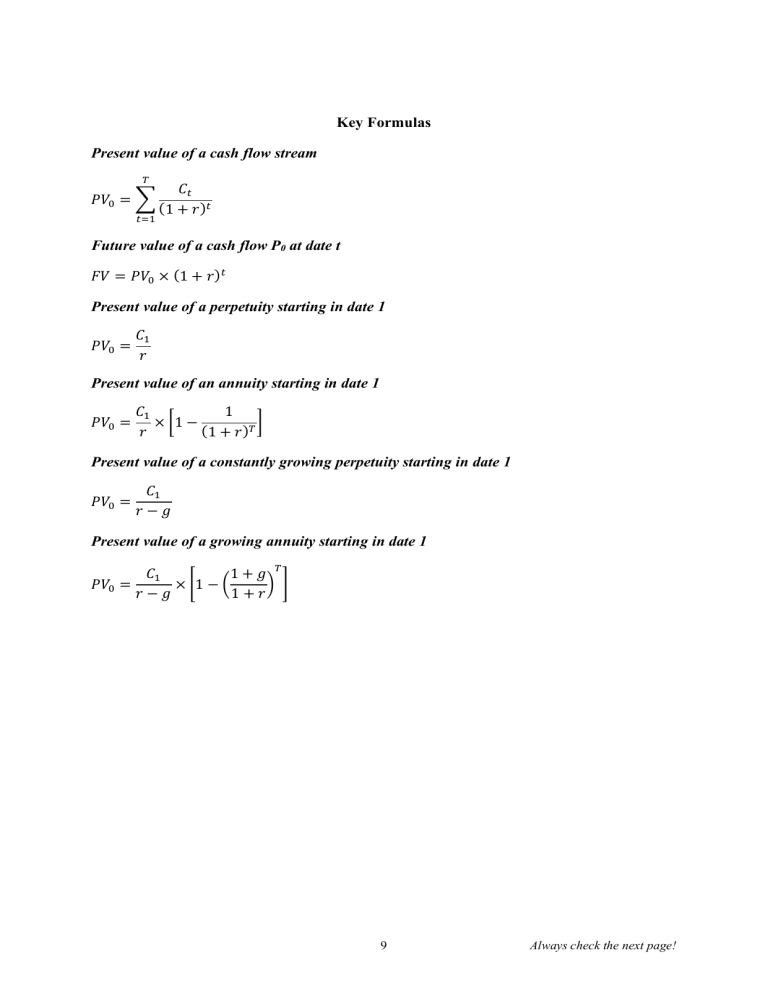

Key Formulas Present value of a cash flow stream - 𝑃𝑉# = % './ 𝐶' (1 + 𝑟 )' Future value of a cash flow P0 at date t 𝐹𝑉 = 𝑃𝑉# × (1 + 𝑟)' Present value of a perpetuity starting in date 1 𝑃𝑉# = 𝐶/ 𝑟 Present value of an annuity starting in date 1 𝑃𝑉# = 𝐶/ 1 × 21 − 4 (1 + 𝑟 )𝑟 Present value of a constantly growing perpetuity starting in date 1 𝑃𝑉# = 𝐶/ 𝑟−𝑔 Present value of a growing annuity starting in date 1 𝑃𝑉# = 𝐶/ 1+𝑔 × 61 − 7 8 9 𝑟−𝑔 1+𝑟 9 Always check the next page! Measures of risk for individual assets Variance: C 𝑉𝑎𝑟 (𝑅< ) = 𝜎<? = 𝐸 (𝑅< − 𝑅A)? = % 𝑝< × (𝑅< − 𝑅A )? <./ Standard deviation (volatility): 𝑆𝐷 (𝑅< ) = 𝜎< = F𝜎<? Covariance: 𝐶𝑜𝑣I𝑅< , 𝑅K L = 𝜎<K = 𝐸[(𝑅< − 𝑅A< ) × I𝑅K − 𝑅AK L] Correlation: 𝐶𝑜𝑟𝑟I𝑅< , 𝑅K L = 𝜌<K = 𝜎<K 𝜎< × 𝜎K Portfolio analysis Expected return of a portfolio p consisting of N assets where wi is the weight of i-th asset in the portfolio: C 𝐸I𝑅P L = % 𝑤< × 𝐸(𝑅< ) <./ Variance of the portfolio p: C C C C 𝜎P? = % % 𝑤< 𝑤K 𝜎<K = % 𝑤<? 𝜎<? + % 𝑤< 𝑤K 𝜎<K <./ K./ 𝛽< = <./ <./ K./ <RK 𝐶𝑜𝑣(𝑅< , 𝑅T ) 𝑉𝑎𝑟(𝑅T ) Capital Asset Pricing Model 𝐸 (𝑅< ) = 𝑟U + 𝛽< × (𝐸 (𝑅T ) − 𝑟U ) Weighted average cost of capital 𝑅VWXX = 𝐸 𝐷 × 𝑅Y + × 𝑅Z × (1 − 𝑇X ) 𝐸+𝐷 𝐸+𝐷 10 Always check the next page!