusing took place in two directions: first, TotalEnergies strengthened its historical positions in the Middle East, an area that contains two-thirds of the world's oil reserves. TotalEnergies is the first Western company to re-enter Iran since the 1979 Islamic revolution. Finally, the group has a strong presence in Qatar, Oman, and Abu Dhabi, in both gas and oil production. However, the company is not locked into a Middle Eastern monoculture. The search for new operating sites in other parts of the world has been successful overall, with the search for new operating sites in other regions of the world has been successful overall, particularly in the North Sea, which remains an attractive area, but also in Latin America and Asia. This redeployment is not only geographical but also sectoral. The main strategic shift has been from refining and marketing to exploration and production. In the short term, TotalEnergies will produce more hydrocarbons than oil. This is mainly due to the low margins of the refining business, which is subject to high taxes. With its very low level of debt, TotalEnergies has also diversified its activities to activities close to its traditional businesses. This is the case with its investment in the nuclear industry through a 15% stake in the capital of Cogema. Finally, in the chemicals sector, the purchase of Mydrin in the United Kingdom has tripled Total's activity in the field of chemicals. Total's business in adhesives for the packaging industry tripled with the purchase of Mydrin in the United Kingdom. The consistency of this global policy is the hallmark of Total's success, which ranked eighth in the world in 1997, a position that has since been strengthened by the successive acquisitions of the Belgian oil company Petrofina Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 13 and the takeover of ELF Aquitaine in 1999. The new entity renamed TotalEnergies is now the seventhlargest oil company in the world. Figure 1: TotalEnergies New Logo 1.2 Mission and Vision Mission TotalEnergies is a global energy producer and provider with operations that span the oil and gas chain. Developing alternative energies such as solar, biomass and nuclear power is also one of their core commitments. Vision: They aim to be the best in all areas and focus on becoming the responsible multinational energy company. 2. Organization 2.1 Business segments In September 2016, TotalEnergies set up a new organization to achieve its goals to become a responsible energy supermajor. It is composed of the following segments: - Exploration & Production - Gas, Renewables & Power - Refining & Chemicals - Trading & Shipping - Marketing & Services - TotalEnergies Global Services 2.2 Subsidiaries and affiliates As of 31 December 2014, TotalEnergies had 903 subsidiaries consolidated into the group results, together with affiliate investments and joint ventures, mostly in LPG. In addition, TotalEnergies had other equity holdings valued at 3 billion euros, treated as investments, and was involved in a number of significant joint ventures, mostly relating to LPG and LNG exploration, production, and shipping. Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 14 2.3 Head office The company headquarter is located in the Tour TotalEnergies in the La Défense district in Courbevoie, France. The building was originally built between 1983 and 1985 for Elf Aquitaine. TotalEnergies SA acquired the building after its merger with the company Elf in 2000. 2.4 Senior management Christophe de Margerie was the CEO from 14 February 2007 until 20 October 2014, when he died in a plane crash in Moscow. His TotalEnergies annual compensation for this role was more than 2 million euros. The present chairman and chief executive of the company is Patrick Pouyanné (2014 to present). 2.5 Executive committee The executive committee is TotalEnergies' primary decision-making organization. Since January 2020, members of the executive committee have been: • Patrick Pouyanné, CEO. • Arnaud Breuillac, president of Exploration & Production. • Patrick de La Chevardière, CFO • Alexis Vovk, president Marketing & Services. • Philippe Sauquet, Gas, Renewables & Power, Strategy & Innovation • Namita Shah, executive vice president, • Bernard Pinatel, President Refining & Chemicals 3. Organizational chart: Figure 2: TotalEnergies organizational chart Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 15 4. Sector of activity: The TotalEnergies Group is present at all stages of energy production. TotalEnergies' activities in the “upstream” sector The group's "upstream" sector is organized around the exploration, development, and production of hydrocarbons, as well as activities in the fields of coal, gas, and new energies. Thus, on an operational level, Total acts upstream on: Part of the oil chain includes Petroleum prospecting and exploration and oil exploitation and production The entire natural gas chain includes: - Prospecting and gas exploration - Gas exploitation and production - Liquefaction (for liquefied natural gas) - Transportation - Commercialization - Electricity production Certain stages of alternative energy cycles include: - The manufacture of solar equipment - The production and sale of coal-steam for thermal power stations - Participation in nuclear projects - The production of electricity from renewable energies; TotalEnergies' activities in the "downstream" sector The group's "downstream" sector is organized around activities only involving petroleum products. Thus, at the operational level, Total acts downstream on: - Maritime transport - Pipeline transport - Refining of petroleum products - Distribution of refined products Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 16 - Market activities TotalEnergies' activities in the "chemicals" sector The group's “chemicals” sector is organized around basic chemical activities and specialties. Thus, on an operational level, Total acts in "chemicals" on: Basic chemistry, which brings together basic petrochemicals (olefins and aromatics) and their derivatives (polyethylene, polypropylene, and polystyrene), as well as the manufacture of fertilizers and fertilizers; specialty chemicals, which brings together rubber processing, resin, adhesive production, and metallization. In January 2012, the breakdown of TotalEnergies' activities was changed between three major sectors: Upstream, Refining-Chemicals, and Supply-Marketing. Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 17 5. Business Model CUSTOMER SEGMENTS - Industry - Refineries - Downstream Business - End Users VALUE PROPOSITIONS - Large scale chemicals manufacturer - A major integrated player in the global solar industry - Sustainable production of energy from several sources CHANNELS - Traders - Gas stations and stores - Social networks - Infographics - Global presence CUSTOMER RELATIONSHIPS - Long term contracts - License of exploration - Brand awareness - Automation REVENUE STREAMS - B2C Sales - Sale of Crude oil, natural gas, chemicals and refined products - Licensing - Solar and biomass sales - Filling sales from third part consumables KEY ACTIVITIES - Exploration and production - Petrochemicals products - Renewables & power - Trading & shipping KEY RESOURCES - Infrastructure - Proven reserves under license - Operations in more than 130 countries KEY PARTNERS - 903 subsidiaries consolidated into the group results - Significant affiliate investments and joint ventures - Oil service providers - Environmental and governmental agencies - Sponsorships COST STRUCTURE - Capital Investment - Acquisitions - Finding Oil and gas - Transporting and trading - Manufacturing and marketing fuels and product Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 18 6. TotalEnergies CSR Rating TotalEnergies has been always one of the greatest oil companies in the world that cares about the environment, society, safety of their employees and therefore, the company has always received great CSR rating compared to the average industry, and we can see that in the charts below: TotalEnergies Vs G&O Industry CSR Rating 100% 80% 60% 40% 20% 0% 4/02/2019 15/05/2019 23/08/2019 1/12/2019 10/03/2020 18/06/2020 26/09/2020 4/01/2021 TotalEnergies O&G Industry Figure 3: TotalEnergies vs G&O industry CSR Rating It is obvious that TotalEnergies is a leader among the oil and gas industry with a CSR rating always higher than the average of its peers, which indicates the importance of this matter for the company. The following data is extracted from S&P Global website: TotalEnergies is a Corporate Sustainability Assessment (CSA) survey respondent. Its ESG score is based on its responses to the CSA and on information available in the public domain. All companies are assessed using the industry specific CSA questionnaire and methodology reflecting a company’s score compared to its industry peers. The CSA focuses on past and current performance on ESG issues. Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 19 Dimensions Score Governance and Economic Social Enviromental 0 10 20 30 Industry Best 40 50 Industry Average 60 70 80 90 100 TotalEnergies Figure 4: TotalEnergies CSR Dimensions Score Companies assessed using the CSA fall into two categories: Participating companies – companies that are rated on information they submit to S&P Global as part of their active participation in the CSA and on publicly available information. Non-participating companies – companies that are assessed on publicly available information only and do not actively participate in the CSA. Sustainability Criterion Dimensions Water related risks 100 Social Impact on Communities Climate Strategy 80 60 40 Risk & Crisis Management 20 Corporate Governance 0 Operational Eco-Efficiency Occupational Health and Safety TotalEnergies Energy Mix Human Rights Industry Best Industry Mean Figure 5: TotalEnergies Sustainability criterion dimensions Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 20 Chapter 2: The conceptual background Introduction This chapter is devoted to the conceptual background of the research. First, we present the schools of thoughts on CSR, tackle the context, which we review the literature on Corporate Social Responsibility (CSR) and present the findings reported by various authors about how CSR influences the profitability of a corporation, and finally, we will go through our Research methodology. I. Schools of thoughts on CSR and Business operations From the vast literature available on the topic of Corporate Social Responsibility, many of which were reviewed as a part of this research work, three different themes or schools of thought emerge, which are designated as ‘Sceptic’, ‘Idealistic’ and ‘Pragmatist’. These are explained further within the following sections. 