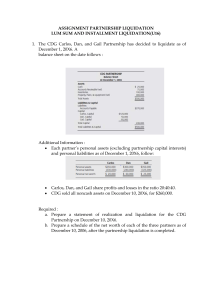

Partnership Liquidation 115. The following condensed balance sheet is presented for the partnership of AA, BB, and CC, who share profits and losses in the ratio of 4:3:3, respectively: Cash Other assets Total P 160,000 320,000 P 480,000 Liabilities AA, capital BB, capital CC, capital Total P 180,000 48,000 216,000 36,000 P 480,000 The partners agreed to dissolve the partnership after selling the other assets for P200,000. Upon the dissolution of the partnership. AA should have received. a. P 0 c. P72,000 b. 48,000 d. 84,000 (AICPA) Answer: (a) Capital balances before liquidation Loss on realization (P320,000 – P200,000): 4:3:3 Cash received AA BB P48,000 P216,000 CC P36,000 (48,000) (36,000) P (36,000) 0 P180,000 P 0 116. W, X, and Y are partners sharing profits and losses in the ratio of 4:3:3, respectively. The condensed balance sheet of Heidi Partnership as of December 31, 20x5 is: Cash Other assets P 50,000 130,000 Total assets P 180,000 Liabilities W, capital X, capital Y, capital P 40,000 60,000 40,000 40,000 Total liabilities and capital P 180,000 Assume instead that the Heidi Partnership is dissolved and liquidated by installments, and the first realization of P40,000 cash is on the sale of other assets with book value of P80,000. After the payment of liabilities, the available cash shall be distributed to W, X, and Y respectively, as follows: a. P36,000: P27,000: and. P27,000 b. P44,000; P28,000; and, P28,000 c. P16,000: P12,000: and, P12,000 d. P24,000: P13,000; and, P13,000 (PhilCPA) Answer: (d) W X Y Balances before liquidation Loss on realization (80,000 – P40,000): 4:3:3 P 60,000 P 40,000 P 40,000 (16,000) (12,000) (12,000) Balances P 44,000 P 28,000 P 28,000 (20,000) (15,000) (15,000) P 24,000 P 13,000 P 13,000 Loss in possible unrealization of noncash assets (P130,00 – P80,000) : 4:3:3 Cash received 117. The partners of the M&N Partnership started liquidating their business on July 1, 20x5, at which time the partners were sharing profits and losses 40% to M and 60% to N. The balance sheet of the partnership appeared as follows: Assets Cash Receivable Inventory Equipment Accumulated Depreciation P 65, 200 (30,800) Total Liabilities & Equity P 8,800 Accounts Payable 22,400 M, capital 39,400 M, drawing N, capital N, drawing 34,400 N, loan P 105,000 P 32,400 P 31,000 ( 5,400) P 33,200 ( 200) 25,600 33,000 14,000 Total P 105,000 During the month of July, the partners collected P600 of the receivables with no loss. The partners also sold during the month the entire inventory on which they realized a total of P32,400. How much of the cash was paid to M's capital on July 31, 20x5? a. P25,600 c. P320 b. 5,400 d. 0 (PhilCPA) Answer: (c) M Drawing Loan Capital Total interest Loan on realization: 40%: 60% Receivables – collection Less: book value P 600 22,400 P21,800 N P(5,400) P(200) - 14,000 31,000 33,200 P25,600 P47,000 Proceeds – inventory Less: book value Unrealized noncash assets P32,400 39,400 7,000 34,400 P63,200 (25,280) (37,920) P 320 P 9,080 118. Larry, Marsha, and Natalie are partners in a company that is being liquidated. They share profits and losses 55 percent, 20 percent, and 25 percent, respectively. When the liquidation begins they have capital account balances of P108,000, P62,000, and P56,000, respectively. The partnership just sold equipment with a historical cost and accumulated depreciation of P25.000 and P18,000, respectively for P10,000. What is the balance in Marsha's capital account after the transaction is completed? a. P62,000 c. P62,600 b. P61,400 d. P65,000 Answer: (c) P62,000 P62,000 P62,000 P62,600 + [P10,000 - (P25,000 - P18,000)] (.20) + (P3,000) (.20) + (P600) (c) 119. After operating for five years, the books of the partnership of Bo and By showed the following balances: Net assets Bo, Capital By, Capital P 169,000 110,500 58,500 If liquidation takes place at this point and the net assets are realized at book value, the partners are entitled to: a. Bo to receive P117,000 & By to receive P52,000 b. Bo to receive P126,750 & By to receive P42,250 c. Bo to receive P84,500 & By to receive P84,500 d. Bo to receive P110,500 & By to receive P58,500 (PhilCPA) Answer: (d) The non-cash assets are realized at book value therefore: There is no gain or loss, in which case partners are entitled to received an amount equivalent to their capital interest. 