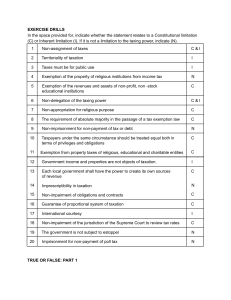

TAX SYSTEM NO, the taxation system of the Spaniards should not be abolished primarily because it is punitive. The policy on taxation in the Philippines is governed by Republic Acts under the Philippine Constitution and all subsequent laws therein. The tax system should embody the equitable and uniform taxation imposed but the reality of the Spanish methods of administration is anything but abuse of power. Government officials connected with the revenue system with their official duty to collect fees took advantage of their position and enforced rules that which the law does not even permit. The conquered people (natives) were required to pay the tribute not for their progress but for the sake of the Crown of Spain. Many important sources of revenue had been farmed out, and the profits of these farms were collected without hesitation by those in high office. Numerous fees and high tax percentages were imposed; and as taxpayers know nothing of their rights, the opportunities of the corrupt officials for extortion were also unlimited. And, because no compilations of royal decrees and orders the people were always ignorant of the law. But whatever may have been the roots of the abuses in the administration in the tax system of the Philippines and serious abuses were undoubtedly present, it cannot obscure that the goal of equitable and honest tax system, might perhaps be improved in some minor particulars and if honestly administered would have met the requirements of a just tax system. If the promise of equitable tax system is realized, Spanish laws relating to taxation may be continued in force and will probably be found to comply with the requirements of justice as nearly as could any revenue laws which might be devised.