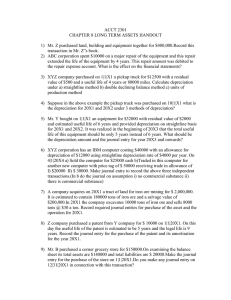

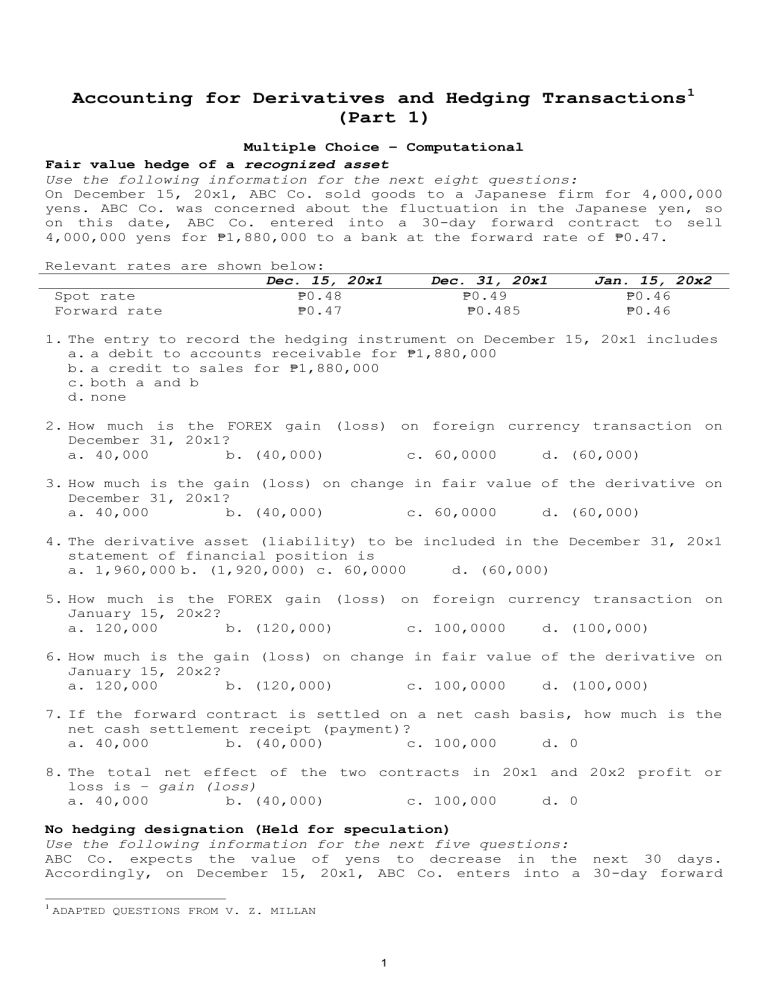

Accounting for Derivatives and Hedging Transactions1 (Part 1) Multiple Choice – Computational Fair value hedge of a recognized asset Use the following information for the next eight questions: On December 15, 20x1, ABC Co. sold goods to a Japanese firm for 4,000,000 yens. ABC Co. was concerned about the fluctuation in the Japanese yen, so on this date, ABC Co. entered into a 30-day forward contract to sell 4,000,000 yens for ₱1,880,000 to a bank at the forward rate of ₱0.47. Relevant rates are shown below: Dec. 15, 20x1 Spot rate ₱0.48 Forward rate ₱0.47 Dec. 31, 20x1 ₱0.49 ₱0.485 Jan. 15, 20x2 ₱0.46 ₱0.46 1. The entry to record the hedging instrument on December 15, 20x1 includes a. a debit to accounts receivable for ₱1,880,000 b. a credit to sales for ₱1,880,000 c. both a and b d. none 2. How much is the FOREX gain (loss) on foreign currency transaction on December 31, 20x1? a. 40,000 b. (40,000) c. 60,0000 d. (60,000) 3. How much is the gain (loss) on change in fair value of the derivative on December 31, 20x1? a. 40,000 b. (40,000) c. 60,0000 d. (60,000) 4. The derivative asset (liability) to be included in the December 31, 20x1 statement of financial position is a. 1,960,000 b. (1,920,000) c. 60,0000 d. (60,000) 5. How much is the FOREX gain (loss) on foreign currency transaction on January 15, 20x2? a. 120,000 b. (120,000) c. 100,0000 d. (100,000) 6. How much is the gain (loss) on change in fair value of the derivative on January 15, 20x2? a. 120,000 b. (120,000) c. 100,0000 d. (100,000) 7. If the forward contract is settled on a net cash basis, how much is the net cash settlement receipt (payment)? a. 40,000 b. (40,000) c. 100,000 d. 0 8. The total net effect of the two contracts in 20x1 and 20x2 profit or loss is – gain (loss) a. 40,000 b. (40,000) c. 100,000 d. 0 No hedging designation (Held for speculation) Use the following information for the next five questions: ABC Co. expects the value of yens to decrease in the next 30 days. Accordingly, on December 15, 20x1, ABC Co. enters into a 30-day forward 1 ADAPTED QUESTIONS FROM V. Z. MILLAN 1 contract to sell 4,000,000 yens at the forward rate of ₱0.47. On December 31, 20x1, the forward rate was ₱0.485 and by January 15, 20x2, the spot rate moved to ₱0.46. 9. The entry to record the forward contract on December 15, 20x1 includes a. a debit to forward contract for ₱60,000 b. a credit to forward contract for ₱60,000 c. a debit to loss on forward contract for ₱60,000 d. none 10. on a. b. How much is the gain (loss) on change in fair value of the derivative December 31, 20x1? 60,000 in profit or loss c. (60,0000) in OCI (40,000) in OCI d. (60,000) in profit or loss 11. The derivative asset (liability) to be included in the December 31, 20x1 statement of financial position is a. 1,960,000 b. (1,920,000) c. 60,0000 d. (60,000) 12. How much is the gain (loss) on change in fair value of the derivative on January 15, 20x2? a. 120,000 b. (120,000) c. 100,000 d. (100,000) 13. How much is the net cash settlement receipt (payment) on January 15, 20x2? a. 40,000 b. (40,000) c. 1,840,000 d. (1,840,000) Fair value hedge of a recognized liability Use the following information for the next seven questions: On December 15, 20x1, ABC Co. purchased goods from a Korean firm for 40,000 wons. ABC Co. was concerned about the fluctuation in the Korean won, so on this date, ABC Co. entered into a 30-day forward contract to buy 40,000 wons for ₱49,600 from a bank at the forward rate of ₱1.24. Relevant rates are shown below: Dec. 15, 20x1 Spot rate 1.20 Forward rate 1.24 Dec. 31, 20x1 1.26 1.27 Jan. 15, 20x2 1.30 1.30 14. The purchased inventory shall be recognized at a. 48,000 b. 49,600 c. 50,400 d. 50,800 15. The derivative asset (liability) to be included in the December 31, 20x1 statement of financial position is a. 2,400 b. (2,400) c. 1,200 d. (1,200) 16. The adjustment to the inventory account on December 31, 20x1 is – increase (decrease) a. 2,400 b. (2,400) c. 1,200 d. 0 17. How much is the FOREX gain (loss) on foreign currency transaction on January 15, 20x2? a. (2,400) b. (1,600) c. 1,200 d. (1,200) 18. How much is the gain (loss) on change in fair value of the derivative on January 15, 20x2? a. 1,200 b. (1,200) c. 1,600 d. (1,600) 2 19. The total net effect of the two contracts on profit or loss in 20x2 is – gain (loss) a. (1,600) b. (400) c. 1,600 d. 0 20. Assuming the forward contract is settled on a net cash basis, how much is the net cash settlement receipt (payment) on January 15, 20x2? a. 1,600 b. (400) c. 2,400 d. (2,400) No hedging designation (Held for speculation) Use the following information for the next two questions: ABC Co. expects the value of wons to increase in the next 30 days. Accordingly, on December 15, 20x1, ABC Co. enters into a 30-day forward contract to buy 40,000 wons at the forward rate of ₱1.24. On December 31, 20x1, the forward rate was ₱1.27 and by January 15, 20x2, the spot rate moved to ₱1.30. 21. The derivative asset (liability) to be included in the December 31, 20x1 statement of financial position is a. 2,400 b. (2,400) c. 1,200 d. (1,200) 22. The total net effect of the transaction on profit or loss in 20x2 is – gain (loss) a. 2,400 b. (2,400) c. 1,200 d. (1,200) Fair value hedge of a firm sale commitment Use the following information for the next six questions: On December 15, 20x1, ABC Co. received a sale order from a Japanese firm in the amount of 4,000,000 yens. The delivery of the goods sold is due on January 15, 20x1. ABC Co. was concerned about the fluctuation in the Japanese yen, so on this date, ABC Co. entered into a 30-day forward contract to sell 4,000,000 yens for ₱1,880,000 to a bank at the forward rate of ₱0.47. Relevant rates are shown below: Dec. 15, 20x1 Spot rate ₱0.48 Forward rate ₱0.47 Dec. 31, 20x1 ₱0.49 ₱0.485 Jan. 15, 20x1 ₱0.46 ₱0.46 23. a. b. c. d. The entries on December 15, 20x1 include a debit to accounts receivable for ₱1,880,000 a credit to sales for ₱1,880,000 both a and b none 24. a. b. c. d. The entry on December 31, 20x1 for the hedged item includes debit to loss on forward contract for ₱60,000 debit to gain on forward contract for ₱60,000 a credit to firm commitment for ₱60,000 a debit to firm commitment for ₱60,000 25. The derivative asset (liability) on December 31, 20x1 is a. 60,000 b. (60,000) c. 40,000 d. (40,000) 26. The effectiveness of the hedging instrument as of December 31, 20x1 is a. 60% b. 80% c. 100% d. 125% 3 27. a. b. c. d. The entry on January 15, 20x2 pertaining to the hedged item includes a credit to sales for ₱1,880,000 a debit to cash (foreign currency) ₱1,880,000 a credit to gain for ₱100,000 a and b 28. Assuming the forward contract is settled on a net cash basis, how much is the net cash settlement receipt (payment) on January 15, 20x2? a. 40,000 b. (40,000) c. 2,400 d. (2,400) Fair value hedge of a firm purchase commitment Use the following information for the next four questions: On December 15, 20x1, ABC Co. entered into a firm commitment to purchase goods from a Korean firm for 40,000 wons. If ABC Co. will not purchase the goods from the Korean firm, it would be required to pay a penalty of 24,000 wons (i.e., ABC’s contract with the Korean firm is a firm commitment). ABC Co. was concerned about the fluctuation in the Korean won, so on this date, ABC Co. entered into a 30-day forward contract to buy 40,000 wons for ₱49,600 from a bank at the forward rate of ₱1.24. Relevant rates are shown below: Dec. 15, 20x1 Spot rate 1.20 Forward rate 1.24 Dec. 31, 20x1 1.26 1.27 Jan. 15, 20x2 1.30 1.30 29. The gain (loss) on the firm commitment on December 31, 20x1 is a. (2,400) b. (1,200) c. (800) d. 800 30. The derivative asset (liability) on December 31, 20x1 is a. 60,000 b. (60,000) c. 1,200 d. (1,200) 31. How much inventory is recognized on January 15, 20x2? a. 49,600 b. 52,000 c. 50,400 d. 48,000 32. Assuming the forward contract is settled on a net cash basis, how much is the net cash settlement receipt (payment) on January 15, 20x2? a. 4,000 b. (4,000) c. 2,400 d. (2,400) Fair value hedge of a firm purchase commitment – Present value Use the following information for the next six questions: ABC Co. operates a chain of coffee shops nationally. On October 1, 20x1, ABC Co. entered into a firm commitment to purchase 4,000 kilograms of coffee beans for a contract price of ₱160 per kilogram on March 31, 20x2. ABC Co. expects that there is a possible decrease in the price of coffee beans, so on this date, ABC Co. entered into a six-month forward contract with a bank to sell 4,000 kilograms of coffee beans at the current forward rate of ₱160 per kilogram. Information on fair values is shown below: Fair value of Fair value of firm Forward forward contract commitment Date Spot price price (asset) (liability) Oct. 1, 20x1 155 160 27,727 a Dec. 31, 20x1 151 153 (27,727) 52,000 b Mar. 31, 20x2 147 147 (52,000) 4 [(160 – 153) x 4,000] x present value factor using 4%, assumed appropriate rate, for three months (or 0.9902427). b [(160 – 147) x 4,000. a 33. The entry on October 1, 20x1 to record the firm purchase commitment includes a a. debit to inventory for ₱640,000 b. credit to accounts payable for ₱640,000 c. both a and b d. none 34. The entries on December 31, 20x1 includes a a. a debit to loss on firm commitment for ₱27,727, recognized in profit or loss b. a debit to loss on firm commitment for ₱27,727, recognized in OCI c. a credit to gain on firm commitment for ₱27,727, recognized in profit or loss d. a credit to gain on firm commitment for ₱27,727, recognized in OCI 35. The derivative asset (liability) on December 31, 20x1 is a. 27,727 b. (27,728) c. 1,200 d. (1,200) 36. The debit to inventory on March 31, 20x2 is a. 640,000 b. 612,000 c. 588,000 d. 0 37. The gain (loss) on forward contract on March 31, 20x2 is a. (24,273) b. 24,273 c. 52,000 d. (52,000) 38. The net cash settlement receipt (payment) on the forward contract on March 31, 20x2 is a. 52,000 b. (52,000) c. (24,273) d. 24,273 Fair value hedge of a firm purchase commitment – Present value Use the following information for the next six questions: ABC Co. supplies cabbage to various hotels and restaurants. On October 1, 20x1, ABC Co. entered into a firm commitment to purchase 4,000 kilograms of cabbage for a contract price of ₱40 per kilogram on March 31, 20x2. ABC Co. is worried about fluctuations in the price of cabbage. Therefore, on October 1, 20x1, ABC Co. entered into a six-month, over-the-counter (OTC) forward contract with a broker to sell 4,000 kilograms of cabbage at the current forward rate of ₱40 per kilogram to be settled on a net cash basis on March 31, 20x2. Date Oct. 1, 20x1 Dec. 31, 20x1 Mar. 31, 20x2 Spot price 41 32 50 Fair value of forward contract (asset) 39,608 a (40,000)b Forward price 40 30 50 Fair value of firm commitment (liability) (39,608) 40,000 [(40 – 30) x 4,000] x present value factor using 4%, assumed appropriate rate, for three months (or 0.9902427). b [(50 – 40) x 4,000. a 5 39. The fair value of the forward contract on Oct. 1, 20x1 is a. 4,000 b. 164,000 c. 160,000 d. 0 40. The fair value of the firm commitment on Oct. 1, 20x1 is a. 4,000 b. 164,000 c. 160,000 d. 0 41. The fair value of the forward contract on Dec. 31, 20x1 is – asset (liability) a. 39,608 b. (39,608) c. 40,000 d. 0 42. The fair value of the firm commitment on Dec. 31, 20x1 is – asset (liability) a. 39,608 b. (39,608) c. (40,000) d. 0 43. The gain (loss) on the derivative on March 31, 20x2 is a. 38,608 b. (40,000) c. (79,608) d. 79,608 44. The net cash settlement – receipt (payment) – on March 31, 20x2 is a. (79,608) b. 79,608 c, 40,000 d. (40,000) Cash flow hedge of a forecasted purchase transaction Use the following information for the next eight questions: ABC Co. produces potato chips. On December 15, 20x1, ABC Co. anticipates purchasing 4,000 kilograms of potatoes on January 15, 20x2. ABC Co. is concerned about the fluctuation in the price of potatoes, so on December 15, 20x1, ABC Co. enters into a 30-day forward contract to purchase 4,000 kilograms of potatoes at a forward rate of ₱45 per kilogram (or ₱180,000). The forward contract will be settled net on January 15, 20x2. Relevant prices per kilogram of potatoes are shown below: Dec. 15, 20x1 Dec. 31, 20x1 Spot price 40 50 Forward price 45 55 Jan. 15, 20x1 60 60 45. The fair value of the hedging instrument on Dec. 15, 20x1 is a. 20,000 b. 180,000 c. 160,000 d. 0 46. The fair value of the hedged item on Dec. 15, 20x1 is a. 20,000 b. 180,000 c. 160,000 d. 0 47. The fair value of the hedging instrument on Dec. 31, 20x1 is a. 40,000 b. (40,000) c. 20,000 d. 0 48. The fair value of the hedged item on Dec. 31, 20x1 is a. 40,000 b. (40,000) c. 20,000 d. 0 49. The net effect of the derivative instrument on the 20x1 profit or loss is – gain (loss) a. 40,000 b. (40,000) c. 20,000 d. 0 50. How much is the gain (loss) on the forward contract on January 15, 20x2? a. 20,000 profit or loss c. 20,000 OCI b. (20,000) profit or loss d. (20,000) OCI 6 51. The net cash settlement – receipt (payment) – on January 15, 20x2 is a. 60,000 b. (60,000) c. 40,000 d. (40,000) 52. Assume that all of the potatoes purchased were used to produce potato chips at a total manufacturing cost of ₱400,000 and that all of the potato chips were sold on February 14, 20x2 for ₱1,440,000, how much cost of goods sold is recognized on February 14, 20x2? a. 400,000 b. 460,000 c. 340,000 d. 420,000 Cash flow hedge of a forecasted sale transaction – Present value (Indirect quotation) Use the following information for the next five questions: ABC Co. produces tomato paste. On October 1, 20x1, ABC Co. anticipates selling goods worth DOP 59,400,000 (Dominican Peso) on April 1, 20x2. ABC Co. enters into to a six-month forward contract to sell DOP 59,400,000 at a forward rate of ₱1:DOP 140 or ₱424,284. The appropriate discount rate is 6% per annum. The following are the relevant exchange rates: Date Spot rate Forward rate Oct. 1, 20x1 ₱1 : DOP 135 ₱1 : DOP 140 Dec. 31, 20x1 ₱1 : DOP 140 ₱1 : DOP 142 Apr. 1, 20x2 ₱1 : DOP 144 ₱1 : DOP 144 53. How much is the gain (loss) on the forward contract on December 31, 20x1? a. 5,887 profit or loss c. (5,887) profit or loss b. 5,887 OCI d. (5,887) OCI 54. a. b. 55. a. How much is the gain (loss) on the hedged item on December 31, 20x1? 5,887 profit or loss c. (5,887) OCI (5,887) profit or loss d. 0 How much sale revenue is recognized in 20x2? 424,286 b. 400,716 c. 406,772 d. 412,500 56. How much is the gain (loss) on the forward contract on April 1, 20x2? a. 5,899 profit or loss c. (5,899) profit or loss b. 5,899 OCI d. (5,899) OCI 57. The net cash settlement – receipt (payment) – on January 15, 20x2 is a. 60,000 b. (60,000) c. 11,786 d. (11,786) Cash flow hedge of a recognized liability – Present value Use the following information for the next seven questions: On December 1, 20x1, ABC Co. purchased goods from a Korean firm for 400,000 wons. ABC Co. was concerned about the fluctuation in the Korean won, so on this date, ABC Co. entered into a 2-month forward contract to buy 400,000 wons for ₱496,000 from a bank at the forward rate of ₱1.24. Relevant rates are shown below: Dec. 1, 20x1 Spot rate 1.20 Forward rate 1.24 Dec. 31, 20x1 1.23 1.27 Jan. 31, 20x2 1.30 1.30 Additional information: ABC Co. chooses to account for the hedging instrument as a cash flow hedge. The initial spot/forward difference (or ‘forward points’) amounts to ₱16,000 over the 2-month term of the forward contract [400,000 x (1.24 7 forward rate - 1.20 spot rate)]. This difference will be amortized as interest expense using the effective interest method. Given the spot/forward relationship above, the implicit interest rate is 19.84% per annum or 1.6530% per month. The following are the relevant present value factors: Dec. 31, 20x1: PV of ₱1, @ 0.5%, n=1 (1 month)………0.99502 Jan. 31, 20x2: PV of ₱1, @ 0.5%, n=0 (maturity date)…1 58. The inventory account is debited on December 1, 20x1 for a. 400,000 b. 480,000 c. 496,000 d. 0 59. The FOREX gain (loss) on the hedged item on December 31, 20x1 is a. (12,000) b. 12,000 c. 9,886 d. 60. How much is recognized in other comprehensive income on December 31, 20x1? debit (credit) a. 19,876 b. (19,838) c. 16,312 d. 0 61. The derivative asset (liability) recognized on December 31, 20x1 is a. 19,876 b. (19,874) c. 11,940 d. (11,940) 62. The FOREX gain (loss) on the hedged item on January 31, 20x2 is a. (28,000) b. 28,000 c. 26,399 d. 0 63. How much is recognized in other comprehensive income on January 31, 20x2? debit (credit) a. 20,126 b. (20,126) c. 18,234 d. 0 64. The net cash settlement – receipt (payment) – on January 15, 20x2 is a. (20,130) b. 20,130 c. (24,000) d. 24,000 Accounting for Derivatives and Hedging Transactions2 (Part 2) Multiple Choice – Computational No hedging designation Use the following information for the next four questions: On December 1, 20x1, ABC Co. enters into a silver futures contract to purchase 4,000 ounces of silver on February 1, 20x2 for ₱200 per ounce. The broker requires an initial margin deposit of ₱80,000. The quoted prices per ounce of silver are as follows: Dec. 1, 20x1 Dec. 31, 20x1 Feb. 1, 20x2 200 190 185 1. The entries on December 1, 20x1 include a. debit to “deposit with broker” for ₱80,000 b. credit to cash for ₱80,000 c. a and b d. none 2. How much is the derivative asset (liability) as of December 31, 20x1? a. 0 b. (34,668) c. (40,000) d. 40,000 2 ADAPTED QUESTIONS FROM V. Z. MILLAN 8 3. How much is the total net effect of the derivative on the 20x1 and 20x2 profit or loss? Gain (loss) a. (60,000) b. 60,000 c. (40,000) d. 40,000 4. How much is the net settlement on February 1, 20x2? – Receipt (payment) a. 20,000 b. (20,000) c. (60,000) d. 60,000 Fair value hedge of a recognized asset – hedged item measured at fair value Use the following information for the next seven questions: ABC Co. is a commodity trader. On December 1, 20x1, ABC Co. carries in its inventory 400 troy ounces of gold valued at ₱4,800,000 (or ₱12,000 per troy ounce). ABC Co. measures its inventory of gold at fair value less costs to sell through profit or loss. To protect the fair value of its inventory against a potential decline in prices, ABC Co. enters into a “short” futures contract on December 1, 20x1 to sell 400 troy ounces of gold at ₱12,100 per troy ounce on February 1, 20x2 (the expected date of sale of the inventory). The futures contract requires an initial margin deposit of ₱384,000. We will assume that the fair values shown below already reflect costs to sell. Dec. 1, 20x1 Dec. 31, 20x1 Feb. 1, 20x2 Spot price 12,000 12,250 11,800 Futures price 12,100 12,300 11,800 5. The entries on December 1, 20x1 include a. debit to “deposit with broker” for ₱384,000 b. credit to cash for ₱384,000 c. a and b d. none 6. How much is the adjustment to the inventory account on December 31, 20x1? Increase (decrease) a. 100,000 b. (100,000) c. 80,000 d. 0 7. How much is the derivative asset (liability) as of December 31, 20x1? a. (100,000) b. 100,000 c. (80,000) d. 80,000 8. How much is the gain (loss) on the futures contract on February 1, 20x2? a. 0 b. (80,000) c. (200,000) d. 200,000 9. How much is the net settlement on February 1, 20x2? – Receipt (payment) a. 120,000 b. (120,000) c. 504,000 d. 504,000 10. How much is the total net cash receipt (payment) contracts? a. 4,840,000 b. (4,840,000) c. (504,000) d. 504,000 on the two Fair value hedge of a recognized asset – hedged item measured at lower of cost or net realizable value (NRV) Use the following information for the next five questions: On December 1, 20x1, ABC Co. has a soybean inventory of 4,000 bushels carried at a cost of ₱240 per bushel (or total cost of ₱960,000). ABC Co. measures its inventory of soybeans at the lower of cost or net realizable value (NRV). 