As of June 30, 2016

Fact sheet

wellsfargofunds.com

WealthBuilder Growth Balanced Portfolio

Asset class: Asset Allocation

CUSIP

Ticker

94975H205

WBGBX

Competitive advantages

■

Rigorous asset allocation process: A combination of quantitative analysis and qualitative

judgments are used in determining asset allocation decisions. Quantitative analysis uses

proprietary asset allocation models. Qualitative judgments take economic and market

conditions into consideration.

■

Multi-manager expertise: The fund invests in affiliated mutual funds, unaffiliated mutual

funds, and exchange-traded funds, seeking the best managers and strategies available.

Factors considered when selecting a fund include the management team's experience, the

strength and consistency of its track record, and how well it complements the other funds in

the portfolio.

THE FUND

The Wells Fargo WealthBuilder Growth

Balanced Portfolio is a fund of funds that seeks

a combination of capital appreciation and

current income.

FUND STRATEGY

■

■

■

Invests in select underlying funds from Wells

Fargo Funds and other nonaffiliated fund

families, including exchange-traded funds,

which collectively provide exposure to stocks,

bonds, and alternative investments.

Allocates up to 70% of assets to stock funds,

up to 40% of assets to bond funds, and up to

20% of assets to alternative investment funds.

Neutral mix is 60% stock funds, 30% bond

funds, and 10% alternatives.

Employs an asset allocation strategy that

combines quantitative analysis and

qualitative judgments to guide tactical asset

allocation decisions.

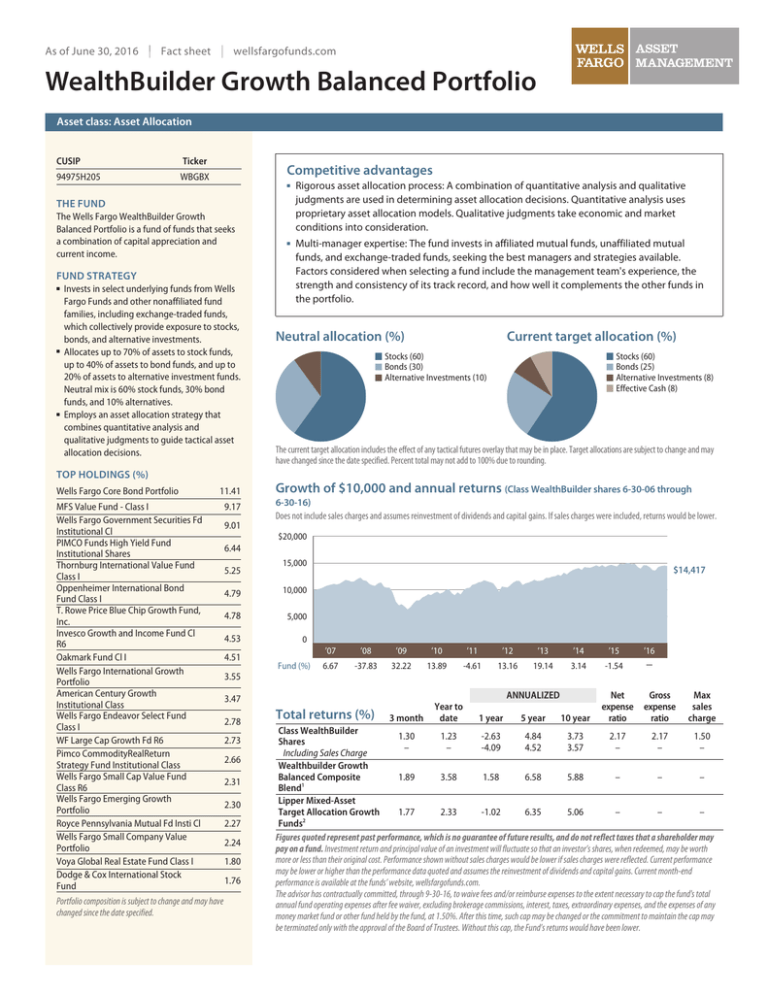

Neutral allocation (%)

Current target allocation (%)

Stocks (60)

Bonds (30)

Alternative Investments (10)

Stocks (60)

Bonds (25)

Alternative Investments (8)

Effective Cash (8)

The current target allocation includes the effect of any tactical futures overlay that may be in place. Target allocations are subject to change and may

have changed since the date specified. Percent total may not add to 100% due to rounding.

