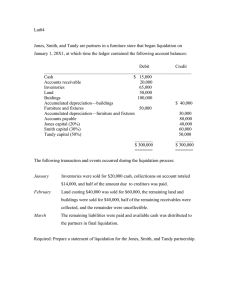

ASSIGNMENT PARTNERSHIP LIQUIDATION LUM SUM AND INSTALLMENT LIQUIDATION(U16) 1. The CDG Carlos, Dan, and Gail Partnership has decided to liquidate as of December 1, 20X6. A balance sheet on the date follows : Additional Information : Each partner’s personal assets (excluding partnership capital interests) and personal liabilities as of December 1, 20X6, follow: Carlos, Dan, and Gail share profits and losses in the ratio 20:40:40. CDG sold all noncash assets on December 10, 20X6, for $260,000. Required : a. Prepare a statement of realization and liquidation for the CDG Partnership on December 10, 20X6. b. Prepare a schedule of the net worth of each of the three partners as of December 10, 2006, after the partnership liquidation is completed. 2. The DSV Partnership decided to liquidate as of June 30, 20X5. Its balance sheet as of this date follows : Additional Information : The personal assets (excluding partnership loan and capital interests) and personal liabilities of each partner as of June 30, 20X5, follow: The DSV Partnership was liquidated during the months of July, August, and September. The assets sold and the amounts realized follow: Required : Prepare a statement of partnership realization and liquidation for the DSV Partnership for the three-month period ended September 30, 20X5. D, S, and V share profits and losses in the ratio 50:30:20, respectively. The partners wish to distribute available cash at the end of each month after reserving $10,000 of cash at the end of both July and August to meet unexpected liquidation expenses. Actual liquidation expenses incurred and paid each month amounted $2,500. Support each cash distribution to the partners with a schedule of safe installment payments.