September 29, 2015

Decision Analysis can be used to determine

the optimal strategies when a decision-maker

is faced with several decision alternatives and

an uncertain future events.

Possibilities to consider

Certainty

Uncertainty

Risk

It is the product of the probability that the

event will occur and the amount to be

received upon such occurrence.

Let P be the probability value and X be the

amount of money.

EV = P(X)

If an event has several possible outcomes

with probability P1, P2, ..., Pn and if X

denotes a discrete variable which can assume

the values X1, X2, ..., Xn then

EV = P1X1 + P2X2 +...+ PnXn

A fair coin is tossed. If the coin lands heads,

Chito will receive P6, and pay P4 if it lands

tails. Find the EV.

EV = (0.50)(6) + (0.50)(-4) = P1

This means that the game is fair for Chito

Consider the following game of chance.

Mark pays P200 and roll a fair die. Then he

receives a payment according to the following

schedule. If the event A={1,2,3} occurs, then he

will receive P100. If the event B={4,5} occurs, Mark

receives P200. If the event C = {6} occurs, then he

will receive P600. What is the average profit he

can make if he participates in this game?

If A occurs , then a profit will be

100-200=-100 (Mark will lose P100)

If B occurs, a profit will be

200-200=0

If C occurs, a profit will be 600-200=400

Therefore we may compute the average profit as follows:

ave.-profit = (3/6)(-100) + (2/5)(0) + (1/6)(400) = 50/3

That is , Mark can expect to make P16.67 on the average

every time he plays this game.

The ABC construction operations manager

has to decide whether to accept a bid or not.

If the manager accepts the bid, the

construction company may gain p3.5 million

if it succeeds, or lose P2.5 million if it fails.

The probability that it will succeed is 30%.

Find the EV if the company accepts the bid.

The ABC construction operations manager has to

decide whether to accept a bid or not. If the manager

accepts the bid, the construction company may gain

p3.5 million if it succeeds, or lose P2.5 million if it fails.

The probability that it will succeed is 30%. Find the EV

if the company accepts the bid.

P1 = 30%

P2 = 70%

X1 = 3.5

X2 = -2.5

EV = -0.7

This means that the company is expected to lose.

The decision-maker is to pick the alternative

with the best payoff for the known event

Payoff – consequence resulting from a specific combination of a decision

alternative and a state of nature

Best alternative

Highest payoff if the payoffs are expressed in profits

Lowest payoff if the payoffs are expressed as costs.

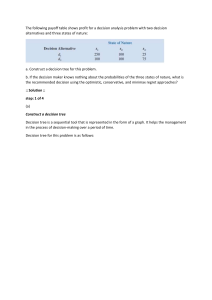

Consider the payoff table which illustrates a capacity planning

problem. It is helpful in selecting among alternatives because they

facilitate comparison of alternatives

Possible Future Demand

Alternative

Low

High

Small Capacity

300

370

Large Capacity

180

900

Present values in thousand pesos

The payoffs are the present values of future revenues minus the

costs for each alternative in each event.

What is the best choice if future demand will be low?

The best choice is the one with highest

payoff.

P300,000 (leads to building small facility)

Assumption:

Managers can list the possible events but

cannot estimate their probabilities.

1.

Conditions that will be used in decision rules:

Pessimistic Approach

Choose the alternative that is the “best of the worst.”

It takes into account only the worst possible outcome

for each alternative.

Maximization : maximin

Minimization : minimax

Example: Refer to the previous table

Alternative

Small facility

Large facility

Worst Payoff

300

180

P300,000 is the worst member, the pessimist

will build a small facility.

Conditions that will be used in decision rules:

2. Optimistic

“best of the best”

“go for it” strategy that has high expectations

Maximization : maximax

Minimization : minimin

Since P900,000 is the best member, the optimistic would

build a large facility.

Conditions that will be used in decision rules:

3. Laplace

Choose the alternative with the best “weighted payoff”

Treats the state of nature as equally likely to each event

Alternative

Small facility

Large facility

Weighted Payoff

0.50(300) + 0.50(370) = 335

0.50(180) + 0.50(900)=540

Since P540,000 is the best weighted payoff, the realist would

build a large facility.

4. Minimax Regret

Choose the alternative with the best “worst regret.”

