Daily Market Watch - BORSA MEDYA ::: Markets, Corporate News

advertisement

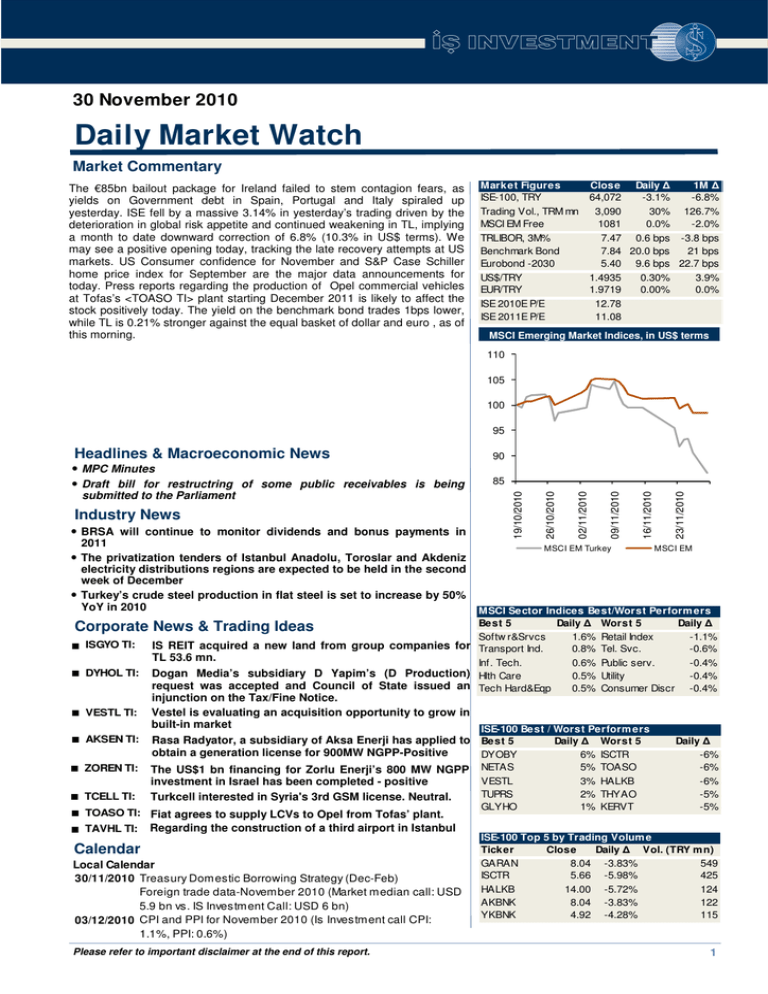

30 November 2010 Daily Market Watch Market Commentary The €85bn bailout package for Ireland failed to stem contagion fears, as yields on Government debt in Spain, Portugal and Italy spiraled up yesterday. ISE fell by a massive 3.14% in yesterday’s trading driven by the deterioration in global risk appetite and continued weakening in TL, implying a month to date downward correction of 6.8% (10.3% in US$ terms). We may see a positive opening today, tracking the late recovery attempts at US markets. US Consumer confidence for November and S&P Case Schiller home price index for September are the major data announcements for today. Press reports regarding the production of Opel commercial vehicles at Tofas’s <TOASO TI> plant starting December 2011 is likely to affect the stock positively today. The yield on the benchmark bond trades 1bps lower, while TL is 0.21% stronger against the equal basket of dollar and euro , as of this morning. Market Figures Close Daily 1M ISE-100, TRY 64,072 -3.1% -6.8% Trading Vol., TRM mn 3,090 30% 126.7% MSCI EM Free 1081 0.0% -2.0% TRLIBOR, 3M% 7.47 0.6 bps -3.8 bps Benchmark Bond 7.84 20.0 bps 21 bps Eurobond -2030 5.40 9.6 bps 22.7 bps US$/TRY 1.4935 0.30% 3.9% EUR/TRY 1.9719 0.00% 0.0% ISE 2010E P/E 12.78 ISE 2011E P/E 11.08 MSCI Emerging Market Indices, in US$ terms 110 105 100 95 MSCI EM Turkey 23/11/2010 16/11/2010 09/11/2010 2011 • The privatization tenders of Istanbul Anadolu, Toroslar and Akdeniz electricity distributions regions are expected to be held in the second week of December • Turkey’s crude steel production in flat steel is set to increase by 50% YoY in 2010 02/11/2010 Industry News • BRSA will continue to monitor dividends and bonus payments in 85 26/10/2010 submitted to the Parliament 90 19/10/2010 Headlines & Macroeconomic News • MPC Minutes • Draft bill for restructring of some public receivables is being MSCI EM MSCI Sector Indices Best/Worst Perform ers Best 5 Daily Worst 5 Daily Softw r&Srvcs 1.6% Retail Index -1.1% IS REIT acquired a new land from group companies for Transport Ind. 0.8% Tel. Svc. -0.6% TL 53.6 mn. Inf. Tech. 0.6% Public serv. -0.4% Dogan Media’s subsidiary D Yapim’s (D Production) Hlth Care 0.5% Utility -0.4% request was accepted and Council of State issued an Tech Hard&Eqp 0.5% Consumer Discr. -0.4% Corporate News & Trading Ideas ISGYO TI: DYHOL TI: VESTL TI: AKSEN TI: ZOREN TI: TCELL TI: injunction on the Tax/Fine Notice. Vestel is evaluating an acquisition opportunity to grow in built-in market ISE-100 Best / Worst Perform ers Rasa Radyator, a subsidiary of Aksa Enerji has applied to Best 5 Daily Worst 5 obtain a generation license for 900MW NGPP-Positive DYOBY 6% ISCTR The US$1 bn financing for Zorlu Enerji’s 800 MW NGPP investment in Israel has been completed - positive Turkcell interested in Syria's 3rd GSM license. Neutral. TOASO TI: Fiat agrees to supply LCVs to Opel from Tofas’ plant. TAVHL TI: Regarding the construction of a third airport in Istanbul Calendar Local Calendar 30/11/2010 Treasury Domestic Borrowing Strategy (Dec-Feb) 30/11/2010 Foreign trade data-November 2010 (Market median call: USD 5.9 bn vs. IS Investment Call: USD 6 bn) 03/12/2010 CPI and PPI for November 2010 (Is Investment call CPI: 1.1%, PPI: 0.6%) Please refer to important disclaimer at the end of this report. NETAS VESTL TUPRS GLYHO 5% 3% 2% 1% TOASO HALKB THYAO KERVT Daily -6% -6% -6% -5% -5% ISE-100 Top 5 by Trading Volum e Ticker Close Daily Vol. (TRY m n) GARAN 8.04 -3.83% 549 ISCTR 5.66 -5.98% 425 HALKB 14.00 -5.72% 124 AKBNK 8.04 -3.83% 122 YKBNK 4.92 -4.28% 115 1 Calendar Global Calendar 30/11/2010 JN:Nomura/JMMA Manufacturing