Decision Analysis Solution: Tree, Optimistic, Conservative, Regret

advertisement

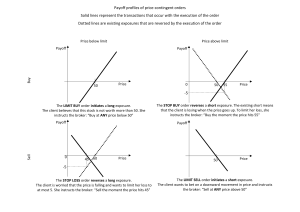

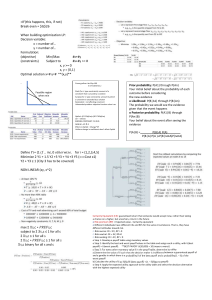

The following payoff table shows profit for a decision analysis problem with two decision alternatives and three states of nature: a. Construct a decision tree for this problem. b. If the decision maker knows nothing about the probabilities of the three states of nature, what is the recommended decision using the optimistic, conservative, and minimax regret approaches? :: Solution :: step: 1 of 4 (a) Construct a decision tree Decision tree is a sequential tool that is represented in the form of a graph. It helps the management in the process of decision-making over a period of time. Decision tree for this problem is as follows: step: 2 of 4 (b) Maximum and minimum profit for each decision alternative: Maximum profit: The maximum profit for is 250 (out of 250, 100, and 25), and is 100 (out of 100, 100, and 25). Minimum profit: The minimum profit for is 25 (out of 250, 100, and 25), and Decision Maximum profit Minimum profit 250 25 100 75 is 75 (out of 100, 100, and 25). Recommended decision using optimistic approach: The following are the criteria for optimistic approach: • For a maximization problem, select the maximax value. • For a minimization problem, select the minimin value. Decision Maximum profit 250 100 Justification: Under optimistic approach, should be selected, which is the maximum of the maximum payoff value. Decision alternative is evaluated in terms of the largest payoff that can arise. step: 3 of 4 Recommended decision using conservative approach: Under the conservative approach, first we should identify the minimum payoff for each alternative and select the alternative with the maximum of the minimum payoff. Decision Minimum payoff 25 75 The minimum payoff for is 25, and the minimum payoff value. is 75. Hence, should be selected with the maximum of step: 4 of 4 Recommended decision using regret or opportunity loss table: The maximum value of follows: , , should be subtracted with the corresponding value in the table as Decision alternative State of nature 0 0 50 150 0 0 is 50, and is 150. Hence, select The maximum opportunity loss for with minimum regret. Likes: 17 4.