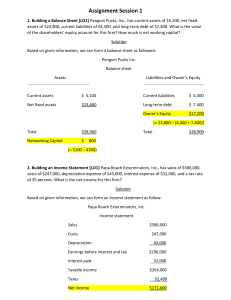

Financial Statements, Cash Flows and Taxes 1 Outline • The Balance Sheet • The Income Statement • Net Working Capital • Financial Cash Flow • Personal and Corporate Taxes • Summary and Conclusions 2 The Balance Sheet • An accountant’s snapshot of the firm’s accounting value as of a particular date. • The Balance Sheet Identity is: Assets = Liabilities + Stockholder’s Equity 3 ABC Inc. Balance Sheet as of Dec 31 ($ in thousands) Assets Current Assets Cash Accounts Receivables Inventory Total Fixed Assets Net Plant & Equipment Total Assets 2021 2022 $45 260 320 $625 $50 310 385 $745 $985 $1610 $1100 $1845 4 Balance Sheet (Continued) • The assets are listed in order by the length of time it normally would take a firm with ongoing operations to convert them into cash. • Clearly, cash is much more liquid than property, plant and equipment. 5 Balance Sheet (Continued) Liabilities and Equity Current Liabilities Accounts Payables Notes Payable Total Long term debt Shareholders Equity Common stock Retained Earnings Total Total Liabilities & Equity 2021 2022 $210 110 $320 $205 $260 175 $435 $225 290 795 $1085 $1610 290 895 $1185 $1845 Liability order reflects time to maturity 6 Balance Sheet Analysis • When analyzing a balance sheet, the financial manager should be aware of three concerns: 1. Liquidity 2. Debt versus equity 3. Market Value versus Book value 7 Liquidity • Refers to the ease and speed with which assets can be converted to cash. • Current assets are the most liquid. • Some fixed assets are intangible. • The more liquid a firm’s assets, the less likely the firm is to experience problems meeting short-term obligations. • Liquid assets frequently have lower rates of return than fixed assets. 8 Debt versus Equity • Generally, when a firm borrows it gives the bondholders first claim on the firm’s cash flow. • Thus shareholder’s equity is the residual difference between assets and liabilities. 9 Debt Vs. Equity Example Original Sales $1000 COGS -700 Depreciation -50 EBIT 250 Interest -50 Taxable Income 200 Taxes @ 40% -80 Net Income 120 Number of Shares 1000 EPS 0.12 Expansion Project Requiring $1000 investment Issued 500 common Issued $1000 in Shares @ $2 each Bonds @10% 1500 $1200 $1500 $1200 -1000 -1000 -1000 -1000 -100 -100 -100 -100 400 100 400 100 -50 -50 -150 -150 350 50 250 -50 -140 -20 -100 20 210 30 150 -30 1500 1500 1000 1000 0.14 0.02 0.15 -0.03 10 Market Value versus Cost (Book Value) • The accounting value of a firm’s assets is frequently referred to as the carrying value or book value. • Market value is a completely different concept. It is the price at which willing buyers and sellers trade the assets. 11 The Income Statement • The income statement measures performance over a specific period of time. • The accounting definition of income is Revenue – Expenses = Income 12 ABC Inc. Income Statement for year ending 2022 ($ in thousands) Net Sales Cost of Goods Sold Depreciation Earnings Before Interest & Taxes Interest Taxable Income Taxes Net Income $710 480 30 $200 20 180 53 $127 Dividends Additions to Retained Earnings 27 $100 13 Income Statement Analysis • There are three things to keep in mind when analyzing an income statement: 1. International Financial Reporting Standards (IFRS) 2. Non Cash Items 3. Time and Costs 14 International Financial Reporting Standards 1. IFRS • The matching principle of IFRS dictates that revenues be matched with expenses. Thus, income is reported when it is earned, even though no cash flow may have occurred. • Income is reported when it is earned or accrued. (For example, when goods are sold for credit, sales and profits are reported). 