PMI JN:Job-To-Applicant Ratio JN:Overall Hhold Spending (YoY) % JN:Jobless Rate % JN:Industrial Production (MoM) % JN:Industrial Production YOY% % UK:GfK Consumer Confidence Survey JN:Labor Cash Earnings YoY % JN:Vehicle Production (YoY) % JN:Housing Starts (YoY) % FR:Producer Prices (MoM) % FR:Producer Prices (YoY) % GE:Unemployment Change (000' s) GE:Unemployment Rate (s.a) % EC:Euro-Zone CPI Estimate (YoY) % EC:Euro-Zone Unemployment Rate % BZ:Net Debt % GDP % BZ:Primary Budget Balance BZ:Nominal Budget Balance US:S&P/CaseShiller Home Price Ind US:S&P/CS Composite-20 YoY % US:S&P/Case-Shiller US HPI US:S&P/Case-Shiller US HPI YOY% % US:Consumer Confidence US:NAPM-Milwaukee Exp. 0.56 5.00 -3.20 3.10 -19 0.70 9.70 0.40 4.10 -20K 7.50 1.90 10.10 40.60 12,7B 1.00 52.6 Pri. 47.2 0.55 0.00 5.00 -1.60 11.50 -19 0.90 11.40 17.70 0.30 4.20 -3K 7.50 1.90 10.10 41.00 27,8B 11,8B 148.59 1.70 138 3.60 50.2 56 Headlines & Macroeconomic News MPC Minutes Central Bank (CBRT) released the minutes of the recent Monetary Policy Committee (MPC) that took place on November 11th. There is not much to chew in the announcement as the Bank plays the same song. On the domestic demand front, while there has been some moderation in the industrial production in 3Q, some acceleration is expected for the last quarter. Meanwhile, as the weak trend in the external demand continues, the Bank does not see an immediate threat to inflation from aggregate demand conditions. Yet, keeping the domestic demand close&closer on the radar, the Bank continues to push alternative monetary tools forward. Hence the possibility of seeing another move on the reserve requirement front or liquidity management is being kept alive. While inflation picture has been suffering from supply-side shock, the Bank underlines the importance of following the commodity prices and their impact on the pricing behaviour. We agree with the Bank. As chubby domestic demand is giving pricing power to the producers, we might see price hikes to be triggered if commodity prices go up. We attribute a considerable weight to this scenario in addition to risk created by possible upward adjustments in the administrated prices. Indeed the Bank also notes that, monetary policy adjustment would be required if government follows a loose path compared to the earlier announced Medium Term Fiscal Program. Knowing CBRT’s base scenario for keeping the policy rates constant to the last quarter of 2011, we still rest our case for rate hike cycle to begin earlier. Being more concerned on the inflation front, we urge the Bank to act more prudent. Some cautious time buffer in rate hikes might limit the size of the rate hikes by eliminating the risk of being late. We expect the rate hike cycle to begin in 2Q2011, adding up to 150 bps through out the year. Draft bill for restructring of some public receivables is being submitted to the Parliament Draft bill regarding the restructring of some public receivables is being sent to the Parliament by the government, covering more than 100 articles. In addition to the earlier mentioned framework there are some other articles, regulating green card usage in the social security system and support to female employment. Meanwhile re-location of Central Bank, BRSA, Capital Markets Board and VakifBank to Istanbul is also said to be a part of the package. We will know more about the framework when we see the full official document. But so far there is not much solid figures to extract from data in hand. Although there has been some market rumours regarding the size of possible collectables through this restructing plan, they still stand as urban legend. The application of the related parties will start two months after the legislation of the bill for restructuring. A more realistic calculation will be possible after seeing the applications and upon the acknowledgement of Ministry of Finance. 