1.1 Sceptic view The skeptics are highly critical of CSR. They believe that in a very free society, the sole responsibility of corporate officials is to create the maximum amount of money for their shareholders, as they will. In keeping with this view, the corporates do not have any responsibility aside from increasing sales and earning profits. The thought of CSR is contrary to the essential purpose of business, which is to make wealth. The proponents of this view think that spending money on CSR activities is a self-imposed tax. They extremely counter any idea for expenses aside from anything associated with business operations and growth. In line with the proponents of this view, managers who are put accountable for a business do not have any right to allow away the money of the owners. Managers are employed to get wealth for the shareholders and not provides it away for charitable purposes. 1.2 Idealistic view The idealistic view of CSR reflects the thought that companies have a previous duty to anyone touched by their activity, their stakeholders instead of their stockholders. Companies are especially liable towards the vulnerable, which can be exploited by the company’s operation. Some holding this set of views think that companies like those manufacturing weapons can never be considered Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 21 accountable for the harmful effects of their products. Companies should not be silent witnesses to illegal and immoral activities in society. Business does not have an unquestioned right to control in society. Those managing businesses should recognize that they depend upon society. Business relies on inputs from society. There is an accord between business and society involving mutual obligations. Society and business must identify that they need to meet these mutual obligations for every other’s existence and success. 1.3 Pragmatic View The pragmatist view is widely followed and practiced. As per the pragmatist view, CSR is not about investing funds and expertise in solving social problems. CSR is about the veracity with which a corporation governs itself, fulfills its objectives, lives by its values, and engages with its stakeholders. The business measures its impacts on society and the way it reports about its activities with honesty. Pragmatist view promotes ethical decision-making in company affairs and transparency of choices and policies. The most theme of this view is compliance with rules and regulations and following them in letter and spirit. This view also promotes persistent assurance by businesses to behave ethically and contribute to economic development by improving the standard of lifetime of the workforce and their families further as that of the area people and society. A company, being a decent citizen within the community should manage its business process to provide an overall positive impact on society. it's duty-bound to conduct business ethically and therefore the interests of the broader community, respond positively to emerging societal priorities and expectations, be willing to act previous regulatory confrontation, and balance shareholder interests against the interests of the broader community. There are four layers of corporate responsibility as per this view: 1. Financial responsibility to earn profits for shareholders. 2. Accountability to fits the law. 3. Ethical not acting only for profit but doing what is right, just, and fair. 4. Philanthropic promoting human welfare and goodwill. The proponents of this view consider responsibility to earn profits jointly of the various responsibilities of business. II. Review of literature During this section, we review the literature on Corporate Social Responsibility (CSR) and present the findings reported by various authors about how CSR influences the profitability of a Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 22 corporation, employee morale, and loyalty, and whether it is sway on customer satisfaction. Broadly, the literature on CSR indicates three different schools of thought or groups. Each of those groups has taken statistically significant samples from different industries and organizations to validate their point. The most theme of those three group’s findings and observations is as mentioned below. One group supports CSR and states that its practices lead to improving the corporate image, helps stabilize stock prices, improve sales, and a positive impact on customer loyalty. The second group opposes CSR and shows that CSR harms profit and only adds to expenses. It results in loss of business focus, which may be better utilized in running the business profitably. The third group is neutral to CSR and shows that CSR could be a good charitable social act with no impact whatsoever on profitability. This section is accordingly organized into three parts, with each part covering the findings from the three groups mentioned above. 