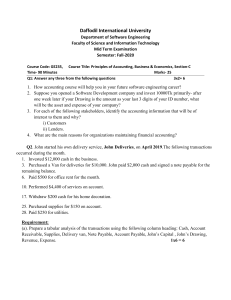

Handout – Accounting Cycle for Merchandising Business By: Joshua A. Eisma Illustrative Exercise Year: 2015 Date June 1 Transaction Leo, the owner, invested ₱ 300,000 in cash and ₱ 50,000 worth of merchandise into the business. The merchandise has an unpaid ₱ 10,000 account from Noir to be assumed by the business. [OR #001] 2 Purchased from Gianne store supplies worth ₱ 5,000 on cash basis [CV #001] 3 Returned ₱500 worth of store supplies purchased from Gianne [OR #002] 4 Purchased from Michael store supplies worth ₱ 2,000 on account 5 Returned ₱ 400 worth of store supplies purchased from Michael 6 Purchased from Jasper store equipment worth ₱ 30,000 on cash basis [CV #002] 7 Was granted a ₱ 3,500 allowance on store equipment purchased from Jasper [OR #003] 8 Purchased from Kendra store equipment worth ₱ 40,00 on terms ₱ 10,000 down, balance on account [CV #003] 9 Was granted a ₱ 3,500 allowance on store equipment purchased from Kendra 10 Received from Meralco the electricity bill for the month of May worth ₱ 10,000 Paid rent for the month, ₱ 20,000 [CV #004] 11 Purchased from Agustus, merchandise on cash basis, ₱ 10,000 [CV #005] Paid freight on merchandise purchased from Agustus, ₱ 500 [CV #006] 12 Paid the utility bill received last June 10 [CV #007] Purchased from Brian merchandise worth ₱ 15,000 on terms 2/10, n/30 The owner invested additional merchandise worth ₱ 12,000 into the business 13 Purchased from Cesarina merchandise worth ₱ 20,000 on terms 50% down, balance 2/10, n/30 [CV #008] 14 Returned ₱ 500 worth of merchandise purchased from Agustus [OR #004] Returned ₱ 1,000 worth of merchandise purchased from Brian 15 Sold to Dianne merchandise on cash basis, ₱ 10,000 [OR #005] Paid freight on merchandise sold to Dianne, ₱ 800 [CV #009] 16 17 Returned ₱ 1,500 worth of merchandise purchased from Cesarina Sold to Ellaine merchandise worth ₱ 15,000 on terms 2/10, n/30 [SI #001] Paid ₱ 2,000 in partial payment of account with Cesarina [CV #010] Sold to Franklin merchandise worth ₱ 20,000 on terms 50% down, balance 2/10, n/30 [OR #006] 18 Received the return of ₱ 500 worth of merchandise sold to Dianne [CV #011] 19 Received the return of ₱ 1,000 worth of merchandise sold to Ellaine 20 Received the return of ₱ 1,500 worth of merchandise sold to Franklin 21 Collected ₱ 2,000 from Franklin for partial payment of account [OR #007] 22 Paid in full account with Brian [CV #012] 26 Collected in full account with Ellaine [OR #008] Page 1 of 7 Handout – Accounting Cycle for Merchandising Business By: Joshua A. Eisma The owner withdrew merchandise worth ₱ 5,000 for personal use 30 Paid in full account with Cesarina [CV #013] Collected in full the account with Franklin [OR #009] THE SQUID PLAY Chart of Accounts Page 2 of 7 Handout – Accounting Cycle for Merchandising Business By: Joshua A. Eisma JOURNAL ENTRIES 1-Jun 2 3 Cash Merchandise Inventory Accounts Payable - Noir Leo, Capital 300,000 50,000 10,000 340,000 Store Supplies Cash Cash 5,000 5,000 500 Store Supplies 4 5 500 Store Supplies Accounts Payable - Michael Accounts Payable - Michael 2,000 2,000 400 Store Supplies 6 7 8 9 10 11 Store Equipment Cash Cash Store Equipment Store Equipment Cash Accounts Payable - Kendra Accounts Payable - Kendra Store Equipment 400 30,000 30,000 3,500 3,500 40,000 10,000 30,000 3,000 3,000 Utilities Expense Accounts Payable - Meralco 10,000 Rent Expense Cash 20,000 10,000 20,000 Page 3 of 7 Handout – Accounting Cycle for Merchandising Business By: Joshua A. Eisma 10,000 10,000 Purchases Cash Freight-in 500 Cash 12 13 14 500 Accounts Payable - Meralco Cash 10,000 Purchases Accounts Payable - Brian 15,000 Purchases Leo, Capital 12,000 Purchases Cash Accounts Payable - Cesarina 20,000 Cash 10,000 15,000 12,000 10,000 10,000 500 Purchase Return and Allowance 15 500 Accounts Payable - Brian Purchase Return 1,000 1,000 Cash Sales Freight-out 10,000 10,000 800 Cash 16 Accounts Payable - Cesarina Purchase Return Accounts Receivable - Ellaine Sales 17 Accounts Payable - Cesarina Cash 800 1,500 1,500 15,000 15,000 2,000 2,000 Page 4 of 7 Handout – Accounting Cycle for Merchandising Business By: Joshua A. Eisma Cash Accounts Receivable - Franklin Sales 18 Sales Return and Allowance 10,000 10,000 20,000 500 Cash 19 20 21 22 500 Sales Return Accounts Receivable - Ellaine 1,000 Sales Return Accounts Receivable - Franklin 1,500 Cash Accounts Receivable - Franklin 2,000 1,000 1,500 2,000 Accounts Payable - Brian Cash 14,000 13,720 Purchase Discount 26 Cash Sales Discount Accounts Receivable - Ellaine 30 280 13,720 280 14,000 Leo, Drawing Purchases 5,000 Accounts Payable - Cesarina Cash 6,500 Cash Accounts Receivable - Franklin 6,500 5,000 6,500 6,500 Page 5 of 7 Handout – Accounting Cycle for Merchandising Business By: Joshua A. Eisma CASH Date Debit 1 Credit 300,000 3 500 7 3,500 14 500 Date 5,000 2 30,000 6 10,000 8 20,000 11 10,000 11 15 10,000 17 10,000 21 2,000 10,000 12 26 13,720 10,000 13 30 6,500 2,000 15 17 13,720 6,500 18 22 30 500 11 800 500 346,720 TOTAL: Date 119,020 227,700 Accounts Receivable Debit Credit Date 16 15,000 1,000 19 17 10,000 1,500 2,000 14,000 6,500 25,000 20 21 26 30 25,000 TOTAL: Date 1 Merchandise Inventory Debit Credit 50,000 50,000 TOTAL: Date Date - 50,000 Store Supplies Debit Credit Date Page 6 of 7 Handout – Accounting Cycle for Merchandising Business By: Joshua A. Eisma 2 5,000 500 3 4 2,000 400 5 7,000 900 TOTAL: Date 6,100 Store Equipment Debit Credit Date 6 30,000 3,000 7 8 40,000 70,000 3,500 6,500 9 TOTAL: 63,500 Page 7 of 7