2 Industry News BRSA will continue to monitor dividends and bonus payments in 2011. Banks will again be informing the BRSA their planned 2011 dividend payout amounts (from 2010 and/or previous years’ earnings reserves) along with the bonus and other performance pays to executives and staff prior to their General Assembly meetings. The news suggests that banks’ dividend payments will again be under close scrutiny by the Watchdog to be able to induce a sustained robustness in banks’ capital bases. We expect the banks’ payout ratios to be similar to 2009-2010 practices. Neutral, as the market already knows that dividends will be monitored by the BRSA, yet it is positive for banks’ RWA growth and profitability. (source: Reuters) The privatization tenders of Istanbul Anadolu, Toroslar and Akdeniz electricity distributions regions are expected to be held in the second week of December The PA announced that they plan to complete the privatization tenders of the last three electricity distribution regions (Istanbul Anadolu, Toroslar and Akdeniz) in the second week of December. The PA also added that they target to complete the transfer of the privatized electricity distribution regions to the new owners by mid-2011. Ayen Enerji A. . (AYEN TI, NR), Aksa Elektrik Perakende Satı A. . (Another group company of AKSEN TI, NR), Alsim Alarko Sanayi Tesisleri ve Ticaret A. . (ALARK TI, PT:TL3.61, MP), Akfen Enerji Da ıtım ve Ticaret A. . (AKFEN TI, PT: TL14.78, OP), Enerjisa Elektrik Daıtım A. . (SAHOL TI, PT: TL8.51, MP), Park Holding A. . (Parent company of PRKTE TI, NR) are among the interested bidders. Turkey’s crude steel production in flat steel is set to increase by 50% YoY in 2010 According to Turkish Iron & Steel Producers’ Association (DCUD), Turkey produced 5.66 mn tonnes of crude steel for flat steel production during Jan-Oct 2010, 49% above the same period in 2009 thanks to new capacities coming from Toscelik, Colakoglu and Isdemir. MMK Atakas is planning to start hot rolled coil production at the beginning of 2011, and Kibar Holding and Habas have ongoing investments for flat steel production. Turkey is expected to become a net exporter for flat steel in the upcoming 2-3 years period accordingly. Total crude steel (long steel and flat steel combined) production of the country is expected to tap 28.5-29 mn tons level in 2010, representing a 15% YoY increase. 3 Corporate News & Trading Ideas Is GYO IS REIT acquired a new land from group companies for TL 53.6 mn. IS REIT acquired 62,490 sqm land in Tuzla Istanbul from T. Sise Cam <SISE TI>, Pa abahce Cam, Trakya Cam <TRKCM TI> and Anadolu Cam <ANACM TI> for TL 53.6mn, corresponding to 5.26% of its total asset value. Part of the land will be used to construct an operating center for Bank, which will be leased to the bank for 25 years, generating 8.01% yield on the total cost. No details provided on the mixed used project planned to be developed on this including another piece of land purchased earlier this year at the same location. Potential Positive. Dogan Yayin Dogan Media’s subsidiary D Yapim’s (D Production) request was accepted and Council of State issued an injunction on the Tax/Fine Notice. Council of State issued an injunction decision in favor of D Yapim in regards to the Tax Court’s verdict that formed the basis of Tax/Fine Notice No.2 amounting to TL1.37bn. Accordingly, in line with the Council of State’s mentioned decision, there will not be any payment at this stage while the case will continue to be discussed on the merits. The State Council had made a similar decision regarding the tax case of Dogan TV nearly 2 