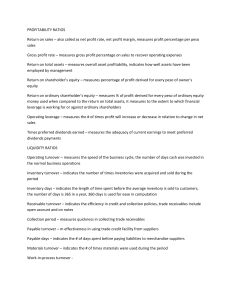

CHAPTER 4 FINANCIAL RATIO ANALYSIS AND THEIR IMPLICATIONS TO MANAGEMENT Ratios present relationships between two variables: Financial ratios, refer to the relationships between financial statement items or accounts expressed in mathematical fashion. In using these ratios, your task is to interpret them as favorable or unfavorable. Some of the standards ratios used are based on: 1. 2. 3. 4. 5. Company budget for the same period Those used by the industry to which the firm belongs Those used by the firm’s successful competitors Those used by the firms using prior periods Those used by the analyst in the past Industry ratios are averages developed by a group of experts involved in research. These empirically-based ratios are used as standards in financial statement analysis. Industries have their own peculiarities; hence experts developed ratios that are suitable for that industry. Results derived from the computation of ratios could be presented as a percentage (%), a fraction (1/4), a peso amount (25.50), or s relative ratio (2:1). ILLUSTRATIVE EXAMPLES: Let us use the figures of Riel Corporation in chapter 3 as example. Assume further that Riel Corporation is a leading department store of fashionable clothes and apparels with five strategic branches located in metro. In this example, provided is the computation of the ratios for the current year. Compute the ratio for the previous year. Riel Corporation Comparative statements of financial position December 31, 2025 and 2024 Assets Current assets Cash & cash equivalent Trade and other receivables Inventory Prepaid expenses Total current assets Noncurrent assets Property, plant & equipment Intangibles Total noncurrent assets Total Assets Liabilities and shareholders equity Current liabilities Trade & other payables Unearned revenues Notes payables-current Total current liabilities Noncurrent liabilities Notes payable-noncurrent Total liabilities Shareholders equity Preference shares ₱ 100 par Ordinary shares ₱ 1 par Premium on ordinary shares Total paid-in-capital Retained earnings Total shareholders equity TOTAL LIABILITIES & SHAREHOLDERS EQUITY Total shareholders equity TOTAL LIABILITIES & SHAREHOLDERS EQUITY 2025 2024 106,789 327,611 334,863 101,565 870,828 102,375 277,467 297,654 114,813 792,309 135,754 7,500 143,254 1,014,082 166,481 7,500 173,981 966,280 238,000 107,508 45,000 390,508 208,703 82,456 45,000 336,159 208,422 598,930 253,500 589,659 105,000 15,000 135,000 255,000 105,000 15,000 135,000 255,000 160,152 121,631 415,152 1,014,082 376,631 966,290 Riel Corporation Comparative Income Statements For the period ending December 31, 2025 and 2024 Sales Less: Cost of good sold Gross profit Less: Selling expenses Administrative Expenses Total Operating Expenses Operating income Less: Interest expense Net income before taxes Less: Income tax Net income after taxes 2025 ₱3,007,887 2,208,520 799,367 372,000 207,000 579,000 220,367 41,860 178,507 62,477 ₱116,030 2024 ₱2,732,712 1,964,865 767,847 345,000 213,000 558,000 209,847 43,905 165,942 58,080 ₱107,862 In doing the analysis we shall cover the company status in terms of: I. II. III. IV. Liquidity/short-term solvency- pertains to the firm’s ability to pay any immediate and incoming cash disbursements (payment of payables and operating costs and expenses). Asset utilization liquidity analysis- measures how often is the turnover of accounts receivable, inventory, and long-term assets. Stated differently, we measure the liquidity of assets, namely: accounts receivable, inventory, and long-term assets. Along with this, we also measure how efficient management uses these assets. Debt-utilization (leverage) ratios- estimates the overall debt status of the firm in light of its asset base and earning power. We measure the degree of company financing in terms of borrowings and investment or equity. We also measure the company’s ability to pay interest and other fixed charges such us rent and payment of investment funds like sinking funds, redemptions, pensions, etc. Profitability ratios- measures the firm’s capacity to earn sufficient return on sales, total assets, and owner’s investment. Solution: Liquidity/short-term solvency 1. Current ratio (2025) = current assets of ₱870,828 = 2.23:1 or 223% Current liabilities of ₱390,508 (2024) = Current ratio of 2.23:1 can be interpreted to mean that for every ₱1 of current liability, the company has ₱2.23 current assets to pay it. This result may at times be considered as favorable