2.1 Literature of CSR having a positive impact on profitability Roger E. Meiners (1982) have said that companies spending on CSR must spend less money on advertising. This helps in reducing costs and creating a company identity or building the reputation of the firm. John W. Slocum (1996) have concluded that CSR can improve corporate reputation and lower the financial risk, which suggests such organizations are less likely to go bankrupt as compared to those, which do not engage in CSR. Curtis P. (1996), have proposed a theoretical model that strong environmental management to improved future financial performance. Samuel B. Graves (1998) have shown that Corporate Social Performance is positively related to prior financial performance. Paterson (2000) has found that financial incentives do not seem to be the key to draw in and retain quality staff. They reported that as high as eighty percent of UK professional workers would turn down a lucrative job offer if the corporate did not accord with their own personal values. Bennett Daviss (1999) has concluded that companies will grow their profits only by embracing their new role because of the engine of positive social and environmental change. Lord Tim Clement (2002) is of the view that CSR has bottom-line relevance and therefore the way it has communicated and reported is vital. CSR helps a company in building loyalty with customers, avoiding expensive class-action suits, helps in attracting, and retaining a talented workforce, and lowering the company’s equity risk premium. Savaria (2004) have shown that socially responsible companies show less diversifiable risk in their stock movement than others. Crawford and Scaletta (2005) have suggested the employment of a Balanced Score Card to form CSR reporting simpler. Falck and Heblich (2007) stated that shareholders react positively towards the stock prices of companies’ strategically practicing corporate social responsibility (CSR). Younghwan, Jungwoo, and Taeyong developed a company transparency index and accessed the transparency of several Korean companies. They concluded that financial, corporate, Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 23 operational, and social transparencies play a crucial role in an exceedingly firm’s profitability. Dr. Boorman (2011) has shown that a healthy and happy workforce can improve a company’s bottom line. 2.2 Literature for CSR having a negative impact on profitability Henderson (2001) has found that CSR could affect negatively profitability. In step with him, the concept of CSR is severely damaged. Adoption of CSR increases the likelihood of cost escalations and impaired performance. He highlights that wide-ranging goals, involvement within the timeconsuming process of debate with outside consultants, will load managers, need for brand new accounting, auditing, and monitoring systems if they practice CSR. All this might offset any gains from CSR. Friedman (2007) is of opinion that a business is responsible only to extend profits and not responsible to society. Reich (2008) argues that the firms practicing CSR must sacrifice freedom of profits to realize social goods. The promotion of corporate social responsibility by companies misleads the public to believe that more is being done by the private sector for the well-being of society than is after all the case. Robert remarks negatively about CSR saying that it is an expense that has only to mislead opinion. 2.3 Literature for CSR having no impact on profitability Derwinski McCarthy (1989) looked up the relationship between corporate social responsiveness and profitability in a sample of corporate directors. Their results show no relationship between the level of director social responsibility and corporate profitability. Balabanis, Phillips, and Lyall (1998) concluded that CSR disclosure positively affected a firm’s CSR performance and its concurrent financial performance. Involvement in environmental protection activities had a negative correlation with subsequent financial performance. McWilliams and Siegel (2000) conclude that CSR has a neutral impact on financial performance. Quazi and O’Brien (2000) found that corporate social responsibility is two-dimensional. Differences in cultural and market settings in which managers operate have very little impact on the ethical perceptions of corporate managers. Their study did not find any significant effect of CSR on profitability. McWilliams and Siegel (2001) outlined a supply and demand model of corporate social responsibility (CSR). Based on this framework, the hypothesis was that a firm’s level of CSR depends on its size, level of diversification, consumer income, and stage in the industry life cycle. From these hypotheses, they concluded that there exists an optimal level of CSR, which managers can determine by doing a cost-benefit analysis. They decided that there is a neutral relationship between CSR and financial performance. Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 24 Husted and Allen (2007) conclude that although directors and government officials insist in public that CSR projects create value for the firm, privately they say that they do not know if CSR really pays off. Mackey and Barney (2011) debate about whether firms should involve in socially responsible behavior. They have proposed a theoretical model in which the supply and demand of socially responsible investment opportunities determine whether these activities improve, reduce, or have no impact on a firm’s market value. Their theory shows that managers in publicly traded firms might fund socially responsible activities that do not maximize the value of their firm’s future cash flows in the short term however maximize the market value of the firm. III. Research methodology For analysis, Leverage, ROE, ROA and D/E ratio of the French company TotalEnergies Petrochemicals were taken for the period between 2019 – 2021 from their annual published financial reports. The CSR rating for these years 2019 and 2021 was taken from csrhub.com. It rates the companies based on their CSR activities. Ordinary Least Squares Regression analysis and correlation analysis are performed on the data using Excel. The company's data is analyzed to see the impact of CSR on the company's financial performance if there is a relationship between CSR activities and financial performance. In addition, the financial figures have experienced an unusual downshift due to the pandemic and the lockdown. This will catch the real essence of the relationship between financial and social performance. The companies are rated on a [0; 100] percentage scale based on criteria like products & services, reach of CSR activities, expenditure on CSR, harmful activities, etc. Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 25 Chapter 3: Results and findings Introduction The main objective of the present study is to investigate if there is some relationship between CSR expenditure made by TotalEnergies Petrochemicals and its financial performance as reflected in Sales Revenue and Net Profit figures. This relationship is required to determine if expenditure on CSR activities affects the financial and/or market performance and if companies with good CSR Rating will have an advantage on other companies during crises. I. CSR Rating and accounting based financial performance 1. Testable hypotheses CSR initiatives as measured by CSR rating is a forecaster as well as a consequence of firm’s financial performance as measured by firm’s sales revenue and profits. To achieve the objective of the paper, two hypotheses have been framed: 𝐻0 : There is no relationship between a company’s CSR Rating and its accounting based - financial performance. 𝐻1 : There is a relationship between a company’s CSR Rating and its accounting based - financial performance. 2. Model specification In order to have a complete analysis regarding the relationship of the CSR rating and the accounting based financial performance of the companies we will create two models to test our hypothesis. The first model is as follows: Equation 1: Regression Model 1 𝑌𝑛𝑖 = 𝛽0 + 𝛽1 𝑋1 𝑛𝑖 + 𝛽2 𝑋2 𝑛𝑖 + 𝛽3 𝑋3 𝑛𝑖 + 𝜀𝑛𝑖 Where: - Y represents the measure of the accounting based financial performance in this case ROE/ ROA each year with “n” representing the quarter of the year and “i” is the year. - 𝛽 represents the regression coefficients. - 𝑋1 represents the CSR Rating scaled from 0 to 100 percentage. Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 26 - 𝑋2 represents the leverage - 𝑋2 represents the D/E ratio. - 𝜀 represents the error term. Equation 2: Leverage Formula Leverage = 𝑇𝑜𝑡𝑎𝑙 𝐷𝑒𝑏𝑡 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 Equation 3: Return on assets formula 𝑅𝑂𝐴 = 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 Equation 4: Return on Equity formula 𝑅𝑂𝐸 = 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 𝑆ℎ𝑎𝑟𝑒ℎ𝑜𝑙𝑑𝑒𝑟 ′ 𝑠 𝑒𝑞𝑢𝑖𝑡𝑦 Equation 5: Debt to Equity ratio formula 𝐷⁄𝐸 𝑟𝑎𝑡𝑖𝑜 = 𝑇𝑜𝑡𝑎𝑙 𝐷𝑒𝑏𝑡 𝑆ℎ𝑎𝑟𝑒ℎ𝑜𝑙𝑑𝑒𝑟𝑠 ′ 𝑒𝑞𝑢𝑖𝑡𝑦 3. Analysis and interpretation of findings 3.1 Summary of descriptive statistics and correlation matrix Table 1 reports a summary of the descriptive statistics of two response variables: ROA and ROE; four predictor variables; CSR Rating, Leverage and debt to equity ratio were used in the study. The average ROE of TotalEnergies was much higher than that of ROA, suggesting that they benefited from leverage effects. The standard deviation of ROE indicates more volatility among the response variables. Similarly, the standard deviation of debt to equity ratio also indicates much more volatility among the explanatory variables. Table 1: Descriptive statistics of response and predictors variables Variables ROE Count 10 Mean 0.010 STD 0.033 Minimum -0.081 Maximum 0.030 ROA 10 0.005 0.014 -0.032 0.012 D/E 10 0.288 0.063 0.183 0.380 Leverage 10 0.122 0.022 0.084 0.152 CSR Rating 10 0.758 0.056 0.663 0.886 Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 27 Table 2 presents the correlation matrix of response and predictor variables. Both D/E and Leverage become negatively correlated with ROE and ROA and