9 ABC Co. intends to sell the whole inventory by February 1, 20x1. On December 1, 20x1, ABC Co. enters into a futures contract to sell the whole inventory on February 1, 20x1 at a price of ₱360 per bushel. The broker requires a deposit of ₱80,000. Information on fair values is as follows: Dec. 1, 20x1 Dec. 31, 20x1 Spot price Futures price Feb. 1, 20x2 354 371 338 360 374 338 11. How much is the adjustment to the inventory account on December 31, 20x1? Increase (decrease) a. 100,000 b. 68,000 c. (68,000) d. 0 12. How much is the derivative asset (liability) as of December 31, 20x1? a. 0 b. (68,000) c. (56,000) d. 56,000 13. How much is the gain (loss) on the futures contract on February 1, 20x2? a. 0 b. (56,000) c. (144,000) d. 144,000 14. How much is the net settlement on the derivative February 1, 20x2? – Receipt (payment) a. 168,000 b. (168,000) c. 88,000 d. (88,000) instrument on 15. How much gross profit from sales is recognized on February 1, 20x2? a. 0 b. 364,000 c. 388,000 d. 456,000 Fair value hedge of a firm sale commitment Use the following information on the next five questions: On December 1, 20x1, ABC Co. enters into a fixed-price contract to sell 4,000 ounces of silver on February 1, 20x2 for ₱210 per ounce. ABC Co. prefers to have the sales contract settled at market value on delivery date. Therefore, on December 1, 20x1, ABC Co. enters into a “long” futures contract to purchase 4,000 ounces of silver at ₱200 per ounce. The futures contract requires an initial margin deposit of ₱120,000. Information on market values is shown below: Dec. 1, 20x1 Dec. 31, 20x1 Spot price 210 240 Futures price 200 235 Feb. 1, 20x2 250 250 16. How much is the firm commitment asset (liability) on December 31, 20x1? a. 120,000 b. (120,000) c. (140,000) d. (100,000) 17. How much is the derivative asset (liability) on December 31, 20x1? a. 140,000 b. (140,000) c. 120,000 d. (120,000) 18. How much is the sale revenue recognized on February 1, 20x2? a. 1,000,000 b. 840,000 c. 800,000 d. 960,000 19. How much gain (loss) from firm commitment is recognized on February 1, 20x2? 10 a. 40,000 b. (40,000) c. (60,000) d. 60,000 20. How much is the net cash settlement on the derivative instrument on February 1, 20x2? a. 200,000 b. (200,000) c. (320,000) d. 320,000 Cash flow hedge of a forecasted purchase transaction – Assessment of Hedge ineffectiveness Use the following information for the next eleven questions: On July 1, 20x1, ABC Co., a vegetable dealer, forecasts the purchase of 4,000 kilograms of broccoli in 6 months. Because ABC Co. is worried that the price of broccoli will increase during the coming months, it enters into 10 long cauliflower futures contracts on July 1, 20x1. Each futures contract is based on the purchase of 400 kilograms of cauliflower at ₱92.98 per kilogram on July 1, 20x1. Relevant prices per kilogram of commodity are shown below: Broccoli Cauliflower Jan. 1 93.76 92.98 Mar. 31 95.18 94.52 June 30 96.20 95.36 21. What is the percentage of effectiveness of the hedging instrument on March 31, 20x1 and June 30, 20x1, respectively? March 31, 20x1 June 30, 20x1 a. 102% 96% b. 95% 103% c. 108% 98% d. 97% 85% 22. How much is derivative asset (liability) on March 31, 20x1? a. (6,160) b. 6,160 c. (5,680) d. 5,680 23. How much is the effective portion of the change in fair value of derivative recognized in other comprehensive income on March 31, 20x1? – Gain (loss) a. 5,680 b. (5,680) c. 6,160 d. (6,160) 24. How much is the ineffective portion of the change in fair value of derivative recognized in profit or loss on March 31, 20x1? – Gain (loss) a. 0 b. 560 c. 480 d. (480) 25. As of March 31, 20x1, the effect of the futures contract is referred to as a. overhedge b. underhedge c. middle hedge d. bottom hedge 26. How much is the debit to inventory on June 30, 20x1? a. 375,280 b. 371,920 c. 384,800 d. 381,440 27. How much is the effective portion of the change in fair value of derivative recognized in other comprehensive income on June 30, 20x1? – Gain (loss) a. (3,840) b. 3,840 c. (4,321) d. 0 28. How much is the ineffective portion of the change in fair value of derivative recognized in profit or loss on June 30, 20x1? – Gain (loss) a. (480) b. 480 c. (960) d. 960 11 29. How much is the net cash settlement derivative instrument on June 30, 20x1? a. 3,360 b. (3,360) c. (9,520) receipt (payment) on the d. 9,520 30. How much is the total net effect of the hedging instrument on profit or loss? Favorable (unfavorable) a. 3,840 b. (3,840) c. (9,520) d. 9,520 31. If all of the inventory purchased were sold on July 15, 20x1, how much is the cost of goods sold? a. 384,800 b. 375,280 c. 381,440 d. 371,920 Fair value hedge of a recognized asset – Put option Use the following information for the next three questions: On December 15, 20x1, ABC Co. sold goods to a Japanese firm for 4,000,000 yens. ABC Co. was concerned about the fluctuation in the Japanese yen, so on this date, ABC Co. purchased a foreign currency put option for ₱30,000 to sell 4,000,000 yens at ₱0.47 on January 15, 20x2. Dec. 15, Dec. 31, Jan. 15, 20x1 20x1 20x1 Spot rate ₱0.48 ₱0.49 ₱0.46 Fair values of the foreign currency put option 30,000 20,000 32,000 32. How much is the gain (loss) on the put option on December 31, 20x1? a. 0 b. 40,000 c. (10,000) d. 10,000 33. How much is the net gain (loss) on the exercise of the put option on January 15, 20x1? a. (20,000) b. 20,000 c. 12,000 d. 8,000 34. Assume that the spot rate on January 15, 20x2 is ₱0.48. How much is the gain (loss) on the put option on January 15, 20x1? a. (20,000) b. 20,000 c. (32,000) d. (40,000) No hedging designation – Call option Use the following information for the next three questions: On April 1, 20x1, ABC Co. enters into a call option contract with an investment banker which gives ABC Co. the option to purchase 4,000 XYZ, Inc. shares of stocks at a strike price of ₱100 per share. The call option expires on July 1, 20x1. ABC Co. pays the investment banker ₱2,400 for the call option. The market price of the XYZ, Inc. shares on April 1, 20x1 is ₱100 per share. Additional information: April 1, 20x1 100/sh. 2,400 Market price of XYZ, Inc. shares Time value June 30, 20x1 106/sh. 1,600 35. How much is the gain (loss) on the call option on June 30, 20x1 arising from change in intrinsic value? a. 24,000 b. (24,000) c. 800 d. (800) 36. How much is the gain (loss) on the call option on June 30, 20x1 arising from change in time value? a. 800 b. (800) c. 24,000 d. (24,000) 12 37. How much is the net cash settlement receipt (payment) on the call option on July 1, 20x1? a. 24,000 b. (24,000) c. 23,200 d. (23,200) Cash flow hedge of a forecasted sale transaction (Indirect quotation) Use the following information for the next six questions: ABC Co. forecasts a sale to an Indian customer of INR 1,120,000 (Indian Rupee) in six months. On October 1, 20x1 when the spot rate is ₱1: INR 1.40, ABC Co. obtained an option to sell INR 1,120,000 for ₱783,216 (₱1 : INR1.43). The option has a cost and fair value of ₱25,600 on inception date. ABC Co. chose to base effectiveness on the changes in the intrinsic value of the option, as measured by the spot rate of the currency underlying the option (e.g., “spot” intrinsic value). Changes in the fair value of the option other than “intrinsic value” (e.g., time value, impact of counterparty nonperformance risk) are excluded from the assessment of effectiveness and will be reported in profit or loss as they occur. The following information was determined: Time value of Date Spot rate option a Oct. 1, 20x1 ₱1 : INR 1.40 25,600 Dec. 31, 20x1 ₱1 : INR 1.45 13,196 Apr. 1, 20x2 ₱1 : INR 1.50 - Fair value of option a 25,600 24,000 36,552 a These amounts are determined using an option pricing model. They are provided in order to simplify the problem. 38. How much derivative asset (liability) is recognized on October 1, 20x1? a. 23,664 b. (25,600) c. 25,600 d. 0 39. The hedging instrument is most likely designated as a a. fair value hedge b. cash flow hedge c. a or b d. none 40. The effective portion of the hedge recognized in other comprehensive income on December 31, 20x1 is a. 10,802 b. 25,746 c. 13,366 d. 0 41. How much derivative asset (liability) is recognized on December 31, 20x1? a. 13,196 b. (24,000) c. 24,000 d. 37,196 42. The effective portion of the hedge recognized in other comprehensive income on April 1, 20x2 is a. 10,802 b. 24,000 c. 12,404 d. 25,747 43. The adjusted sale revenue recognized on April 1, 20x2 is a. 798,364 b. 788,312 c. 783,215 d. 776,325 Cash flow hedge of a variable-rate debt (Swap payment at maturity) Use the following information for the next five questions: On January 1, 20x1, ABC Co. obtained a two-year, ₱4,000,000 variable-rate loan with interest payments due at each year-end and the principal due on December 31, 20x2. 13 As protection from possible fluctuations in current market rates, ABC Co. enters into an interest rate swap for the whole principal of the loan. Under the agreement, ABC Co. shall receive variable interest and pay fixed interest based on a fixed rate of 8%. The interest rate swap will be settled net on maturity date. The following are the current market rates: Jan. 1, 20x1 8% Jan. 1, 20x2 10% 44. The hedging instrument is most likely designated as a a. fair value hedge b. cash flow hedge c. a or b d. none 45. How much derivative asset (liability) is recognized on December 31, 20x1? a. 80,000 b. (72,728) c. 72,728 d. 74,074 46. How much is the derivative gain (loss) recognized in profit or loss on December 31, 20x1? a. 74,074 b. (72,728) c. 72,728 d. 0 47. The net cash settlement on the interest rate swap on December 31, 20x2 is – Receipt (payment) a. 80,000 b. (80,000) c. 72,728 d. 0 48. The interest expense recognized in profit or loss in 20x2 is a. 320,000 b. 240,000 c. 335,728 d. 0 Cash flow hedge of a variable-rate debt (Swap payments at each year-end) Use the following information for the next nine questions: On January 1, 20x1, ABC Co. obtained a three-year, ₱4,000,000 variablerate loan with interest payments due at each year-end and the principal due on December 31, 20x3. As protection from possible fluctuations in current market rates, ABC Co. enters into an interest rate swap for the whole principal of the loan. Under the agreement, ABC Co. shall receive variable interest and pay fixed interest based on a fixed rate of 9%. Swap payments shall be made at each year-end. The following are the current market rates: Jan. 1, 20x1 9% Jan. 1, 20x2 8% Jan. 1, 20x3 12% 49. The net cash settlement on December 31, 20x1 is a. 40,000 b. 37,037 c.36,697 d. 0 50. The derivative asset (liability) on December 31, 20x1 is a. 37,037 b. (71,331) c. 36,697 d. 40,000 51. The net cash settlement receipt (payment) on December 31, 20x2 is a. 36,697 b. (71,331) c. (40,000) d. 0 52. The balance of accumulated OCI recognized on the hedging instrument as of December 31, 20x2 is – Debit (credit) a. (67,140) b. (107,141) c. (138,472) d. 0 14 53. The interest expense recognized in profit or loss in 20x2 is a. 400,000 b. 387,542 c. 421,984 d. 0 54. The derivative asset (liability) on December 31, 20x2 is a. 107,141 b. (107,141) c. 138,472 d. (67,140) 55. How much is the derivative gain (loss) recognized in OCI on December 31, 20x2? a. 138,472 b. (138,472) c. 107,141 d. (107,141) 56. The net cash settlement – receipt (payment) – on the interest rate swap on December’ 31, 20x3 is a. 50,000 b. 120,000 c. 80,000 d. (120,000) 57. The interest expense recognized in 20x3 is a. 400,000 b. 240,000 c. 520,000 d. 320,000 Fair value hedge of a fixed-rate debt Use the following information for the next eight questions: On January 1, 20x1, ABC Co. obtained a three-year, ₱4,000,000, 10% fixedrate loan with interest payments due at each year-end and the principal due on December 31, 20x3. ABC Co. expects that the current interest rates will decrease in the future. Thus, ABC Co. enters into a “receive fixed, pay variable” interest rate swap. Swap payments shall be made at each year-end. The following are the current market rates: Jan. 1, 20x1 10% Jan. 1, 20x2 12% Jan. 1, 20x3 14% 58. The derivative asset (liability) on December 31, 20x1 is a. 135,204 b. (135,204) c. 80,000 d. (80,000) 59. Unrealized gain (loss) on the derivative instrument recognized in profit or loss on December 31, 20x1 is a. 135,204 b. (135,204) c. 80,000 d. 0 60. Unrealized gain (loss) on the hedged item recognized in profit or loss on December 31, 20x1 is a. 135,204 b. (135,204) c. 80,000 d. 0 61. The interest expense recognized in 20x2 is a. 400,000 b. 264,796 c. 463,776 d. 535,204 62. The derivative asset (liability) on December 31, 20x2 is a. 140,352 b. (140,352) c. 168,342 d. (168,342) 63. Unrealized gain (loss) on the derivative instrument recognized in profit or loss on December 31, 20x2 is a. 140,352 b. (140,352) c. (168,342) d. 0 64. Unrealized gain (loss) on the hedged item recognized in profit or loss on December 31, 20x2 is a. 140,352 b. (140,352) c. (168,342) d. 0 15 65. The interest expense recognized in 20x3 is a. 400,000 b. 540,351 c. 493,867 d. 565,304 Accounting for Derivatives and Hedging Transactions3 (Part 3) Multiple Choice – Computational Hedge of a net investment in foreign operation Use the following fact pattern for the next eight questions: Fact pattern On July 1, 20x1, ABC Co. acquired 100% interest in XYZ, Inc., a company situated in a foreign country. The currency of this country is the Armenian Dram (AMD). The business combination did not result to any goodwill. The year-end financial statements of the combining constituents show the following information: Assets Investment in subsidiary Receivable from XYZ, Inc. Total assets Liabilities Payable to ABC Co. Equity - Jan. 1, 20x1 Profit for the year Total liabilities and equity July 1, 20x1 Date of acquisition ABC Co. XYZ, Inc. (in pesos) (in AMD) 40,000,000 24,000,000 8,000,000 - Dec. 31, 20x1 Reporting date ABC Co. XYZ, Inc. (in pesos) (in AMD) 56,000,000 40,000,000 - 8,000,000 - - 4,000,000 - 48,000,000 24,000,000 68,000,000 40,000,000 32,000,000 - 12,000,000 - 32,000,000 - 14,000,000 7,000,000 16,000,000 12,000,000 16,000,000 12,000,000 20,000,000 7,000,000 68,000,000 40,000,000 48,000,000 24,000,000 The following are the relevant exchange rates: Spot rate at 7/1/20x1 Spot rate at 12/31/20x1 Average spot rate from 7/1/20x1 to 12/31/20x1 Twelve-month forward rate at 7/1/20x1 Six-month forward rate at 12/31/20x1 ₱1 ₱1 ₱1 ₱1 ₱1 : : : : : AMD AMD AMD AMD AMD 1.50 2.00 1.75 1.54 2.02 Case#1: No hedging instrument 1. How much is the FOREX gain (loss) arising from translation of intercompany accounts recognized in the subsidiary’s 20x1 separate financial statements? a. 2,400,000 b. (2,400,000) c. (1,000,000) d. 1,000,000 2. How much is the subsidiary’s 20x1 adjusted separate profit immediately before consolidation? a. 6,000,000 b. 8,000,000 c. 6,362,524 d. 8,429,824 3. How much is the translation adjustment to be recognized in OCI in the 20x1 consolidated financial statements? - gain (loss) a. (2,571,429) b. 2,571,429 c. 2,428,571 d. (2,428,571) 3 ADAPTED QUESTIONS FROM V. Z. MILLAN 16 4. How much is the year-end consolidated total assets? a. 76,000,000 b. 80,000,000 c. 74,362,428 d. 78,522,542 5. How much is the year-end consolidated total equity? a. 37,571,428 b. 40,000,000 c. 37,000,000 d. 42,376,542 Case #2: With hedging instrument Use the same fact pattern, except that ABC Co. decided on July 1, 20x1 to limit its foreign currency exposure as it relates to the initial net investment by entering into a forward contract to sell ADM 20,000,000 (tax rate 40%) at a forward rate of 1.54 in 12 months and to designate it as a hedge of the net investment. The appropriate discount factor is 0.971286. 