120. RR, SS and I decided to dissolve the partnership on November 30, 20x5. Their capital balances and profit ratio on this date, follow: Capital Balances P 50,000 60,000 20,000 RR SS TT Profit Ratio 40% 30% 30% The net income from January 1 to November 30, 20x5 is P44,000. Also, on this date, cash and liabilities are P40,000 and P90,000, respectively. For RR to receive P55,200 in full settlement of his interest in the firm, how much must be realized from the sale of the firm's non-cash assets? a. P196,000 c. P193,000 b. 177,000 d. 187,000 (Adapted) Answer: (c) Total Capital ( P50,000 + P60,000 + P20,000 + P44,000) Total Liabilities Total Assets P174,000 90,000 P264,000 Less: Cash Non-cash assets 40,000 P224,000 Less: Loss on realization: (P55,200 - P67,600*) / 40% Proceeds from sale 31,000 P 193,000 * [P50,000 + (P44,000 x 40%)] (P50,00 + P17,600) P67,600 121. Larry. Marsha, and Natalie are partners in a company that is being liquidated. They share profits and losses 55 percent, 20 percent, and 25 percent, respectively. When the liquidation begins they have capital account balances of P108,000, P62,000, and P56,000, respectively. The partnership just sold equipment with a historical cost and accumulated depreciation of P25,000 and P18,000, respectively for P10,000. What is the balance in Larry's capital account after the transaction is completed? a. P106,350 c. P109,650 b. P108,000 d. P110,000 Answer: (c) P108,000 + [P10,000 - (25,000 - P18,000)] (.55) P108,000 + (P3,000) (.55) P108,000 + (P1,650) P109,650 122. Donald, Marion, and Jeff are liquidating their partnership. At the date the liquidation begins Donald, Marion, and Jeff have capital account balances of P147,000, P260,000, and P285,000, respectively and the partners share profits and losses 35%, 25%, and 40%, respectively. In addition, the partnership has a P28,000 Notes Payable to Donald and a P15,000 Notes Receivable from Jeff. When the liquidation begins, what is the loss absorption power with respect to Donald? a. P 80,000 c. P420,000 b. P340,000 d. P500,000 Answer: (d) (P147,000 + P28,000 ) / (.35) (P175,000) / (.35) P500,000 123. Silverio, Domingo, Reyes, and Pastor are partners, sharing earnings in the ratio of 3/21, 4/21, 6/21 and 8/21, respectively. The balances of their capital accounts on December 31, 20x5 are as follows: Silverio Domingo Reyes Pastor P 1,000 25,000 25,000 9,000 P 60,000 The partners decide to liquidate, and they accordingly convert the noncash assets into P23,200 of cash. After paying the liabilities amounting to P3,000, they have P22,200 to divide. Assume that a debit balance in any partner's capital is uncollectible. After the P22,200 was divided, the capital balance of Domingo was a. P3,200 c. P 4,500 b. 3,920 d. 17,800 (PhilCPA) Answer: (b) Silverio Domingo Reyes Pastor Total Balances before liquidation P 1,000 P 25,000 P 25,000 P 9,000 P 60,000 Loss or realization: (P22,200 - P60,000) 3/21: 4/21: 6/21: 8/21 (5,400) 7,200 (10.800) (14,400) (37,800) Balances Loss for possible insolvency of Silverio and Pastor: 4:6 P4,400 + P5,400) P(4,400) P17,800 P14,200 P(5,400) P22,200 4,400 (3,920) (5,880) 5,400 _ P13,880 P8,320 Cash received P22,200 Therefore, the capital balance of Domingo after cash settlement is: Capital balance after loss on realization but before payment to patterns P17,800 13,880 Less: cash received P 3,920 124. As of December 31, 20x5, the books of Ton Partnership showed capital balances of: T, P40,000: O, P25,000: N, P5,000. The partners' profit and loss ratio was 3:2:1, respective. The partners decided to liquidate and they sold all non-cash assets for P37,000. After settlement of all liabilities amounting P12,000, they still have cash of P28,000 left for distribution. Assuming that any capital debit balance is uncollectible, the share of T in the distribution of the P28,000 cash would be: a. P17,800 c. P19,000 b. 18,000 d. 17,000 (PhilCPA) Answer: (a) T Balances before Liquidation Loss on realization: (P28,000 – P70,000) 3:2:1 O N TOTAL P40,000 P25,000 P5,000 P70,000 (21,000) (14,000) (7,000) (42,000) Balances Loss on possible insolvency of N: 3:2 P19,000 (1,200) P11,000 P(2,000) P28,000 (800) 2,000 0 Cash received P17,800 P10,200 P28,000 125. A local partnership was considering the possibility of liquidation since one of the partners is solvent (Tillman) and the others are insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively. Ding, capital Laurel, capital Ezzard, capital Tillman, capital P 60,000 67,000 17,000 96,000 Ding's creditors filed a P25,000 claim against the partnership's assets. At that time, the partnership held assets reported at P360,000 and liabilities of P 120,000. If