statistically significant at 5% level. However, CSR rating was positively correlated with both of the response variables with a percentage close to 65% and statistically significant at 5% level. The correlation matrix reveals that all the correlation coefficients, among the response and predictor variables, less than 0.7 implies no evidence of multicollinearity problem among independent variables. Table 2: Correlation matrix of response and predictor variables Variables ROE D/E Leverage CSR Rating ROA ROE 1 -0.69 -0.64 0.65 1.00 D/E Leverage CSR Rating ROA 1 0.98 -0.49 -0.71 1 -0.58 -0.66 1 0.64 1 3.2 Regression Results This study focused mainly on regression results. Tables 3, 4, 5 and 6 show the results of regression analysis. Table 3 and 4 report the results related to ROE and Tables 5 and 6 report the results related to ROA. The R square measures the regression’s explanatory power. An R square of 1 indicates that the independent variables explain all of the variations in the dependent variable. A value of 0 indicates that very little variation is explained by the independent variables. The beta coefficients indicate the strength of relationship. The P-value indicates at what level the results are statistically significant. Typically, a P-value of 0.05 or less shows that the results are significant. Table 3 reports the effects of D/E, Leverage, and CSR Rating on TotalEnergies ROE. The value of Rsquare (.87) reveals that the overall explanatory power of the regression model was fair with indicating that 87 percent of the variation in the company’s ROE was explained by the variation in the independent variables. The low value of the significance F-statistics clearly indicates that this regression model is a good fit. In Table 3, the regression coefficient of debt to equity ratio (β1 = -1.954, p < .01) indicates that a higher D/E ratio results in a lower ROE to TotalEnergies. The regression coefficient of leverage (β2 = 5.268, p < .05) shows that a higher leverage would eventually result in a higher ROE. In Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 28 addition, the regression coefficient of CSR Rating (β3 = 0.496, p < .01) indicates that a higher CSR Rating results in a higher ROE to the company. This result is consistent with the findings of prior researchers. Table 3: Multiple regression equation of ROE on all predictor variables Coefficients Standard Error t Stat P-value Intercept -0.449 0.132 -3.389 0.015 D/E -1.954 0.480 -4.073 0.007 Leverage 5.268 1.469 3.587 0.012 CSR Rating 0.496 0.121 4.108 0.006 Table 4: Regression Statistics equation of ROE on all predictor variables Regression Statistics Multiple R R Square Adjusted R Square F Significance F Standard Error Observations 0.936 0.876 0.813 14.065 0.004 0.014 10 Table 5 reports the effects of D/E, Leverage, and CSR Rating on TotalEnergies ROA. The value of R-square (.88) reveals that the overall explanatory power of the regression model was fair with indicating that 88 percent of the variation in the company’s ROA was explained by the variation in the independent variables. The low value of the significance F-statistics clearly indicates that this regression model is a good fit and we can reject the null hypothesis. In Table 5, the regression coefficient of debt to equity ratio (β1 = -0.802 , p < .01) indicates that a higher D/E ratio results in a lower ROA to TotalEnergies. The regression coefficient of leverage (β2 = 2.140, p < .05) shows that a higher leverage would eventually result in a higher ROE. In addition, the regression coefficient of CSR Rating (β3 = 0.195, p < .01) indicates that a higher CSR Rating results in a higher ROE to the company. This result is consistent with the findings of prior researchers. Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 29 Table 5: Multiple regression equation of ROA on all predictor variables Coefficients Standard Error t Stat P-value Intercept -0.174 0.053 -3.278 0.017 D/E -0.802 0.193 -4.167 0.006 Leverage 2.140 0.589 3.631 0.011 CSR Rating 0.195 0.048 4.021 0.007 Table 6: Regression Statistics equation of ROA on all predictor variables Regression Statistics Multiple R R Square Adjusted R Square F Significance F Standard Error Observations 0.938 0.881 0.821 14.754 0.004 0.006 10 Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 30 II. CSR Rating and TotalEnergies market Performance This part of the paper will try to study the relationship between the company’s CSR rating and its market performance and if companies with good CSR Rating will have an advantage on other companies during crises. TOTALENERGIES CSR RATING vs TTE STOCK PRICE JAN 2020 - MAR 2021 $55.00 95.00% 90.00% $45.00 85.00% $35.00 80.00% $25.00 75.00% 70.00% $15.00 65.00% $5.00 60.00% TTE Stock price TOTAL CSR RATING Figure 6:TTE vs TotalEnergies CSR Rating 1. Testable hypotheses To achieve the objective of the paper, two hypotheses have been framed. These are the following hypothesis: - 𝐻0 : There is no relationship between a company’s CSR Rating and its market financial performance (stock price). - 𝐻1 : There is a relationship between a company’s CSR Rating and its market financial performance (stock price). 