months ago. Neutral. Vestel Vestel is evaluating an acquisition opportunity to grow in built-in market According to the Daily Hurriyet, Vestel may be interested in the acquisition of an international brand to achieve market share target in built-in products market. According to the statement given by the Vestel Chairperson, Omer Yungul, Vestel White Goods sees a significant potential in built-in products market thanks to the growing construction sector in the country. The company plans to offer all types of built-in products and grab 25% market share in a near future. Therefore, the company may evaluate the opportunity to purchase an international brand company operating in builtin market as a part of its strategy. Slightly positive. bberki@isyatirim.com.tr ISGYO TI (TRY) Price Mcap, mn FF Mcap, mn (x) P/E P/BV EV/EBITDA (TRY) Avg. Vol. Mn Relative Perf. % OP Current 1.65 743 408 2010E 16.79 0.81 11.75 1M 2.3 -3.8 45% Upside Target 2.40 1,080 594 2011E 13.50 0.74 10.37 YtD 5.0 -15.0 ihomris@isyatirim.com.tr DYHOL TI (TRY) Price Mcap, mn FF Mcap, mn (x) P/E P/BV EV/EBITDA (TRY) Avg. Vol. Mn Relative Perf. % NR Current 1.67 1,670 568 2010E 1M 71.0 21.9 Target 2011E YtD 28.1 6.7 bdinckoc@isyatirim.com.tr VESTL TI (TRY) Price Mcap, mn FF Mcap, mn (x) P/E P/BV EV/EBITDA (TRY) Avg. Vol. Mn Relative Perf. % NR Current 2.43 815 677 2010E 1M 3.6 6.9 Target 2011E YtD 6.5 -23.0 4 Corporate News & Trading Ideas Aksa Enerji Rasa Radyator, a subsidiary of Aksa Enerji has applied to obtain a generation license for 900MW NGPP-Positive Rasa Radyator, 99.6% subsidiary of Aksa Enerji, has applied to obtain a generation license from EMRA for its 900MW natural gas based power plant investment in Bilecik. This project is not one of the announced projects of Aksa Enerji but within the plans to reach an installed capacity of 4,202MW by 2014. Positive for Aksa Enerji. Zorlu Enerji The US$1 bn financing for Zorlu Enerji’s 800 MW NGPP investment in Israel has been completed - positive Zorlu Enerji has 25% stake in the company, which will build the so called Dorad NG powerplant in Ashkelon region in Israel. The total cost of the investment will be US$1.2 bn, of which US$1 bn will be financed with a group of financial institutions. The loan will have a 3 years grace period (until the plant becomes operational) and will be paid back in 17 years. The interest rate varies between 5.1%-5.6%. Positive news as the project has been on hold for a while. However, it is also stated that the construction of the plant will not be undertaken by Zorlu Industrial, which is the contractor company of Zorlu Group, as it was previously planned. Therefore, although not confirmed by the company, we think that Zorlu Enerji might sell its 25% stake in this investment in the mid-term. Turkcell Turkcell interested in Syria's 3rd GSM license. Neutral. Turkcell, along with STC, France Telecom, Etisalat and Otel, has prequalified for the 3rd GSM license in Syria. With a population of 20.5mn (36% of which is below the age of 15), the mobile penetration rate is 48% in Syria in 1H10, while Syriatel and MTN Syria are the existing 2 operators, operating under BOT licences, which will also be replaced bu full mobile licences soon. In 2008, Turkcell had been interested in the 55% stake sale of Syriatel, talks for which was later rumored to be frozen due to US sanctions against Syriatel’s majority owner Makhlouf. We believe that it is important for Turkcell to seek growth elsewhere, whether it be geographically or through finding synergies with other industries, however, it is too early to comment on such a possible acquisition, and is also dependent on the price to be paid, even if realized. Neutral. akumbaraci@isyatirim.com.tr AKSEN TI (TRY) Price Mcap, mn FF Mcap, mn (x) P/E P/BV EV/EBITDA (TRY) Avg. Vol. Mn Relative Perf. % NR Current 4.94 2,853 143 2010E Target 2011E 1M 5.4 6.0 YtD 2.5 0.0 akumbaraci@isyatirim.com.tr ZOREN TI (TRY) Price Mcap, mn FF Mcap, mn (x) P/E P/BV EV/EBITDA (TRY) Avg. Vol. Mn Relative Perf. % NR Current 2.71 763 244 2010E 1M 7.8 -2.4 Target 2011E YtD 7.3 -28.4 ihomris@isyatirim.com.tr TCELL TI (TRY) Price Mcap, mn FF Mcap, mn (x) P/E P/BV EV/EBITDA (TRY) Avg. Vol. Mn Relative Perf. % UP Current 10.40 22,880 7,779 2010E 12.15 2.37 7.08 1M 22.9 7.3 3% Upside Target 10.70 23,540 8,004 2011E 11.28 2.16 6.39 YtD 25.1 -15.4 5 Corporate News & Trading Ideas Tofas Fabrika Fiat agrees to supply LCVs to Opel from Tofas’ plant. Fiat Group has agreed to supply the German automaker Opel with at least 250,000 commercial vehicles starting in December, 2011. The vehicles based on the Fiat Doblo platform will replace the Opel Combo light commercial vehicle and will be produced at the Tofas plant in Bursa. The commercial vehicles will be supplied with the initial amount of 6,000 vehicles from December 2011 for sale by Vauxhall and Opel dealers in Europe and markets outside of North America. The program is planned to cover the supply of at least 250,000 units. This will extend the total lifetime production of new Fiat Doblo platform in the Tofas plant to 1.3 million units. Thanks to new agreement with Opel, Tofas will increase new Doblo production to160,000 units from 120,000 units commencing from 2012. The Opel/Vauxhall design team in Germany is actively involved in the development of the new models and works in cooperation with the Fiat Group Automobiles’ Engineering and Design Group in Italy. Tofas is also working on a new passenger car project which is expected to replace its Albea model. According to Tofas’ CEO Ali Pandır comments in daily Hurriyet, the company aims to increase its Bursa plant capacity to 550,000 units from its current level of 400,000 units within the next three years with an investment amount of €200mn. TAV Holding Regarding the construction of a third airport in Istanbul As had been stated earlier, the construction of a third airport is almost certain and although a decision has not been taken regarding the exact location, the Minister of Transpoert stated that it will be located in the European side of Istanbul. Mr. Yildirim announced that the pax capacity of the airport will be at least 60mn and the airport will contain two seperate runways. Note that Ataturk Airport is known to have a capacity of 70mn pax, yet this has been reduced due to limited parking capacity. The new airport investment valued at US$5bn will be a BOT tender. On that note, capacity expansion studies have been continuing as TAV is planning to acquire the military area at Ataturk to convert it into new parking area. The location of the third airport is expected to be clarified towards the end of 2011 followed by wind studies in the area. As a result, the project is estimated to be finalized earliest in 6-10 years. Note that TAV’s contract at Ataturk will expire by 2020 and when such a tender is launched, the Company will most probably be one of the bidders. Although we think that this is a long-term project, it may create a short-term noise on TAV. Slightly negative. esuner@isyatirim.com.tr TOASO TI (TRY) Price Mcap, mn FF Mcap, mn (x) P/E P/BV EV/EBITDA (TRY) Avg. Vol. Mn Relative Perf. % MP Current 7.18 3,590 862 2010E 9.87 2.23 6.75 1M 4.9 -3.1 18% Upside Target 8.45 4,225 1,014 2011E 9.54 2.10 6.25 YtD 5.3 31.3 ihomris@isyatirim.com.tr TAVHL TI (TRY) Price Mcap, mn FF Mcap, mn (x) P/E P/BV EV/EBITDA (TRY) Avg. Vol. Mn Relative Perf. % New ly Announced Capital Increases and dividend paym ents (%) Ticker Rights Issue Bonus Issue Stock Dividend Gross Dividends