15 Income Statement Analysis 2. Non Cash Items • These are expenses that do not affect cash flow directly. • Depreciation is the most apparent. No firm ever writes a cheque for “depreciation.” • Another noncash item is deferred taxes, which does not represent a cash flow. 16 Income Statement Analysis 3. Time and Costs • In the short run, certain equipment, resources, and commitments of the firm are fixed, but the firm can vary such inputs as labour and raw materials. • In the long run, all inputs of production (and hence costs) are variable. • Financial accountants do not distinguish between variable costs and fixed costs. Instead, accounting costs usually fit into a classification that distinguishes product costs from period costs. 17 Net Working Capital Net Working Capital = Current Assets – Current Liabilities • NWC is +ve when current assets are greater than current liabilities. • A firm can invest in NWC. This is called change in NWC. • The change in NWC is usually +ve in a growing firm. 18 ABC Inc. Current Assets and Current Liabilities as of Dec 31 ($ in thousands) Current Assets Cash Accounts Receivables Inventory Total 2021 $45 260 320 $625 2022 $50 310 385 $745 Current Liabilities 2021 2022 Accounts Payables $210 $260 Notes Payable 110 175 Total $320 $435 Here we see NWC increased from 625-320 = $305 in 2021 to 745-435 =310 in 2022. This increase of $5 is an investment of the firm. 19 Financial Cash Flow • In finance, the most important item that can be extracted from financial statements is the actual cash flow of the firm. • Since there is no magic in finance, it must be the case that the cash received from the firm’s assets must equal the cash flows to the firm’s creditors and stockholders. CF(A) = CF(B) + CF(S) 20 Cash Flow Summary 1. Cash Flow from Assets = Cash Flow to Creditors + Cash Flow to Stockholders This is based upon the balance sheet identity: Assets = Liabilities + Equity 2. Cash Flow from Assets = Operating Cash Flow - Net Capital Spending - Additions to NWC Where Operating Cash Flow = Net Capital Spending = EBIT + Depreciation – Taxes Ending Net Fixed Assets - Beginning NFA + Depreciation Change in NWC = Ending NWC – Beginning NWC 3. Cash Flow to Creditors = Interest Paid – Net New Borrowing 4. Cash Flow to Stockholders = Dividends paid – Net New Equity Raised 21 ABC Inc Cash Flow from Assets ($ in thousands) Cash Flow from Assets: Operating Cash Flow: EBIT + Depreciation - Taxes =OCF Change in Net Working Capital: Ending NWC - Beginning NWC =Change in NWC Net Capital Spending: Ending Net Fixed Assets -Beginning Net Fixed Assets +Depreciation =Net Capital Spending 1100 -985 30 $145 Cash Flow from Assets $27 $200 30 53 $177 $310 -305 $5 22 ABC Inc Cash Flow from Assets ($ in thousands) Total Cash Flow to Creditors and Stockholders: Cash Flow to Creditors: Interest Paid -Net New Borrowing Cash Flow to Creditors $20 -20 0 Cash Flow to Stockholders: Dividends Paid -Net New Equity Raised Cash Flow to Stockholders $27 0 $27 Cash Flow to Creditors and Stockholders $27 23 CORPORATE AND PERSONAL TAXES 24 Federal & Ontario Personal Tax Rates, Brackets, and Surtaxes for 2021 Jurisdiction Federal Bracket ($s) $49,020 or less $49,021 - 98,040 $98,041 - 151,978 $151,979 – 216,511 Over $216,511 Tax Rate 15% $7,353 + 20.5% on next $49,020 $17,402.1 + 26% on next $53,938 $31,425.98 + 29% on the next 64,533 $50,140.55 + 33% on income over $216,511 Ontario $45,142 or less $45,143 – 90,287 $90,288 – 150,000 $150,001 – 220,000 Over $220,000 5.05% 2,279.67 + 9.15% on next $45,145 $6,410.44 + 11.16% on next $59,713 $13,074.41 + 12.16% on next $70,000 $21,586.41 + 13.16% on income over $220,000 No Surtax at Federal level. Ontario Income Tax < $4,875 Ontario Income Tax $4,875 – 6,237 Ontario Income Tax above $6,237 surtax =$0 surtax = 20% surtax = $272.60 + 56% of Ontario Income Tax above $6,237 Dividend Gross up is 38%. Dividend tax credit is 20.73% at the federal level and 13.8% at the Ontario level of the actual dividend 25 Taxation of Investment Income • interest income taxed like employment income. • Dividends from Canadian companies are grossed up by 44% (taxable dividend); then a dividend tax credit (DTC) is deducted