and satisfactory. It indicates that riel is able to pay their current maturing debts, with ₱1.23 to spare for every ₱1 of liability they have. Inventory is considered as a slow-moving asset in terms of its convertibility into cash. Another asset that some analyst do not use in the computation of current ratio is prepaid expense. The reason is because they are not sources of cash. It represents the consumption or use of future benefits like prepaid rent or prepaid advertisement. Consumption of these does not entail cash inflow but recognition of expense for the company. On the other hand, a company with a low current ratio may be able to pay current maturing debts because the composition of its current asset is easily convertible to cash like having collectible receivables and highly salable trading securities. It is recommended to see whether the said ratio is favorable or not by comparing it with the firm’s competitors or with the firm’s trend of liquidity over a period of 5 years. 2. Upward and Downward Movement of Current Ratio Movements in current ratio components give rise to changes in the current ratio. Ponder on the following statements and experiment using the figures of Riel Corporation: a. Increase in current assets or decrease in current liabilities increases the current ratio. Components Total current assets Total current liabilities Current ratio: Components Total current assets Total current liabilities Current ratio: Previous current ratio ₱50,000 ₱25,000 2:1 Previous current ratio ₱50,000 ₱25,000 2:1 Increase(decrease) ₱10,000 Increase(decrease) ₱10,000 New current ratio ₱60,000 ₱25,000 2.4:1 increase New current ratio ₱50,000 ₱15,000 3.3:1 increase b. If the previous current ratio is 1:1 and there is an increase or decrease of the same amount on both the total current assets and total current liabilities, it shall have no effect on the new current ratio or the new current ratio will be the same as the previous. To prove this, here is an example. Components Total current assets Total current liabilities Current ratio: Previous current ratio ₱50,000 ₱50,000 1:1 Increase(decrease) ₱10,000 ₱10,000 New current ratio ₱60,000 ₱60,000 1:1 no effect/same ratio c. If the previous current ratio is positive (current assets>current liabilities), and there is an increase by the same amount in both total current assets and total current liabilities, the ratio shall decrease and vice-versa. The opposite will occur if the previous current ratio is negative (current liabilities >current assets). Components Total current assets Total current liabilities Current ratio: Components Total current assets Total current liabilities Current ratio: Previous current ratio ₱50,000 ₱25,000 2:1 positive Previous current ratio ₱25,000 ₱50,000 0.5:1 negative Increase(decrease) New current ratio ₱10,000 ₱10,000 ₱60,000 ₱35,000 1.71:1 decrease Increase(decrease) ₱10,000 ₱10,000 New current ratio ₱35,000 ₱60,000 0.58:1 decrease 3. Acid test ratio/Quick ratio/Liquidity ratio (2025) = quick assets (cash +trading securities=receivables) Of ₱106,789+327,611 =2.23:1 or 223% Current liabilities Of ₱ 390,508 =1.11:1 or 1.11%(2024) (2024) = The quick ratio is a stricter test of liquidity. This could be interpreted that for every ₱1.11 of current assets to pay it. As you can see, Riel is not as liquid as we pictured it to be done when the current ratio was used. As a general rule, the higher the quick ratio, the more liquid the firm is and thus, can pay its current maturing debts. Note that the inventories are ignored because of its nature being uncertain as to their salability. Another reason for their exclusion from the formula is its uncertainty as to when the item will be converted into cash. This is more so if the company is a manufacturing entity where the inventory will be raw materials the work in process to finished goods, converted to receivables, and eventually collected and converted into cash. Asset Utilization Liquidity Analysis 1. For Accounts Receivable Accounts Receivable Turnover Net Sales of ₱3,007,887 (2025) = = 9.94 times Average Accounts Receivable of ₱227,467 + ₱327,611 2 (2024) Note for the 2024 receivable turnover you may use the ending inventory of 2014 as the average inventory. Days’ Sales in Average Collection Period 365 days (2025) = =36.7 days Receivable turnover of 9.94 times (2024) This ratio is used to measure the liquidity of the firm’s accounts receivable. The result of 9.94 times could be interpreted to mean the firm is able to collect all their receivables 