in Cash Ex-Date DOGUB 26.58% 30/11/2010 Base Price 1.21 TL MP Current 7.16 2,601 1,144 2010E 22.71 2.85 11.47 1M 6.8 2.5 17% Upside Target 8.40 3,052 1,343 2011E 19.74 2.68 10.37 YtD 13.1 24.5 Cash Dividend Per Share Dividend Yield 6 Currency • Despite a positive opening following the EUR 85bn bailout package F/X Data • • granted to Ireland over the weekend, Eastern European EM currencies continued post sharp losses yesterday driven by concerns over the region’s stability. The EUR/USD reached 1.3124 levels yesterday on the back of on-going economic worries in the Eurozone about Portugal and Spain after Ireland. UAH (+1.2% against the equally weighted basket) was the day’s outperformer followed by the THB and the CNY. TRY continued to underperform the EM average amid uncertainties in Europe, ending the day down by 0.6% on a basket basis, down 1.1% against the USD and down 0.1% against the EUR. In terms of data releases today, on the local front, we have the Treasury Domestic Borrowing Strategy (Dec-Feb), Foreign trade data-November 2010 (Market median call: USD 5.9 bn vs. IS Investment Call: USD 6 bn). On the European front we have the Euro-Zone CPI and Unemployment Rate and the German Unemployment data and the French Producer Prices. On the US front, we have the S&P/CaseShiller Home Price Ind, Composite-20, US HPI and Consumer Confidence data releases. Local Bills and Bonds As of 29/11/2010 US Dollar Euro Euro/US Dollar Equal Weighted Basket Change Daily -1.13 -0.05 -1.08 -0.52 Close 1.5060 1.9728 1.3100 1.7394 (%) YTD -0.46 8.83 -7.48 -5.79 Source: Bloomberg Daily Performance Against US Dollar(%) 1.0% UAH 0.5% 0.0% KZT -0.5% ZAR -1.0% -1.5% BRL CNY RUB INR ARP RON TRY -2.0% CZK -2.5% HUF -3.0% PLN • With increasing worries in the Eurozone and consequently the flight to • • safer assets and a weakening TRY, the local rate market witnessed sharp sell-offs yesterday. The benchmark traded in a wide range and closed the day 20 bps up at 8.05% simple (7.84% comp.). The sell-off was noticeable at the belly and the long-end. The 15/01/20 note ended the day at 8.87% simple ( 9.07% comp), 10 bps up compared to Friday' s close. The Treasury will announce the December-February domestic borrowing strategy today at 5 pm. The debt service in December is about TL 10bn. Unless there is a change to the schedule today, all of the auctions in will take place next week on Monday and Tuesday. Structures to be issued will be the re-openings of the 20-mo benchmark note, the 7-yr FRN and the 5-yr fixed coupon note. The Treasury and government officials have been signalling for a longer dated issue over the last couple of months. Given the heavy debt service in January, we believe that we might see the addition of a 20-yr structure to the calendar in today’s release. Early quotations in the benchmark note this morning are around 7.83% comp. 8.1 7.5 7.3 7.1 6.9 6.7 Bill Coupon Zero 6.5 2 1 3 yr 0.8 0.6 4 yr Mil TL 04/12* 5 yr Daily Volume FRN Coupon Zero Bill Benchmark Volume: 162.5mil TL 0.4 0.2 • EM eurobonds started the week flat but on the back of the negative • TL Yield Curve 7.7 Eurobonds newsflow in Europe there was a sell-off pressure in global markets and EM rate and equity markets posted losses. The EUR 85bn aid package for Ireland was not sufficient to ease worries regarding uncertainties about the country’s debt stock and its banking sector amid mounting concerns that Portugal and Spain might also have to apply for an IMF/EU fund in the near future. With weakening EUR and unsuccessful Italian 3,7 and 10 yr bond issues, uncertainties accentuated in the Eurozone which in return had a negative effect in EM eurobonds throughout the day. Despite an initial tightening in CDS spreads following the Irish aid package announcement