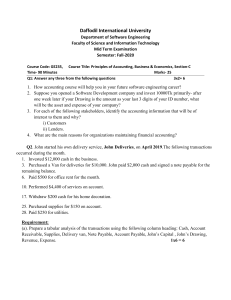

Partnership Formation – Additional Problems II PROBLEM 1 On June 1, 2021, ABBA and QUEEN decided to pool their assets and form a partnership. After the formation, the partners will participate in the profits and loss ratio of 60% and 40% for ABBA and QUEEN respectively. The balance sheet on June 1 before the adjustments were as follows: ABBA QUEEN 396,000 633,600 2,592,000 2,880,000 Allowance for Bad Debts (64,800) (72,000) Notes Receivable 720,000 - Merchandise Inventory 230,400 216,000 - 72,000 Building 1,440,000 - Acc. Depreciation (144,000) - Equipment - 1,152,000 Acc. Depreciation - (86,400) 5,169,600 4,795,200 Cash Accounts Receivable Prepaid Rent Total Assets ABBA QUEEN 72,000 86,400 - 720,000 Capital 5,097,600 3,998,800 Total Liab. and Capital 5,169,600 4,795,200 Accounts Payable Notes Payable The firm is to take over business assets and assume business liabilities. Capitals are to be based on net assets transferred after the following adjustments: a. 4% of the account receivable of ABBA may prove to be uncollectible while the Account Receivable of QUEEN is estimated to be 98% realizable. b. Interest at 15% on notes receivable amounting to P200,000 dated April 1, 2021 should be accrued and interest at 12% on the balance of the notes dated February 1, 2021. c. The inventory of ABBA should be valued at P240,000 while P36,000 of the inventory of QUEEN is considered worthless. d. 4/5 of the prepaid rent has expired. e. The building is over depreciated by P24,000. f. The equipment is to be valued at P1,030,000. g. Interest at 10% on notes payable dated May 1, 2021 should be accrued. h. QUEEN has office supplies on hand which have been charged to expenses amounting to P16,000. These are still to be used by the partnership. i. Accrued expenses of P12,000 is to be recognized in the books of ABBA. After formation, the new capital of the partnership is based on the adjusted capital balance of ABBA, so that QUEEN may either withdraw or invest additional cash to make the partners’ capital balance in proportionate to their profits and losses ratio. Partnership Formation – Additional Problems II Required: 1. Adjusting and closing entries on the books of the partners. 2. Entries to record the investments of ABBA and QUEEN under the 2a. Net investment method 2b. The partners’ capital balances are to be made equal with their profit and loss ratio. 2b1. Either by withdrawing or investing additional cash 2b2. Bonus Method 2b3. Revaluation (Goodwill) Method PROBLEM 2 The MADAH and LEE formed MADALI partnership on January 1, with the following investments: MADAH LEE Cash P40,000 Inventory 80,000 Land P100,000 Building 210,000 Furniture 110,000 The partners agreed to divide profits in the ratio of 2:3 and that the partnership will assume the mortgage loan on the building amounting to P40,000. The land and building had an appraised value of P200,000 and P150,000 respectively while inventory and furniture are 25% lower in market value. Required: 1. If the partners agreed that their equity should be based on net assets investments, how much will the capital credit of each of the partners be? 2. If the partners agreed that capital credit based on total investments be made equal to the profit and loss ratio with either partner making a cash investment or withdrawal accordingly, who should make the cash investment or withdrawal and by how much? 3. Using the agreement in number 2, but that there was no provision for cash investment or withdrawal then what would be the implication? 4. Assume instead that LEE’s investment represents a 40% share and that an intangible asset should be recognized. Is the agreement valid? Why or why not? 5. Assume instead that MADAH’s investment represent a 60% share in total equity and that asset revaluation be recognized. Would the agreement be valid? Why or why not? PROBLEM 3 On December 1. 2022, the sole proprietor GANDA Company expands the company and establish a partnership with THEE and FULL. The partners plan to share profits and losses as follows: BYU, 40%; THEE, 35%; and FULL, 25%. Partnership Formation – Additional Problems II BYU asked THEE to join the partnership because his image and reputation are expected to be valuable during the formation. THEE is also contributing P105,000 cash and building that was acquired for P1,010,000 with carrying amount of P870,000, and a fair market value of P490,000. The building is subject to a P198,000 mortgage that the partnership did not assume. FULL is contributing P212,000 cash and marketable securities costing P335,000 but are currently worth P475,000. BYU’s investment in the partnership is the GANDA company. The statement of financial position for GANDA company follows: Assets Cash Accounts Receivable Merchandise Inventory Equipment, net Total Assets GANDA Company Statement of Financial Position December 1, 2022 Liabilities and Equity P390,000 Accounts Payable 456,000 Notes Payable 394,000 BYU, Capital 618,000 Total Liability and Equity 1,858,000 P437,000 592,000 829,000 1,858,000 The partners agree that 35% of the inventory is considered worthless, the equipment is worth 75% of the carrying amount, and 15% of the accounts receivable is uncollectible. BYU plans to pay off the accounts payable with his personal assets. The other partners have agreed that partnership will assume the notes payable. The partners agreed that their capital balances upon formation will be in conformity with their profit and loss ratio. All the statements are TRUE except? a. Assuming the partners will either invest or withdraw cash, using FULL as the base, BYU and THEE will both invest cash with a total amount of P560,800. b. If the transfer of capital method is used, the capital accounts of BYU and FULL will be debited in the amount of P30,320 and P140,200, respectively. c. Assuming the partners will either invest or withdraw cash using BYU as the base, THEE and FULL will both invest cash with a total amount of P75,800. d. Assuming the partners will either invest or withdraw cash using THEE as the base, BYU and FULL will both withdraw cash with a total amount of P487,200.