6. How much is the translation adjustment to be recognized in OCI in the 20x1 consolidated financial statements? - gain (loss) a. (630,124) b. 621,739 c. 428,571 d. (428,571) 7. How much is the year-end consolidated total assets? a. 72,340,242 b. 80,000,000 c. 71,798,447 d. 78,000,000 8. How much is the year-end consolidated total equity? a. 38,798,448 b. 40,000,000 c. 37,000,000 d. 42,376,542 Forward contract – Hedge of a recognized asset Use the following information for the next three questions: On March 1, 20x1, ABC Co. sold inventory to a foreign company for FC 4,000,000 (‘FC’ means foreign currency) when the spot exchange rate is FC 40: ₱1. The payment is due on April 1, 20x1. ABC Co. is concerned about the possible fluctuation in exchange rates, so on this date, ABC Co. entered into a forward contract to sell FC 4,000,000 for ₱100,000 to a broker. According to the terms of the forward contract, if FC 4,000,000 is worth less than ₱100,000 on April 1, 20x1, ABC Co. shall receive from the broker the difference; if it is worth more than ₱100,000, ABC Co. shall pay the broker the difference. 9. Case #1: If the exchange rate on April 1, 20x1 is FC35: ₱1, how much is the net cash settlement? - Receipt / (Payment) a. 14,286 b. (14,286) c. 12,366 d. (12,366) 10. Case #2: If the exchange rate on April 1, 20x1 is FC50: ₱1, how much is the net cash settlement? - Receipt / (Payment) a. 23,478 b. (23,478) c. 20,000 d. (20,000) 11. Case #3: If the exchange rate on April 1, 20x1 is FC45: ₱1, how much is the fair value of the interest rate swap? – Asset / (Liability) a. 11,111 b. (11,111) c. 12,366 d. (12,366) Forward contract – Hedge of a forecast transaction Use the following information for the next two questions: ABC Co. does printing jobs for various customers. On January 1, 20x1, ABC Co. forecasted the purchase of 1,000 reams of paper in the next quarter. The expected purchase date is on April 15, 20x1. ABC Co. expects that the price of paper will fluctuate because of the upcoming elections. Thus, on January 1, 20x1, ABC Co. enters into a forward contract to purchase 1,000 reams of paper at a forward rate of ₱2,400 per ream. If the market price on April 15, 20x1 is more than 17 ₱2,400, ABC Co. shall receive the difference from the broker. On the other hand, if the market price is less than ₱2,400, ABC Co. shall pay the difference to the broker. The forward contract will be settled net on April 15, 20x1. The discount rate is 10%. 12. If the price of paper is ₱2,800 per ream on March 31, 20x1, how much is the derivative asset (liability) to be recognized in ABC Co.’s first quarter financial statements? a. 367,338 b. (367,338) c. 400,000 d. (400,000) 13. If the price of paper is ₱2,200 per ream on March 31, 20x1, how much is the derivative asset (liability) to be recognized in ABC Co.’s first quarter financial statements? a. 187,333 b. (187,333) c. 200,000 d. (200,000) Forward contract – Present value Use the following information for the next three questions: ABC Co. produces feeds for hogs and chickens. In its long-term budget completed on November 1, 20x1, ABC Co. forecasts a purchase of 100,000 kilos of corn on January 1, 20x3. To protect itself from fluctuation in prices, ABC Co. enters into a forward contract on November 1, 20x1 to purchase 100,000 kilos of corn for ₱20,000,000 (or ₱200 per kilo). The forward contract will be settled net on January 1, 20x3. 14. What is the notional value of the forward contract? a. 20,000,000 b. 30,000,000 c. 40,000,000 d. 50,000,000 15. If the current market price of corn is ₱260 per kilo on December 31, 20x1, what amount of derivative asset (liability) shall be reported in ABC Co.’s 20x1 year-end financial statements? The appropriate discount rate is 10%. a. 5,454,545 b. (5,454,545) c. 6,000,000 d. (6,000,000) 16. If the current market price of corn is ₱160 per kilo on December 31, 20x2, what amount of derivative asset (liability) shall be reported in ABC Co.’s 20x2 year-end financial statements? The appropriate discount rate is 10%. a. 3,636,364 b. (3,636,364) c. 4,000,000 d. (4,000,000) Futures contract 17. ABC Co. has the following futures contract: Futures price Quantity - 1/1/x1 1. "Long" futures contract to 400 2,000 purchase gold 2. "Long" futures contract to 800 1,600 purchase silver 3. "Short" futures contract to 4,000 250 sell coffee beans 4. "Short" futures contract to 6,000 60 sell potatoes Market price - 12/31/x1 1,800 1,900 220 75 How much is the total net derivative asset (liability) on December 31, 20x1? a. 220,000 b. (220,000) c. 190,000 d. (190,000) 18 Call option Use the following information for the next two questions: On May 6, 20x1, ABC Co. entered into a firm commitment to purchase equipment from a foreign company for FC 4,000,000 when the exchange rate was FC 40: ₱1. Payment is due on June 1, 20x1. ABC Co. is concerned about the possible fluctuation in exchange rates, so on this date, ABC Co. entered into a call option to purchase FC 4,000,000 for ₱100,000 to a broker. ABC Co. paid ₱4,000 for the purchased option. 18. Case #1: If the exchange rate on June 1, 20x1 is FC 35: ₱1, how much did ABC Co. save by purchasing the call option? a. 14,286 b. (14,286) c. (14,000) d. 0 19. Case #2: If the exchange rate on June 1, 20x1 is FC 50: ₱1, how much did ABC Co. save by purchasing the call option? a. 20,000 b. (20,000) c. (6,000) d. 0 Put option 20. On March 31, 20x1, ABC Co. acquired for ₱40,000 a put option which entitles ABC Co. to sell 20,000 units of a commodity for ₱880 per unit. The option expires on July 1, 20x1. On July 1, 20x1, the current market price of the commodity is ₱1,000 per unit. How much is the loss on the put option to be recognized by ABC Co. in its 20x1 financial statements? a. 40,000 b. 240,000 c. 280,000 d. 0 Call option – No hedging designation Use the following information for the next four questions: On October 1, 20x1, ABC Co. acquired for ₱40,000 a call option which entitles ABC Co. to purchase 20,000 units of a commodity for ₱880 per unit. The option is exercisable on March 31, 20x2. The call option was not designated as a hedging instrument. The following are the current market prices: October 1, 20x1 880 December 31, 20x1 960 March 31, 20x1 1,000 21. How much is the derivative asset (liability) on December 31, 20x1? a. (1,600,000) b. 1,640,000 c. 1,600,000 d. (1,560,000) 22. How much is the unrealized gain (loss) on December 31, 20x1? a. (1,560,000) b. 1,560,000 c. 1,600,000 d. (1,600,000) 23. How much is the net cash settlement – receipt (payment) – on March 31, 20x2? a. 2,440,000 b. 2,360,000 c. (2,400,000) d. 2,400,000 24. How much is the realized gain (loss) on the call option on March 31, 20x2? a. 760,000 b. (840,000) c. (800,000) d. 800,000 Interest rate swap (swap payment at maturity) Use the following fact pattern for the next four questions: On January 1, 20x1 when the current market rate of interest was 10%, ABC Co. obtained a two-year, ₱4,000,000, variable-rate loan. Interest payments on the loan are due every year-end. 19 ABC Co. was worried about future fluctuations in interest rates. Thus, on January 1, 20x1, ABC Co. entered into an interest rate swap wherein ABC Co. shall receive interest at whatever the current market rate of interest is at the beginning of the year and pay fixed interest at 10%. Swap payment shall be made only at maturity date. Case #1: 25. If the current market rate of interest on January 1, 20x3 is 8%, how much is the net cash settlement at maturity date? – Receipt (Payment) a. (80,000) b. 80,000 c. (30,000) d. 0 26. If the current market rate of interest on December 31, 20x2 is 8%, how much is the fair value of the interest rate swap? - Asset (Liability) a. (74,072) b. 74,072 c. (80,000) d. (72,727) Case #2: 27. If the current market rate of interest on January 1, 20x3 is 12%, how much is the net cash settlement at maturity date? – Receipt (Payment) a. (80,000) b. 80,000 c. (30,000) d. 0 28. If the current market rate of interest on December 31, 20x2 is 12%, how much is the fair value of the interest rate swap? – Asset (Liability) a. (71,432) b. 71,432 c. 80,000 d. 72,727 Interest rate swap (periodic swap payments) Use the following information for the next three questions: On January 1, 20x1, ABC Co. obtained a five-year, ₱4,000,000 variable-rate loan with interest payments due at each year-end and the principal due on December 31, 20x5. As protection from possible fluctuations in current market rates, ABC Co. enters into an interest rate swap for the whole principal of the loan. Under the agreement, ABC Co. shall receive variable interest and pay fixed interest based on a fixed rate of 8%. Swap payments shall be made at each year-end. The following are the current market rates: Jan. 1, 20x1 8% Jan. 1, 20x2 9% Jan. 1, 20x3 12% 29. What is the “notional” amount of the interest rate swap agreement? a. 4,000,000 b. 320,000 c. 4,320,000 d. 0 30. How much is the fair value of the interest rate swap on December 31, 20x1? – Asset (Liability) a. 40,000 b. (36,697) c. 36,697 d. 129,589 31. How much is the fair value of the interest rate swap on December 31, 20x2? – Asset (Liability) a. 384,292 b. 202,806 c. 143,234 d. 36,697 20 Theory of Accounts Reviewer 1. In accordance with PFRS 7, which of the following best describes the risk that an entity will encounter if it has difficulty in meeting obligations associated with its financial liabilities? a. Liquidity risk b. Credit risk c. Financial risk d. Payment risk 2. In accordance with PFRS 7, which of the following best describes credit risk? a. The risk that one party to a financial instrument will cause a financial loss for the other party by failing to discharge an obligation b. The risk that an entity will encounter difficulty in meeting obligations associated with financial liabilities c. The risk that the fair value associated with an instrument will vary due to changes in the counterparty's credit rating d. The risk that an entity's credit facilities will be withdrawn due to cash flow sensitivities 3. Which of the following are types of hedging relationship? I. Cash flow hedge II. Credit risk hedge III. Interest rate hedge IV. Fair value hedge a. I only b. I and II c. I and IV d. All of these 4. In accordance with PFRS 7, which of the following are components of market risk? I. Credit risk II. Currency risk III. Interest rate risk IV. Liquidity risk a. I only b. I and II c. I and IV d. All of these 5. Techniques such as hedging, forward contracts and options can: a. Reduce risk. c. Totally eliminate risk. b. Increase risk. d. Are purely for speculation. 6. Which of the following is the characteristic of a perfect hedge? a. No possibility of future gain or loss b. No possibility of future gain only c. No possibility of future loss only d. The possibility of future gain and no future loss (AICPA) 7. It is a financial instrument which its return is based on the return of some other underlying asset a. FVPL b. FVOCI c. Amortized cost d. Derivative 8. When an entity is unable to separate an embedded derivative from its host contract, the entity should classify the hybrid instrument as a. FVPL b. FVOCI 21 c. Amortized cost d. a or b 9. If a company having a floating-rate debt is concerned that interest rates will rise causing interest costs to increase, it would most likely to enter into a swap to a. Pay-variable rate and receive-fixed rate. b. Pay-fixed rate and receive-floating rate. c. Swaps are not used for this purpose. d. It would depend on whether the swap is in, at, or out-of-the money. 10. Arnold Co. purchased a call option on the rice field of Robert Co. on January 1, 200A exercisable on or before January 1, 200B. On December 31, 200A, the fair market value of the rice field was below the call option price, making the instrument “out of the money,” and Arnold Co. decided not to exercise the call option. Which of the following statements is correct? a. The call option does not meet the definition of a derivative under PFRSs regarding settlement at a future date. b. The call option does not meet the definition of a derivative under PFRSs regarding the absence of initial net investment or the presence of a little initial net investment c. The call option meets the definition of a derivative under PFRSs regarding settlement at a future date since expiry at maturity is a form of settlement even though there is no additional exchange of consideration. d. The call option meets the definition of a derivative; however, it should be written off on December 31, 200A and a corresponding financial liability should be recognized. 11. On January 1, 200A, Clifton Co. enters into a forward contract to purchase 10,000 shares of stock from Jane Co. on December 31, 200A at a forward price of ₱100 per share. Clifton Co. prepays the shares at ₱100 per share which is the current price of the shares on January 1, 200A. Which of the following is correct? a. The forward contract meets the definition of a derivative. b. The forward contract fails the “underlying” test for a derivative since the current price and forward price are equal on inception. c. The forward contract fails the “future settlement” test for a derivative since Clifton Co. prepaid the shares at inception at an amount equal to settlement price. Prepayment at an amount equal to settlement price is tantamount to settlement. d. The forward contract fails the “no initial net investment or an initial net investment that is smaller than would be required for other types of contracts that would be expected to have a similar response to changes in market factors” test for a derivative. 12. Which of the following may qualify as net investment in a foreign operation, of a Philippine company, to be a hedged item for hedge accounting purposes? a. fish ball and kikyam operations in the US b. investment in associate on a company operating in Canada c. joint venture with McDonalds to sell Mcbalut in retail stores all over the world d. investment in subsidiary on a domestic corporation selling e-load and auto load only within the Philippines. 22 13. To be considered highly effective, actual results of the hedge should a. be 100% effective c. result to no gain or loss b. be within a range of 80 to 125% d. be documented properly 14. Which of the following is not a derivative? a. Equity contracts c. Option Contract b. Futures contract d. Swap contracts (Adapted) 15. An interest rate swap in which company has fixed rate of interest and pays a variable rate is called a : a. cash flow hedge b. fair value hedge c. deferred hedge d. hedge of foreign currency exposure of net investment in foreign operations (Adapted) 16. A derivative may be: a. an asset account b. a liability account c. an equity account d. either an asset or liability account 17. The PFRSs require a company to recognize in its current net income any gain or loss from a change in the fair value of the derivative for a: (Item #1) Fair Value Hedge; (Item #2) Cash Flow Hedge a. Yes, Yes b. Yes, No c. No, No d. No, Yes 18. Uncertainty about the future market value of an asset is referred to as a. price risk. c. interest rate risk. b. credit risk. d. exchange rate risk. 19. Uncertainty that the party on the abide by the terms of the agreement is a. price risk. c. interest b. credit risk. d. exchange other side of an agreement will referred to as rate risk. rate risk. 20. A contract, traded on an exchange, that allows a company to buy a specified quantity of a commodity or a financial security at a specified price on a specified future date is referred to as a(n) a. interest rate swap. c. futures contract. b. forward contract. d. option. 21. An agreement between two parties to exchange a specified amount of a commodity, security, or foreign currency at a specified date in the future with the price or exchange rate being set now is referred to as a(n) a. interest rate swap. c. futures contract. b. forward contract. d. option. 22. If a cannery wanted to lock in the price they would pay for peaches in August four months before harvest (in April of the same year), they would be most likely to enter into which kind of agreement? a. Interest rate swap c. Futures contract b. Fixed commodities contract d. Option 23 23. or in a. b. A contract giving the owner the right, but not the obligation, to buy sell an asset at a specified price any time during a specified period the future is referred to as a(n) interest rate swap. c. futures contract. forward contract. d. option. 24. of a. b. c. d. In exchange for the rights inherent in an option contract, the owner the option will typically pay a price only when a call option is exercised. only when a put option is exercised. when either a call option or a put option is exercised. at the time the option is received regardless of whether the option is exercised or not. 25. Which type of contract is unique in that it protects the owner against unfavorable movements in the prices or rates while allowing the owner to benefit from favorable movements? a. interest rate swap. c. futures contract. b. forward contract. d. option. 