the assets could be sold for P228,000, what is the minimum amount that Ding's creditors would have received? a. P 0 c. P36,000 b. P2,500 d. P38,720 Answer: (b) Balances before liquidation Loss on realization 4:2:2:2 (P228,000 –P360,000) Ding P60,000 Laurel P67,000 Ezzard P17,000 Tillman P96,000 Total P240,000 (52,800) (26,400) (26,400) (13,200) (132,000) Balances Loss on possible insolvency (4:2:2) P7,200 P40,600 P(9,400) P69,600 P108,000 (4,700) (2,350) 9,400 (2,350) -0- Balances P2,500 P38,250 -0- P67,250 P108,000 Cash Non-cash assets P 10,000 Liabilities 300,000 Keaton, capital Lewis, capital Meador,capital P 130,000 60,000 40,000 80,000 P 300,000 P 310,000 126. The Keaton. Lewis and Meador partnership had the following balance sheet just before entering liquidation: Keaton, Lewis and Meador share profits and losses in a ratio of 2:4:4. Noncash assets were sold for P180,000. Liquidation expenses were P10,000. Assume that Keaton was personally insolvent with assets of P8,000 and liabilities of P60,000. Lewis and Meador were both solvent and able to cover deficits in their capital accounts, if any. What amount of cash could Keaton's personal creditors have expected to receive from partnership assets? a. P0 c. P30,000 b. P26,000 d. P34,000 Answer: (d) Keaton Lewis Meador Total Balances before liquidation Liquidation expenses (2:4:4) P60,000 (2,000) P40,000 (4,000) P80,000 (4,000) P180,000 (10,000) Loss on realization – 2:4:4 (P180,000 – P300,000) (24,000) (48,000) (48,000) (120,000) Balances Additional investment P34,000 P(12,000) 12,000 P28,000 P50,000 12,000 Payment to partners P34,000 -0- P28,000 P62,000 127. The following account balances were available for the Perry, Quincy and Renquist partnership just before it entered liquidations: Cash Non-cash assets P90, 000 300,000 Total P390,000 Liabilities Perry,capital Quincy, capital Renquist, capital P170,000 70,000 50,000 100,000 P390,000 Perry, Quincy and Renquist had shared profits and losses in a ratio of 2:4:4. Liquidation expenses were expected to beP8,000 . All partners are solvent. What would be the minimum amount for which the non-cash assets must have been sold for, in order for Quincy to receive some cash from the liquidations? a. b. c. d. Any amount in excess of P175,000 Any amount in excess of P117,000 Any amount in excess of P183,000 Any amount in excess of P198,667 Answer: (c) Quincy capital before liquidation P50,000 Less: share in liquidation expenses (P8,000x40%) Quincy capital before realization of non-cash assets Less: cash received by Quincy(minimum) 3, 200 P46,800 0 Share in the loss of realization P46,800 Divided by: Profit and loss ratio 40% Loss on realization P117,000 Less: non-cash assets 300,000 Proceeds from sale P183,000 128. AA, BB, and CC are partners in ABC and share profits and losses 50%, 30%, and 20%, respectively. The partners have agreed to liquidate the partnership and some liquidation expenses to be incurred. Prior to the liquidation, the partnership balance sheet reflects the following back values: Cash Non-cash assets Notes payable to CC P 25,200 297,600 38,400 Other liabilities AA, capital BB, capital deficit CC, capital 184,800 72,000 (12,000) 39,600 Assuming that the actual liquidation expenses are P16,800 and that the non-cash assets with a book value of P240,000 are sold for P216,000. How much cash should CC received? a. P 46,457 c. P 74,571 b. d. -0- 39, 600 (Adapted) Answer: (b) AA Capital (deficit) balance Notes payable Total Interest P 72,000 0 P 72,000 BB (P 12,000) 0 CC P 39,600 38, 400 (P 12,000) P 78,000 ( 2,200) (4,800) Loss on realization: ( P216,000- P240,000) 50%, 30%, 20% ( 12,000) Balances P 60,000 Payment of liquidation expenses Balances (8,400) P 51,600 ( P 19,200) ( 5,040) ( P 24,240) P 73,200 ( 3,360) P 69,840 Loss on possible unrealization of noncash assets: (P297,600- P240,000) Balances (28,800) P 22,800 Loss for possible insolvency of 58(5:2) (29,657) Balances ( 6,857) (17,280) ( P 41,520) P 41,520 (11,520) P 58,320 (11,862) P 44,457 Loss for possible insolvency of AA P 6,857 ( 6,657) Cash received P 39,600 (b) or alternatively, AA Total Interest P 72,000 Other deficit (5:2) ( 8,571) Balances BB CC (P 12,000) P 39,600 P12,000 ( 3, 429) P 63,429 Loss on realization: ( P216,000- P240,000) P 74,571 (17,143) Balances P 46,286 Payment of liquidation expenses (P 12,000) Balances P 34,286 (6,657) P 73,200 ( 4,800) P 62,914 Loss on possible unrealization of noncash assets: (P297,600- P240,000) (41,143) Balances ( 6,857) Loss for possible insolvency