9.94 times in a year. A high turnover rate means that receivable is collected in a short period of time. In Riel corporation’s case, it is able to collect the average receivables every 37 days or approximately every month. This has great bearing on management since a high receivable turnover speed up its conversion to cash, management can use it further to enhance company operations and increase company profits. High receivable turnover rate does not automatically mean good of efficient collection of the company. The high turnover rate could be caused by any of the following. a. b. c. d. e. f. Price level changes Changes in sales terms Special sales promotion Strikes and plant shutdown during the previous period Higher cash sales (turnover was) computed when most receivables are collected 2. For Inventory Inventory Turnover Ratio The inventory turnover rate pertains to the number of times the average inventory is sold (finishing goods and merchandise) used (raw materials), or processed (work-in-process). The following formulas are adapted depending on the nature of the inventory being assessed: raw materials used Raw materials = Inventory turnover Average raw materials inventory cost of goods manufactured Work-in-process Inventory process = Average work in process inventory cost of goods sold Finished goods = Inventory turnover Average finished goods inventory cost of goods sold Merchandise = Inventory turnover average merchandise inventory beginning inventory + Ending inventory Average inventory = 2 In our example, we used Merchandise Inventory; hence, the turnover rate is computed as: cost of goods sold of ₱2,208,520 (2025) = = 6.98 times ₱297,654+ ₱334,863 Average inventory of 2 (2024) = The inventory turnover indicates the company’s efficiency in managing and disposing inventory. As a general rule, the higher the turnover rate, the better. However, this is not always the case because a high turnover rate may also indicate that the firm is underinvesting in their inventory or suffering lost orders. It may also mean inventory shortages. For purposes of providing an interpretation for Riel Corporation, the result has a relatively slight unfavorable inventory turnover. A dress store like Riel should be able to dispose of their inventory quicker, since fashion is highly dynamic and the turnover of new clothes are high; a higher turnover for Riel would be more appropriate. The management should recommend and come up with strategies on improving the inventory turnover ratio. Number of days in Inventory or Average Sale Period 365 days (2025) = = 52.30 days Inventory turnover of 6.98 times (2024) = The number of days in inventory indicates the number of days the entire inventory is sold. As a general rule, the higher the result, the better. This indicates that since inventories are sold out quickly, funds use for the inventories are quickly converted to cash, and ultimately translated to more earnings. Riel’s days inventory of 52.30 days can still be improved. It would be better if management can dispose of their inventory in shorter number of days. 3. Property, Plant, and Equipment (PPE) or Fixed Asset Turnover Net sales of ₱3,007,887 (2025) = = 19.90:1 Average net PPE of ₱135,754 + ₱166,481 (2024) = This turnover indicated the firm’s efficiency in using their PPE in generating revenue. The computed ratio of 19.90:1 can be interpreted that for every ₱1 PPE acquired and used by the company, ₱19.90 sales revenue is generated. We could infer that Riel Corporation is efficient in using their PPE. 4. Total Asset Turnover Net sales of ₱3,007,887 (2025) = = 3.04:1 or 304 % Average total assets of ₱1,014,082 + 966,290 (2024) = This ratio presents the company’s efficiency in utilizing their total assets to generate revenue. Low turnover rate means that there is slow or low sales generation or that there is too high investment in assets. Looking at Riel’s asset turnover rate (3.04:1), we can interpret that for every ₱1 asset of the company, ₱3.04 of sales revenue is generated. Based on this, we can infer that management utilizes its asset efficiently. It can, however, be recommended that the company instills more asset utilization policies that would further enhance asset usage efficiency. Debt-Utilization (Leverage)Ratios The leverage ratios allow the analyst to ascertain how efficient the company manages its financial obligations. Under this, you need to compare the liabilities and owner’s equity vis-à-vis total assets or total liabilities and owners’ equity. As previously