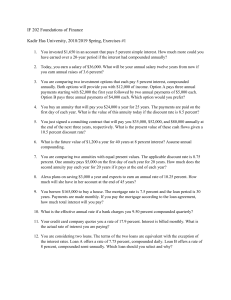

Brandeis International Business School BUS 71a Introduction to Finance Fall 2020 Student Name: ______________________ Quiz 1 (40 minutes) September 24, 2020 Multiple Choice Questions. 12 Questions. 5 Points Each. 1. Which one of the following statements correctly applies to a sole proprietorship? A. The business entity has an unlimited life. B. The ownership can easily be transferred to another individual. C. The owner enjoys limited liability for the firm's debts. D. Debt financing is easy to arrange in the firm's name. E. Obtaining additional equity is dependent on the owner's personal finances. 2. Jessica invested $2,000 today in an investment that pays 6.5 percent annual interest. Which one of the following statements is correct, assuming all interest is reinvested? A. She will earn the same amount of interest each year. B. She could have the same future value and invest less than $2,000 initially if she could earn more than 6.5 percent interest. C. She will earn an increasing amount of interest each and every year even if she should decide to withdraw the interest annually rather than reinvesting the interest. D. Her interest for Year 2 will be equal to $2,000 × .065 × 2. E. She will be earning simple interest. 3. What is the future value of $8,000 invested today and held for 15 years at 8 percent compounded annually? A. $25,377.35 B. $27,197.94 C. $29,139.86 D. $29,509.77 E. $10,200.00 4. Lisa has $1,000 in cash today. Which one of the following investment options is the most likely to double her money? A. 6 percent interest for 3 years B. 12 percent interest for 5 years C. 9 percent interest for 8 years D. 7 percent interest for 9 years E. 6 percent interest for 10 years 5. You just won $17,500 and deposited your winnings into an account that pays 6.7 percent interest, compounded annually. How long will you have to wait until your winnings are worth $50,000? A. 15.1 years B. 15.31 years C. 15.52 years D. 15.73 years E. 16.19 years 6. A preferred stock that pays annual dividends offers a rate of return of 6.55 percent per year and sells for $78.20. What is the annual dividend amount? A. $4.26 B. $4.09 C. $3.53 D. $4.50 E. $5.12 7. Letitia borrowed $6,000 from her bank two years ago. The loan term is four years. Each year, she must repay the bank $1,500 in principal plus the annual interest. Which type of loan does she have? A. Amortized Loan with Fixed Equal Payments (mortgage style) B. Amortized Loan with Fixed Principal Payments (straight-line amortization) C. Interest-only D. Pure discount E. Complex 8. Suzie is retiring today. How much money does she need to have in her retirement savings account today if she wishes to withdraw $45,000 a year for 20 years? The withdrawals will be at annual frequency and the first withdrawal will be one year from now. Suzie expects to earn a rate of return of 9 percent per year. A. $426,580.50 B. $410,784.56 C. $403,569.81 D. $385,160.98 E. $388,683.83 9. First Bank offers personal loans at 7.9 percent compounded monthly. Second Bank offers similar loans at 7.6 percent compounded daily. Which one of the following statements is correct concerning these loans? Assume a 365-day year. A. The First Bank loan has an effective annual rate of 7.98 percent. B. The Second Bank loan has an effective annual rate of 8.01 percent. C. The annual percentage rate for the Second Bank loans is 7.68 percent. D. Borrowers should prefer the loans offered by Second Bank. E. Both banks offer the same effective rate. 10. You want to purchase a new condominium that costs $695,000. Your plan is to pay 25 percent down in cash and finance the balance with a mortgage over 15 years at 3.35 percent APR compounded monthly. You will make equal monthly payments. How large will each monthly payment be? A. $1,568.07 B. $3,861.11 C. $3,245.23 D. $3,688.05 E. $4,326.97 11. Cromwell is acquiring some land for $1,200,000 in exchange for semiannual payments of $75,000 at an APR of 7.6 percent compounded semiannually. How many years will it take Cromwell to pay for this purchase? A. 12.55 years B. 12.00 years C. 11.10 years D. 11.47 years E. 11.92 years 12. You want to purchase a new condominium that costs $325,000. Your plan is to pay 20 percent down in cash and finance the balance over 15 years at 4.2 percent APR with monthly compounding (hint: monthly rate = 0.35%). What will be your monthly mortgage payment including principal and interest? A. $1,949.35 B. $2,185.56 C. $2,560.39 D. $2,420.30 E. $2,258.34