of AA (16,457) P 46,457 P 6,857 ( 6,857) Cash received P 39,600 (b) 129. After all non-cash assets have been converted into cash in the liquidation of the AA and JJ partnership, the ledger contains the following account balances: Debit Cash Accounts payable Loan payable to AA AA, capital JJ, capital Credit P 34, 000 P 25, 000 9, 000 8, 000 8, 000 Available cash should be distributed P25, 000 to accounts payable and: a. P9, ,000 loan payable to AA b. P4,500 each to AA and JJ c. P1,000 to AA and P8,000 to JJ d. P8,000 to AA and P1,000 to JJ (Adapted) Answer: (c) Cash Balances before liquidation P34,000 Payment of accounts payable (25, 000) Balances 9, 000 Payment to partners (9, 000) *Net of capital deficit Accounts Payable P 25,000 AA P 1,000 JJ 8,000 (P 25,000) 1,000 (1,000) 8, ,000 (8,000) (c) 130. Arthur, Baker and Carter are partners in textile distribution business sharing profit and losses equally. On December 31, 20x5 the partnership capital and partners drawings were as follows: Capital Drawing Arthur P100, 000 60, 000 Baker P 80, 000 40, 000 Carter P 300, 000 20, 000 Total P 480, 000 120, 000 The partnership was unable to collect on trade receivables and was forced to liquidate. Operating profit in 20x5 amounted to P72, 000 which was all exhausted, including the partnership assets. Unsettled creditor’s claims of December 31, 20x5 totalled P84, 000. Baker and Carter have substantial private resources but Arthur has no personal assets. The final cash distribution to Carter was? a. P78, 000 b. 84, 000 c. P108, 000 d. 162, 000 ( PhilCPA) Answer: (a) Arthur Balances before net Baker Carter Total income: Capital P100, 000 P 80, 000 P 300, 000 P 480, 000 60, 000 40, 000 20, 000 120, 000 P 40, 000 P 40, 000 P280, 000 P360, 000 24, 000 24, 000 Total interests P 64, 000 P 64, 000 P304, 000 Loss on liquidation (172, 000) (172, 000) (172, 000) (516, 000) Balances P108, 000 P108, 000 P132, 000 (P 84, 000) P108, 000 P 54, 000 P 54, 000 P162, 000 P 78, 000(a) Drawings Totals Add: Net income(equally) 24, 000 72, 000 P 432, 000 Loss for insolvency of Arthur: (equally) *Loss on (P 84, 000) liquidation amounted to: Liabilities P84, 000 Capital (P64, 000+ 64, 000+ P304, 000) Total assets 432, 000 P516, 000 The P516, 000 assets are exhausted with no proceeds arising from it, therefore the P516, 000 represents loss on realization. **The P162, 000 capital deficiency of Baker will ultimately be considered as additional investment since he has substantial resources to cover it. The P162, 000 investment will be applied first to unpaid liabilities of P84, 000,then the balance will be given to Carter, P 78, 000. 131. Jar, Ram and Millo, who divide profits and losses, 50% 30% and 20% respectively, have the following October 31, 20x5 account balances: Jar, drawing Dr. P 12, 000 Milo, drawing Cr. 4,800 Accounts receivable-Jar 7,200 Loans payable-Ram 14, 000 Jar, capital 59, 400 Ram, capital 44, 400 Millo, capital 39, 000 The partnership assets are P21, 200 (including cash of P64, 200), the partnership is liquidated and Millo receives P33, 000 in final settlement .How much is the total loss on realization? a. P 10,500 b. 30,200 c. P 54,000 d. 64,200 (Adapted) Answer: (c) Total interests of Millo Capital Drawings Less: Cash received in Final settlement P 39, 000 4,800 P 43,800 33,000 Share in loss on realization Divide by: Profit and loss ratio of Millo Loss on realization P 10, 800 20% P 54, 000 (c) 132. When Mikki and Mylene, partners who share earnings equally were incapacitated in an airplane accident, a liquidator was appointed to wind up their business. The accounts showed cash, P 35, 000 other assets P100, 000; Liabilities, P 20, 000; Mikki, capital, P71, 000 and Mylene, capital, P54, 000. Because of highly specialized nature of the non-cash assets, the liquidator anticipated that considerable time would be required to dispose them. The expenses of liquidating the business (advertising, rent, travel, etc.) are estimated as P 10, 000.How much cash can be distributed safely to each partner at this point? a. b. c. d. 5, 000 to Mikki: and P 0 to Mylene 5, 000 to Mikki: and P500 to Mylene 3, 000 to Mikki: and P 0 to Mylene 5, 000 to Mikki: and P 1,000 to Mylene (Adapted) Answer: (a) Mikki Balances before liquidation Mylene P 71, 000 P 54, 000 Total P125, 000 Loss on possible unrealization at non-cash assets (equally) Balances (55, 000) P 16, 000 Liquidation expenses (equally) Balances (55, 000) (110, 000) ( P 1, 000) P 15, 000 (5, 000) 10, 000 ( 6, 000) 5, 000 ( 5, 000) P 11, 000 