Finance Formula Sheet: Investments, Returns, and Portfolio Choice

advertisement

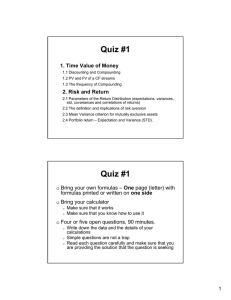

Formula Sheet Performance of Securities • Future Value FV = PV(1+r)t • PV = FV/(1+r)t • r = (FV/PV)1/t -1 • t = log(FV/PV)/log(1+r) • A perpetuity or a consol is a bond that pays a fixed payment C forever. No principal 𝐶 1 𝐶 payment. 𝑃𝑉 = 1+𝑟 × 1 = 𝑟 1−1+𝑟 • 1− An annuity pays a fixed cash flow C for T periods. 𝑃𝑉 = 𝐶 [ 1 (1+𝑟)𝑇 𝑟 ] Remember our convention that no payment is made in the initial period. Quoted Rates and Compounding • Annual quoted rate r with N compounding periods per year means in t years: 𝑟 𝐹𝑉 = 𝑃𝑉 × (1 + )𝑁𝑇 𝑁 • Under continuous compounding the formula becomes: FV = PV erT • The Effective Annual Rate (EAR) is the annually compounded rate of return that would result in the future value that a given compounding frequency. If the quoted rate is compounded m times a year, then 𝐴𝑃𝑅 𝑚 𝐸𝐴𝑅 = (1 + ) −1 𝑚 • Holding Period Return – The HPR is defined as: 𝑃𝑡+1 + 𝐷𝑡+1 𝐻𝑃𝑅 = −1 𝑃𝑡 The annualized holding period return (HPRA) is defined as the value that solves: 𝑉0 (1 + 𝑎𝑛𝑛𝐻𝑃𝑅)𝑇 = 𝑉𝑇 • 𝑉 𝑎𝑛𝑛𝐻𝑃𝑅 = ( 𝑉𝑇 ) 0 • 1⁄ 𝑇 − 1= 𝑎𝑛𝑛𝐻𝑃𝑅 = (1 + 𝐻𝑃𝑅) 1⁄ 𝑇 −1 The formula for T periods is simply: 𝑉𝑇 𝑉𝑇 𝑉𝑇−1 𝑉𝑇−2 𝑉1 = … 𝑉0 𝑉𝑇−1 𝑉𝑇−2 𝑉𝑇−3 𝑉0 = 𝐻𝑃𝑅0,𝑇 + 1 = (1 + 𝐻𝑃𝑅 𝑇 )(1 + 𝐻𝑃𝑅 𝑇−1 ) … (1 + 𝐻𝑃𝑅1 ) 𝐻𝑃𝑅0,𝑇 + 1 = • And the formula for annualized HPR is: 1 𝑎𝑛𝑛𝐻𝑃𝑅 = [(1 + 𝐻𝑃𝑅1 )(1 + 𝐻𝑃𝑅2 ) … (1 + 𝐻𝑃𝑅 𝑇 )] ⁄𝑇 − 1 • Internal rate of return is a number, denoted IRR, that solves the equation: ∞ 𝐶𝑡 𝑃0 = 𝑃𝑉 = ∑ (1 + 𝐼𝑅𝑅)𝑡 𝑡=1 Portfolio Choice: • The expected value is the average outcome if the event was repeated infinitely many times. 