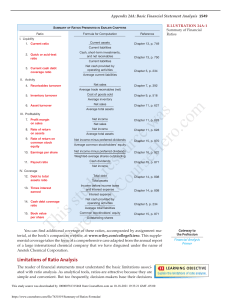

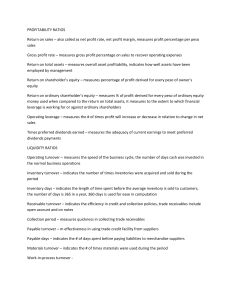

Financial Reporting & Analysis Chapter 1 Generally accepted accounting principles are accounting principles that have substantial authoritative support. Relevance and reliability, the two primary qualities, make accounting information useful for decision making. The information needs to be: Predictive Timely Verifiable Neutral Qualitative Characteristics of Accounting Information: Relevance Reliability Comparability Elements of financial statements: 1. Assets 2. Liabilities 3. Equities 4. Investments by owners 5. Distribution to owners 6. Comprehensive income 7. Revenues 8. Expenses 9. Gains 10. Losses To be recognized, an item should meet the following criteria: – Fits in to a definition of elements – Measurable with sufficient reliability – Information should be relevant – Information should be reliable The five different measurement attributes used are: Historical cost (historical proceeds) Current cost Current market value Net realizable (settlement) value Present (or discounted) value of future cash flows A full set of financial statements for a period should show the following: 1. Financial position at the end of the period 2. Earnings (net income) 3. Comprehensive income (total nonowner change in equity) 4. Cash flows during the period 5. Investments by and distributions to owners during the period Major financial frauds Enron WorldCom Traditional assumptions of the accounting model: Business Entity Going Concern or Continuity Time Period Monetary Unit Historical Cost Conservatism Realization Business entity: The business entity is separate and distinct from the owners of the entity The entity is an economic unit that stands on its own Going concern or continuity: The entity will remain in business for an indefinite period of time Disregards possibility of bankruptcy or liquidation Impacts how assets and liabilities are measured and reported In case of a threat of liquidation or bankruptcy, financial statements must disclose that the presumption of continuity is not applicable Time period: – Natural business year (31 dec) – Calendar year (31 dec) – Fiscal year (other month other than December) Inflation: loss in value of money Conservatism guides selection of the alternative that has the least favorable impact on net income and financial position Realization: when to recognize revenue This happens at: 1. Point of sale 2. End of production 3. Receipt of cash 4. During production 5. Cost recovery Matching: – Match revenue recognized with costs associated – Direct association (i.e., inventory sales and cost of the inventory) – Costs that have no direct connection with revenue Methods of disclosure: Parenthetical explanations Supporting schedules Cross-references Notes Materiality concept involves the relative size and importance of an item to a firm. The cash basis recognizes revenue when cash is received and recognizes expenses when cash is paid. Acceptability: Usually not accepted by GAAP May be used if difference between cash basis and accrual basis is not material The accrual basis of accounting recognizes revenue when realized (realization concept) and expenses when incurred (matching concept). – More complex than cash basis – Result is more representational of financial condition – Supports the time period assumption Chapter 2 A business entity may be a sole proprietorship (1 person), a partnership, or a corporation. Financial statements: 1. Balance Sheet 2. Statement of Stockholders Equity (links the balance sheet to the income statement) 3. Income statement 4. Statement of Cash Flows a. Cash flows from operating activities b. Cash flows from investing activities c. Cash flows from financing activities 5. Notes The accounting cycle: 1. Recording transactions 2. Recording adjusting entries 3. Preparing the financial statement Two statements are prepared directly from the adjusted accounts – Income statement – Balance sheet From analysis of general ledger accounts – Statement of cash flows Auditor’s opinion: Unqualified opinion Qualified opinion Adverse opinion Disclaimer of opinion Other types of engagements: Review Compilation Management is responsible for – The preparation of the financial statements – The integrity of the financial statements The proxy, the solicitation sent to stockholders for the election of directors and for the approval of other corporation actions, represents the shareholder authorization regarding the casting of that shareholder’s vote. Consists of: - Annual meeting - Beneficial ownership - Board of directors - Standing committees - Compensation of directors Essential values can be considered central to relations between people: Caring Honesty Accountability Promise keeping Pursuit of excellence Loyalty Consolidated statements are financial statements that a parent company produces when its financial statements and those of a subsidiary are added together. Accounting for business combination: • Effected through merger or acquisition • Accounted for using the purchase method • Excess of purchase