=IF(this happens, this, if not)

Break even = $G$26

When building optimization LP:

Decision variable:

x = number of…

y = number of…

Formulation:

(objective)

Min/Max

#x+#y

(constraints)

Subject to

#x+#y >= #

x, y >= 0

x, y = {0,1}

Optimal solution x=# y=# **(x,y)**

.

Como graficar: 4x+10y=100

Si x=0 obtienes y

Feasible region

when min

Slack (for ≤ type constraints): amount of a

constraint that is unused by a solution

Surplus (for ≥ type constraints): amount by which

a constraint is exceeded by a solution

Redundant = not affecting constraint

Unbounded problem: objective function value is œ

OptSol= (FV*ObjCoe)+(2FV*2ObjCoe)

1E+ = infinite

BINDING CONTRAINT: FV=RHS

NON BC= SP 꼭 0

Effect on OptSol = Change*SP

Uniform change in coefficients don’t affect OptSol

Prior probability: P(A1) through P(An)

Your initial belief about the probability of each

outcome before considering

the new evidence

o Likelihood: P(B|A1) through P(B|An)

The probability we would see the evidence

given that the event happens

o Posterior probability: P(A1|B) through

P(An|B)

Your belief about the event after seeing the

evidence

P(A|B) =

P(B|A) P(A)

P(B|A) P(A )+P(B|notA)P(notA)

Define 𝑌𝑖= {1 𝑖𝑓 .. in𝑖, 0 𝑜𝑡ℎ𝑒𝑟𝑤𝑖𝑠𝑒. for i = {1,2,3,4,5}

Minimize 2 Y1 + 1.5 Y2 +3 Y3 + Y4 +3 Y5 (===Cost x1)

Y2 + Y3 ≥ 1 (City 3 has to be covered)

NON LINEAR (xy, x^2)

max Σ 𝑋s,c ∗ 𝑃𝑅𝐸𝐹s,c

subject to Σ 𝑋c,c ≤ 1 for all c

Σ 𝑋s,c ≤ 1 for all s

Σ 𝑋s,c ∗ 𝑃𝑅𝐸𝐹s,c ≥ 1 for all s

𝑋s,c binary for all s and c

Certainty Equivalent (CE): guaranteed return that someone would accept now, rather than taking

a chance on a higher, but uncertain, return in the future

o Risk premium (RP) = Expected value - Certainty equivalent

o Different individuals have different CEs and RPs for the same circumstance. That is, they have

different attitudes toward risk.

□ Risk averse: CE < EV, RP > 0

□ Risk neutral: CE = EV, RP=0

□ Risk seeking: CE > EV, RP < 0

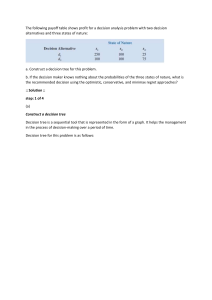

o Step 1: Develop a payoff table using monetary values

o Step 2: Identify the best and worst payoff values in the table and assign each a utility, with U(best

payoff) > U(worst payoff). **BEST PAYOFF U(20,000) = 10 (mayor a worst)

utility:

between a guaranteed payoff of

and a gamble in which there is a

worst payoff

b) Calculate the utility of

payoff)

o Step 4: Apply the expected utility approach to the utility table and select the decision alternative

with the highest expected utility