𝐸(𝑅𝑖 ) = ∑𝑆𝑠=1 𝑅𝑖 (𝑠)𝑝(𝑠) • The variance is the average squared deviation from the expected value. 𝑉𝑎𝑟[𝑅𝑖 ] = 𝜎𝑖2 = 𝐸([𝑅𝑖 (𝑠) − 𝐸(𝑅𝑖 )]2) 𝑠 = ∑[𝑅𝑖 (𝑠) − 𝐸(𝑅𝑖 )]2 𝑝(𝑠) • 𝑠=1 The standard deviation (SD), also know as volatility, is the square root of the variance: 𝜎𝑖 = √𝜎𝑖2 • The covariance between two random variables is the average of the products of their respective deviations from the mean. 𝑐𝑜𝑣(𝑅𝑖 , 𝑅𝑗 ) = 𝐸([𝑅𝑖 − 𝐸(𝑅𝑖 )][𝑅𝑗 − 𝐸(𝑅𝑗 )]) 𝑆 = ∑[𝑅𝑖 (𝑠) − 𝐸(𝑅𝑖 )][𝑅𝑗 (𝑠) − 𝐸(𝑅𝑗 )]𝑝(𝑠) • 𝑠=1 Correlation between two variables is defined as the covariance between the two variables, normalized by the product of the standard deviations: 𝐶𝑜𝑟𝑟[𝑅𝑖 , 𝑅𝑗 ] = 𝜌𝑖𝑗 = 𝐶𝑜𝑣[𝑅𝑖 ,𝑅𝑗 ] 𝜎𝑖 𝜎𝑗 • Portfolio Math – The expected return on the portfolio is 𝐸(𝑅𝑝 ) = ∑𝑁 𝑖=1 𝑤𝑖 𝐸(𝑅𝑖 ) • With 2 securities, the variance of portfolio return is: 𝑉𝑎𝑟(𝑅𝑝 ) = 𝑉𝑎𝑟(𝑤1 𝑅1 + 𝑤2 𝑅2 ) = 𝑤12 𝜎12 + 𝑤22 𝜎22 + 2𝑤1 𝑤2 𝐶𝑜𝑣(𝑅1 , 𝑅2 ) = 𝑤12 𝜎12 + 𝑤22 𝜎22 + 2𝑤1 𝑤2 𝜌12 𝜎1 𝜎2 More generally, the portfolio variance is 𝑉𝑎𝑟(𝑅𝑝 ) = 𝑉𝑎𝑟(𝑤1 𝑅1 + ⋯ + 𝑤𝑁 𝑅𝑁 ) 𝑁 𝑁 𝑁 = ∑ 𝑤𝑖2 𝜎𝑖2 + 2 ∑ ∑ 𝑤𝑖 𝑤𝑗 𝜌𝑖𝑗 𝜎𝑖 𝜎𝑗 𝑖=1 𝑖=1 𝑗>1 1 • Mean-variance utility: 𝑈(𝑅𝑝 ) = 𝐸(𝑅𝑝 ) − 2 𝐴𝑉𝑎𝑟(𝑅𝑝 ) • The Sharpe Ratio (SR) is the risk premium per unit of risk. • The Capital Markets Line gives the risk-return combinations achieved by forming portfolios 𝐸[𝑅𝑖 −𝑅𝑓 ] 𝜎𝑖 from the risk-free security and the market portfolio 𝐸[𝑅𝑝 ] = 𝑅𝑓 + ( 𝐸(𝑅𝑀 )−𝑅𝑓 𝜎𝑀 ) 𝜎𝑃 • According to the CAPM, the expected return on any asset is given the Security Market Line: 𝐶𝑜𝑣(𝑅𝑖 , 𝑅𝑀) 𝐸[𝑅𝑖 ] = 𝑅𝑓 + 𝛽𝑖 𝐸[𝑅𝑀 − 𝑅𝑓 ], where 𝛽𝑖 = 𝑉𝑎𝑟(𝑅 ) • Systematic and Idiosyncratic Risk – The total risk of a security can be partitioned into two components: 𝜎𝑖2 = 𝛽𝑖2 𝜎𝑀2 + 𝜎̅𝑖2 Where, 𝜎𝑖2 =total risk, 𝛽𝑖2 𝜎𝑀2 =systematic or market risk and 𝜎̅𝑖2 =idiosyncratic risk 𝑀