Loss for possible insolvency of Mylene 6, 000 Cash received 6, 000 P 5, 000 P5, 000 (a) 133. A balance sheet for the partnership KK, LL and MM, who share profits 2:1:1 respectively, shows the following balances just before liquidation; Cash Other Assets Liab. KK. Cap. LL. Cap. MM. Cap. P48,000 P238,000 P80,000 P88,000 P62,000 P56,000 In the first month of liquidation, P125,000 was received on the sale of certain assets. Liquidation expenses of P4,000 were paid and additional liquidation expenses of P3,200 are anticipated before liquidation is completed. Creditors were paid P22,400. The available cash was distributed to the partners. The cash to be received by each partner based on the above data: KK a. P56,600 b. 86,000 LL P28,300 61,000 MM P28,300 55,000 KK c. P29,400 D. 88,000 LL P32,700 62,000 MM P26,700 56,000 (Adapted) Answer: (c) KK LL MM Total Balances before liquidation..... P88,000 P62,000 P56,000 P206,000 Loss on realization (P128,000P238,000): 2:1:1................... Balances.................................... (55,000) P33,000 (27,500) P34,500 (27,500) P28,500 (110,000) P96,000 Payment of liquidation expenses. (2,000) (1,000) (1,000) (4,000) Balances...................................... P31,000 P33,500 P27,500 P92,000 (P1,600) P29,400 (P8,00) P32,700 (P8,00) P26,700 (P3,200) P88,880 (c) Anticipated liquidation Expenses............................ 134. NN, OO, PP and GG, partners to a law firm, shares profits at the ratio of 5:3:1:1. On June 30 relevant partners accounts follow; NN............................ OO........................... PP............................. GG........................... Advances Dr. P18,000 10,000 Loans Cr. P20,000 40,000 - a. PP and GG c. All equally a. OO and GG d. NN and OO Capital Cr. P160,000 120,000 60,000 100,000 On this day, cash of P72,000 is declared as available for distribution to partners as profits. Who among the partners will benefit from the P72,000 cash distribution? (Adapted) Answer: (b) NN OO PP GG Total (P18,000 ) - (P10,000) (P28,,000) - 60,000 Balances before liquidation..... Advances................. Loans......................... 20,000 40,000 Capital....................... 160,000 120,000 60,000 100,000 440,000 Total Interest................................ P180,000 P160,000 P42,000 P90,000 P472,000 Loss on realization (5:3:1:1)........ (200,000) (120,000) (40,000) (40,000) (400,000)* Balances..................................... (P20,000) P40,00 P2,000 P50,000 P72,000 2,0000 (12,000 ) (4,000) (4,000) - P28,000 (P2,000) 46,000 P72,000 (P1,500) P26,500 P2,000 (500) P45,500 P72,000 (b) Loss of possible insolvency 3:1:1............................ Balances....................................... Anticipated liquidation Expenses............................. Cash received.......................... *P72,000-P472 135. The partnership of AA, BB and CC was dissolved on June 30, 20x5 and account balances after non-cash assets were converted into cash on September 1 20x5 are: Assets Cash............................ P50,000 Liabilities and Equity Accounts Payable.......... P120,000 AA, Capital (30%)............ 90,000 BB, Capital (30%)............. (60,000) CC, Capital (40%)........... (100,000) Personal assets and liabilities of the partners at September 1, 20x5 are: Personal Asset P80,000 100,000 192,000 AA............................................ BB............................................. CC............................................ Personal Liabiliities P90,000 61,000 80,000 If CC contributes P70,000 to the partnership to provide cash to pay the creditors, what amount of AA’s P90,000 partnership equity would appear to be recoverable? b. P90,000 b. P79,000 b. 81,000 c. None Answer: (b) AA Balances before liquidation..... P90,000 BB CC Total (P60,000) (P100,000) (P70,000) 70,000 70,000 Additional Investment.............. P90,000 Additional Investment.............. Additional loss for insolvency Of BB (3:4)................... (P60,000) (P30,000) 39,000 (9,000) P81,000 21,000 P 39,000 (12,000) (P42,000) P39,000 P42,000 42,000 Additional investment (P192,000-P80,000P70,000).................... P81,000 P81,000 (b) 136. Aaron, Ben and Chris are partners who share income in a 1:3:1 ratio, respectively. On January 1, 20x5, they decide to terminate operations. The partnership’s final balance on that date is as follows: Cash Accounts Receivable Loan Receivable-Ben Inventory Equipment Accounts Payable Bank Loan Payable Loan Payable Capital-Aaron Capital-Ben Capital-Chris Debit P 20,000 200,000 15,000 400,000 600,000 P 1,235,000 Credit P80,000 240,000 25,000 3 10,000 250,000 330,000 P 1,235,000 Liquidation of assets will take place over the next few months. At the end of each month, available cash, less an amount retained to cover estimated future liquidation cost is distributed to each partner. During January 20x5, the following events occur 1. 