26. When gains or losses on derivatives designated as fair value hedges exceed the gains or losses on the item being hedged, the excess a. affects reported net income. b. is recognized as an equity adjustment. c. is recognized as part of comprehensive income. d. is not recognized. 27. For which type of derivative are changes in the fair value deferred and recognized as an equity adjustment? a. Fair value hedge c. Operating hedge b. Cash flow hedge d. Notional value hedge (Adapted) 28. Which choice best describes the information that should be disclosed related to derivative contracts? a. Fair value c. Both a and b b. Notional amount d. Neither a nor b 29. On February 1, Shoemaker Corporation entered into a firm commitment to purchase specialized equipment from the Okazaki Trading Company for ¥80,000,000 on April 1. Shoemaker would like to reduce the exchange rate risk that could increase the cost of the equipment in U.S. dollars by April 1, but Shoemaker is not sure which direction the exchange rate may move. What type of contract would protect Shoemaker from an unfavorable movement in the exchange rate while allowing them to benefit from a favorable movement in the exchange rate? a. Interest rate swap c. Call option b. Forward contract d. Put option 30. A company enters into a futures contract with the intent of hedging an account payable of DM400,000 due on December 31. The contract requires that if the U.S. dollar value of DM400,000 is greater than $200,000 on December 31, the company will be required to pay the difference. Alternatively, if the U.S. dollar value is less than $200,000, the company will receive the difference. Which of the following statements is correct regarding this contract? 24 a. The Deutsche mark futures contract effectively hedges against the effect of exchange rate changes on the U.S. dollar value of the Deutsche mark payable. b. The futures contract is a contract to buy Deutsche marks at a fixed price. c. The futures contract is a contract to sell Deutsche marks at a fixed price. d. The contract obligates the company to pay if the value of the U.S. dollar increases. 31. A company enters into a futures contract with the intent of hedging an expected purchase of some equipment from a German company for DM400,000 on December 31. The contract requires that if the U.S. dollar value of DM800,000 is greater than $400,000 on December 31, the company will receive the difference. Alternatively, if the U.S. dollar value is less than $400,000, the company will pay the difference. Which of the following statements is correct regarding this contract? a. The Deutsche mark futures contract effectively hedges against the effect of exchange rate changes on the U.S. dollar value of the Deutsche mark commitment. b. The futures contract exceeds the amount of the commitment and thus hedges movements in the Deutsche mark exchange rate. c. The futures contract is a contract to sell Deutsche marks at a fixed price. d. The extra DM400,000 would be accounted for as a speculative investment. 32. A company enters into an interest rate swap in order to hedge a $5,000,000 variable-rate loan. The loan is expected to be fully repaid this year on June 10. The contract requires that if the interest rate on April 30 of next year is greater than 11%, the company receives the difference on a principal amount of $5,000,000. Alternatively, if the interest rate is less than 11%, the company must pay the difference. Which of the following statements is correct regarding this contract? a. The swap agreement effectively hedges the variable interest payments. b. The timing of the swap payment matches the timing of the interest payments and, therefore, the variable interest payments are hedged. c. The timing of the swap payment does not match the timing of the interest payments and, therefore, the variable interest payments are not hedged. d. This swap represents a fair value hedge. Use the following information for the next four questions: Fact pattern Hall, Inc., enters into a call option contract with Bennett Investment Co. on January 2, 2016. This contract gives Hall the option to purchase 1,000 shares of WSM stock at $100 per share. The option expires on April 30, 2016. WSM shares are trading at $100 per share on January 2, 2016, at which time Hall pays $100 for the call option. 33. a. b. c. d. The call option would be recorded in the accounts of Hall as an asset. a liability. a gain. would not be recorded in the accounts (memorandum entry only). 25 34. Assume that the price of the WSM shares has risen to $120 per share on March 31, 2016, and the Hall is preparing financial statements for the quarter ending March 31. As regards this option, Hall, Inc., would report which of the following? a. A $20,000 realized gain. b. A $20,000 unrealized gain. c. a description of the change in price would be disclosed in the notes to the financial statements, but would not be reflected in the financial statements. d. Nothing would be reported in the financial statements or the notes thereto. 35. The 1,000 shares of WSM stock in this contract is referred to as a. the collateral. c. the option premium. b. the notional amount. d. the derivative. (Adapted) 36. The $400 paid by Hall, Inc., to Baird Investment is referred to as a. the option premium. c. the strike price. b. the notional amount. d. the intrinsic value. (Adapted) 37. Assume that the price per share of WSM stock is $120 on April 30, 2016, and that the time value of the option has not changed. In order to settle the option contract, Hall, Inc., would most likely a. pay Baird Investment $20,000. b. purchase the shares of WSM at $100 per share and sell the shares at $120 per share to Baird. c. receive $20,000 from Baird Investment. d. receive $400 from Baird Investment. (Adapted) 38. Alpha Company purchases a call option to hedge an investment in 20,000 shares of Beta Company stock. The option agreement provides that if the prices of a share of Beta Company stock is greater than $30 on October 25, Alpha receives the difference (multiplied by 20,000 shares). Alternatively, if the price of the stock is less than $30, the option is worthless and will be allowed to expire. Which of the following statements regarding this call option is correct? a. The call option effectively hedges the investment in the shares of Beta stock. b. The call option is an option to sell Beta Company stock at a fixed price. c. The call option represents a speculative option rather than a hedge. d. Alpha could have purchased a put option or a call option to effectively hedge the investment in the shares of Beta stock. (Adapted) 39. Which of the following statements about options and their underlying assets is FALSE? a. The value of an option, in comparison to its underlying asset, has the potential of creating an arbitrage opportunity. b. The owner of the option is legally required to engage in a transaction involving the asset. c. The holder of a long position on an option is the only party with the right to initiate a transaction involving the asset. d. The seller of the option is legally required to engage in a transaction involving the asset. 26 (Adapted) 40. Which of the following statements about forward and future contracts is FALSE? a. A future requires the contract purchaser to receive delivery of the good at a specified time. b. A predetermined price to be paid for a good is a necessary requirement in the terms of a forward contract. c. The future value of a financial derivative depends on the value of its underlying asset. d. The primary difference between forwards and futures is that only futures are considered financial derivatives. (Adapted) 41. Futures contracts differ from forward contracts in which of the following ways? a. Performance of each party in a futures transaction is guaranteed by a clearinghouse. b. All of these choices are correct. c. Futures contracts require a daily settling of any gains or loses. d. Futures contracts are standardized. (Adapted) 42. Which of the following statements accurately describes how futures contracts differ from forward contracts? a. Futures contracts are standardized. b. Futures contracts require a daily settling of gains and losses. c. All of these choices are correct. d. The performance of counterparties to a futures contract is guaranteed by a clearinghouse. (Adapted) 43. When a call option on a future is exercised, the buyer receives: a. a short position in the underlying future. b. an option to purchase the underlying future. c. the physical good. d. a long position in the underlying future and a cash payment. (Adapted) 44. Which of the following statements about swap agreements is FALSE? a. They are standardized agreements, similar to futures. b. Counterparties are the principles who engage in a swap agreement. c. They allow for the exchange of different sets of future cash flows. d. Interest rate and currency are common types of swaps. (Adapted) 45. Which of the following requires the purchase of the underlying asset at a specified price? a. Purchasing a call option. c. Writing a call option. b. Writing a put option. d. Purchasing a put option. (Adapted) 46. Frank Jameson is a portfolio manager with 90 percent of the large-cap diversified mutual fund he controls invested in common stocks. Jameson is concerned the overall market will decline by a significant amount over the next two months due to a slowing of the general economy. Which of the following actions will provide a hedge for the mutual fund? a. Selling interest rate future contracts. 27 b. Writing put options on the S&P 500. c. Purchasing put options on the Standard and Poor's 500 Index (S&P 500). d. Purchasing call options on the S&P 500. (Adapted) 47. Ron Jensen is a speculator who does not currently own GHP Corporation common stock but believes it will increase in market value by 25 percent over the next month. Jensen can most likely achieve the highest percentage return on the expected stock price increase by: a. writing GHP put options. c. buying GHP put options. b. buying GHP call options. d. buying GHP common stock. (Adapted) 48. Which of the following statements about derivatives is TRUE? a. Although forwards have terms that are not standardized, the clearinghouse of that exchange still takes the opposite position of each trade, thereby protecting the counterparties from default risk. b. Although minimal, arbitragers face the risk of the market value of the underlying asset declining by an amount greater then what was protected with the hedge. c. When a call option on a future is exercised, the seller receives a short position in the underlying future plus pays cash to the holder of the option. d. The market value of a financial derivative is primarily a function of the relative demand and supply for that contract. (Adapted) 49. If an oil wholesaler expects to buy some gasoline for his customers in the future and wants to hedge his risk, he needs to: a. sell gasoline now. c. do nothing. b. sell crude oil futures contract. d. buy crude oil futures contract. (Adapted) 50. Which of the following statements about forward contracts is CORRECT? A long trader agrees to: a. take delivery, and a short trader agrees to take delivery b. take delivery, and a short trader agrees to make delivery. c. take delivery, and a short trader agrees to make delivery. d. make delivery, and a short trader agrees to take delivery. (Adapted) 51. If a farmer expects to sell his wheat in anticipation of a harvest and wants to hedge his risk, he needs to: a. sell wheat now. c. buy wheat futures contracts now. b. buy wheat now. d. sell wheat futures contracts now. (Adapted) 52. Which of the following statements about speculators and hedgers in the futures market is TRUE? a. Hedging can allow a business to guard against a price increase in a commodity without sacrificing profit if the commodity price decreases. b. A speculator would use futures to take a long position in a commodity if its price is expected to decrease. c. A speculator would use futures to take a short position in a commodity if its price is expected to increase. d. Hedgers guard against market price changes that would cause a reduction in their operating profit. 28 (Adapted) 53. Standardized futures contracts are an aid to increased market liquidity because: a. standardization results in less trading activity. b. uniformity of the contract terms broadens the market for the futures by appealing to a greater number of traders. c. standardization of the futures contract stabilizes the market price of the underlying commodity. d. non-standardized forward contracts are not allowed to trade. (Adapted) 54. Futures have greater market liquidity than forward contracts, because futures are: a. developed with specific characteristics to meet the needs of the buyer. b. standardized contracts. c. sold only for widely traded commodities, unlike forwards. d. written for shorter periods of time. (Adapted) 55. Standardization features of futures contracts do not include the: a. quality of the good that can be delivered. b. delivery time. c. quantity of the good to be delivered. d. delivery price of the commodity. (Adapted) 56. What is the primary difference between an American and a European option? a. American and European options are never written on the same underlying asset. b. The European option can only be traded on overseas markets. c. The American option can be exercised at any time on or before its expiration date. d. American and European options always have different strike prices when written on the same underlying asset. (Adapted) 57. American options are worth no less than European options with the same maturity, exercise price, and underlying stock because: a. purchasers of American options receive stock dividends, while purchasers of European options do not. b. American options are traded in U.S. exchanges where trading costs are less than in European exchanges. c. all of these choices are correct. d. American options can be exercised before maturity, while European options can be exercised only at maturity. (Adapted) 58. Which of the following statements about European and American options is FALSE? a. European options offer more flexible trading opportunities for speculators. b. American options can be exercised at any time on or before the expiration date. c. European options are easier to analyze and value than American options. d. American options are far more common than European options. (Adapted) 29 59. Which of the following statements regarding options is TRUE? a. An American option is worth no less than a European option with the same maturity, exercise price, and underlying stock. b. European options are always worth the same as American options with the same maturity, exercise price, and underlying stock. c. European options are always worth more than American options with the same maturity, exercise price, and underlying stock. d. All of these choices are correct. 60. The writer of the put option has the: a. obligation to sell the underlying asset in the future conditions. b. right to buy the underlying asset in the future conditions. c. right to sell the underlying asset in the future conditions. d. obligation to buy the underlying asset in the future conditions. under certain under certain under certain under certain 61. The writer of an option has: a. neither the right nor obligation. c. the right. b. both the right and obligation. d. the obligation. 62. John Elam has a position in an option in which Elam pays an upfront fee to receive payments if the value of a stock is below $18 at expiration. If the stock is not below $18 at expiration, Elam receives nothing. Elam’s position in the option is: a. short a put option. c. long a call option. b. short a call option. d. long a put option. 63. James Anthony has a short position in a put price of $94. If the stock price is below $94 at happen to Anthony’s short position in the option? a. The person who is long the put option will option. b. He will have the option exercised against him who is long the put option. c. He will exercise the option at $94. d. He will let the option expire. option with a strike expiration, what will not exercise the put at $94 by the person 64. Which of the following represents a long position in an option? a. Writing a call option. c. Writing a naked call option. b. Writing a put option. d. Buying a put option. 65. a. b. c. The options market is a zero-sum game in that: whatever the long call gains, the short call loses. the short put position has limited gain but also has limited loss. the long put position can gain infinitely, but the long call position can only lose the premium. d. the long put position has limited gain but also has limited loss. 66. The options market is a zero-sum game because: a. there are no net profits or losses in the market. b. the profits from the buyer and seller of a call option together are always zero. c. all of these choices are correct. d. profits come only at the expense of another trader. 