Problems 2

advertisement

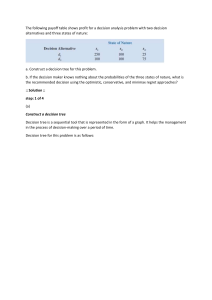

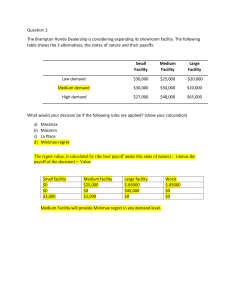

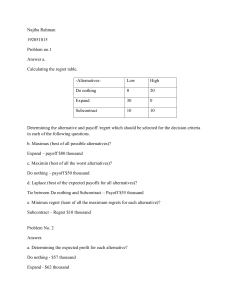

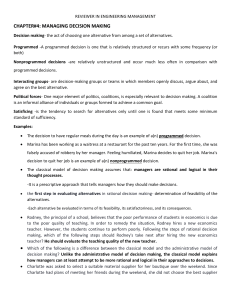

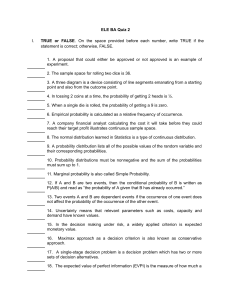

Problems 2 1. The following payoff table shows profit for a decision analysis problem with two decisions alternatives and three states of nature State of Nature Decision Alternatives S1 S2 S3 d1 250 100 25 d2 100 100 75 . a. Conduct a decision tree for this problem b. If the decision maker knows nothing about the probabilities of the three states of nature, what is the recommended decisions using the optimistic, conservative, and mini-max regret approaches? 2. Southland Corporation’s decision to produce a new line of recreational product resulted in the need to construct either the small plant or a large plant. The best selection of plant size depends on how the market place reacts to the new product line. To conduct an analysis, marketing management has decided to view the possible long-run demand as either low, medium, or high. The following payoff table shows the projected profit in millions of dollars Plant Size Small Large Long-Run Demand low Medium 150 200 50 200 High 200 500 What is the decision to be made, and what is the chance event for Southland’s problem? b. Construct an influence diagram c. Construct a decision tree d. Recommend decision based on the use of optimistic, conservative, and minimax regret approach a. 3. The following profit payoff table was presented in problem (1) suppose that the decision maker obtained the probability assessments P(s1) = 0.65, P(s2)=0,15 P(s3)=0,20. Use the expected value approach to determine the optimal decision Decision Alternatives d1 d2 State of Nature S1 S2 250 100 100 100 S3 25 75