2. 3. 4. 5. P90,000 of the accounts receivable are collected The inventory was sold for P300,000 Liquidation costs of P10,000 were paid. The bank loan and the accounts payable were paid. P18,000 of cash is to be retained to cover future costs. The capital balance (deficiency) of the partners on January 31 before the distribution of possible losses and anticipated expenses (if any) for Aaron, Ben and Chris re4spectively: a. b. c. d. P203,400; (P159,800); P198,400 P225,400; (P93,800); P220,400 P229,000; (P159,800); P198,400 P123,500; P0; P242,000 Answer: (a) Capital Loans Combined capital/Total Interest Loss on inventory sale Loss on equipment sale Liquidation costs January 31, capital Less: Cash withheld Potential loss on receivables Balance Distribute deficiency Sale payments Aaron (20%) P310,000 25,000 P335,000 (44,000) (60,000) (2,000) P229,000 Ben (60%) P250,000 (15,000) P235,000 (132,000) (180,000) (6,000) (P83,000) Chris (20%) P330,000 Total P330,000 (44,000) (60,000) (2,000) P224,000 P890,000 10,000 P900,000 (220,000) (300,000) (10,000) 370,000 (3,600) (22,000) P203,400 (29,900) P123,500 (10,800) (66,000) (P159,800) 159,800 P0 (3,600) (22,000) P198,400 (P29,900) P118,500 (18,000) (110,000) P242,000 P242,000 137. How much should each partner receive for the month of February? a. b. c. d. P203,400; (P159,800); P198,400 P225,400; (P93,800); P220,400 P229,000; (P159,800); P198,400 P123,500; P0; P118,500 Answer: (d) Refer for No. 136 for computation Items 138 to 140 are based on the following information: In 20x3, four friends form a partnership to invest in real estate. All are equal partners. At January 1, 20x5, the books of the partnership show cash of P23,000 and real estate with a cast of P400,000 and fair market value of P650,000. The partnership has no liabilities. The partnership books are maintained on a cost basis, and neither goodwill nor bonus is recorded when a new partner is admitted. On January 1, 20x5 a new partner joins the partnership making a cash investment equal to one fourth of the fair market value of partnership assets. During 20x5 each partner invested P10,000 in new funds and the partnership invested P370,000 in real estate. Also during 20x5, real state costing P100,000 was sold for P150,000. The January 1, 20x5 fair market value of the real estate sold was P125,000. Interest earned on the partnership savings account for 20x5 was P500. 138. How much must the new partner invest in the partnership at January 1, 20x5? a. P168,250 b. P105,750 c. P100,000 d. Zero Answer: (d) [(P23,000+P65,000)/4= P168,250] 139. The share in the partnership's 20x5 income to the four original partners (as a group). a. P 0 b. P20,000 c. P25,000 d. P45,400 Answer: (d) Original Partners Gain on real state sold: Prior to 1/1/x5 After 1/1/x5 Interest income Total income allocation P25,000 20,000 400 P45,400 New Partners P5,000 100 P5,100 TOTAL P25,000 25,000 500 P50,500 140. In January 20x6, the partners sell all an partnership real estate for P925,000 and dissolve the partnership. How much will the new partner (NP), and the original partners as a group (OP, each cover? a. NP, P183,350; OP, P757,400 b. NP, P189,350; OP, P508,400 c. NP, P183,350; OP, P508,400 d. NP, P189,350; OP, P757,400 Answer: (d) Total gain on sale of real estate: Selling price Cost (P400,000 + P370,000 – P100,000) Total gain P925,000 670,000 P255,000 Gain prior to 1/1/x5 Remaining fair value (P650,000 – p125,000) Remaining cost (P400,000 – P100,000) Pre- 1/1/x5 gain P525,000 300,000 P225,000 Gain after 1/1/x5: Total gain Less pre- 1/1/x5 Post- 1/1/x5 P255,000 (225,000) P30,000 Cash balance of dissolution Balance 1/1/x5 New partner investment All partners investment Proceeds from sale of real estate Interest Investment in real estate Balance 12/31/x5 Proceeds from sale of real estate Total cash at dissolution P23,000 168,250 50,000 150,000 500 (370,000) P21,750 25,000 P246,750 Original partners Capital, 1/1/x5 New partner investment All partners investment 20x5 income allocation P423,000 40,000 45,400 New partner P168, 250 10,000 5,100 TOTAL P423,000 168,250 50,000 50,500 Capital, 12/31/x5 Allocation of pre- 1/1/x5 gain Allocation of post- 1/1/x5 gain