mentioned in chapter 3, the owner’s equity is considered as the margin of safety by the creditors. This is because the owner’s equity is the amount that can absorb any decline in asset. In other words, in case the assets of the company decline, the owner’s equity is the amount that can be used to pay the creditors. In Riel corporation, the total assets may decline by ₱415,152 (amount of stockholder’s equity) or ₱598,930 and the company will still be able to pay its credits. The following ratios may be used in the analyses: 1. Debt to Equity Ratio total liabilities of ₱598,930 (2025) = = 1.44:1 0r 144% Total stockholder’s equity of ₱415, 152 (2024) = The use of borrowed funds in carrying out the firm’s operation is called trade on equity. This means that the firm is willing to borrow money and pay fixed interest charges from the loan. The borrowed money will be used to increase volume of operation and ultimately earn more profit. This is an example of financial leverage. When a firm borrows fund to be used in the business, the total assets (cash) and total liabilities (bank loan) of the company increase, however, the owner’s equity remains the same. If profits increase, the trading on equity (use of borrowed money) would increase the debt/ equity. The debt /equity ratio presents the firm’s capital structure and its inherent risk. The liabilities of the company present a risk, and blessings or benefit on the part of the owners. It is a risk because if the company fails to use the borrowed money wisely to improve operations the interest expense from their borrowings will be higher than their operating income (operating loss). It will be a blessing, if the company is able to use the money wisely to improve operations leading to higher income, and the higher income ultimately increases owner’s equity. The high income exceeds the interest expense from the borrowing, thus making liabilities a blessing for the company. This structure indicates the tradeoff between risk and return. Riel’s debt /equity (144%) presents a high risk in the firm’s capital structure. Management should be mindful of the efficient use of the company’s borrowings in improving operations to ensure higher yields. 2. Debt Ratio total liabilities of ₱598,930 (2025) = = 0.59.1 or 59% Total assets of ₱1,014,082 (2024) = The ratio could be interpreted to mean that for every ₱1 asset of the company, ₱0.59 was borrowed or was provided by the creditors. It basically presents the proportion of borrowings to total assets. Generally, as explained earlier, the higher the debt proportion, the higher is the risk. In addition, the risk is higher be cause of the firm gets bankrupt, the creditors must be paid first, if the assets are not sufficient to pay all the debts, the owners will end up with nothing. Riel’s debt ratio (59%) presents a relatively high risk on the part of the company. Management should be mindful of the risk from borrowings. In addition, the ratio may bring about some difficulty on the part of management to borrow when they need it. Low owner’s equity structure decreases the margin of the safety for creditors. 3. Number of Times Interest Earned Net Income before interest and Income tax or operating income of ₱220,367 (2025) = = 5.26 times Annual Interest Expense of ₱41,860 (2024) = This ratio indicates the ability of the firm o pay fixed interest charges. It gauges the company’s ability to protect long-term creditors. Riel’s times interest earned of 5.26 times indicate that the firm is very much capable of paying its fixed interest charges from its operating income. Profitability Ratios 1. Gross Profit Ratio gross profit of ₱799,367 (2025) = =₱0.26 or 0.26:1 or 26% Net sales of ₱3,007,887 (2024) = This presents the gross margin per peso of sales. This is used to ascertain if the gross margin or profit is sufficient to cover the operating expenses and the firm’s desired net income. It also gauges the firm’s ability to control production/ acquisition costs and inventories, including mark-ups in the selling of their products. The said mark-ups must be more than adequate to cover not only the inventory related costs but also operating expenses and achieve a desired profit for a period. Riel’s gross profit ratio (₱0.26) indicates their ability to earn more than adequate sales revenue to cover their cost of selling the goods. However, a 26% gross profit ratio means a 74% cost ratio. This is relatively too high. Management must come up with more stringent cost control measures to decrease cost of sales thereby increasing the gross margin ratio in the succeeding years. 