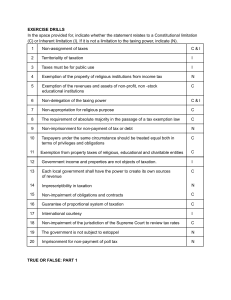

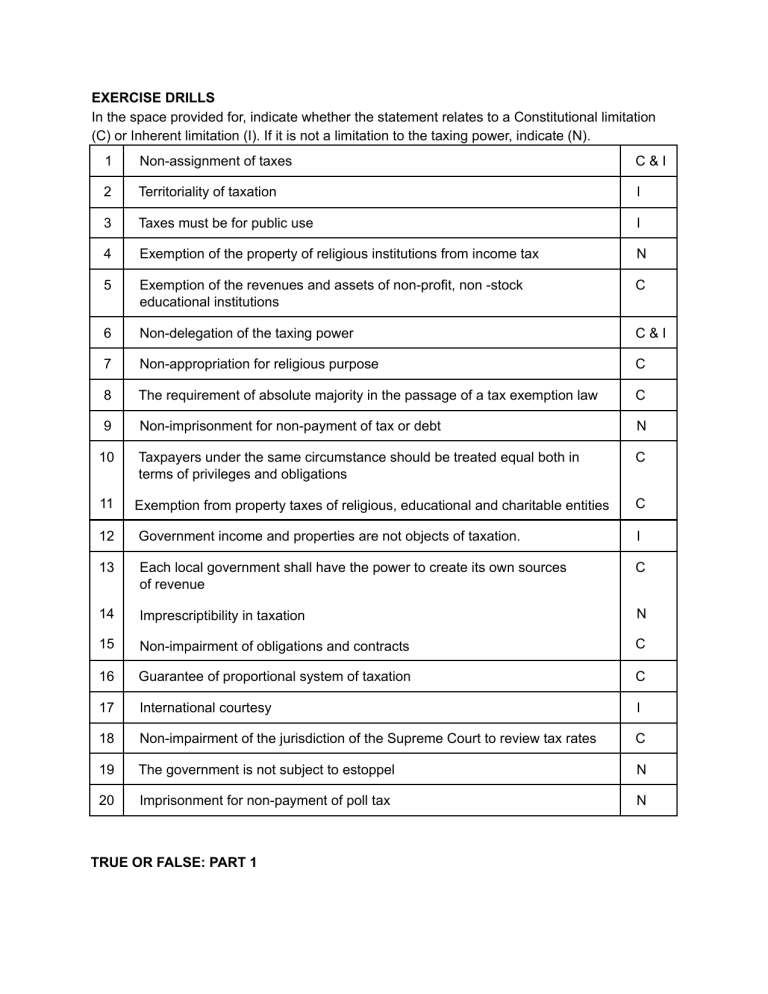

EXERCISE DRILLS In the space provided for, indicate whether the statement relates to a Constitutional limitation (C) or Inherent limitation (I). If it is not a limitation to the taxing power, indicate (N). 1 Non-assignment of taxes C&I 2 Territoriality of taxation I 3 Taxes must be for public use I 4 Exemption of the property of religious institutions from income tax N 5 Exemption of the revenues and assets of non-profit, non -stock educational institutions C 6 Non-delegation of the taxing power C&I 7 Non-appropriation for religious purpose C 8 The requirement of absolute majority in the passage of a tax exemption law C 9 Non-imprisonment for non-payment of tax or debt N 10 Taxpayers under the same circumstance should be treated equal both in terms of privileges and obligations C 11 Exemption from property taxes of religious, educational and charitable entities C 12 Government income and properties are not objects of taxation. I 13 Each local government shall have the power to create its own sources of revenue C 14 Imprescriptibility in taxation N 15 Non-impairment of obligations and contracts C 16 Guarantee of proportional system of taxation C 17 International courtesy I 18 Non-impairment of the jurisdiction of the Supreme Court to review tax rates C 19 The government is not subject to estoppel N 20 Imprisonment for non-payment of poll tax N TRUE OR FALSE: PART 1 1. Eminent domain involves confiscation of prohibited commodities to protect the well-being of the people. FALSE (POLICE POWER NOT EMINENT DOMAIN) 2. Horizontal equity requires consideration of the circumstances of the taxpayer. TRUE 3. Taxes are the lifeblood of the government. TRUE 4. Taxation is a mode of apportionment of government cost to the people. TRUE 5. There should be direct receipt of benefit before one could be compelled to pay taxes. FALSE (THE RECEIPT IS CONCLUSIVELY PRESUMED.) 6. The exercise of taxation power requires Constitutional grant. FALSE 7. Taxation is inherent in sovereignty. TRUE 8. Police power is the most superior power of the government. Its exercise needs to be sanctioned by the Constitution. FALSE 9. All inherent powers presuppose an equivalent form of compensation. TRUE 10. The reciprocal duty of support between the government and the people underscores the basis of taxation. TRUE TRUE OR FALSE: PART 2 1. The Constitutional exemption of religious, charitable, non-profit cemeteries, churches and mosques refers to income tax and real property tax. FALSE (PROPERTY TAX ONLY) 2. Taxpayers under the same circumstances should be taxed differently. FALSE (DIFFERENT TAXPAYERS WARRANTS DIFFERENT TAX TREATMENTS) 3. Taxation is subject to Inherent and Constitutional limitations. TRUE 4. International comity connotes courtesy between nations. TRUE 5. Collection of taxes in the absence of a law is violative of the Constitutional requirement for due process. TRUE (IT WILL RESULT TO VIOLATION OF SUBSTANTIVE DUE PROCESS) 6. The scope of taxation is regarded as comprehension, plenary, unlimited, and supreme. TRUE 7. No one shall be imprisoned for non-payment of tax. FALSE (THE CONSTITUTIONAL GUARANTEE FOR NON IMPRISONMENT OF DEBT AND POLL TAX NOT TAX) 8. The lifeblood doctrine requires the government to override its obligations and contracts when necessary. FALSE (THE CONSTITUTION GUARANTEE THE SANCTITY OF CONTRACT BY ITS NON-IMPAIRMENT CLAUSE) 9. ⅔ of all members of Congress is required to pass a tax exemption law. FALSE (THE CONSTITUTION REQUIRES THE MAJORITY OF ALL MEMBERS OF CONGRESS TO PASS A TAX EXEMPTION LAW) 10. The government should tax itself. FALSE EXERCISE DRILL Identify the type of tax that is described by the following: 1 A consumption tax collection by non-VAT business PERCENTAGE TAX - 3% OF GROSS SALES 2 Tax on gratuitous transfer of property by a living donor DONOR’S TAX - 6% OF TOTAL GIFTS IN EXCESS OF PHP 250,000 DURING THE CALENDAR YEAR. FOR DONATIONS TO BE EXEMPT FROM DONOR’S TAX THERE ARE AUTHORIZED CHANNELS PROVIDED BY TAX CODE AND SPECIAL LAWS. 3 Tax that decreases in rates as the amount or value of REGRESSIVE TAX the tax object increases 4 Tax collected upon persons who are not the statutory INDIRECT TAX - 12% VAT taxpayers 5 Tax that is imposed based on the value of the tax AD VALOREM TAX object EX: PROPERTY TAXES ON REAL ESTATE, SALES TAX ON CONSUMER OF GOODS AND VAT 6 7 Tax for general purposes FISCAL/GENERAL/REVENU E TAX Tax imposed by the national government NATIONAL TAX 8 A tax on sin products or non-essential commodities EXCISE TAX OR SIN TAX 9 Imposed on the gratuitous transfer of property upon ESTATE TAX - 6% OF NET death ESTATE 10 Tax on residents of a country COMMUNITY TAX OR RESIDENCY TAX 11 Tax that remains at flat rate regardless of the value of PROPORTIONAL TAX the tax object 12 Tax which is collected on a per unit basis SPECIFIC TAX 13 Tax is collected upon the statutory taxpayer DIRECT TAX 14 Tax imposed to regulate businesses or professions REGULATORY TAX 15 Tax upon performance of an act or enjoyment of a EXCISE TAX OR privilege PRIVILEGE TAX