Total distribution to partners P508,400 225,000 24,000 P757,400 P183,350 6,000 P189,350 P691,750 225,000 30,000 P946,750 141. After all partnership assets were converted into cash and all available cash was distributed to creditors, the ledger of the Daniela, Erika, and Fredline partnership showed the following balances: Debit Accounts payable Daniela, capital(40%) Erika, capital(30%) Fredline, capital(30%) Credit P 20,000 10,000 60,000 P 90,000 P 90,000 P 90,000 Percentages indicated are residual profit and loss sharing ratios. Personal assets and liabilities of the partners are as follows: Personal assets Personal liabilities Daniela P 50,000 45,000 Erika P 50,000 40,000 Fredline P 100,000 40,000 The partnership creditors proceed against Fredline for recovery of their claims, and the partners settle their claims against each other. How much would Erika receive? a. P -0 c. P47,143 b. 45,000 d. Cannot be determined (Adapted) Answer: (b) Daniela Total interest Payment of liabilities by Fredline Balances Additional investment (P100,000 – 40,00 – 20,000 = P40,000) Balances Erika Fredline TOTAL P10,000 P60,000 10,000 60,000 P(90,000) 20,000 P(70,000) (20,000) 20,000 0 60,000 40,000 (30,000) 40,000 40,000 10,000 Additional loss for possible insolvency (4:3) Balances Investment Balances Additional loss for possible insolvency (17,143) (7,143) 5,000 (12,857) 47, 143 - (2,143) 2,143 47, 143 (2,143) P45,000 30,000 -040,000 5,000 45,000 -0P45,000 142. The August. Albert and Gerry partnership became insolvent on January 1, 20x5, and the partnership is being liquidated as soon as practicable. In this respect the following information for the partners has been marshaled: Capital Balances P 70,000 (60,000) (30,000) P(20,000) August Albert Gerry Total Personal Assets Personal Liabilities P 80,000 30,000 70,000 P 40,000 50,000 30,000 Assume that residual profits and losses are shared equally among the three partners. Based on this information, calculate the maximum amount that August can expect to receive from the partnership liquidation is: a. P20,000 c. P70,000 b. 40,000 d. 110,000 (Adapted) Answer: (a) Balances before realization Additional investment Balances Additional loss (1:1) Balances Additional investment (P70,000 – P30,000 – P30,000) Balances Additional loss Balances August P70,000 P70,000 (30,000) P40,000 P40,000 (20,000) P20,000 Albert P(60,000) P(60,000) 60,000 Gerry P(30,000) 30,000 (30,000) P(30,000) 10,000 P(20,000) 20,000 143. Gardo and Gordo formed a partnership on July 1, 20x5 to operate two stores to be managed by each of them. They invested P30,000 and P20,000 and agreed to share earnings 80% and 40%, respectively. All their transactions were tor Cam and all their subsequent transactions were handled through the respective bank accounts as summarized below: Cash receipts Cash disbursements Gardo P 79,100 62,275 Gordo P 65,245 70,695 On October 31, 20x5, all remaining noncash assets in the two stores were sold for cash of P50,000. The partnership was dissolved, and cash settlement was effected. In the distribution of the P60,000 cash, Gardo received: a. P24,000 c. P34,000 b. 26,000 d. 36,000 (PhilCPA) Answer: (b) Gardo 60% P 30,000 62,275 (79,100) P 13,175 12,825 P 26,000 P(P26,000) Initial investment Investment (personal disbursements*) Investment (personal receipt Balances before liquidation Gain on realization (P60,000 – P38,625) Balances before payment to partners Payment to partner Gordo 40% P 20,000 70,695 (5,240) P 25, 450 8,550 P 34,000 P (34,000) TOTAL P(50,000) 132,970 (144,345) P38,625 21,375 60,000 P(60,000) 144. PP, QQ, and RR partners to a firm have capital balances of P11,200, P13,000, and P5,800, respectively, and share profits in the ratio of 4:2:1. Prepare a schedule showing how available cash will be given to the partners as it becomes available. Who among the partners shall be paid first with an available cash of P1,400? a. QQ c. RR b. No one d. PP (Adapted) Answer: (b) INTEREST Balances before realization Divided by: P&L ratio Loss absorption ability Priority I Priority II PAYMENTS PP P 11,200 QQ P13,000 RR P5,800 4/7 2/7 1/7 P 19,600 P 45,500 P 40,600 - (4,900) P 19,600 P 40,600 P 40,600 - (21,000) (21,000) - 6,000 3,000 9,000 P 19,600 P 19,600 P 19,600 P- P7,400 P3,000 P10,400 Cash Distribution: QQ - Available Cash payment to partner Less: Priority I PP RR TOTAL P 1,400 PP P 1,400 (P 1,400) QQ P 1,400 RR P 1,400 145. The PQR Partnership is being dissolved. All liabilities have been paid and the remaining assets are being realized