30 67. Which of the following statements regarding buyers of call and options is TRUE? a. Buyers of calls anticipate the value of the underlying asset decrease, while the buyers of puts anticipate the value of underlying asset to increase. b. Buyers of calls anticipate the value of the underlying asset decrease, and buyers of puts also anticipate the value of underlying asset to decrease. c. Buyers of calls anticipate the value of the underlying asset increase, and buyers of puts also anticipate the value of underlying asset to increase. d. Buyers of calls anticipate the value of the underlying asset increase, while the buyers of puts anticipate the value of underlying asset to decrease. put to the to the to the to the 68. Which of the following is a reason to use the swaps market rather than the futures market? To: a. maintain the firm's privacy. b. increase the liquidity of the contract. c. reduce the credit risk involved with the contract. d. provide for a standardized contract. 69. is a. b. c. d. Which of the following statements about notional principal in swaps TRUE? Notional principal is used as a base for computation of payments. Notional principal is useless in most swaps. Notional principal is not actually exchanged. Notional principal is not actually exchanged and notional principal is used as a base for computation of payments. 70. a. b. c. d. Parties agreeing to swap cash flows are: dealers. agents. counterparties. swap facilitators. 71. Consider a commercial bank that is about to make a large variablerate loan. Which of the following would be an appropriate position for the bank to hedge its risk with this loan? Pay: a. variable to a currency swap counterparty and receive fixed. b. variable to an interest rate swap counterparty and receive fixed. c. fixed to an interest rate swap counterparty and receive variable. d. fixed to a currency swap counterparty and receive variable. 72. Consider a commercial bank that has many floating-rate liabilities and has many fixed-rate assets. Which of the following would be an appropriate position for the bank to hedge its risk? Pay: a. variable to an interest rate swap counterparty and receive fixed. b. fixed to a currency swap counterparty and receive variable. c. variable to a currency swap counterparty and receive fixed. d. fixed to an interest rate swap counterparty and receive variable. 73. A typical savings and loan association accept deposits (which is floating rate in nature) and lend those funds on fixed rate terms. As a result, it can be left with floating rate liabilities and fixed rate 31 assets. To escape this interest rate risk, the savings and loan might be motivated to engage in: a. a currency swap. c. an interest rate swap. b. an equity swap. d. swaps can never help. 74. An interest rate swap: a. all of these choices are correct. b. allows a firm to convert outstanding fixed rate debt to floating rate debt. c. allows a firm to convert outstanding floating rate debt to fixed rate debt. d. obligates two counterparties to exchange cash flows at one or more future dates. 75. The main motivation for engaging in swap transactions is: a. commercial needs. c. both of these choices are correct. b. comparative borrowing advantages. d. none of these choices are correct. 76. Which of the following MUST be part of ANY swap transaction? a. Swap dealers. c. Counterparties. b. Swap facilitators. d. Counterparties and swap facilitators. (Adapted) 77. I. A derivative Specifically unrecognized II. Expected to value of the a. I only. nor II. (AICPA) designated as a fair value hedge must be: identified to the hedged asset, liability or firm commitment. be highly effective in offsetting changes in the fair hedged item. b. II only. c. Both I and II. d. Neither I 78. In order for a financial instrument to be a derivative for accounting purposes, the financial instrument must: I. Have one or more underlyings. II. Require an initial net investment. a. I only. b. II only. c. Both I and II. d. Neither I nor II. (AICPA) 79. The determination of the value or settlement amount of a derivative involves a calculation which uses: I. An underlying. II. A notional amount. a. I only. b. II only. c. Both I and II. d. Neither I nor II. (AICPA) 80. On December 31, 199X, the end of its fiscal year, Smarti Company held a derivative instrument which it had acquired for speculative purposes during November, 199X. Since its acquisition the fair value of the derivative had increased materially. On December 31, how should the increase in fair value of the derivative instrument be reported by Smarti in its financial statements? a. Recognized as a deferred credit until the instrument is settled. 32 b. Recognized in current net income for 199X. c. Recognized as a component of other comprehensive income for 199X. d. Disregarded until the instrument is settled. (AICPA) 81. Gains and losses from changes in the fair value of a derivative designated and qualified as a fair value hedge should be: a. Disregarded until the derivative is settled. b. Recognized as a deferred debit or deferred credit in the balance sheet until the derivative is settled. c. Recognized in current net income in the period in which the fair value of the derivative changes. d. Recognized as a component of other comprehensive income in the period in which the fair value of the derivative changes. (AICPA) 82. Qualified derivatives may be used to hedge the cash flow associated with an/a: (Item #1) Forecasted; (Item #2) Asset transaction a. Yes Yes b. Yes No c. No Yes d. No No (AICPA) 83. A change in the fair value of a derivative qualified as a cash flow hedge is determined to be either effective in offsetting a change in the hedged item or ineffective in offsetting such a change. How should the effective and ineffective portions of the change in value of a derivative which qualifies as a cash flow hedge be reported in financial statements? Effective portion in Ineffective portion in a. Current income Current income b. Current income Other comprehensive income c. Other comprehensive income Current income d. Other comprehensive income Other comprehensive income (AICPA) 84. Which of the following risks are inherent in an interest rate swap agreement? I. The risk of exchanging a lower interest rate for a higher interest rate. II. The risk of nonperformance by the counterparty to the agreement. a. I only. b. II only. c. Both I and II. d. Neither I nor II. (AICPA) 85. Which of the following financial instruments is not considered a derivative financial instrument? a. Interest-rate swaps. c. Stock-index options. b. Currency futures. d. Bank certificates of deposit. (AICPA 86. Derivatives that are not hedging instruments are always classified in which category of financial instruments? a. Financial assets or liabilities with fair values through profit or loss b. Held-to-maturity investments. c. Loans and receivables originated by the enterprise. d. Available-for-sale financial assets. (AICPA) 33 87. Which of the following is the best description of a financial instrument? a. Any monetary contract denominated in a foreign currency. b. Cash, an investment in equities, and any contract to receive or pay cash. c. Any form of a company’s own capital stock. d. Any transaction with a bank or other financial institution. (Adapted) 88. On November 1, Year One, the Jeter Company signs a contract to receive one million Japanese yen on February 1, Year Two, for $10,000 based on the three-month forward exchange rate at that time of $1 for 100 Japanese yen (1,000,000 x 1/100 or $10,000). Why would Jeter obtain this contract? a. Jeter believes the value of the Japanese yen will be increasing in relation to the value of the US dollar. b. Jeter believes the value of the Japanese yen will be decreasing in relation to the value of the US dollar. c. Jeter believes that the economy of Japan will be growing at a rate faster than that of the US economy. d. Jeter could be hedging a future need to make a payment in Japanese yen or it could be speculating that the Japanese yen will become more valuable. (Adapted) 89. On November 1, Year One, the Haynie Company signs a contract to receive one million Japanese yen on February 1, Year Two, for $10,000 based on the three-month forward exchange rate at that time of $1 for 100 Japanese yen (1,000,000 x 1/100 or $10,000). This contract is a derivative because its value is derived from the future value of the Japanese yen in relation to the US dollar. On December 31, Year One, the Haynie Company is producing financial statements. How is this forward exchange contract reported? a. It is shown as an asset or a liability at its fair value. b. It is shown only as an asset at its fair value. c. It is shown only as a liability at its fair value. d. It is only disclosed in the notes to the financial statements because it is a future transaction. (Adapted) 90. On December 1, Year One, a company acquires two three-month financial instruments that qualify as derivatives. Financial instrument A was bought to serve as a fair value hedge. Financial instrument B was bought to serve as a cash flow hedge. By the end of Year One, both of these financial instruments have increased in value by $1,000. How should these gains in value be reported by the company on the Year One financial statements? a. Both gains are reported within net income. b. Both gains are reported within accumulated other comprehensive income. c. The gain on the fair value hedge is reported within net income whereas the gain on the cash flow hedge is reported within accumulated other comprehensive income. d. The gain on the fair value hedge is reported within accumulated other comprehensive income whereas the gain on the cash flow hedge is reported within net income. (Adapted) 34 91. Some financial instruments qualify as derivatives. Which of the following is the best description of a derivative? a. A contract denominated in two different currencies. b. A contract that derives its value from some other index, item, or security. c. A contract that may happen but is not guaranteed to happen. d. A contract made by two parties but which directly impacts a third party. (Adapted) 92. The functional currency of Nash, Inc.’s subsidiary is the French franc. Nash borrowed French francs as a partial hedge of its investment in the subsidiary. In preparing consolidated financial statements, Nash’s translation loss on its investment in the subsidiary exceeded its exchange gain on the borrowing. How should the effects of the loss and gain be reported in Nash’s consolidated financial statements? a. The translation loss less the exchange gain is reported separately as other comprehensive income. b. The translation loss less the exchange gain is reported in the income statement. c. The translation loss is reported separately in the stockholders’ equity section of the balance sheet and the exchange gain is reported in the income statement. d. The translation loss is reported in the income statement and the exchange gain is reported separately in the stockholders’ equity section of the balance sheet. (AICPA) 93. A gain in the fair value of a derivative may be included in comprehensive income if the derivative is appropriately designated as a a. Speculation in Foreign Currency. b. Hedge of a Foreign Currency exposure of an available-for-sale security. c. Hedge of a Foreign Currency exposure of a forecasted foreign currency denominated transaction. d. Hedge of a foreign currency firm commitment. (AICPA) 94. Shore Co. records its transactions in US dollars. A sale of goods resulted in a receivable denominated in Japanese yen, and a purchase of goods resulted in a payable denominated in euros. Shore recorded a foreign exchange transaction gain on collection of the receivable and an exchange transaction loss on settlement of the payable. The exchange rates are expressed as so many units of foreign currency to one dollar. Did the number of foreign currency units exchangeable for a dollar increase or decrease between the contract and settlement dates? (Item #1) Yen exchangeable for ₱1; (Item #2) Euros exchangeable for ₱1 a. Increase Increase c. Decrease Increase b. Decrease Decrease d. Increase Decrease (AICPA) 95. On October 1, 2016, Mild Co., a US company, purchased machinery from Grund, a German company, with payment due on April 1, 2017. If Mild’s 2016 operating income included no foreign exchange transaction gain or loss, then the transaction could have a. Resulted in an extraordinary gain. 35 b. Been denominated in US dollars. c. Caused a foreign currency gain to be reported as a contra account against machinery. d. Caused a foreign currency translation gain to be reported as other comprehensive income. (AICPA) 96. On October 1, 2016, Velec Co., a US company, contracted to purchase foreign goods requiring payment in Qatari rials, one month after their receipt at Velec’s factory. Title to the goods passed on December 15, 2016. The goods were still in transit on December 31, 2016. Exchange rates were one dollar to twenty-two rials, twenty rials, and twenty-one rials on October 1, December 15, and December 31, 2016, respectively. Velec should account for the exchange rate fluctuation in 2016 as a. A loss included in net income c. An extraordinary gain. b. A gain included in net income d. An extraordinary loss. (AICPA) 97. Derivatives are financial instruments that derive their value from changes in a benchmark based on any of the following except a. Stock prices. c. Commodity prices. b. Mortgage and currency rates. d. Discounts on accounts receivable. (AICPA) 98. Derivative instruments are financial instruments or other contracts that must contain a. One or more underlyings, or one or more notional amounts. b. No initial net investment or smaller net investment than required for similar response contacts. c. Terms that do not require or permit net settlement or delivery of an asset. d. All of the above. (AICPA) 99. The basic purpose of derivative financial instruments is to manage some kind of risk such as all of the following except a. Stock price movements. c. Currency fluctuations. b. Interest rate variations. d. Uncollectibility of accounts receivables. (AICPA) 100. Which of the following statements is(are) true regarding derivative financial instruments? I. Derivative financial instruments should be measured at fair value and reported in the balance sheet as assets or liabilities. II. Gains and losses on derivative instruments not designated as hedging activities should be reported and recognized in earnings in the period of the change in fair value. a. I only. b. II only. c. Both I and II. d. Neither I nor II. (AICPA) 101. Which of the following is an underlying? a. A credit rating. c. An average daily temperature. b. A security price. d. All of the above could be underlyings. (AICPA) 36 102. If price a. At b. In (AICPA) the price of the underlying is greater than the strike or exercise of the underlying, the call option is the money. c. On the money. the money. d. Out of the money. 103. Which of the following is not a distinguishing characteristic of a derivative instrument? a. Terms that require or permit net settlement. b. Must be “highly effective” throughout its life. c. No initial net investment. d. One or more underlyings and notional amounts. (AICPA) 104. An example of a notional amount is a. Number of barrels of oil. c. Currency swaps. b. Interest rates. d. Stock prices. (AICPA) 105. Disclosures related to financial instruments, both nonderivative, used as hedging instruments must include a. A list of hedged instruments. b. Maximum potential accounting loss. c. Objectives and strategies for achieving them. d. Only a. and c. (AICPA) derivative and 106. Which of the following financial instruments or other contracts is not specifically excluded from the definition of derivative instruments in PAS 39? a. Leases. c. Adjustable rate loans. b. Call (put) option. d. Equity securities. (AICPA) 107. Which of the following is not a derivative instrument? a. Futures contracts. c. Interest rate swaps. b. Credit indexed contracts. d. Variable annuity contracts. (AICPA) 108. Which of the following criteria must be met for bifurcation to occur? a. The embedded derivative meets the definition of a derivative instrument. b. The hybrid instrument is regularly recorded at fair value. c. Economic characteristics and risks of the embedded instrument are “clearly and closely” related to those of the host contract. d. All of the above. (AICPA) 109. Financial instruments sometimes contain features that separately meet the definition of a derivative instrument. These features are classified as a. Swaptions. c. Embedded derivative instruments. b. Notional amounts. d. Underlyings. (AICPA) 110. The process of bifurcation a. Protects an entity from loss by entering into a transaction. 37 b. Includes entering into agreements between two counterparties to exchange cash flows over specified period of time in the future. c. Is the interaction of the price or rate with an associated asset or liability. d. Separates an embedded derivative from its host contract. (AICPA) 111. Hedge accounting is permitted for all hedges except a. Trading securities. b. Unrecognized firm commitments. c. Available-for-sale securities. d. Net investments in foreign operations. (AICPA) of the following types of 112. Which of the following is a general criterion for a hedging instrument? a. Sufficient documentation must be provided at the beginning of the process. b. Must be “highly effective” only in the first year of the hedge's life. c. Must contain a nonperformance clause that makes performance probable. d. Must contain one or more underlyings. (AICPA) 113. For an unrecognized firm commitment to qualify as a hedged item it must a. Be binding on both parties. b. Be specific with respect to all significant terms. c. Contain a nonperformance clause that makes performance probable. d. All of the above. (AICPA) 114. A hedge of the exposure to changes in the fair value of a recognized asset or liability, or an unrecognized firm commitment, is classified as a a. Fair value hedge. c. Foreign currency hedge. b. Cash flow hedge. d. Underlying. (AICPA) 115. Gains and losses on the hedged asset/liability and the hedged instrument for a fair value hedge will be recognized a. In current earnings. b. In other comprehensive income. c. On a cumulative basis from the change in expected cash flows from the hedged instrument. d. On the balance sheet either as an asset or a liability. (AICPA) 116. Gains and losses of will be recognized in which of the following? hedge a. Yes No b. Yes (AICPA) the effective portion of a hedging instrument current earnings in each reporting period for (Item #1) Fair value hedge; (Item #2) Cash flow Yes c. No No d. No Yes 117. Which of the following risks are inherent in an interest rate swap agreement? 