price over fair value of net assets acquired is reported as goodwill • Income of the acquired firm is considered from the date of acquisition • Retained earnings of the acquired firm do not continue Chapter 3 Balance sheet form: – Account form (side by side) – Report form (assets at top and liabilities and stockholders’ equity at bottom) dominant in the U.S. Assets can be physical and intangible. Current or non-current. Current assets: Cash and assets that will be converted into cash during the operating cycle or within a year, whichever is longer. Depreciation Methods: – Straight-line – Declining-balance – Sum-of-the-years’-digits – Units-of-production Balance sheet presentation is cost of the asset – accumulated depreciation = net book value Straight line method: Cost Salvage Value = Annual Depreciation Estimated Value $10,000 $2,000 $1,600 5 Years Declining balance method: 1 × 2 = Double the straight-line rate* Estimated Life 1 × 2 × Book Value at Beginning of Year = Annual Depreciation 5 *Double the straight-line rate is the maximum rate Sum of the years digits: Number of Remaining Years (Cost Salvage) = Annual Depreciation Sum of Digits of Estimated Life 5 ($10,000 $2,000) $2,666.67 (5 4 3 2 1) or 15 Units of production: Cost Salvage Value Per Unit Depreciation Estimated Life in Capacity 10,000 2,000 = $0.50 16,000 Hours Bereken bonds ku discount= Bonds payable – bonds discount Intangible long term assets: (goodwill, copyrights, etc) • Intangibles are nonphysical assets • They are recorded at historical cost • An intangible asset that has a finite life is amortized over its useful life • An intangible asset with an indefinite life are reviewed for impairment Liabilities relating to operational obligations: Deferred taxes are caused by using different accounting methods for tax and reporting purposes. Warranty obligations are estimated obligations arising out of product warranties. Noncontrolling interest reflects the ownership of noncontrolling shareholders in the equity of consolidated subsidiaries less than wholly owned Two basic types of capital stock – Preferred – Common Common stock: • Shareholder ownership – Voting rights • Election of board of directors • Major corporate decisions – Liquidation rights secondary to • Creditors • Preferred stockholders’ Preferred stock: • Does not normally convey voting rights – May carry any or all of these features: • Preference as to dividends • Accumulation of dividends • Participation in excess of stated dividend rate • Convertibility into common stock at holder’s discretion • Callability by the corporation • Redemption at future maturity date • Preference in liquidation secondary to creditors Donated capital may be included in the paid-in capital. Capital is donated to the company by stockholders, creditors, or other parties. Retained earnings are the undistributed earnings of the corporation—that is, the net income for all past periods minus the dividends (both cash and stock) that have been declared. Quasi-reorganization: an accounting procedure equivalent to an accounting fresh start. A company with a deficit balance in retained earnings “starts over” with a zero balance rather than a deficit. Treasury stock: when a firm repurchases its own stock and does not retire it. • Stock purchased and held by the issuing corporation • Record treasury stocks in two ways • Par-value method • Cost method Subsequent events: occur during the period between the balance sheet date and the date statements are issued. Chapter 4 Income statement: Summarizes revenues and expenses, and gains and losses Basic elements of income statement • Net Sales (Revenues) • Cost of Goods Sold (Cost of Sales) • Other Operating Revenue • • Operating Expenses Other Income or Expense Operating expenses: 1. Administrative expenses 2. Selling expenses Income Taxes Related to Operations – Federal, state, and local taxes – Includes both paid and deferred taxes Tax Rate = Taxes : Income before taxes Extraordinary Items: material events and transactions distinguished by their unusual nature and by the infrequency of their occurrence. – Unusual and infrequent – Reported net of income tax – Analysis issues The balance sheet is presented for two years, income statement for three years, and statement of cash flows for three years. Earnings per share EPS = Net income Outstanding shares of common stock Dividends return profits to the owners of a corporation. Stock dividends: Issuing a percentage of outstanding stock as new shares to existing shareholders Stock splits: 2-for-1 split – Doubles the quantity of stock – Par or stated value is halved Comprehensive income: net income plus the period’s change in accumulated other comprehensive income. • Required disclosures – Comprehensive income – Each category of other comprehensive income – Reclassification adjustments for each category of other comprehensive income – Tax effects for each category of other comprehensive income – Balances for each category of accumulated other comprehensive income Comprehensive income ta bin despues di Net Income (+) Chapter 5 Ratio