2. Net Profit or Profit Margin net profit of ₱116,030 (2025) = = ₱0.039: ₱1 or 3.9 Net sales of ₱3,007,887 (2024) = The ratio could mean that for every ₱1 sales revenue, the firm has ₱0.39 net income. These gauges the profitability of the firm after including all revenues and deducting all costs and expenses, and taxes. Riel’s net profit ratio of 39% is positive. however, management should look closely to come up with measures that would increase revenue and decrease costs in order to ensure and achieve profit maximization. 3. Return on Assets (ROA) net income of ₱116,030 (2025) = = 0.12:1 or 12% Average total assets of ₱1,014,082 + ₱966,290 2 (Du pont Method) = Net profit ratio of 3.9% × total asset turnover of 3.04= 12% (2024) = This could mean that for every ₱1 asset used by the company to generate revenue, it yielded ₱0.12 of net income. It gauges the profitability of the firm in the use of the total assets or total liabilities and total owner’s equity. 4. Return on Equity net income of ₱116,030 (2025) = = 0.29:1 or 29% Ave. stockholder’s equity of ₱415,142 + ₱376,631 (2024) = This could be interpreted to mean that for every ₱1 of invested capital by the owner’s and used to generate revenue, it yielded ₱0.29 of net income. This ratio, just like ROA, is used to gauge the company’s efficiency in managing its total assets invested and in coming up with return to shareholders. 5. Du Pont System of Analysis After seeing and analyzing the ratios, you might think that they are too many. A man by the name of Donald Brown, who happened to be Du Pont’s chief financial officer, thought of the same thing. He came up with the Du Pont Equation or the Du Pont System Analysis. The Du Pont company emphasized that satisfactory return on assets may be achieved by having high profit margins/net profit ratio or by having a faster asset turnover, or a good combination of both. A favorable net profit ratio would indicate that the company has good cost control measures, and a high asset turnover rate would mean efficient use of assets. Various industries have various operating and financial structures. Companies belonging to industries with heavy/ high capital produce emphasizes high net profit ratio with a relatively low asset turnover. On the other hand, the food processing industries emphasize low net profit margin and high turnover of assets indicating a satisfactory return on assets. The model includes the following formula to compute return on equity: Return on assets = Profit Margin or Net Profit Ratio × asset turnover Debt ratio = total liabilities/total assets Equity ratio = 1- debt ratio Return on equity = return on assets (Du Pont Method) Equity Ratio Using the analysis for Riel Corporation: Return on Asset Debt ratio = 12% (Du Pont) = 59% Return 0n Equity = 12% = 29% 1-59% RATIOS USED TO GUAGE COMPANY LIQUIDITY OR SHORT-TERM SOLVENCY The following rate are the most common ratios to gauge a firm’s liquidity or short-term solvency: Ratio Formula Significance Current assets Current liabilities Signifies the firm’s capacity to 1. Current ratio Note: some analysts do not pay or meet current financial include prepaid expenses in the obligation computation of the current assets Current assets Current liabilities 2. Quick ratio Quick asses current A stricter test of liquidity; Liabilities QA=cash + trading suggest the firm’s ability to pay securities + trade and other current financial obligations by receivables considering more liquid current assets Current assets Suggests the relative liquidity of 3. Currents assets to total Total assets the total assets and shows the assets or Working proportion of current asset to capital to Total assets total asset 4. Each current asset item to total current assets Each current asset items Total current asset 5. Cash flow liquidity ratio Cash & cash equivalents + trading services + cash flow from operating Activities Current liabilities 6. Defensive interval ratio Current liabilities Cash and cash equivalents Signifies the proportion of each current asset item to total assets, also indicates the liquidity of the current assets and the breakdown of each component Gauges the firm’s ability to pay current financial obligations by considering cash and other cash equivalents Indicates the coverage of current liabilities RATIOS USED TO GUAGE ASSET MANAGEMENT EFFICIENCY AND LIQUIDTY The following are the most common ratios to gauge a firm’s ability to efficiently manage