38 I. The risk of exchanging a lower interest rate for a higher interest rate. II. The risk of nonperformance by the counterparty to the agreement. a. I only. b. II only. c. Both I and II. d. Neither I nor II. (AICPA) 118. Which of the following meet the definition of assets and/or liabilities? (Item #1) Derivative instruments; (Item #2) G/L on the fair value of derivatives a. Yes No b. No Yes c. Yes Yes d. No No (AICPA) 119. The risk of an accounting loss from a financial instrument due to possible failure of another party to perform according to terms of the contract is known as a. Off-balance-sheet risk. c. Credit risk. b. Market risk. d. Investment risk. (AICPA) 120. Examples of financial instruments with off-balance sheet risk include all of the following except a. Outstanding loan commitments written. c. Warranty obligations b. Recourse obligations on receivables. d. Futures contracts. (AICPA) 121. Off-balance-sheet risk of accounting loss does not result from a. Financial instruments recognized as assets entailing conditional rights that result in a loss greater than the amount recognized in the balance sheet. b. Financial instruments not recognized as either assets or liabilities yet still expose the entity to risk of accounting loss. c. Financial instruments recognized as assets or liabilities where the amount recognized reflects the risk of accounting loss to the entity. d. Financial instruments recognized as liabilities that result in an ultimate obligation that is greater than the amount recognized in the balance sheet. (AICPA) 122. Are there any circumstances when a contract that is not a financial instrument would be accounted for as a financial instrument under PAS 32 and PAS 39 (and PFRS 9)? a. No. Only financial instruments are accounted for as financial instruments. b. Yes. Gold, silver, and other precious metals that are readily convertible to cash are accounted for as financial instruments. c. Yes. A contract for the future purchase or delivery of a commodity or other nonfinancial item (e.g., gold, electricity, or gas) generally is accounted for as a financial instrument if the contract can be settled net. d. Yes. An entity may designate any nonfinancial asset that can be readily convertible to cash as a financial instrument. (Adapted) 123. All of the following are characteristics of a derivative except: a. It is acquired or incurred by the entity for the purpose of generating a profit from short-term fluctuations in market factors. 39 b. Its value changes in response to the change in a specified underlying (e.g., interest rate, financial instrument price, commodity price, foreign exchange rate, etc.). c. It requires no initial investment or an initial net investment that is smaller than would be required for other types of contracts that would be expected to have a similar response to changes in market factors. d. It is settled at a future date. (Adapted) 124. Is a derivative (e.g., an equity conversion option) that is embedded in another contract (e.g., a convertible bond) accounted for separately from that other contract? a. Yes. PFRSs require all derivatives (both freestanding and embedded) to be accounted for as derivatives. b. No. PFRSs preclude entities from splitting financial instruments and accounting for the components separately. c. It depends. PFRSs require embedded derivatives to be accounted for separately as derivatives if, and only if, the entity has embedded the derivative in order to avoid derivatives accounting and has no substantive business purpose for embedding the derivative. d. It depends. PFRSs require embedded derivatives to be accounted for separately if, and only if, the economic characteristics and risks of the embedded derivative and the host contract are not closely related and the combined contract is not measured at fair value with changes in fair value recognized in profit or loss. (Adapted) 125. Which of the following is not a condition for hedge accounting? a. Formal designation and documentation of the hedging relationship and the entity’s risk management objective and strategy for undertaking the hedge at inception of the hedging relationship. b. The hedge is expected to be highly effective in achieving offsetting changes in fair value or cash flows attributable to the hedged risk, the effectiveness of the hedge can be reliably measured, and the hedge is assessed on an ongoing basis and determined actually to have been effective. c. For cash flow hedges, a forecast transaction must be highly probable and must present an exposure to variations in cash flows that could ultimately affect profit or loss. d. The hedge is expected to reduce the entity’s net exposure to the hedged risk, and the hedge is determined actually to have reduced the net entity-wide exposure to the hedged risk. (Adapted) 126. What is the accounting treatment of the hedging instrument and the hedged item under fair value hedge accounting? a. The hedging instrument is measured at fair value, and the hedged item is measured at fair value with respect to the hedged risk. Changes in fair value are recognized in profit or loss. b. The hedging instrument is measured at fair value, and the hedged item is measured at fair value with respect to the hedged risk. Changes in fair value are recognized directly in equity to the extent the hedge is effective. c. The hedging instrument is measured at fair value with changes in fair value recognized directly in equity to the extent the hedge is effective. The accounting for the hedged item is not adjusted. 40 d. The hedging instrument is accounted for in accordance with the accounting requirements for the hedged item (i.e., at fair value, cost or amortized cost, as applicable), if the hedge is effective. (Adapted) 127. What is the accounting treatment of the hedging instrument and the hedged item under cash flow hedge accounting? a. The hedged item and hedging instrument are both measured at fair value with respect to the hedged risk, and changes in fair value are recognized in profit or loss. b. The hedged item and hedging instrument are both measured at fair value with respect to the hedged risk, and changes in fair value are recognized directly in equity. c. The hedging instrument is measured at fair value, with changes in fair value recognized directly in equity to the extent the hedge is effective. The accounting for the hedged item is not adjusted. d. The hedging instrument is accounted for in accordance with the accounting requirements for the hedged item (i.e., at fair value, cost or amortized cost, as applicable), if the hedge is effective. (Adapted) Suggested answers to Theory of accounts questions 1. A 21. B 41. B 61. D 81. C 2. A 22. C 42. C 62. D 82. A 3. C 23. D 43. D 63. B 83. C 4. B 24. D 44. A 64. D 84. C 5. A 25. D 45. B 65. A 85. D 6. A 26. A 46. C 66. C 86. A 7. D 27. B 47. B 67. D 87. B 8. A 28. C 48. C 68. A 88. D 9. B 29. C 49. D 69. D 89. A 10. C 30. C 50. B 70. C 90. C 11. D 31. D 51. D 71. B 91. B 12. A 32. C 52. D 72. D 92. A 13. B 33. A 53. B 73. C 93. C 14. A 34. C 54. B 74. A 94. B 15. B 35. B 55. D 75. C 95. B 16. D 36. A 56. C 76. C 96. B 17. B 37. C 57. D 77. C 97. D 18. A 38. C 58. A 78. A 98. B 19. B 39. B 59. A 79. C 99. D 20. C 40. D 60. D 80. B 100. C 41 101. 102. 103. 104. 105. 106. 107. 108. 109. 110. 111. 112. 113. 114. 115. 116. 117. 118. 119. 120. D B B A D B D A C D A A D A A A C A C C 121. 122. 123. 124. 125. 126. 127. C C A D D A C Accounting for Derivatives and Hedging Transactions (Part 1) Multiple Choice – Computational Answers at a glance: 1. D 11. D 21. C 31. A 41. A 51. A 2. A 12. C 22. C 32. C 42. B 52. C 3. D 13. A 23. D 33. D 43. C 53. B 4. D 14. A 24. D 34. A 44. D 54. D 5. B 15. C 25. B 35. A 45. D 55. A 6. C 16. D 26. C 36. C 46. D 56. B 7. A 17. B 27. A 37. B 47. A 57. C 8. B 18. A 28. A 38. A 48. D 58. B 9. D 19. B 29. B 39. D 49. D 59. A 10. D 20. C 30. C 40. D 50. C 60. E 61. C 62. A 63. A 64. D Solutions: 1. D Solution: Hedged item – Account receivable Dec. 15, 20x1 Accounts receivable……1.92M Hedging instrument – Forward contract (Derivative) Dec. 15, 20x1 No entry (4M yens x 0.48 spot rate) Sales…………………….1.92M 2. A Solution: Hedged item – Account receivable Dec. 31, 20x1 Accounts receivable……40K [(0.49 - 0.48) x 4M] FOREX gain……………....40K to adjust accounts receivable for the increase in spot rate Hedging instrument – Forward contract (Derivative) Dec. 31, 20x1 Loss on forward contract….60K Forward contract (liability)...60K [(0.485 - 0.47) x 4M] to record the value of the derivative 3. D (See entries above) 4. D (See entries above) 5. B Solution: Hedged item – Account receivable Hedging instrument – Forward contract (Derivative) Jan. 15, 20x2 Cash – foreign currency…1.84M Jan. 15, 20x2 Cash – local currency……1.88M (4M x 0.46 current spot rate) (4M x 0.47 agreed rate) FOREX loss………………...120K Accounts receivable……...1.96M (1.92M + 40K) to record the receipt of 1M yens from the customer Forward contract (liability)….60K Cash – foreign currency…1.84M Gain on forward contract ...100K to record the remittance of 4M yens to the bank in exchange for the pre-agreed sale price of ₱1,880,000 6. C (See entries above) 7. A (1.88M debit to cash – 1.84 credit to cash) = 40,000 net cash receipt (See entry above) 8. B 20x1: (40,000 gain – 60,000 loss) - 20x2: (120,000 loss – 100,000 gain) = 40,000 net loss (See entries above) 9. D Solution: Hedged item – None Forward contract (Derivative) Dec. 15, 20x1 No entry 10. D Solution: Hedged item – None Forward contract (Derivative) Dec. 31, 20x1 Loss on forward contract…..60K Forward contract (liability)....60K [ (0.485 - 0.47) x 4M] to record the value of the derivative 11. D (See entry above) 12. C Solution: Hedged item – None Forward contract (Derivative) Jan. 15, 20x2 Cash – local currency…...1.88M (4M x 0.47 agreed rate) Forward contract (liability). 60K Cash – foreign currency. 1.84M Gain on forward contract…100K to record the remittance of 4M yens to the bank in exchange for the pre-agreed sale price of ₱1,880,000 13. A (1.88M debit to cash – 1.84 credit to cash) = 40,000 net cash receipt (See entry above) 14. A Solution: Hedged item – Account payable Dec. 15, 20x1 Inventory……………48,000 Hedging instrument – Forward contract (Derivative) Dec. 15, 20x1 No entry (40K wons x 1.20 spot rate) Accounts payable…48,000 15. C Solution: Hedged item – Account payable Dec. 31, 20x1 FOREX loss ………… 2,400 [40K x (1.26 – 1.20)] Accounts payable…. 2,400 16. D Hedging instrument – Forward contract (Derivative) Dec. 31, 20x1 Forward contract (asset).. 1,200 Gain on forward contract.. 1,200 [(1.27 forward rate – 1.24 forward rate) x 40K] 17. B Solution: Hedged item – Account payable Hedging instrument – Forward contract (Derivative) Jan. 15, 20x2 Accounts payable…….50,400 Jan. 15, 20x2 Cash - foreign currency...52,000 (48K + 2.4K) (40K x 1.30) FOREX loss…………… 1,600 [(1.30 -1.26) x 40K] Cash - foreign currency…...52,000 to record the payment of 40,000 wons to the supplier Cash - local currency….….49,600 Forward contract (asset)… 1,200 Gain on forward contract.....1,200 [(1.30 – 1.27) x 40K] to record the purchase of 40,000 wons from the bank at the pre-agreed purchase price of ₱49,600 18. A (See entries above) 19. B (1,600 loss – 1,200 gain) = 400 net loss (See entries above) 20. C (52,000 debit to cash – 49,600 credit to cash) = 2,400 net cash receipt (See entries above) 21. C Solutions: Hedged item – None Forward contract (Derivative) Dec. 15, 20x1 No entry Dec. 31, 20x1 Forward contract (asset).. 1,200 Gain on forward contract.. 1,200 [(1.27 forward rate – 1.24 forward rate) x 40K] Jan. 15, 20x2 Cash - foreign currency.. .52,000 (40K x 1.30) Cash - local currency….….49,600 Forward contract (asset)… 1,200 Gain on forward contract.... 1,200 [(1.30 – 1.27) x 40K] 22. C (See entries above) 23. D Solution: Hedged item – Firm sale commitment Dec. 15, 20x1 No entry 24. D Solution: Hedged item – Firm sale commitment Hedging instrument – Forward contract (Derivative) Dec. 15, 20x1 No entry Hedging instrument – Forward contract (Derivative) Dec. 31, 20x1 Firm commitment (asset)..60K Gain on firm commitment……………60K Dec. 31, 20x1 Loss on forward contract..60K Forward contract (liability)..60K to recognize the change in the fair value of the firm commitment to recognize the change in the fair value of the forward contract [(0.485 – 0.47) x 4M yens 25. B (See entry above) 26. C (60,000 loss ÷ 60,000 gain) = 100% 27. A Solution: Hedged item – Firm sale commitment Jan. 15, 20x2 Cash (foreign currency)… 1.84M (4M yens x 0.46 spot rate) Loss on firm commitment...100K Sales…………………… 1.88M Hedging instrument – Forward contract (Derivative) Jan. 15, 20x2 Cash (local currency)….....1.88M Forward contract (liability)… 60K Gain on forward contract…100K Cash (foreign currency)….1.84M (4M yens x 0.47 forward rate) Firm commitment (asset).. 60K to record the actual sale transaction, to recognize the change in the fair value of the firm commitment, and to derecognize the firm commitment to record the remittance of 4M yens to the bank in exchange for the pre-agreed sale price of ₱1,880,000 28. A (1,880,000 debit to cash – 1,840,000 credit to cash) = 40,000 net cash receipt (See entries above) 29. B Solution: Hedged item – Firm purchase commitment Dec. 15, 20x1 No entry Hedged item – Firm purchase commitment Hedging instrument – Forward contract (Derivative) Dec. 15, 20x1 No entry Hedging instrument – Forward contract (Derivative) Dec. 31, 20x1 Loss on firm commitment .. 1,200 Firm commitment (liability).. 1,200 Dec. 31, 20x1 Forward contract (asset)… 1,200 to recognize the change in the fair value of the firm commitment to recognize the change in the fair value of the forward contract [(1.27 – 1.24) x 40K yens Gain on forward contract… 1,200 30. C (See entry above) 31. A Solution: Hedged item – Firm purchase commitment Jan. 15, 20x2 Inventory…………………..49.6K (40K wons x 1.24 forward rate) Loss on firm commitment... 1.2K Firm commitment (liability).. 1.2K Cash (foreign currency)……52K Hedging instrument – Forward contract (Derivative) Jan. 15, 20x2 Cash (foreign currency)…...52K Gain on forward contract.. 1.2K Forward contract (asset)… 1.2K Cash (local currency)…. 49.6K (40K wons x 1.30 spot rate) to record the payment of 40,000 wons to the supplier to record the purchase of 40,000 wons from the bank at the pre-agreed purchase price of ₱49,600 32. C (52,000 debit to cash – 49,600 credit to cash) = 2,400 net cash receipt (See entries above) 33. D Solution: Hedged item – Firm purchase commitment Oct. 1, 20x1 No entry Hedging instrument – Forward contract (Derivative) Oct. 1, 20x1 No entry 34. A Solution: Hedged item – Firm purchase commitment Hedging instrument – Forward contract (Derivative) Dec. 31, 20x1 Dec. 31, 20x1 Loss on firm commitment ..27,727 Forward contract (asset)..27,727 Firm commitment (liability).. 27,727 Gain on forward contract 27,727 to recognize the change in the fair value of the firm commitment to recognize the change in the fair value of the forward contract 35. A (See entries above) 36. C Solution: Hedged item – Firm purchase commitment Mar. 31, 20x2 Inventory (147 x 1,000).588,000 Loss on firm commitment (52,000 – 27,727)……… 24,273 Firm commitment (liability)………………...27,727 Cash ………………………640,000 Hedging instrument – Forward contract (Derivative) Mar. 31, 20x2 Cash [(160 - 147) x 4,000]...52,000 Gain on forward contract (52,000 – 27,727). l24,273beoForward contract (asset)…27,727 (160 fixed contract price x 4,000) to record the actual purchase transaction, to recognize the change in the fair value of the firm commitment, and to derecognize the firm commitment to recognize the change in forward rates during the period and to record the net cash settlement of the forward contract. 37. B (See entries above) 38. A (See entries above) 39. D Solutions: Hedged item – Firm purchase commitment Oct. 1, 20x1 No entry Hedging instrument – Forward contract (Derivative) Oct. 1, 20x1 No entry Dec. 31, 20x1 Dec. 31, 20x1 Loss on firm commitment 39,608 Forward contract (asset) 39,608 Firm commitment (liability). 39,608 Gain on forward contract. 39,608 to recognize the change in the fair value of the firm commitment to recognize the change in the fair value of the forward contract Mar. 31, 20x2 Inventory (50 x 4,000) 200,000 Firm commitment (liability)……………….39,608 Cash…………………… 160,000 Gain on firm commitment……………… 79,608 Mar. 31, 20x2 Loss on forward contract..79,608 [40,000 minus (negative 39,608)] Forward contract (asset)…39,908 Cash………………………. 