It seeks to minimize the difference between the given

payoff and the best payoff for each state of nature.

For profit: Regret Value = Highest column entry-every

column entry

For cost: Regret Value=Entry every column-lowest

column entry

Regret

Alternative

Low Demand

High Demand

Maximum

Regret

Small facility

300-300=0

900-370=530

530

Large facility

300-180=120

900-900=0

120

Pick a large facility to minimize the maximum

regret.

The manager has less information than with

decision-making under certainty but more

information than with decision-making under

uncertainty.

A widely used approach

circumstances is the EV

under

such

EV is the sum of the payoffs for an alternative

where each payoff is weighted by the

probability for the relevant state of nature.

state of nature – possible outcomes for a chance

event

Which is the best alternative if the probability

of low demand is estimated to be 0.40 and

the probability of high demand is estimated

to be 0.60?

Possible Future Demand

Alternative

Low

High

EV

Small Facility

300

370

0.4(300)+0.6(370)=342

Large Facility

180

900

0.4(180)+0.6(900)=612

The large facility has higher EV which is 612.

A schematic model of alternative available to

the decision maker along wit their possible

consequences

Composed of a number of nodes that have

branches emanating from it.

Two types of nodes

a square

a circle

represents a decision point

stands for a chance event.

The branches of the tree having square nodes

represent alternatives and branches having

circular nodes represent chance events.

The manager of the company has to decide

whether to prepare a bid or not. It costs

P5,000 to prepare the bid. If the bid is

submitted, the probability that the contract

will be awarded is 60%. If the company is

awarded the contract, it may earn an income

of P60,000 if it succeeds or pay a fine of

P15,000 if it fails. The probability of success is

estimated to be 70%. Should the owner

prepare the bid?

P = 0.70

P = 0.60

contract awarded

prepare

not awarded

▪ not prepare

P = 0.40

success

60,000-5000

failure

-15,000-5,000

P = 0.30

-5,000

Compute the EV backward from position.

EV = 0.70(55,000) + 0.30(-20,000)

= 32,500

EV = 0.60(32,500) + 0.40(-5,000)

= 17,500

55,000

P=0.60

contract awarded

prepare

success P=0.70

32,500

failure

P17,500

P=0.30

not awarded

P=0.40

not prepare

-20,000

-5,000

0

Decision: The manager should therefore decide to prepare the bid.

Once a manager knows which decision to

make, the payoff increases and is now a

certainty, not a probability.

EVPI = expected payoff under certainty –

expected payoff under risk.

Compute for the expected payoff under certainty. The

best payoff for the small capacity and large capacity

are P370 and P900 respectively. Then combine by

weighing each payoff by the probability of that state

of nature and add the amounts.

The expected payoff under certainty is

0.40(370)+0.60(900) = P688

The expected payoff under risk, as computed is P612.

EVPI = P688-P612=P76

Mr. X is planning to open up a new branch of Engrande Lechon at a

new location in Pasig or expand the existing branch located in

Marikina City. Demand on the new location is expected to be 60%

high and 40% low. Fixed cost will reach the amount P150,000. If

the demand becomes high, he expects to have a revenue of

P250,000, however if the demand becomes low, he could only

expect a revenue of P200,000. Upon analyzing the situation in his

existing branch, he believes that by introducing new recipes the

sales will reach the amount P120,000 if the demand becomes high.

However, if the demand becomes low, he could only expect

P80,000 revenue. Projection on high demand in the existing

branch tends to be 55% and upon computing the fixed cost it

would reach the amount of P50,000.

If you were the consultant of Mr. X, what would you advise?

Ruth has to decide whether or not to open a

small dress shop near the U-belt, a few blocks

away from her. Her options are to open a small

shop, a medium-sized shop, or no shop at all.

The market for a dress shop can be good,

average, or bad. The probabilities are 0.20 for a

good market, 0.50 for an average, and 0.30 for a

bad market. The no profit loss for the mediumsized or small shops for the various market

conditions are given in the table. Building no

shops at all yields no loss and no gain. What do

you recommend?

Alternatives

Good Market (PhP)

Ave. Market (PhP)

Bad Market (PhP)

Small Shop

85,000

20,000

-30,000

Medium-sized shop

120,000

45,000

-70,000

No shop

0

0

0

Probabilities

0.20

0.50

0.30