from tax payable — this messy mechanism reduces double taxation: – – – – – Taxable dividend (TD) = 1.44 × Dividend Include TD in taxable income Federal DTC = 0.1797 × TD Provincial DTC = Prov. credit % × TD Deduct DTC from federal and provincial tax. 26 Capital Gains Taxation • Capital gain is the profit from sale of an investment. • Taxable capital gain is the portion included in taxable income. • Inclusion rate 50%. • Net allowable capital losses can only be written off against taxable capital gains. • Tax-free: gain on principal residence; first $500K of family farms, small businesses. 27 Marginal Tax Rates • Marginal or incremental income/cost is the basis for financial decisions. • Marginal tax rate is the rate that applies to the marginal, or incremental income — the “next $”. 28 Investment Income Tax Treatment for an Ontario Resident with a taxable income of $220,000 • Interest Tax Treatment Interest Federal Tax @ 33% Provincial Tax @ 13.16% Surtax @ 56% of the Provincial Tax Total Tax $1000.00 330.00 131.60 73.70 $535.30 Capital Gain Taxable Capital Gain Federal Tax at 33% Provincial Tax @ 13.16% Surtax @ 56% of the Provincial Tax Total Tax $1000.00 500.00 165.00 65.80 36.85 $267.65 • Capital Gain Tax Treatment 29 Investment Income Tax Treatment for an Ontario Resident with a taxable income of $220,000 (continued) • Dividend Tax Treatment Dividends Gross Up at 38% Grossed Up Dividends $1000.00 380.00 $1380.00 Federal Tax @ 33% on Grossed Up Dividend Less Dividend Tax Credit @ 20.73% of Actual Dividend Federal Tax Payable Provincial Tax @ 13.16% Surtax @ 56% of the Provincial Tax Less Dividend Tax Credit @ 13.8% of Actual Dividend Provincial Tax including Surtax Total Tax 455.40 207.30 248.10 181.61 101.70 138.00 145.31 $393.41 30 Corporate Tax Rates in Canada Federal Ontario Combined 15% 11.5% 26.5% All small corporations 9% with a taxable income up to $500,000 3.2% 12.2% Basic corporation 31 Carry-back and Carry-forward • Net capital loss can be carried back up to 3 years and forward indefinitely to reduce prior or future taxes on capital gains • Net operating loss can be carried back and forward up to 3 and 20 years respectively since 2006 32 Capital Cost Allowance (CCA) • CCA is the depreciation for tax purposes. • CCA is deducted before taxes and acts as a tax shield. • Every capital assets is assigned to a specific asset class by the government. • Every asset class is given a depreciation method and rate. • The CCA rate is the rate that is applied to the undepreciated capital cost (UCC) of an asset class. 33 Common Capital Cost Allowance Classes Class Rate 1 4% 8 20% 10 30% Assets Buildings acquired after 1987 Furniture, photocopiers Vans, trucks, tractors, and equipment 22 50% Pollution control equipment 43 30% Manufacturing Equipment 45 45% Computers 13 Straight line Leasehold improvements 34 UCC and CCA • UCC: Undepreciated capital cost (undepreciated book value of assets) • UCC(at the end of the year)=UCC (at the beginning of the year) – CCA • Initial UCC = Cost of Asset at Purchase • Half-year Rule – In the first year of the acquisition, CCA will be claimed only on half of the net acquisition value of the asset 35 CCA and CCA Tax Shield Example: Van was purchased for $30,000. Tax rate is 40%. UCC of CCA at Year Pool Addition 30% T(CCA) 1 $0 $30,000 $4,500 $1,800 2 25,500 0 7,650 3,060 3 17,850 0 5,355 2,142 4 12,495 0 3,748 1,499 5 8,747 0 2,624 1,050 36 Summary and Conclusions • Financial statements provide important information regarding the value of the firm. • A financial manager should be able to determine cash flow from the financial statements of the firm. • Knowing how to determine cash flow helps the financial manager make better decisions. • Since taxes affect cash flows, we learned how corporations are taxed. • Not all investment incomes are taxed the same. We learned how different types of investment incomes are taxed at the personal level. 37