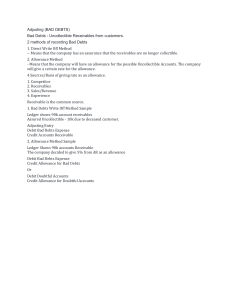

Bad Debts and Allowance for Receivables Sales If a sale is for cash, The double entry would be : Dr Cash XX Cr Sales revenue XX If the sale is on credit terms the customer will pay for the goods/services after receiving them. The double entry is recorded as follows: Dr Receivables XX Cr Sales revenue XX When the customer eventually settles the debt the double entry will be: Dr Cash account XX Cr Receivables XX This then clears out the balance on the customer’s account. 1 Prepared by : Sanjay kumar Bad Debts and Allowance for Receivables Accrual concept The accruals concept dictates that when a sale is made, it is recognised in the accounts, regardless of whether or not the cash has been received. Occasionally customers either refuse to or cannot settle their outstanding debts 2 Prepared by : Sanjay kumar Bad Debts and Allowance for Receivables Bad debt / Irrecoverable debts If it is highly unlikely that the amount owed by a customer will be received, then this debt is known as an irrecoverable debt. An irrecoverable debt is a debt which is, or is considered to be, uncollectable. The double entry required to achieve this is: Dr Irrecoverable debts expense xx Cr Receivables xx With such debts it is prudent to remove them from the receivable accounts and to charge the amount as an expense for irrecoverable debts to the statement of profit or loss. Irrecoverable debts recovered There is a possible situation where a debt is written off as irrecoverable in one accounting period, perhaps because the customer has been declared bankrupt, and the money, or part of the money, due is then unexpectedly received in a subsequent accounting period. Accounting entry will be: Dr Cash xx Cr Irrecoverable debts expense xx 3 Prepared by : Sanjay kumar Bad Debts and Allowance for Receivables Allowance for receivables If there is concern over whether a customer will pay but there is still hope that the amount (or at least some of it) can be recovered an 'allowance' is created. It is prudent to recognise the possible expense of not collecting the debt in the statement of profit or loss, but the receivable must remain in the accounts in case the customer does, in fact, settle the amount outstanding. An allowance is set up which is a credit balance This is netted off against trade receivables in the statement of financial position to give a net figure for receivables that are probably recoverable. 4 Prepared by : Sanjay kumar Bad Debts and Allowance for Receivables An allowance for receivables is set up with the following journal: Dr Irrecoverable debts expense XX Cr Allowance for receivables XX Increase in allowance Dr Irrecoverable debts expense XX Cr Allowance for receivables XX Decrease in allowance Dr Allowance for receivables XX Cr Irrecoverable debts expense XX Summary of this topic 5 Prepared by : Sanjay kumar