their assets and measure liquidity or short-term solvency: Ratio 1. Receivable turnover 2. Average collection period or number of days in receivables 3. Merchandise Turnover Formula Net sales or Net Credit sales Average Receivables 365 Days or 360 days Receivable Turnover Costs of goods sold Average merchandise inventory 4. Finished Goods Turnover Costs of goods sold Average finished goods inventory 5. Wok-in-process Turnover Cost of goods manufactured Average work in process inventory 6. Raw materials Turnover 7. Number of days in inventory 8. Working capital turnover Raw materials used Average raw materials inventory 365 days or 360 days Inventory turnover Costs of goods sold + operating Expenses (excluding charges not requiring working capital) Or Net sales Average Working capital Significance Signifies the number of times the average receivables are collected during the year, also measures the firm’s efficiency in collecting their receivables This ratio is very much related to accounts receivable turnover, indicates the number of days the firm collects its average receivables. It implies the efficiency of the firm in collecting their receivables Suggests the number of times the average inventory was disposed of during the accounting period, also signifies the over or under investment of the firm in inventory Suggests the number of times the average inventory was disposed of during the accounting period, also signifies the over or under investment of the firm in inventory Signifies the number of times average inventory was produced during the accounting period, also indicates the time taken to produce the products Measures the number of times average raw materials inventory was used during the period, also indicates the sufficiency of the raw materials available Indicates the number of days by which inventories are used or sold, implies the firm’s efficiency in consuming or selling inventories. Signifies the pace by which working capital is used; also indicates the adequacy of working capital in the firm’s operations 9. Current Asset turnover 10. Payable turnover 11. Operating Cycle (trading Concern) 12. Operating cycle (manufacturing concern) Cost of goods sold + operating expenses + income taxes + other expenses (excluding charges not requiring current assets like depreciation and amortization expenses) Average Current assets Net credit purchases or net purchases Average trade and other payables or accounts payables Signifies the firm’s ability to pay trade payables; also measures the number of times the amount of average payables is paid during the accounting period Day’s sales in merchandise Measures the length of time in inventory + no. of days to order to convert cash to collect receivables inventory to receivables and back to cash No. of days usage in raw Measures the length of time in materials inventory + no. of order to convert cash to rawdays in production process + no. materials inventory to work-inof days sales in finished goods process to finished good inventory + no. of days to inventory to receivables and collect receivables back to cash Average cash balance 13. Days Cash Cash operating costs 365 days or 360 days 14. Asset Turnover Net sales Average Total Asset 15. Property, plant, & equipment turnover or fixed asset Turnover Signifies the pace by which current assets are used; also indicates the adequacy of current Assets in the firm’s operations Net sales Average PPE Assets Indicates the ability of the firm’s cash to pay the average daily cash obligations Indicates the firm’s ability to efficiently manage their assets to generate revenue Indicates the firm’s ability to efficiently manage their PPE’s to generate revenue RATIOS USED TO GAUGE FIRM’S UTILIZATION OF DEBT AND COMPANY STABILITY The following are the most common ratios used to gauge a firm’s stability or long-term solvency: Ratio 1. Debt to Equity Ratio 2. Equity to Debt Ratio 3. Proprietary or Equity Ratio 4. Debt Ratio 5. Fixed Assets to Total Owner’s Equity 6. Fixed Assets to Total Asset 7. Fixed Assets to Total longterm Liabilities 8. Plant Turnover 9. Book Value per Share 10. Number of times interest earned 11. Number of times preference shares dividend requirement is earned 12. Number of times Fixed charges are earned Formula Total Liabilities Owner’s Equity Owner’s Equity Total Liabilities Owner’s Equity Total Asset Total Liabilities Total assets PPE or Fixed Assets (net) Owner’s Equity PPE or Fixed Assets (net) Total Asset PPE or Fixed Assets (net) Total Long-term liabilities