analysis: • Liquidity ratios – Measures a firm’s ability to meet its current obligations • Borrowing capacity (leverage) ratios – Measures the degree of protection for long-term creditors • Profitability ratios – Measures the earning ability of a firm • Cash flow ratios Ratios are interpretable in comparison with 1. prior ratios 2. ratios of competitors 3. industry ratios 4. predetermined standards Vertical analysis compares each amount with a base amount selected from the same year. Horizontal analysis compares each amount with a base amount for a selected base year. Year-to-year change analysis use both absolute and percentages Industry variations: • Merchandising – Inventory is a principal asset – Sales may be primarily for cash or on credit • Service – Inventory is low or nonexistent • Manufacturing – Large inventory holdings – Substantial investment in plant assets – Cost of sales often represents the major expense Narrative data o Annual report o Trade periodicals o Industry reviews Trend analysis studies the financial history of a firm for comparison It reveals whether the ratio is – Falling – Rising – Relatively constant The users of financial statements: • Management • • – Analyze information from the perspective of both investors and creditors Investors – Analysis of past and present information to project the future prospects of the entity Creditors – Short-term creditor focus on current resources – Long-term creditors consider the future prospects of the firm Chapter 6 Current assets: Cash • Unrestricted – Available for deposit or to pay creditors – Reported as current asset • Restricted – Maybe reported as current but must disclose restrictions – Eliminate cash and related current liability when measuring short-term debt-paying ability Days sales in receivables: Indicates the length of time that the receivables have been outstanding Days' Sales in Receivables = Gross Receivables Net Sales 365 Accounts receivables turnover: Indicates the liquidity of receivables Accounts Receivable Turnover = Net Sales Average Gross Receivables Accounts receivables turnover in days: Similar to days’ sales in receivables except average gross receivables are used Average Receivable Turnover in Days = Average Gross Receivables Net Sales 365 Inventories: • Perpetual – A continuous record of physical quantities is maintained – Inventory and cost of goods sold are updated as sales and purchases take place – Records are verified through physical inventory • Periodic – Periodic physical counts to determine quantity – Attach costs to ending inventory based on selected cost flow assumption(s) Cost flow assumptions – FIFO (first-in, first-out) – LIFO (last-in, first-out) – Averaging If LIFO method is being used, short-term debt-paying ability is understated Impact on financial statements: • Cash flow is higher when LIFO is used for tax reporting • LIFO generally results in a lower profit LIFO profit reflects current costs of sales • FIFO inventory is closer to replacement value of the asset • LIFO reserve – Measures the spread between LIFO and FIFO inventory value – Discloses the approximate FIFO inventory value Liquidity of inventory: • Days’ sales in inventory • Inventory turnover in times per year • Inventory turnover in days Days sales in inventory: Indicates the length of time needed to sell all inventory on hand Days’ Sales in Inventory Ending Inventory Cost of Goods Sold 365 Inventory turnover: Indicates the liquidity of inventory Inventory Turnover = Cost of Goods Sold Average Inventory Inventory Turnover in Days = Inventory Turnover per Year = Average Inventory 365 Cost of Goods Sold 365 Inventory Turnover in Days Operating cycle: The period between acquisition of goods and the final cash realization from sales Operating Cycle = Accounts Receivable Turnover in Days + Inventory Turnover in Days Liquidity ratios: Working Capital = Current Assets Current Liabilities Current Ratio = Current Assets Current Liabilities Acid-Test (Quick) Ratio = Current Assets Inventory Current Liabilities Cash Equivalents + Marketable Securities + Net Receivables Acid-Test (Quick) Ratio = Current Liabilities Working capital: Indicates short-run solvency of a business Current ratio: Determines short-term debt-paying ability • Minimum current ratio is 2.00 Acid test ratio: Measures the immediate liquidity of the firm • Minimum acid-test ratio is 1.00 Cash ratio: Cash Ratio = Cash Equivalents + Marketable Securities Current Liabilities Sales to working capital: Measures the turnover of working capital per year Sales to Working Capital = Sales Average Working Capital Chapter 7 Time interest earned • Indicates long-term debt-paying ability • Consider only recurring income • Exclude (add back) to income • Include interest capitalized Recurring Earnings, Excluding Interest Expense, Tax Expense, Equity Earnings, and Noncontrolling Interest Times Interest Earned = Interest Expense, Including Capitalized Interest Fixed charge coverage: Indicates a firm’s ability to cover fixed charges Recurring Earnings, Excluding Interest Expense, Tax Expense, Equity