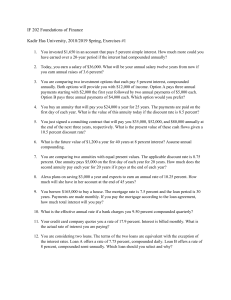

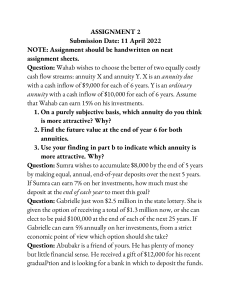

Fin 125 Ch 6 Study online at quizlet.com/_6rh6vn 1. An annuity that pays $12,500 a year at an annual interest rate of 5.45% costs $150,000 today. What is the length of the annuity time period? D b) 18 years The Distribution Point plans to save $2,000 a month for the next 3 years for future emergencies. The interest rate is 4.5% compounded monthly. The first monthly deposit will be made today. What would today's deposit amount to be if the firm opted for one lump sum deposit that would yield the same amount of savings as the monthly deposits after 3 years? c) 15 years a) $70,459.07 d) 20 years b) $67,485.97 e) 22 years c) $69,068.18 4. a) 25 years 2. Assume you work for an employer who will contribute $60 a week for the next 20 years into a retirement plan for your benefit. At a discount rate of 9%, what is this employee benefit worth to you today? A B d) $69,333.33 e) $67,233.84 5. a) $28,927.38 b) $27,618.46 Marcus is scheduled to receive annual payments of $3,600 for each of the next 12 years. The discount rate is 8%. What is the difference in the present value if these payments are paid at the beginning of each year rather than at the end of each year? A c) $29, 211.11 a) $2,170.39 d) $25,306.16 b) $2,511.07 e) $25,987.74 3. Chris has three options for settling an insurance claim. Option A will provide $1,500 a month for 6 years. Option B will pay $1,025 a month for 10 years. Option C offers $85,000 as a lump sum payment today. The applicable discount rate is 6.8%, compounded monthly. Which option should Chris select, and why, if he is only concerned with the financial aspects of the offers? c) $2,021.18 E d) $2,027.94 e) $2,304.96 6. A preferred stock pays an annual dividend of $5.20. What is one share of this stock worth today if the rate of return is 10.44%? a) Option A: It provides the largest monthly payment. a) $51.48 b) Option B: It pays the largest total amount. b) $41.18 c) Option C: It is all paid today. c) $49.81 d) Option B: It pays the greatest number of payments. d) $39.87 e) Option B: It has the largest value today. e) $42.90 C 7. 8. Sara wants to establish a trust fund to provide $75,000 in scholarships each year and earn a fixed 6.15% rate of return. How much money must she contribute to the fund assuming that only the interest income is distributed? D 10. Troy will receive $7,500 at the end of Year 2. At the end of the following two years, he will receive $9,000 and $12,500, respectively. What is the future value of these cash flows at the end of Year 6 if the interest rate is 8%? a) $987,450 a) $38,418.80 b) $1,478,023 b) $32,907.67 c) $1,333,333 c) $36,121.08 d) $1,219,512 d) $39,010.77 e) $1,500,000 e) $33,445.44 Southern Tours is considering acquiring Holiday Vacations. Management believes Holiday Vacations can generate cash flows of $218,000, $224,000, and $238,000 over the next three years, respectively. After that time, they feel the business will be worthless. If the desired rate of return is 14.5%, what is the maximum Southern Tours should pay today to acquire Holiday Vacations? A 11. Waldo expects to save the following amounts: Year 1 = $50,000; Year 2 = $28,000; Year 3 = $12,000. If he can earn an average annual return of 10.5%, how much will he have saved in this account exactly 25 years from the time of the first deposit? C E a) $1,172,373 b) $935,334 a) $519,799.59 c) $806,311 b) $538,615.08 d) $947,509 c) $545,920.61 e) $1,033,545 d) $595,170.53 12. e) $538,407.71 9. Sue just purchased an annuity that will pay $24,000 a year for 25 years, starting today. What was the purchase price if the discount rate is 8.5%? What is the EAR of 14.9% compounded continuously? a) 15.59% E b) 15.62% c) 15.69% a) $241,309 d) 15.84% b) $245,621 e) 16.07% c) $251,409 d) $258,319 e) $266,498 E 13. You are considering a project with cash flows of $16,500, $25,700, and $18,000 at the end of each year for the next three years, respectively. What is the present value of these cash flows, given a discount rate of 7.9%? B 16. Your broker is offering 1.2% compounded daily on its money market account. If you deposit $7,500 today, how much will you have in your account 15 years from now? A a) $8,979.10 a) $54,877.02 b) $9,714.06 b) $51,695.15 c) $8,204.50 c) $55,429.08 d) $9,336.81 d) $46,388.78 e) $9,414.14 e) $53,566.67 14. You are paying an EAR of 16.78% on your credit card. The interest is compounded monthly. What is the annual percentage rate on this account? 17. A a) 15.61% b) 13.80% b) 13.97% c) 15.95% c) 14.98% d) 17.25% d) 15.75% e) 14.71% a) $387.71 Your grandfather left you an inheritance that will provide and annual income for the next 20 years. You will receive the first payment one year from now in the amount of $2,500. Every year after that, the payment amount will increase by 5%. What is your inheritance worth to you today if you can earn 7.5% on your investments? b) $391.40 a) $37,537.88 c) $401.12 b) $28,667.40 d) $419.76 c) $23,211.00 e) $394.89 d) $35,612.20 You just obtained a loan of $16,700 with monthly payments for four years at 6.35% interest, compounded monthly. What is the amount of each payment? B a) 18.92% 18. e) 16.35% 15. Your credit card company charges you 1.15% interest per month. What is the APR? E e) $30,974.92 A 19. You want to borrow $27,500 and can afford monthly payments of $650 for 48 months, but no more. Assume monthly compounding. What is the highest APR rate you can afford? A a) 6.33% b) 6.67% c) 5.82% d) 7.01% e) 7.18% 20. You would like to provide $125,000 a year forever for your heirs. How much money must you deposit today to fund this goal if you can earn a guaranteed 4.5% rate of return? a) $2,777,778 b) $2,521,212 c) $2,666,667 d) $2,858,122 e) $2,850,000 A