on Sunday, PIGS and EM CDS spreads continued to widen amid uncertainties. Turkish Eurobonds continued to post losses mainly at the long-end of the curve. Turkey’s benchmark 2030 note ended the day at 5.38% 8 bps up compared to the previous day’s level while Turkey 5-yr CDS levels continued to widen and are currently trading at 149/153 levels. % 7.9 0.0 0 2-5 yrs Recommendations Local Rates: • 15-01-20 Fixed Coupon Note: We continue to like the longer end of the curve given the carry. • Deposits versus short notes: We do not see any value in the short end of the curve and thus recommend investors to prefer deposits instead at levels around 8.00%-8.50%. We maintain our call for the CBRT to start hiking rates in May-2011. Eurobonds: • 7.50% 14-Jul-17 USD (HOLD): We continue to like the issue given its yield versus similar issues. 7 Most Traded Local Bonds & Bills Instrument Maturity Term Amt Daily Weekly Last Simple Comp Yld Chg 3 mo Range 3 mo Orig. PVBP Outstd. Volume Volume Traded Yield Yield 1D Wk Low High Avg Dur. Cnvx Term * 100 (%) (%) (bp) (bp) (%) Price (M il TL) (M il TL) (M il TL) (%) (%) T-Bills TRB200711T14 20/07/11 8 m 12 m 4,292 2 2 95.664 7.10 7.19 TRB120111T10 12/01/11 6m 6m 1,803 0 70 99.149 7.12 7.35 TRT080812T26 08/08/12 20 m 21 m -8 0 7.19 7.84 7.47 0.61 0.004 0.58 7.55 7.55 7.35 0.11 0.001 0.12 Zero Coupon Bonds 8,924 591 2,180 88.022 8.05 7.84 20 17 7.56 7.84 7.65 1.63 0.045 1.31 TRT250112T14 25/01/12 14 m 21 m 11,715 177 603 91.892 7.65 7.61 14 -2 7.33 8.13 7.77 1.11 0.019 0.97 TRT250412T11 25/04/12 17 m 21 m 14,278 163 380 90.081 7.85 7.73 12 13 7.50 8.20 7.87 1.35 0.035 1.14 Coupon Bearing Bonds TRT150120T16 15/01/20 9.1 y 10 y TRT190111T13 19/01/11 5,675 152 608 110.075 8.87 9.07 10 10 8.41 9.25 8.80 5.86 0.003 6.59 2m 5y 9,316 29 236 100.952 6.82 7.02 -2 -5 6.90 7.57 7.35 0.13 0.113 0.14 TRT060814T18 06/08/14 3.7 y 5y 7,492 8 35 108.900 8.16 8.33 3 7.67 8.77 8.22 2.96 0.004 3.31 This report has been prepared by “ Yatırım Menkul De erler A. .” ( Investment) solely for the information of clients of Investment. Opinions and estimates contained in this material are not under the scope of investment advisory services. Investment advisory services are given according to the investment advisory contract, signed between the intermediary institutions, portfolio management companies, investment banks and the clients. Opinions and recommendations contained in this report reflect the personal views of the analysts who supplied them. The investments discussed or recommended in this report may involve significant risk, may be illiquid and may not be suitable for all investors. Investors must make their decisions based on their specific investment objectives and financial positions and with the assistance of independent advisors, as they believe necessary. The information presented in this report has been obtained from public institutions, such as Istanbul Stock Exchange (ISE), Capital Market Board of Turkey (CMB), Republic of Turkey, Prime Ministry State Institute of Statistics (SIS), Central Bank of the Republic of Turkey (CBT); various media institutions, and other sources believed to be reliable but no independent verification has been made, nor is its accuracy or completeness guaranteed. All information in these pages remains the property of Investment and as such may not be disseminated, copied, altered or changed in any way, nor may this information be printed for distribution purposes or forwarded as electronic attachments without the prior written permission of Investment. (www.isinvestment.com) This research report can also be accessed by subscribers of Capital IQ, a division of Standard & Poor' s. For more information, please visit Capital IQ' s web site at www.capitaliq.com. 8