40,000 [(50 – 40) x 4,000] [40,000 minus (negative 39,608)] to record the actual purchase transaction, to recognize the change in the fair value of the firm commitment, and to derecognize the firm commitment to recognize the change in forward rates during the period and to record the net cash settlement of the forward contract. 40. D (See entries above) 41. A (See entries above) 42. B (See entries above) 43. C (See entries above) 44. D (See entries above) 45. D Solution: Hedged item – Highly probable forecast transaction Dec. 15, 20x1 No entry Hedging instrument – Forward contract (Derivative) Dec. 15, 20x1 No entry 46. D (See entries above) 47. A Solution: Hedged item – Highly probable forecast transaction Dec. 31, 20x1 No entry Hedging instrument – Forward contract (Derivative) Dec. 31, 20x1 Forward contract (asset)… 40K [(55 –45) x 4,000 Accumulated OCI… ……. 40K to recognize the change in the fair value of the forward contract 48. D (See entries above) 49. D (See entries above) 50. C Solution: Hedged item – Highly probable forecast transaction Jan. 15, 20x2 Inventory………………….240K (4,000 x 60 current spot rate) Cash (foreign currency)….240K to record the actual purchase transaction Hedging instrument – Forward contract (Derivative) Jan. 15, 20x2 Forward contract (asset)… 20K [(60 –55) x 4,000 Accumulated OCI… ……. 20K to recognize the change in the fair value of the forward contract Jan. 15, 20x2 Cash [(60 – 45) x 4,000]…. 60K Forward contract (asset)…60K to record the net settlement of the forward contract. 51. A (See entries above) 52. C Solution: Feb. 14, 20x2 Cash…………………….1.44M Cost of goods sold………400K Inventory……………………400K Sales……………………….1.44M Feb. 14, 20x2 Accumulated OCI… ……. 60K (40K + 20K) Cost of goods sold…………..60K to record the sale of inventory to reclassify accumulated gains on forward contract to profit or loss as a reduction to cost of goods sold. Net cost of goods sold = 400,000 debit – 60,000 credit = 340,000 53. B Solutions: The fair values of the forward contract are determined as follows: Translation using forward Cumulative changes Date rates since inception date 10/1/0x1 (DOM 59.400M ÷ 140) = ₱424,286 12/31/x1 (DOM 59.400M ÷ 142) = ₱418,310 (418,310 – 424,286) = 5,976 4/1/x2 (DOM 59.400M ÷ 144) = ₱412,500 (412,500 – 424,286) = 11,786 Fair value of Date Cumulative PV of 1* changes PV forward factors contract - asset (liability) 10/1/0x1 12/31/x1 4/1/x2 5,976 11,786 @ .5% n=3 0.98515 @ .5% n=0 1 5,887 11,786 Changes in fair values – gain (loss) 5,887 5,899 * (6% ÷ 12 months = .5% per month); n= 3 is three months, Dec. 31 to Apr. 1 The measurements resulted to assets and gains because the forward prices were ₱418,310 and ₱412,500 on December 31 and April 1, respectively, but ABC Co. can sell at a higher price of ₱424,286. These conditions are favorable to ABC. 54. D – None, the actual sale have not yet taken place. 55. A Solutions: Hedged item – Highly probable forecast transaction Oct. 1, 20x1 No entry Dec. 31, 20x1 No entry Hedging instrument – Forward contract (Derivative) Oct. 1, 20x1 No entry Dec. 31, 20x1 Forward contract (asset).. 5,887 Accumulated OCI… ……. 5,887 to recognize the change in the fair value of the forward contract April 1, 20x2 Accounts receivable..412,500 Sales……………………412,500 April 1, 20x2 Forward contract (asset)..5,899 Accumulated OCI… ……. 5,899 (59.4M ÷ 144 spot rate) to record the actual sale transaction April 1, 20x2 Accumulated OCI……. 11,786 (5,887 + 5,899) Sales……………………...11,786 to reclassify the gain accumulated in OCI to profit or loss. to recognize the change in the fair value of the forward contract April 1, 20x2 Cash (5,887 + 5,899)……11,786 Forward contract (asset)…11,786 to record the net settlement of the forward contract. Sales at current spot rate (59.4M ÷ 144) Reclassification of accumulated OCI to P/L Total sales 56. B (See entries above) 57. C (See entries above) 412,500 11,786 424,286 58. B Solution: Hedged item – Account payable Dec. 15, 20x1 Inventory……………480,000 Hedging instrument – Forward contract (Derivative) Dec. 15, 20x1 No entry (400K wons x 1.20 spot rate) Accounts payable…480,000 59. A Solution: The amortization table is prepared as follows: Interest expense Discount a = b x 1.6530% Total 7,934 8,066 16,000 IGNORED Dec. 1, 20x1 Dec. 31, 20x1 Jan. 31, 20x2 Present value b = prev. bal. + a 480,000* 487,934 496,000 *400,000 notional amount x 1.20 spot rate The fair values of the forward contract are computed as follows: Fair value Change of forward in fair contract values Dec. 1, 20x1 11,940 11,940 Dec. 31, 20x1: (1.27 - 1.24) x 400,000 x .99502 24,000 12,060 Jan. 31, 20x2: (1.30 - 1.24) x 400,000 x 1 Hedged item – Account payable Dec. 31, 20x1 FOREX loss ………… 12,000 [400K x (1.23 – 1.20)] Accounts payable… 12,000 to recognize FOREX loss on the increase in exchange rates. Hedging instrument – Forward contract (Derivative) Dec. 31, 20x1 Interest expense……….. 7,934 Forward contract (asset)...11,904 Accumulated OCI ………19,838 to recognize the change in the fair value of the derivative and to record the effective portion in OCI, taking into account the interest expense implicit in the forward contract. Dec. 31, 20x1 Accumulated OCI …12,000 Gain on forward contract 12,000 to reclassify an amount out of OCI to offset the transaction loss on the account payable. 60. B The CORRECT ANSWER is 19,838. (See entries above) 61. C (See entries above) 62. A Solutions: Hedged item – Account payable Jan. 31, 20x2 FOREX loss ………… 28,000 [400K x (1.30 – 1.23)] Accounts payable….28,000 to recognize FOREX loss on the increase in exchange rates. Accounts payable…520,000 Cash - foreign currency…520,000 to record the settlement of the account payable Hedging instrument – Forward contract (Derivative) Jan. 31, 20x2 Interest expense……….. 8,066 Forward contract (asset)...12,060 Accumulated OCI ………20,126 to recognize the change in the fair value of the derivative and to record the effective portion in OCI, taking into account the interest expense implicit in the forward contract. Cash – foreign currency..520K Cash – local currency… 496K Forward contract……… 24K to record the settlement of the forward contract. Accumulated OCI …… 27,964 (19,838 – 12,000 + 20,126) Gain on forward contract 27,964 to reclassify the remaining amount of accumulated OCI. 63. A (See entries above) 64. D (520,000 debit – 496,000 credit) = 24,000 net cash receipt Accounting for Derivatives and Hedging Transactions (Part 2) Multiple Choice – Computational Answers at a glance: 1. C 11. B 21. C 31. B 41. C 51. C 2. C 12. C 22. B 32. C 42. D 52. B 3. 4. A A 13. D 14. A 23. A 24. C 33. 34. B A 43. C 44. B 53. 54. E A 5. C 15. D 25. A 35. A 45. C 55. A 6. A 16. B 26. C 36. B 46. D 56. B 7. 8. C D 17. A 18. A 27. B 28. A 37. 38. A C 47. A 48. A 57. 58. E B 9. D 19. B 29. D 39. B 49. D 59. B 10. A 20. D 30. D 40. A 50. B 60. A 61. C 62. B 63. E 64. 65. E B Solutions: 1. C Solution: Hedged item – None Futures contract (Derivative) Dec. 1, 20x1 Deposit with broker ……..80K Cash………………………..80K to record the initial margin deposit with the broker 2. C Solution: Hedged item – None Futures contract (Derivative) Dec. 31, 20x1 Loss on futures contract…..40K Futures contract (liability)...40K [(200 - 190) x 4,000] to record the value of the derivative computed as the change in the underlying multiplied by the notional amount. 3. A Solution: Hedged item – None Futures contract (Derivative) Feb. 1, 20x2 Loss on futures contract… 20K [(190 - 185) x 4,000] Futures contract (liability)..40K Cash – local currency…… 20K Deposit with broker…….....80K to recognize loss on the change in the fair value of the futures contract and to record the net cash settlement of the futures contract. 40,000 loss in 20x1 + 20,000 loss in 20x2 = 60,000 total loss 4. A (See entry above) 5. C Solution: Hedged item – Inventory Dec. 1, 20x1 No entry Hedging instrument – Futures contract (Derivative) Dec. 1, 20x1 Deposit with broker …….384K Cash………………………...384K to record the initial margin deposit with the broker 6. A Solution: Hedged item – Inventory Dec. 31, 20x1 Inventory………….……100K Gain on fair value change...100K [(12,250 – 12,000) x 400] to recognize the change in the fair value less costs to sell of the gold inventory. 7. C (See entries above) Hedging instrument – Futures contract (Derivative) Dec. 31, 20x1 Loss on futures contract….80K Futures contract (liability)...80K [(12,300 -12,100) x 400] to recognize the change in the fair value of the futures contract. 8. D Solution: Hedged item – Inventory Feb. 1, 20x2 Loss on fair value change…180K [(12,250 – 11,800) x 400] Inventory……………………180K Futures contract (Derivative) Feb. 1, 20x2 Futures contract (asset).. 200K Gain on futures contract…200K [(12,300 – 11,800) x 400] to recognize the change in the fair value less costs to sell of the gold inventory. to recognize the change in the fair value of the futures contract. Feb. 1, 20x2 Cash……………………..4.72M Sale (11.8 spot price x 400).. 4.72M Feb. 1, 20x2 Cash……………………….504K Cost of goods sold……. 4.72M Inventory (4.8M +100K – 180K) 4.72M to recognize the sale of the gold inventory. [(12.1K – 11.8K) x 400] + 384K Futures contract (asset)......120K (200K asset – 80K liability) Deposit with broker………..384K to record the net cash settlement of the futures contract. 9. D (See entries above) 10. A Solution: Outflow on deposit with broker - Dec. 1, 20x1 Cash receipt from sale Net cash receipt on settlement of futures contract Net cash receipt (equal to the pre-agreed sale price) (384,000) 4,720,000 504,000 4,840,000 11. B Solutions: Hedged item – Inventor y Dec. 1, 20x1 No entry Hedging instrument – Futures contract (Derivative) Dec. 1, 20x1 Deposit with broker ……..80K Cash………………………..80K to record the initial margin deposit with the broker Dec. 31, 20x1 Inventory………….……68K Gain on fair value change.....68K [(371 – 354) x 1,000] to recognize the change in the fair value of the inventory due to changes in the hedged risk. Dec. 31, 20x1 Loss on futures contract....56K Futures contract (liability).. 56K [(374 -360) x 4,000] to recognize the change in the fair value of the futures contract. 12. C (See entries above) 13. D (See entries above) 14. A Solution: Hedged item – Inventory Feb. 1, 20x2 Loss on fair value change…132K [(371 – 338) x 4,000] Inventory……………………132K Futures contract (Derivative) Feb. 1, 20x2 Futures contract (asset).. 144K Gain on futures contract… 144K [(374 – 338) x 4,000] to recognize the change in the fair value of the inventory due to changes in the hedged risk. to recognize the change in the fair value of the futures contract. Feb. 1, 20x2 Cash (338 spot price x 4K)..1.352M Sales……………………..….1.352M Feb. 1, 20x2 Cash……………………….168K Cost of goods sold……….896K Inventory (960K + 68K –132K) 896K to recognize the sale of the soybean inventory. [(360 – 338) x 4K] + 80K deposit Futures contract (asset) ........88K (144K asset – 56K liability) Deposit with broker…………80K to record the net cash settlement of the futures contract. 15. D (1,352,000 sales less 896,000 cost of sales) = 456,000 (See entries above) 16. B Solution: Hedged item – Firm sale commitment Dec. 1, 20x1 No entry Hedging instrument – Futures contract (Derivative) Dec. 1, 20x1 Deposit with broker …….120K Cash……………………….120K to record the initial margin deposit with the broker Dec. 31, 20x1 Loss on firm commitment.. 120K [(240 – 210) x 4,000] Firm commitment (liability) 120K to recognize the change in the fair value of the firm commitment 17. A (See entries above) Dec. 31, 20x1 Future contract (asset)… 140K [(235 – 200) x 4,000] Gain on futures contract…..140K to recognize the change in the fair value of the futures contract 18. A Solution: Hedged item – Firm sale commitment Feb. 1, 20x2 Firm commitment (liability)..120K Loss on firm commitment.... 40K Hedging instrument – Futures contract (Derivative) Feb 1, 20x2 Cash ……………………….320K [(250 – 200) x 4,000] + 120K deposit Deposit with broker ………120K Futures contract (asset)….140K Gain on futures contract….. 60K [(250 – 240) x 4,000] Cash……………………….. 840K (210 contract price x 4,000) [(250 – 235) x 4,000] Sale (250 spot price x 4,000)... 1M to record the actual sale transaction to record the net settlement of the futures contract. 19. B (See entries above) 20. D (See entries above) 21. C Solution: The changes in the expected cash flows on the forecasted transaction and the changes in the fair values of futures contract are computed as follows: Hedging Hedged item: instrument: Forecasted Futures transaction contracts (Broccoli) (Cauliflower) Mar. 31, 20x1 Current prices – Mar. 31 95.18 94.52 Previous prices – Jan. 1 93.76 92.98 Increase (Decrease) 1.42 1.54 a 4,000 Multiplied by: Kilograms of commodity 4,000 Changes during the period – 3/31/x1 (5,680) 6,160 Fair value - 1/1/x1 Cumulative changes – 3/31/x1 (5,680) 6,160 June 30, 20x1 Current prices – June 30 Previous prices – Mar. 31 Increase (Decrease) Multiplied by: Kilograms of commodity Changes during the period – 6/30/x1 Fair value - 3/31/x1 Cumulative changes – 6/30/x1 96.20 95.18 1.02 4,000 (4,080) (5,680) (9,760) 95.36 94.52 0.84 4,000 3,360 6,160 9,520 a No. of futures contracts x Kilograms covered by each contract = (10 x 400) = 4,000. Cumulative changes in: Fair values of futures contract Expected cash flows of forecasted transaction Ratio March 31 6,160 5,680 108% June 30 9,520 9,760 98% 22. B (See solutions above) 23. A Solution: To determine the ineffectiveness of the hedge, the following procedures are performed: Step 1: Determine the cumulative changes in the expected cash flows on the forecasted transaction. Step 2: Determine the cumulative changes in the fair values of the hedging instrument. Step 3: Determine the lower of the amounts computed in Step 1 and Step 2, in absolute values. Step 4: The amount determined in Step 3 is the effective portion which is recognized in other comprehensive income. The difference between the change in the fair value of the hedging instrument and the effective portion represents the ineffective portion which is recognized in profit or loss. The steps above are applied as follows: Forecasted Futures transaction contract Broccoli Cauliflower Cumulative Cumulative Dates 1/1/x1 3/31/x1 6/30/x1 Effective portion - OCI (Step 3) Lower of a and b – Cumulative OCI change in cash flows (Step 1) change in fair values (Step 2) a b c 6,160 9,520 5,680 9,520 (5,680) (9,760) Ineffective portion P/L (Step 4) OCI during the period d=cprev. bal. 5,680 3,840 P/L Cumulative P/L during the period f=e- e=b-c prev. bal. - 480 - 480 (480) 24. C (See table above) 25. A - On March 31, 20x1, the effect of the hedge is “overhedge” (the increase in the cash inflows from the hedging instrument is greater than the increase in the expected cash outflows on the hedged item). 26. C Solution: Hedged item – Highly probable forecast transaction Hedging instrument – Futures contract (Derivative) Jan. 1, 20x1 No entry Jan. 1, 20x1 No entry Mar. 31, 20x1 No entry Mar. 31, 20x1 Futures contract…..6,160 Accumulated OCI……… 5,680 Gain on futures contract…. 480 to recognize the change in the fair value of the effective portion of the futures contract in OCI and the ineffective portion in profit or loss. June 30, 20x1 Inventory……………384,800 June 30, 20x1 (4,000 x 96.20) Loss on futures contract.. 480 Cash…………………….384,800 to record the purchase of broccoli at the current price. Futures contract……. 3,360 Accumulated OCI………. 3,840 to recognize the change in the fair value of the effective portion of the futures contract in OCI and the ineffective portion in profit or loss. June 30, 20x1 Cash…………………9,520 Futures contract……….. 9,520 (6,160 + 3,360) to record the net settlement of the futures contract. 27. B (See table above) 28. A (See table above) 29. D (See entry above) 30. D – This amount is reclassified to profit or loss when the related inventory is sold. 31. B (384,800 cost of inventory – 9,520 reclassification adjustment of OCI) = 375,280 32. C Solution: Hedged item – Account receivable Dec. 15, 20x1 Accounts receivable…… 1.92M (4M yens x 0.48 spot rate) Hedging instrument – Put option (Derivative) Dec. 15, 20x1 Put option ……..…….. 30K Cash………..……………… 30K Sales……………………...1.92M Dec. 31, 20x1 Dec. 31, 20x1 Accounts receivable……40K Loss on put option…..…..10K [4M x (0.49 - 0.48)] Put option…………………..10K FOREX gain……………....40K (30K – 20K) to adjust the accounts receivable for the increase in spot exchange rate to recognize loss on the decrease in the fair value of the option. Jan. 15, 20x2 Cash – foreign currency.. 1.84M Jan. 15, 20x2 Cash – local currency…1.88M (4M x 0.46 current spot rate) (4M x 0.47 option price) FOREX loss…………….. 120K Accounts receivable……….1.96M (1.92M + 40K) to record the receipt of 4M yens from customer Put option (30K – 10K)…….. 20K Cash – foreign currency. 1.84M Gain on put option….…… 20K to record the exercise of the put option which is in the money. 33. B (See entries above) 34. A 20,000 - carrying amount of the option 35. A Solution: Hedged item – None Call option (Derivative) April 1, 20x1 April 1, 20x1 Call option ……..…….. 2,400 Cash………..……………… 2,400 June 30, 20x1 June 30, 20x1 Call option ……..…….. 24,000 [(106 – 100) x 4,000] Gain on call option………. 24,000 to record the increase in the fair value of the call option due to the increase in intrinsic value (excess of market value of shares over exercise price). June 30, 20x1 Loss on call option……….800 (2,400 – 1,600) Call option……………………..800 to record the decrease in the fair value of the call option due to the decrease in 1 time value. July 1, 20x1 July 1, 20x1 Cash…………… [(106 – 100) x 4,000] 24,000 Loss on call option….1,600 Call option ……..……..….. 