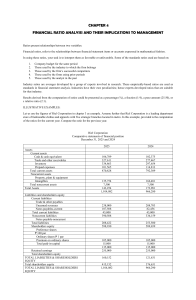

PROFITABILITY RATIOS Return on sales – also called as net profit rate, net profit margin, measures profit percentage per peso sales Gross profit rate – measures gross profit percentage on sales to recover operating expenses Return on total assets – measures overall asset profitability, indicates how well assets have been employed by management Return on shareholder’s equity – measures percentage of profit derived for every peso of owner’s equity Return on ordinary shareholder’s equity – measures % of profit derived for every peso of ordinary equity money used when compared to the return on total assets, it measures to the extent to which financial leverage is working for or against ordinary shareholders Operating leverage – measures the # of times profit will increase or decrease in relation to change in net sales Times preferred dividends earned – measures the adequacy of current earnings to meet preferred dividends payments LIQUIDITY RATIOS Operating turnover – measures the speed of the business cycle, the number of days cash was invested in the normal business operations Inventory turnover – indicates the number of times inventories were acquired and sold during the period Inventory days – indicates the length of time spent before the average inventory is sold to customers, the number of days is 365 in a year, 360 days is used for ease in computation Receivable turnover – indicates the efficiency in credit and collection policies, trade receivables include open account and on notes Collection period – measures quickness in collecting trade receivables Payable turnover – m effectiveness in using trade credit facility from suppliers Payable days – indicates the # of days spent before paying liabilities to merchandise suppliers Materials turnover – indicates the # of times materials were used during the period Work-in-process turnover -