2. Model specification The model is as follows: Equation 6: Regression model 2 𝑌𝑛𝑖 = 𝛽0 + 𝛽1 𝑋1 𝑛𝑖 + 𝛽2 𝑋2 𝑛𝑖 + 𝜀𝑛𝑖 Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 31 Where: - Y represents the measure of the market financial performance in this case its stock price weekly with “n” representing the week of the year and “i” is the year. - 𝛽 represents the regression coefficients. - 𝑋1 represents the CSR Rating scaled from 0 to 100 percentage. - 𝑋2 represents ^XOI stock price - 𝜀 represents the error term. 3. Analysis and interpretation of findings 3.1 Summary of descriptive statistics and correlation matrix Table 1 reports a summary of the descriptive statistics of the response variable: TTE stock price and two predictor variables; CSR Rating and ^XOI stock price were used in the study. The standard deviation of ROE indicates more volatility among the response variables. Similarly, the standard deviation of debt to equity ratio also indicates much more volatility among the explanatory variables. Table 7: Descriptive statistics of response and predictors variables Variables Count Mean STD Minimum Maximum TTE 44 38.59 6.28 25.02 50.20 ^XOI 44 841.19 194.89 536.94 1293.41 TotalEnergies CSR 44 0.738 0.055 0.653 0.886 Table 2 presents the correlation matrix of response and predictor variables. Both ^XOI stock price and TotalEnergies CSR Rating become positively correlated with TTE stock price and statistically significant at 5% level. The correlation matrix reveals that the correlation coefficients, among TTE, ^XOI the CSR Rating is less than 0.7 implies no evidence of multicollinearity problem among independent variables. Table 8: Correlation matrix of response and predictor variables Variables TTE TTE TotalEnergies CSR ^XOI 1 ^XOI 0.91 1 TotalEnergies CSR 0.50 0.31 1 Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 32 3.2 Regression Results This study focused mainly on regression results. Tables 9 and 10 show the results of regression analysis. Table 9 reports the effects of ^XOI stock price and CSR Rating on TotalEnergies stock price. The value of R-square (.87) reveals that the overall explanatory power of the regression model was fair with indicating that 87 percent of the variation in the TTE stock price was explained by the variation in the independent variables. The low value of the significance F-statistics clearly indicates that this regression model is a good fit. In Table 9, the regression coefficient of ^XOI stock price (β1 = 0.027, p < .01) indicates that a higher D/E ratio results in a higher TotalEnergies stock price. The regression coefficient of the CSR Rating (β2 = 27.736, p < .01) shows that a higher CSR Rating would eventually result in a higher TTE stock price. . This result is consistent with the findings of prior researchers. Table 9: Multiple regression equation of TTE on all predictor variables Coefficients Intercept ^XOI Total Energies CSR Standard Error t Stat P-value -4.450 4.601 -0.967 0.339 0.027 0.002 14.543 0.000 27.736 6.539 4.241 0.000 Table 10: Regression Statistics equation of TTE on all predictor variables Regression Statistics Multiple R R Square Adjusted R Square F Significance F Standard Error Observations 0.937 0.878 0.872 147.767 1.81E-19 2.244 44.000 Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 33 TTE and the industry average: As shown in the first graph TotalEnergies has been always above the industry average regarding the CSR rating and close enough to be the industry best. For this analysis we chose to compare the stock price of the company to an index called ^XOI. The NYSE Arca Oil Index, ticker symbol XOI, is a price-weighted index of the leading companies involved in the exploration, production of oil and natural gas. It measures the performance of the oil industry through changes in the sum of the prices of component stocks. The index was developed with a base level of 125. TTE vs ^XOI Change 01/01/2020 - 30/06/2021 5.00% -15.00% -35.00% -55.00% -75.00% TTE ^XOI Linear (TTE) Linear (^XOI ) Figure 7: TTE vs ^XOI stock price change This chart shows the change happened from early 2020 until now. We can see that TTE has a better performance in the market compared to ^XOI. From these data, we can conclude that TotalEnergies having a better CSR rating compared to its peers in the oil and gas production industry is performing better in crises market wise. Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 34 Summary and Conclusions The purpose of this study was to find the relationship between the corporate social responsibility of an organization and the financial performance (accounting-based / marketbased) of the organization. CSR rating of the organization has been taken as an indicator of CSR and ROE and stock price have been taken as indicators of financial performance. Two hypotheses were made. In order to test 𝐻0 , regression analysis was done taking ROE as the dependent variable and CSR rating as independent variable. By checking casualty of data from 2019 to 2021, the results of the study show that CSR rating of the firm results in improved financial performance and the firms having more CSR rating will be more