25,600 (2,400 + 24,000 – 800) to record the net settlement of the call option contract. 36. B (See entries above) 37. A (See entries above) 38. C Solution: Hedged item – Highly probable forecast transaction Oct. 1, 20x1 No entry Hedging instrument – Put option (Derivative) Oct. 1, 20x1 Put option ……..……..25.6K Cash………..…………… 25.6K to record the purchase of option contract 39. B – Cash flow hedge because the hedged item is a highly probable forecasted transaction. 40. A Solution: The gain or loss on December 31, 20x1 is computed as follows: Change in: Change in Intrinsic value Time value fair value of (OCI) (P/L) option 10.1.x1 (see table above) 25,600 25,600 12.31.x1 10,802 13,196 24,000 (1.12M ÷ 1.45) – 783,216 Gain (Loss) 10,802 (12,404) (1,600) 41. C (See table above) 42. D Solution: 12.31.x1(see table above) 4.1.x2 (1.12M ÷ 1.50) – 783,216 Gain (Loss) Change in: Intrinsic value Time value (OCI) (P/L) 10,802 13,196 36,549 25,747 43. C 746,667 + 36,550 = 783,217 Solution: Hedged item – Highly probable forecast transaction 191 (13,196) Change in fair value of option 24,000 36,549 12,549 April 1, 20x2 Accounts receivable….746,667 Sales………………………746,667 (1,120,000 ÷ 1.50 spot rate) to record the actual sale transaction April 1, 20x2 Accumulated OCI……..36,550 (10,802 + 25,748) Sales……………………… 36,550 to reclassify accumulated OCI to profit or loss 44. B 45. C Solution: Receive variable 20x1 320,000 320,000 - a Pay 8% fixed Net cash settlement - receipt 20x2 400,000 320,000 80,000 a The interest rates used are the current rates as at the beginning of the year (i.e., 4M x 8% = 320,000) & (4M x 10% = 400,000). There is no cash settlement in 20x1 because the variable and fixed rates are the same (i.e., 8% and 8%, respectively). The net cash settlement in 20x2 is discounted to determine the fair value of the derivative on Dec. 31, 20x1: Net cash settlement – receipt (due on Dec. 31, 20x2) PV of 1 @ 10%, n=1 Fair value of derivative - 12/31/x1 (asset) 80,000 0.90909 72,727 46. D – the gain is recognized in OCI not in P/L Solution: Hedged item – Hedging instrument – Variable interest payments Interest rate swap (Derivative) Dec. 31, 20x1 Interest expense… 320,000 Cash (4M x 8%)….……... 320,000 Dec. 31, 20x1 Interest rate swap…..72,727 Accumulated OCI……….72,727 to recognize interest expense on the variable-rate loan to recognize the change in the fair value of the interest rate swap 47. A (See computation in #45) 192 48. A (400,000 – 80,000) = 320,000 (See entries below) Solution: Hedged item – Hedging instrument – Variable interest payments Interest rate swap (Derivative) Dec. 31, 20x2 Interest expense….400,000 Cash (4M x 10%) ……..….400,000 Dec. 31, 20x2 Cash…………………80,000 Interest rate swap……....72,727 Accum. OCI (squeeze)……7,273 to recognize interest expense on the variable-rate loan to record the net cash settlement of the interest rate swap Dec. 31, 20x2 Loan payable……….4M Cash……………………………4M Dec. 31, 20x2 Accumulated OCI…..80,000 Interest expense……….80,000 to record the settlement of the loan to reclassify accumulated OCI to profit or loss 49. D Solution: Receive variable a (4M x 9%) & (4M x 8%) Pay 9% fixed Net cash settlement – payment a 20x1 360,000 360,000 - 20x2 320,000 360,000 (40,000) Based on the current rates as at the beginning of the year. The net cash settlement is discounted to determine the fair value of the derivative on Dec. 31, 20x1. Net cash payment (due annually starting on Dec. 31, 20x2) PV of ordinary annuity of 1 @8%, n=2 Fair value of derivative - 12/31/x1 (liability) (40,000) 1.783265 (71,331) 50. B (See computation above) 51. C (See computation above) 52. B – The fair value of the derivative on this date. Solution: Receive variable (4M x 12%) Pay 9% fixed Net cash settlement – receipt 20x3 480,000 360,000 120,000 The net cash settlement is discounted to determine the fair value of the derivative on Dec. 31, 20x2. Net cash receipt (due on Dec. 31, 20x3 – maturity date) Multiply by: PV of 1 @12%, n=1 Fair value of derivative - 12/31/x2 (asset) 120,000 0.892857 107,143 53. E The CORRECT ANSWER is 360,000 (320,000 + 40,000) (See entries below) Solution: Hedged item – Variable interest payments Hedging instrument – Interest rate swap (Derivative) Dec. 31, 20x2 Interest expense…320,000 Cash (4M x 8%)…...……320,000 Dec. 31, 20x2 Interest rate swap…..40,000 Cash…………………….40,000 to recognize interest expense on the variable-rate loan to record the periodic net cash settlement on the interest rate swap - (see previous computation) Dec. 31, 20x2 Interest expense……...40,000 Accumulated OCI……40,000 to record a piecemeal reclassification of accumulated OCI to profit or loss 54. A (See computations in #52) 55. A Solution: The change in the fair value of the interest rate swap is determined as follows: Fair value of interest rate swap – Dec. 31, 20x2 - (asset) 107,143 Less: Carrying amount of interest rate swap – Dec. 31, 20x2 (71,331 liability – 40,000 net cash settlement) - (liability) (31,331) Change in fair value – gain 138,474 56. B Solution: Receive variable (1M x 12%) Pay 9% fixed Net cash settlement – receipt 20x3 480,000 360,000 120,000 57. E The CORRECT ANSWER is 360,000 (See solution below) Interest expense (4M x 12%) Reclassification of accum. OCI Net interest expense - 20x3 480,000 (120,000) 360,000 58. B Solutions: Hedging instrument: The net cash settlement on the swap is determined as follows: 20x1 20x2 Receive 10% fixed 400,000 400,000 a Pay variable (4M x 10%) & (4M x 12%) 400,000 480,000 Net cash settlement – payment (80,000) a Based on the current rates as at the beginning of the year. The net cash settlement is discounted to determine the fair value of the derivative on Dec. 31, 20x1. Net cash payment (due annually starting on Dec. 31, 20x2) PV of ordinary annuity of 1 @12%, n=2 Fair value of derivative - 12/31/x1 (liability) (80,000) 1.69005 (135,204) PV of ordinary annuity is used because swap payments are made at each yearend (i.e., Dec. 31, 20x2 and Dec. 31, 20x3; ‘n=2’). A liability is recognized because the net cash settlement is a payment. 59. B Solution: Fair value of derivative - 12/31/x1 (liability) Fair value of derivative - 12/1/x1 Unrealized loss on the derivative instrument (135,204) (135,204) 60. A Solution: Hedged item: The fair value of the loan payable on Dec. 31, 20x1 is determined as follows: PVF @12% current rate, Future cash flows: Present n=2 value Principal 4,000,000 0.797193878 3,188,776 Interest at 10% fixed rate 400,000 1.69005102 676,020 3,864,796 Fair value of loan payable - Dec. 31, 20x1 Carrying amount of loan payable - Dec. 31, 20x1 Gain on decrease in liability 3,864,796 4,000,000 135,204 61. C Solution: Date Interest payments Interest expense @ 12% Amortization 12/31/x1 12/31/x2 400,000 463,776 63,776 Present value 3,864,796 3,928,572 62. B Solution: Hedging instrument: The net cash settlement in 20x3 is determined as a basis for adjusting the fair value of the interest rate swap on Dec. 31, 20x2. 20x3 Receive 10% fixed 400,000 Pay variable (4M x 14%) 560,000 Net cash settlement – payment (160,000) The net cash settlement is discounted to determine the fair value of the derivative on Dec. 31, 20x2. Net cash payment (due on Dec. 31, 20x3 – maturity date) Multiply by: PV of 1 @14%, n=1 Fair value of derivative - 12/31/x2 (liability) (160,000) 0.877192982 (140,351) 63. E The CORRECT ANSWER is (85,147) (See solution below) Fair value of interest rate swap – Dec. 31, 20x2 - (liability) Carrying amount of interest rate swap – Dec. 31, 20x2 (135,204 liability – 80,000 net cash settlement) - (liability) Change in fair value – loss (increase in liability) 140,351 (55,204) 85,147 64. E The CORRECT ANSWER is (68,923) (See solution below) Solution: Hedged item: The fair value of the loan payable on Dec. 31, 20x2 is determined as follows: PVF @14% current rate, Future cash flows: Present n=1 value Principal 4,000,000 0.877192982 3,508,772 Interest at 10% fixed rate 400,000 0.877192982 350,877 3,859,649 The gain or loss on the change in the fair value of the loan payable is determined as follows: Fair value of loan payable - Dec. 31, 20x2 3,859,649 Carrying amt. - Dec. 31, 20x2 (see amortization table above) 3,928,572 Gain on decrease in liability – Dec. 31, 20x2 68,923 65. B Solution: Date Interest payments Interest expense @ 14% 400,000 540,351 Amortization 12/31/x2 12/31/x3 140,351 Present value 3,859,649 4,000,000 Accounting for Derivatives and Hedging Transactions (Part 3) Multiple Choice – Computational Answers at a glance: 1. C 6. A 11. A 16. D 21. C 26. A 2. A 7. E 12. C 17. C 22. B 27. B 3. D 4. A 8. A 9. B 13. D 14. A 18. E 19. D 23. D 24. D 28. B 29. A 5. C 10. C 15. A 20. A 25. A 30. D 31. A Solutions: 1. C Solution: Receivable from XYZ, Inc. (in pesos) Multiply by: Closing rate, Dec. 31, 20x1 Adjusted balance of Payable to ABC Co. (in AMD) Payable to ABC Co. (in AMD) - unadjusted Payable to ABC Co. (in AMD) - adjusted FOREX loss in subsidiary's P/L (in AMD) 2. A Solution: XYZ's separate profit before FOREX loss (in AMD) FOREX loss (in AMD) XYZ's separate profit after FOREX loss (in AMD) 3. D Solution: ₱4,000,000 2 8,000,000 7,000,000 8,000,000 (1,000,000) 7,000,000 (1,000,000) 6,000,000 1) Translation of XYZ's opening net assets: Net assets of sub., July 1 - at opening rate Net assets of sub., July 1 - at closing rate Decrease in opening net assets - loss (12M ÷ 1.50) (12M ÷ 2.00) 8,000,000 6,000,000 (2,000,000) Cumulative translation difference - Jan. 1 2) Translation of changes in net assets during the period: Profit of subsidiary at average rate (6M ÷ 1.75) Profit of subsidiary at closing rate (6M ÷ 2.00) Decrease in profit – loss 3) Translation of goodwill: Goodwill, Dec. 31 - at opening rate Goodwill, Dec. 31 - at closing rate Increase (Decrease) in goodwill -gain (loss) Total translation loss – OCI 4. A Solution: - 3,428,571 3,000,000 (428,571) (2,428,571) Receivable from XYZ Total assets XYZ, Inc. ABC Co. (in AMD) - Adjustments (in pesos) unadjusted 56,000,000 40,000,000 8,000,000 4,000,000 68,000,000 40,000,000 Liabilities Payable to ABC Co. Total liabilities 32,000,000 32,000,000 14,000,000 7,000,000 1,000,000 21,000,000 14,000,000 8,000,000 22,000,000 Equity - July 1, 20x1 Profit for the year 16,000,000 12,000,000 12,000,000 Assets Investment in subsidiary Translation loss – OCI Total equity – Dec. 31 Total liabilities & equity (1,000,000) XYZ, Inc. (in AMD) adjusted 40,000,000 40,000,000 20,000,000 7,000,000 6,000,000 36,000,000 19,000,000 18,000,000 68,000,000 40,000,000 40,000,000 Rates 2 XYZ, Inc. (in Consolidation pesos) 20,000,000 (56M + 20M) (eliminated) (eliminated) 20,000,000 2 2 1.75 76,000,000 76,000,000 7,000,000 (32M + 7M) 4,000,000 (eliminated) 11,000,000 39,000,000 (omitted) (parent only) 3,428,571 (20M+ 16,000,000 23,428,571 3,428,571) (see above) 2 Consolidated 39,000,000 9,000,000 (2,428,571) 37,000,000 20,000,000 76,000,000 The 1,000,000 adjustments pertain to the FOREX loss on the intercompany payable which is recognized in the subsidiary’s separate profit or loss. Notice that the even though the intercompany accounts have been eliminated, the FOREX loss remains in the consolidated total equity 5. C (See solution above) 6. A Solution: Hedging instrument: The fair value of the forward contract on July 1, 20x1 is zero. The fair value of the forward contract on December 31, 20x1 is computed as follows: Sale price at 6-month forward rate - 12/31/20x1 (20M ÷ 2.02) 9,900,990 Sale price at the pre-agreed forward rate (20M ÷ 1.54) 12,987,013 Difference 3,086,023 Multiply by: PV factor (given) 0.971286 Fair value of forward contract - Dec. 31, 20x1 (asset) 2,997,411 An asset is recognized because the sale price at the six-month forward rate is ₱9,900,990 but ABC can sell at a higher price of ₱12,987,013 – a condition that is favorable to ABC. The gain (loss) on the forward contract is computed as follows: Fair value of forward contract - July 1, 20x1 2,997,411 Fair value of forward contract - Dec. 31, 20x1 Increase in fair value - Unrealized gain in OCI (gross of tax) 2,997,411 (1,198,964) Less: Deferred tax liability (2,997,411 x 40%) 1,798,447 Unrealized gain in OCI (net of tax) The net translation gain (loss) to be recognized in other comprehensive income is computed as follows: Total translation loss – OCI (without hedging - see Case #1) Unrealized gain in OCI - net of tax Total FOREX translation loss - OCI (with hedging) (2,428,571) 1,798,447 (630,124) 7. E The CORRECT ANSWER is 78,997,411 (See solution below) Solution: Hedging instrument – Forward contract (Derivative) July 1, 20x1 No entry Dec. 31, 20x1 Forward contract….2,997,411 Deferred tax liability….... 1,198,964 Accumulated OCI……… 1,798,447 to recognize the change in the fair value of the forward contract Consolidated (without hedging) Journal entry on hedging instrument Consolidated (with hedging) Total assets 76,000,000 2,997,411 78,997,411 Total liabilities 39,000,000 1,198,964 40,198,964 Equity - July 1, 20x1 16,000,000 16,000,000 Profit for the year 23,428,571 23,428,571 Translation loss – OCI (2,428,571) Total equity – Dec. 31 37,000,000 38,798,447 Total liab. & equity 76,000,000 78,997,411 1,798,447 (630,124) 8. A (See solution above) 9. B Solution: Fixed selling price Selling price at current spot rate (4M ÷ 35) Excess – payment to broker 100,000 114,286 (14,286) 10. C Solution: Fixed selling price Selling price at current spot rate (4M ÷ 50) Deficiency - receipt from broker 100,000 80,000 20,000 223 11. A Solution: Fixed selling price Selling price at current spot rate (4M ÷ 45) Fair value of forward contract – receivable (asset) 100,000 88,888 11,111 12. C Solution: Fixed purchase price (₱2,400 x 1,000) Purchase price at current mkt. price (₱2,800 x 1,000) Derivative asset - receivable from broker 2,400,000 2,800,000 400,000 13. D Solution: Fixed purchase price (₱2,400 x 1,000) Purchase price at current mkt. price (₱2,200 x 1,000) Derivative liability - payable to broker 2,400,000 2,200,000 (200,000) 14. A ₱20,000,000 (100,000 kilos notional figure x ₱200 forward price) 15. A Solution: Fixed purchase price (100,000 x ₱200) Purchase price at current mkt. price (100,000 x ₱260) Receivable from broker Multiply by: PV of 1 @10%, n=1 Fair value of forward contract (asset) 20,000,000 26,000,000 6,000,000 0.90909 5,454,540 16. D Solution: Fixed purchase price (100,000 x ₱200) Purchase price at current mkt. price (100,000 x ₱160) Payable to broker Multiply by: PV of 1 @10%, n=0 Fair value of forward contract (liability) 20,000,000 16,000,000 (4,000,000) 1 (4,000,000) 17. C Solution: "Long" futures contract to purchase gold: Fixed purchase price (₱2,000 x 400) Purchase price at current market price (₱1,800 x 400) 800,000 720,000 Payable to broker (80,000) "Long" futures contract to purchase silver: Fixed purchase price (₱1,600 x 800) 224 1,280,000 Purchase price at current market price (₱1,900 x 800) 1,520,000 Receivable from broker "Short" futures contract to sell coffee beans: Fixed selling price (₱250 x 4,000) Selling price at current market price (₱220 x 4,000) Receivable from broker 240,000 1,000,000 880,000 "Short" futures contract to sell potatoes: Fixed selling price (₱60 x 6,000) Selling price at current market price (₱75 x 6,000) Payable to broker 120,000 360,000 450,000 Net derivative asset (90,000) 190,000 18. E The CORRECT ANSWER is 10,286 (See solution below) Solution: Purchase price using the option 100,000 Purchase price without the option (4M ÷ 35) 114,286 Savings from exercising the option - gross 14,286 Less: Cost of purchased option (4,000) Net savings from call option 10,286 19. D 20. A 40,000 – the cost of option 21. C Solution: Fixed purchase price (₱880 x 20,000) Purchase price at current market price (₱960 x 20,000) Derivative asset - receivable from broker 22. B Solution: Fair value of call option - July 1, 20x1 (cost) Fair value of call option - Dec. 31, 20x1 (see above) Unrealized gain - increase in fair value 23. D Solution: Fixed purchase price (₱880 x 20,000) Purchase price at current market price (₱1,000 x 20,000) 17,600,000 19,200,000 1,600,000 40,000 1,600,000 1,560,000 17,600,000 20,000,000 Net cash settlement - receipt 24. D Solution: March. Cash (see above) Call option (see above) 31, 20x2 2,400,000 2,400,000 Gain on call option (squeeze) 1,600,000 800,000 to record the net settlement of the call option 25. A Solution: 20x1 400,000 400,000 Net cash settlement - (payment) (due on Dec. 31, 20x3) 20x2 320,000 400,000 (80,000) 26. A Solution: Net cash settlement - (payment) (due on Dec. 31, 20x3) Multiply by: PV of 1 @8%, n=1 Fair value of interest rate swap - liability (80,000) 0.9259 (74,072) Receive variable (at Jan. 1 current rates) Pay 10% fixed 27. B Solution: 20x1 Receive variable (at Jan. 1 current rates) 400,000 Pay 10% fixed 400,000 Net cash settlement – receipt (due on Dec. 31, 20x3) 28. B Solution: Net cash settlement - receipt (due on Dec. 31, 20x3) Multiply by: PV of 1 @12%, n=1 Fair value of interest rate swap - asset 20x2 480,000 400,000 80,000 80,000 0.8929 71,432 29. A 4,000,000 – the principal amount of the loan 30. D Solution: Receive variable (4M x 9%) Pay 8% fixed Net cash settlement - receipt (due annually for the next 4 yrs.) Multiply by: PV ordinary annuity @9%, n=4 360,000 320,000 40,000 3.23972 Fair value of forward contract – asset 129,589 31. A Solution: Receive variable (4M x 12%) Pay 8% fixed Net cash settlement - receipt (due annually for the next 4 yrs.) Multiply by: PV ordinary annuity @12%, n=3 Fair value of forward contract - receivable 480,000 320,000 160,000 2.40183 384,293