gradually. The equity of the partners is as follows: P Q R Partners’ Accounts P 24,000 36,000 60,000 Loans to (from Partnership) 6,000 (10,000) Profit and Loss Ratio 3 3 4 The second cash payment to any Partner(s) under a program of priorities shall be made thus: a. To R, P2,000 c. To R, P8,000 b. To Q, P6,000 d. To Q, P6,000 & R, P8,000 (PhilCPA) Answer: (d) INTEREST P PAYMENTS Q R P Balances before realization Loans P6,000 Capital 24,000 P36,000 60,000 P30,000 P36,000 P50,000 Divided by: P&L ratio 3/10 3/10 4/10 Loss absorption ability Priority I P100,000 P120,000 P125,000 - - P100,000 P120,000 P120,000 - (20,000) (20,000) P100,000 P100,000 Total interest Priority II Q R P(10,000) (5,000) P 2,000 P2,000 6,000 8,000 14, 000 P6,000 P10,000 P16,000 - P100,000 P - 146. A cash distribution plan (payment priority program) for the Matthew, Norell, and Reams partnership appears below: First P 300,000 Next P 80,000 Next P 70,000 Remainder Priority Creditor 100% Matthew Norell 70% 3/7 22% 30% 34% Reams 4/7 44% If P550,000 of cash is to be distributed, how much will be received by the priority creditors, Matthew, Norell and Reams? a. b. c. TOTAL Priority Creditor P 0 0 300,000 Matthew P 0 121,000 55,000 Norell P 0 187,000 85,000 Reams P 0 242,000 110,000 d. 300,000 108,000 58,000 84,000 (Adapted) Answer: (d) Priority creditors First P300,000 Matthews Norell Reams P300,000 Next P80,000 (7:3) P300,000 P56,000 P24,000 Next P70,000 (3:4) 30,000 Remainder P300,000 TOTAL 22,000 34,000 80,000 P40,000 70,000 44,000 100,000 P108,000 P58,000 P84,000 P550,000 147. Scott, Joe, and Ed ore liquidating their partnership. At the date the liquidation begins Scott, Joe, and Ed have capital account balances of P162,000, P192,500, and P215,000, respectively and the partners share profits and losses 40%, 35%, and 25%, respectively, in addition, the partnership has a P36,000 Notes Payable to Scott and a P20,000 Notes Receivable from Ed. When the liquidation begins, what is the loss absorption power with respect to Joe? a. P192,500 c. P550,000 b. P 67,375 d. P770,000 Answer: (d) (P192,500/.35) Assets: Cash Receivables – net Inventory Plant assets – net Loan to Reed P 15,000 20,000 40,000 70,000 5,000 Liabilities and Equity: Liabilities Loan from Stac Queen, capital – 30% Reed, capital – 50% Stac, capital – 20% P 170,000 70,000 50,000 100,000 15,000 Total assets P 390,000 Total Liabilities and Equity P 390,000 148. The assets and equities of the Queen, Reed, and Stac Partnership at the end of its fiscal year on October 31, 20x5 are as follows: The partners decide to liquidate the partnership. They estimate that the noncash assets, other than the loan to Reed, can be converted into P100,000 cash over the two-months period ending December 31, 20x5. Cash is to be distributed to the appropriate parties as it becomes available during the liquidation process. The partner most vulnerable to partnership losses on liquidation is: a. Queen c. Reed and Queen equally b. Reed d. Stac (Adapted) Answer: (b) Balances before liquidation Loan (to) from Capital balances Total interest Divided by: P&L ratio Loss absorption abilities/potential Vulnerability ranking (1 most vulnerable) Quen Reed P45,000 P45,000 30% P150,000 P(5,000) 30,000 P25,000 50% P50,000 3 1 Stac P10,000 15,000 P25,000 20% P125,000 2 The most vulnerable is the partner with the lowest absorption ability. In order to determine their vulnerability to possible losses, the equity of each partner is divided by his or her profit sharing ratio to identify the maximum loss that a partner could absorb without reducing his or her equity below zero. The vulnerability ranks indicate that Reed is most vulnerable to losses because his equity would be reduced to zero with a total partnership loss on liquidation of P50,000. 149. Using the same information in No. 148, and P65,000 is available for first distribution, it should be paid to: a. b. c. d. Priority Creditor P 60,000 60,000 50,000 50,000 Queen P 5,000 1,500 5,000 12,000 Reed P 0 2,500 0 0 Stac P 0 1,000 10,000 3,000 (Adapted) Answer: (d) Quen Reed Stac TOTAL Balances before liquidation Loan (to) from Capital balances P45,000 P(5,000) 30,000 P10,000 15,000 - Total interest Reduce in equity P45,000 (24,000) P25,000 (40,000) P25,000 (16,000) P95,000 (80,000) Payment to partners* Additional loss (3:2) P21,000 (9,000) P(15,000) 15,000 P9,000 (6,000) P15,000 - Payment to partners P12,000 P3,000 P15,000 *cash available for first distribution Less: priority creditors Payment to partners P65,000 50,000 P15,000