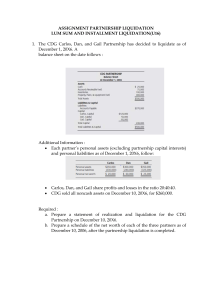

Partnerships Liquidation *Process of converting business assets into cash and making settlement with creditors. *Winding up the business usually by selling the assets, paying liabilities, and distributing the remaining cash to the partners. *Realization – sale of assets. *Accounts must be adjusted and closed, and the resulting Income or Loss in the final period is transferred to the capital accounts of the partners. Basic objective of liquidation: To convert the partnership assets to cash (Realization), to pay off partnership obligations and to distribute cash and any unrealized assets to the partners. - Computation of gains or losses on realization of assets. Payment of liabilities Distribution of cash to the partners Rules that should be followed in the liquidation of the partnership: 1. Always allocate and close gains or losses to the partners’ capital accounts prior to distributing any to the partners 2. Partners entitled to an amount depending upon his capital contribution (effecting drawings, share in P&L before liquidation, G&L on realization, balance of loan account Each partners will receive in the final settlement the amount of his equity in the business. Deficiency (debit balance) must be paid to the partnership otherwise fellow partners would bear more than their contractual share in losses Cash distribution schedule: 1. Outside creditors 2. Partners for loan accounts (Supported by legal doctrine called right of offset) 3. Partners for capital accounts Right of offset – law permits the exercise of the right of offset by part or all of his loan against the capital deficiency. Debit balance causes: losses incurred in the realization of assets or by prorata absorption of an uncollectible deficit of partner whose combined capital and loan accounts is not enough to absorb the partner’s share of total losses. Methods of Partnership Liquidation 1. Lump-sum liquidation, Total Liquidation or Single Distribution 2. Installment Liquidation, Installment Distribution For internal use only Lump-Sum Liquidation All assets are converted into cash within a very short time, outside creditors are paid, and a single, lump-sum payment is made to the partners for their total interests. Expenses of Liquidation: Expenses incurred such as legal, accounting, and advertising cost are allocated to partners’ capital accounts in their P&L Ratio. Procedures: 1. Realization of assets and distribution of Gain or Loss on realization among the partners based on P&L ratio 2. Payment of Expenses 3. Payment of Liabilities 4. Elimination of Partner’s capital deficiencies 4.1 Exercise right of offset 4.2 If the deficient partner is solvent, invest cash to eliminate deficiency 4.3 If the deficient partner is insolvent, other partners absorb deficiency 5. Payment to partners 5.1 Loan Accounts 5.2 Capital Accounts Partnerships Liquidation by Installment Cash distributions to the partners are authorized even before all the losses that may be incurred and charged against the partners are known. Cash is only distributed to partners only if he has an excess credit balance in his partnership interest after absorption of his share of the MAXIMUM POSSIBLE LOSS that may occur Schedule of Safe Payments – safe installment payments to partners. Prepared as if no more cash is forthcoming, either from sale of assets or from collection of deficiencies. Steps: 1. Determine the total interest of each partner. (Capital interest and Loans) 2. Compute the total possible loss of the partnership to be absorbed by each partner. When do you make a schedule of safe payments? – When the initial schedule for the first month of installment resulted to a deficient partner as the ratio of the capital balances after the initial cash distribution in the first month is not equal to the P&L ratio For internal use only