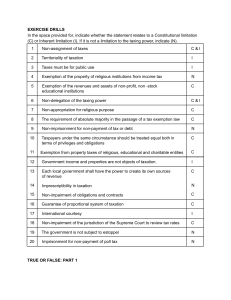

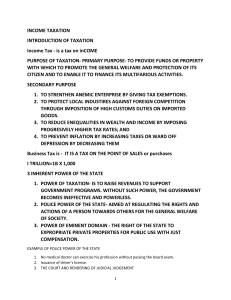

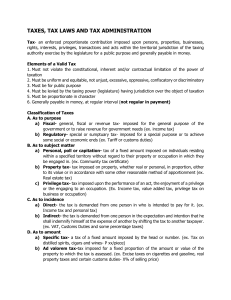

Assignment # 3 Income Taxation 1. Tax law Tax law, the set of laws according to which a public government has a taxpayer argument demanding that part of its money or property be passed to the authority. Taxation is widely acknowledged as a right to governments. Today, income taxes in society are what that everyone knows. Yet tax law and the general intent of taxation on wages is something about which society as a whole represents nothing. Furthermore, there are few tax preparers who are aware of the variations between the GAAP and the tax accounting system, not to mention the consequences of ignoring or avoiding the adequate complementarity of income tax reporting. 2. Tax exemption law; The tax exemption is the decrease or removal of the obligation of compulsory payment to persons, property, income or transactions that would otherwise be imposed by the ruling force. Full relief from taxes, reduced rates or tax on only part of the goods may be given as a tax-except condition. Examples include exemptions from property and income taxes, veterans and certain cross-border or multijurisdictional scenarios for charitable organizations. Tax exoneration generally means a statutory exemption from the general rule instead of simply the absence of taxation, otherwise known as exclusion, in particular circumstances. 3. Nature of Philippine Tax law The Philippines' tax law covers national and local charges. The Bureau's national internal revenue taxes are those imposed by the National Government and collected by the Bureau of Internal Revenue (BIR), and the local taxes are those that the local government imposes and collects. 4. Tax and its elements; and The tax is considered established only in that case when taxpayers and elements of taxation have been identified, namely, the object of taxation, tax base, tax period, tax rate, tax calculation procedure, the procedure, and terms of tax payment. 5. Classification of taxes Taxes are generally classified as direct or indirect, as is the income tax and sales tax, for example, formerly classified as income tax.