resistant to crises. Most of the literature reviewed also concludes with positive relationship between CSR rating and financial performance. The results of our analysis clearly establish the relationship between CSR and financial performance. The relationship between CSR and financial performance has been empirically examined by many studies and there have been many theoretical debates and discussions concerning the positive relationship between corporate social performance and firm financial performance. This study employed three ordinary least squares regression models to explain the cause-and-effect relationship between response and predictor variables. The first regression model, which incorporated ROE as the dependent variable, was statistically significant (F = 14.065, p< .05) suggesting that the regression model was best fitted. Similarly, the second regression model, which incorporated ROA as the dependent variable, was statistically significant (F = 14.754, p< .01), suggests that the regression model seemed best fitted. Finally, the third regression model, which included TTE stock price as the dependent variable, was statistically significant (F = 147.767, p < .01) suggesting that the regression model appeared best fitted. The first regression equation reveals that the higher the CSR Rating the higher the ROE of the company. Similarly, the results from the second regression says that the higher the CSR Rating the higher the ROA of TotalEnergies. We can conlude that indeed CSR rating has a positive relationship with the accounting based financial performance. Finally, the results of Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 35 the third regression reveals that the higher the CSR Rating the higher the TTE stock price, which means that CSR Rating has also a positive relationship with the market based financial performance. This finding could help companies to take an effective action to improve their CSR Rating to reach higher profitability. Limitations This study covered only three variables such as CSR Rating , leverage, and D/E ratio to show the impact on the company’s profitability and only ^XOI stock price along with the CSR Rating to show the impact on the company’s market performance. Therefore, further research needs to be done by including other industry specific factors and macroeconomic variables. Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 36 References 1. Ali, I., Rehman, K.U., Yilmaz, A.K., Nazir, S., J.F. Ali. Effects of corporate social responsibility on consumer retention in cellular industry of Pakistan // African Journal of Business Management, 2010. N4 (4). - pp. 475-485. 2. Aras, G., Aybars, A., O. Kutlu. Managing corporate performance: Investigating the relationship between corporate social responsibility and financial performance in emerging markets // International Journal of Productivity and Performance Management, 2010. - N59 (3). - pp. 229-254. 3. Aupperle, K.L., Carroll, A.B., J.B. Hatfield. An Empirical Examination of the Relationship between Corporate Social Responsibility and Profitability // The Academy of Management Journal, 1985. - N28 (2). - pp. 446-463. 4. Balabanis, G., Phillips, H.C., J. Lyall. Corporate social responsibility and economic performance in the top British companies: are they linked? // European Business Review, 1998. - N98 (1). - pp. 25-44. 5. Barnett M.L. Stakeholder Influence Capacity and the Variability of Financial Returns to Corporate Social Responsibility // The Academy of Management Review, 2011. - N32 (3). - pp. 794-816. 6. Baron, D.P. Corporate Social Responsibility and Social Entrepreneurship // Journal of Economics & Management Strategy, 2007. - N16 (3). - pp. 683-717. 7. Baron, D.P. Private Politics, Corporate Social Responsibility, and Integrated Strategy // Journal of Economics & Management Strategy, 2001. - N10 (1). - pp. 7-45. 8. Blackburn, V.L., Doran, M., C.B. Shrader. Investigating the dimensions of Social Responsibility and the consequences for Corporate Financial Performance // Journal of Managerial Issues, 1994. - N6 (2). - pp. 195-212. 9. Boorman, S. Healthy profits: Workers’ wellbeing is directly linked to the bottom line // Western Daily Press [Bristol (UK)] July 5, 2011. - p. 1. 10. Borgonovi, V., Meier, S., Manjari Sharda, M., L. Vaidyanathan. Creating Shared Value in India: How Indian Corporations Are Contributing to Inclusive Growth While Strengthening Their Competitive Advantage // FSG, 2011. 11. Burke, L., J.M. Logsdon. How corporate social responsibility pays off // Long Range Planning, 1996. - N29 (4). - pp. 495-502. 12. Namita Rajput, Geetanjali Batra and Ruchira Pathak (2012).// Linking CSR and financial performance: an empirical validation. Problems and Perspectives in Management, 10(2) Data Sources https://finance.yahoo.com/quote/TTE https://finance.yahoo.com/quote/%5EXOI https://www.totalenergies.com/investors/publications-and-regulated-information/reportsand-publications#quarterlyResult https://www.csrhub.com/CSR_and_sustainability_information/Total-Petrochemicals https://www.spglobal.com/esg/scores/results?cid=4011129 Omar AMEUR | TUNIS BUSINESS SCHOOL TUNIS, TUNISIA 37