Earnings, and Noncontrolling Interest + Interest Portion of Rentals Fixed Charge Coverage = Interest Expense, Including Capitalized Interest + Interest Portion of Rentals The more items included as “fixed charges,” the more conservative the ratio Debt ratio: Indicates the firm’s long-term debt-paying ability Debt Ratio = Total Liabilities Total Assets Debt to tangible net worth ratio: more conservative than debt ratio or debt/equity ratio due to exclusion of intangibles Debt to Tangible Net Worth Ratio = Total Liabilitites Shareholders' Equity Intangible Assets Current debt/net worth ratio: Indicates a relationship between current liabilities and funds contributed by shareholders Total capitalization ratio: Compares long-term debt to total capitalization A joint venture is an association of two or more businesses established for a special purpose Contingencies: An existing condition involving uncertainty as to possible gain or loss to an enterprise Chapter 8 Net profit margin: Also referred to as return on sales • Reflects net income dollars generated by each dollar of sales Net Income Before Noncontrolling Interest, Equity Income, and Nonrecurring Items Net Profit Margin = Net Sales Asset turnover: Measures the activity of the assets and the ability of the firm to generate sales through the use of the assets Total Asset Turnover = Net Sales Average Total Assets Return on assets: Measures the ability to utilize assets to create profits Net Income Before Noncontrolling Interest and Nonrecurring Items Return on Assets = Average Total Assets Operating Income Margin = Operating Income Net Sales Operating assets turnover: Measures the ability of operating assets to generate sales dollars Operating Asset Turnover = Net Sales Average Operating Assets Return on operating assets: Measures the ability of operating assets to generate operating income Return on Operating assets = Operating Income Average Operating Assets Sales to fixed assets: Measures the ability to make productive use of property, plant, and equipment by generating sales dollars Sales to Fixed Assets = Net Sales Average Net Fixed Assets (Exclude Construction in Progress) Return on investment: Measures income earned on invested capital and how well the firm utilizes its asset base Net Income Before Noncontrolling Interest and Nonrecurring Items + [(Interest Expense) × (1 Tax Rate)] Return on Investment = Average (Long-Term Liabilities + Equity) Return on total equity: Measures the return to common and preferred stockholders Net Income Before Nonrecurring Items Dividends on Redeemable Preferred Stock Return on Equity = Average Total Equity Gross profit margin: Comparing gross profit with net sales is termed the gross profit margin Net Sales Revenue − Cost of Goods Sold = Gross Profit Beginning Inventory + Purchases of Inventory − Ending Inventory Gross Profit Margin = • Gross Profit Net Sales Gross profit margin analysis: Analysis helps the following ways: – Managers budget gross profit levels into their predictions of profitability – Used in cost control – Estimate inventory levels for interim financial statements and insured losses in merchandising industries – Used by auditor and Internal Revenue Service to judge accuracy of accounting systems Chapter 10 Statements of cash flow: • Uses a concept of cash that includes not only cash but also short-term, highly liquid investments – Referred to as the cash and cash equivalent focus • Explains the changes in focus accounts Structure Operating activities: • Cash inflows from – Sale of goods or services – Returns on loans (interest) – Return on equity securities (dividends) • Cash outflows for payments – For acquisitions of inventory – To employees – For taxes – For interest expenses – For other expenses Investing activities: • Cash inflows from – Receipts from loans collected – Sales of debt or equity securities of other corporations – Sale of property, plant, and equipment • Cash outflows for – Loans to other entities – Investment in debt or equity securities of other entities – Purchase of property, plant, and equipment Financing activities: • Cash inflows from – Sale of equity securities – Sale of bonds, mortgages, notes, and other short- and long-term borrowings • Cash outflows for – Payment of dividends – Reacquisition of capital stock – Payment of amounts borrowed Operating Cash Flow to Current Maturities of Debt: • Indicates a firm’s ability to meet its current maturities of debt • Higher ratio indicates better liquidity Operating Cash Flow Current Maturities of Long-Term Debt and Current Note Payable Operating Cash Flow to Total Debt • Indicates a firm’s ability to cover total debt with the yearly operating cash flow Operating Cash Flow Total Debt Operating Cash Flow per Share • Indicates the funds flow per common share outstanding Operating Cash Operating Cash Flow Preferred Dividends Flow per Share = Diluted Weighted Average Common Shares Outstanding Operating Cash Flow to Cash Dividends • Indicates a firm’s ability to cover cash dividends with the yearly operating cash flow Operating Cash Flows Cash Dividends