Finance Management Test: Annuities, Interest, Present Value

advertisement

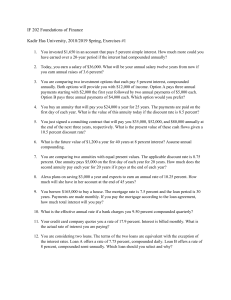

Name: Class: Finance Management Date: 14/03/2022 Ch4 spring 2022 Indicate the answer choice that best completes the statement or answers the question. 1 2 3 4 5 a e a e b 6 7 8 9 10 A C B C e 11 12 13 14 15 B B E B a 16 17 18 19 20 D E B B B 1. Your girlfriend just won the Florida lottery. She has the choice of $15,000,000 today or a 20-year annuity of $1,050,000, with the first payment coming one year from today. What rate of return is built into the annuity? a. 3.44% b. 3.79% c. 4.17% d. 4.58% e. 5.04% 2. Suppose People's bank offers to lend you $10,000 for 1 year on a loan contract that calls for you to make interest payments of $250.00 at the end of each quarter and then pay off the principal amount at the end of the year. What is the effective annual rate on the loan? a. 8.46% b. 8.90% c. 9.37% d. 9.86% e. 10.38% 3. You agree to make 24 deposits of $500 at the beginning of each month into a bank account. At the end of the 24th month, you will have $13,000 in your account. If the bank compounds interest monthly, what nominal annual interest rate will you be earning? a. 7.62% b. 8.00% c. 8.40% d. 8.82% e. 9.26% 4. Your bank pays 4% interest annually. You have $2,500 invested in the bank. How long will it take for your funds to double? a. 14.39 b. 15.15 c. 15.95 d. 16.79 e. 17.67 5. The going rate of interest on a 5-year treasury bond is 4.25%. You have one that will pay $2,500 five years from now. How much is the bond worth today? a. $1,928.78 b. $2,030.30 Copyright Cengage Learning. Powered by Cognero. Page 1 Name: Class: Finance Management Date: 14/03/2022 Ch4 spring 2022 c. $2,131.81 d. $2,238.40 e. $2,350.32 6. Your sister's pet supplies business obtained a 30-year amortized mortgage loan for $250,000 at a nominal annual rate of 7.0%, with 360 end-of-month payments. The firm can deduct the interest paid for tax purposes. What will the interest tax deduction be for for the first year of the loan? (Assume she took out the loan on January 1.) a. $17,419.55 b. $17,593.75 c. $17,769.68 d. $17,947.38 e. $18,126.85 7. Cyberhost Corporation's sales were $225 million last year. If sales grow at 6% per year, how large (in millions) will they be 5 years later? a. $271.74 b. $286.05 c. $301.10 d. $316.16 e. $331.96 8. You just deposited $2,500 in a bank account that pays a 4.0% nominal interest rate, compounded quarterly. If you also add another $5,000 to the account one year (4 quarters) from now and another $7,500 to the account two years (8 quarters) from now, how much will be in the account three years (12 quarters) from now? a. $15,234.08 b. $16,035.88 c. $16,837.67 d. $17,679.55 e. $18,563.53 9. You are in negotiations to make a 7-year loan of $25,000 to DeVille Corporation. To repay you, DeVille will pay $2,500 at the end of Year 1, $5,000 at the end of Year 2, and $7,500 at the end of Year 3, plus a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. You are confident the payments will be made, since DeVille is essentially riskless. You regard 8% as an appropriate rate of return on a low risk but illiquid 7-year loan. What cash flow must the investment provide at the end of each of the final 4 years, that is, what is X? a. $4,271.67 b. $4,496.49 c. $4,733.15 d. $4,969.81 e. $5,218.30 10. You expect to receive $5,000 in 25 years. How much is it worth today if the discount rate is 5.5%? a. $1,067.95 b. $1,124.16 c. $1,183.33 Copyright Cengage Learning. Powered by Cognero. Page 2 Name: Class: Finance Management Date: 14/03/2022 Ch4 spring 2022 d. $1,245.61 e. $1,311.17 11. What's the present value of a perpetuity that pays $250 per year if the appropriate interest rate is 5%? a. $4,750 b. $5,000 c. $5,250 d. $5,513 e. $5,788 12. Wildwoods, Inc. earned $1.50 per share five years ago. Its earnings this year were $3.20. What was the growth rate in earnings per share (EPS) over the 5-year period? a. 15.54% b. 16.36% c. 17.18% d. 18.04% e. 18.94% 13. Your friend offers to pay you an annuity of $2,500 at the end of each year for 3 years in return for cash today. You could earn 5.5% on your money in other investments with equal risk. What is the most you should pay for the annuity? a. $5,493.71 b. $5,782.85 c. $6,087.21 d. $6,407.59 e. $6,744.83 14. How much would $100, growing at 5% per year, be worth after 75 years? a. $3,689.11 b. $3,883.27 c. $4,077.43 d. $4,281.30 e. $4,495.37 15. JG Asset Services is recommending that you invest $1,500 in a 5-year certificate of deposit (CD) that pays 3.5% interest, compounded annually. How much will you have when the CD matures? a. $1,781.53 b. $1,870.61 c. $1,964.14 d. $2,062.34 e. $2,165.46 16. You are considering investing in a European bank account that pays a nominal annual rate of 18%, compounded monthly. If you invest $5,000 at the beginning of each month, how many months would it take for your account to grow to $250,000? Round fractional months up. a. 23 Copyright Cengage Learning. Powered by Cognero. Page 3 Name: Class: Finance Management Date: 14/03/2022 Ch4 spring 2022 b. 27 c. 32 d. 38 e. 44 17. Your investment advisor has recommended your invest in bonds that pay 6.0%, compounded annually. If you invest $10,000 today, how many years will it take for your investment to grow to $30,000? a. 12.37 b. 13.74 c. 15.27 d. 16.97 e. 18.85 18. Geraldine was injured in a car accident, and the insurance company has offered her the choice of $25,000 per year for 15 years, with the first payment being made today, or a lump sum. If a fair return is 7.5%, how large must the lump sum be to leave her as well off financially as with the annuity? a. $225,367 b. $237,229 c. $249,090 d. $261,545 e. $274,622 19. Suppose you just won the state lottery, and you have a choice between receiving $2,550,000 today or a 20-year annuity of $250,000, with the first payment coming one year from today. What rate of return is built into the annuity? Disregard taxes. a. 7.12% b. 7.49% c. 7.87% d. 8.26% e. 8.67% 20. You are considering investing in a bank account that pays a nominal annual rate of 7%, compounded monthly. If you invest $3,000 at the end of each month, how many months will it take for your account to grow to $150,000? a. 39.60 b. 44.00 c. 48.40 d. 53.24 e. 58.57 Copyright Cengage Learning. Powered by Cognero. Page 4