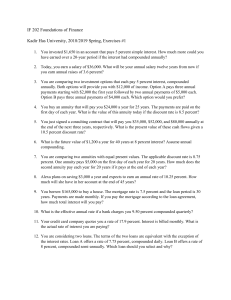

IF 202 Foundations of Finance Kadir Has University, 2018/2019 Spring, Exercises #1 1. You invested $1,650 in an account that pays 5 percent simple interest. How much more could you have earned over a 20-year period if the interest had compounded annually? 2. Today, you earn a salary of $36,000. What will be your annual salary twelve years from now if you earn annual raises of 3.6 percent? 3. You are comparing two investment options that each pay 5 percent interest, compounded annually. Both options will provide you with $12,000 of income. Option A pays three annual payments starting with $2,000 the first year followed by two annual payments of $5,000 each. Option B pays three annual payments of $4,000 each. Which option would you prefer? 4. You buy an annuity that will pay you $24,000 a year for 25 years. The payments are paid on the first day of each year. What is the value of this annuity today if the discount rate is 8.5 percent? 5. You just signed a consulting contract that will pay you $35,000, $52,000, and $80,000 annually at the end of the next three years, respectively. What is the present value of these cash flows given a 10.5 percent discount rate? 6. What is the future value of $1,200 a year for 40 years at 8 percent interest? Assume annual compounding. 7. You are comparing two annuities with equal present values. The applicable discount rate is 8.75 percent. One annuity pays $5,000 on the first day of each year for 20 years. How much does the second annuity pay each year for 20 years if it pays at the end of each year? 8. Alexa plans on saving $3,000 a year and expects to earn an annual rate of 10.25 percent. How much will she have in her account at the end of 45 years? 9. You borrow $165,000 to buy a house. The mortgage rate is 7.5 percent and the loan period is 30 years. Payments are made monthly. If you pay the mortgage according to the loan agreement, how much total interest will you pay? 10. What is the effective annual rate if a bank charges you 9.50 percent compounded quarterly? 11. Your credit card company quotes you a rate of 17.9 percent. Interest is billed monthly. What is the actual rate of interest you are paying? 12. You are considering two loans. The terms of the two loans are equivalent with the exception of the interest rates. Loan A offers a rate of 7.75 percent, compounded daily. Loan B offers a rate of 8 percent, compounded semi-annually. Which loan should you select and why?