Net sales Average PPE or Fixed Assets (net) Ordinary Shareholder’s Equity Number of ordinary sales outstanding net income before interest and income taxes annual interest charges Net income after tax Preference shares dividend requirment Net income before taxes & fixed charges Fixed expenses (rent, interest, sinking fund payments before taxes) Significance Measures the relationship or proportion of the capital provided by creditors to the capital provided by owner’s Measures the margin of safety creditors Measures the proportion of the firm’s assets coming from its owner’s, signifies financial stability of the firm and caution the creditors Measures the proportion of the firm’s assets coming from its creditors, also signifies the extent of trading on equity Measures the portion of the owner’s equity used to acquire fixed assets Signifies whether the firm over or under invested in PPE Measures the extent covered by the carrying value of PPE to longterm obligations Signifies the firm’s efficiency in using their PPE Measures the carrying value of net assets for every ordinary share outstanding, also indicates the amount, which the shareholders can recover if the firm sells its assets upon liquidation or converts them into cash at their bock values Signifies the firm’s capacity in paying fixed interest charges, measures the number of times interest charges is covered by the firm’s operating income Measures the firm’s ability to pay the preference shareholder’s dividend requirement Indicates the firm’s ability to pay annual fixed charges RATIOS USED TO GAUGE FIRM’S PREOFITABILTY AND RETURN TO OWNER’S The following are the most common ratios used to gauge a firm’s profitability and returns to owner’s. Ratio 1. Rate of return on sales or net profit ratio or net profit margin Formula Net income Net sales Return on sales × asset turnover 2. Rate of return to total assets (ROA) 3. Asset turnover 4. Gross Profit ratio 5. Operating Ratio 6. Cash flow margin 7. Rates of return on Current assets or working capital 8. Rate of return on current assets or Working Capital (current assetscurrent liabilities) Or Net income Average total assets net sales Average total assets gross profit net sales operating income net sales cash flow from operating activities net sales Net income Average current assets net income average net working capital Significance Measures the amount of net income per peso of sales, also shows the proportion of net income to the firm’s sales revenue Measures the company’s profitability in using their total assets; indicates the net income generated by using the firm’s total asset’s; signifies management efficiency in using their assets to earn income Signifies management efficiency in using their assets to generate sales revenue Measures the gross profit per peso of sales revenue; important in ascertaining the adequacy of gross profit to meet operating expenses plus their desired profit Measures the portion of sales revenue used to cover operating costs. Indicates the firm’s ability to translate sales into cash Gauges management efficiency in using current assets to generate net income Measures management efficiency in using net working capital to generate revenue 9. Rate return on owner’s equity 10. Earnings per share 11. Price-earnings Ratio 12. Earning-price ratio or capitalization rate 13. Dividends per share 14. Payout ratio or dividends payout 15. Retained Earnings to share capital 16. Market price to book value per share net income average owner’s equity Net income- preference share dividend requirement No. of ordinary shares outstanding market price per share earnings per share earnings per share market price per share Dividends paid or declared Ordinary shares outstanding Dividends per share Earnings per share Retained Earnings Share capital market price per share book value per share Indicates the amount of return per peso of owner’s equity; gauges management efficiency in using its invested capital to generate revenue Measures the peso return on each ordinary share issued; signifies the firm’s ability to pay dividends Indicates the relationship between the market price of ordinary shares and the earnings of each ordinary share Measures the rate at which the share market is capitalizing the value of current earnings Indicates the earnings distributed to the owner’s on a per share basis Measures the percentage of the company’s earnings paid to owners Measures the probability of declaration of dividends by the firm Signifies the under or overvaluation