TOP HOLDINGS (%)

Wells Fargo Core Bond Portfolio

11.41

MFS Value Fund - Class I

Wells Fargo Government Securities Fd

Institutional Cl

PIMCO Funds High Yield Fund

Institutional Shares

Thornburg International Value Fund

Class I

Oppenheimer International Bond

Fund Class I

T. Rowe Price Blue Chip Growth Fund,

Inc.

Invesco Growth and Income Fund Cl

R6

Oakmark Fund Cl I

Wells Fargo International Growth

Portfolio

American Century Growth

Institutional Class

Wells Fargo Endeavor Select Fund

Class I

WF Large Cap Growth Fd R6

Pimco CommodityRealReturn

Strategy Fund Institutional Class

Wells Fargo Small Cap Value Fund

Class R6

Wells Fargo Emerging Growth

Portfolio

Royce Pennsylvania Mutual Fd Insti Cl

Wells Fargo Small Company Value

Portfolio

Voya Global Real Estate Fund Class I

Dodge & Cox International Stock

Fund

Portfolio composition is subject to change and may have

changed since the date specified.

9.17

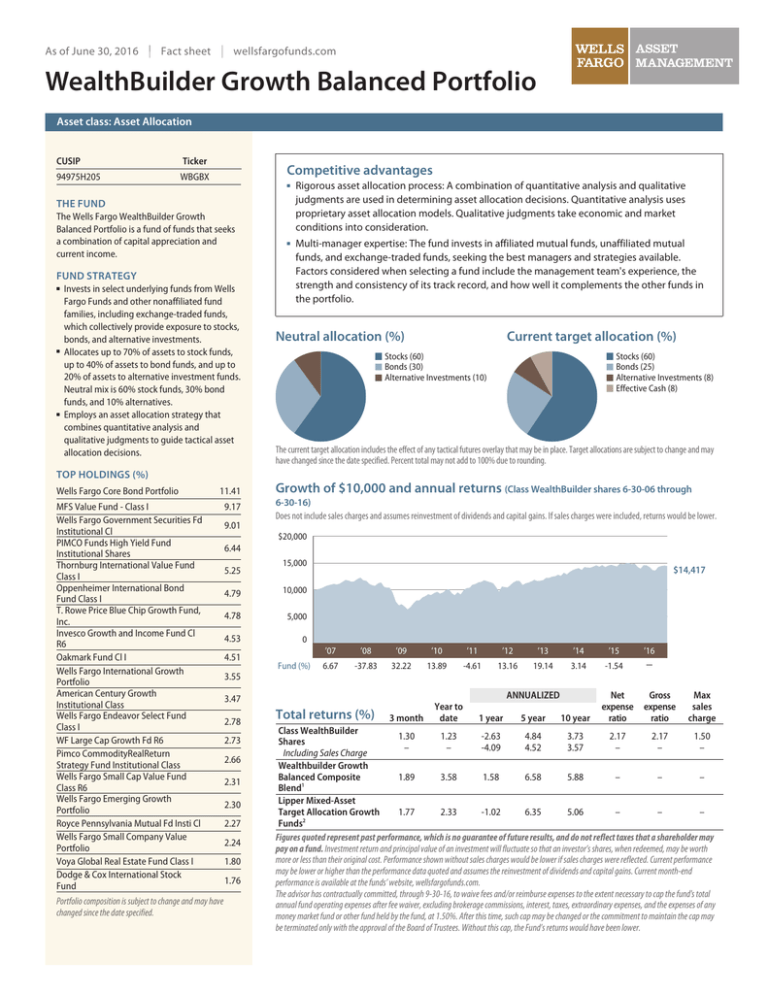

Growth of $10,000 and annual returns (Class WealthBuilder shares 6-30-06 through

6-30-16)

Does not include sales charges and assumes reinvestment of dividends and capital gains. If sales charges were included, returns would be lower.

9.01

$20,000

6.44

5.25

15,000

4.79

10,000

4.78

5,000

4.53

0

4.51

Fund (%)

$14,417

’07

’08

’09

’10

’11

’12

’13

’14

’15

6.67

-37.83

32.22

13.89

-4.61

13.16

19.14

3.14

-1.54

’16

3.55

ANNUALIZED

3.47

2.78

2.73

2.66

2.31

2.30

2.27

2.24

1.80

1.76

Total returns (%)

Year to

date

Net

expense

ratio

Gross

expense

ratio

Max

sales

charge

3 month

1 year

5 year

10 year

Class WealthBuilder

1.30

1.23

-2.63

4.84

3.73

2.17

2.17

1.50

Shares

–

–

-4.09

4.52

3.57

–

–

–

Including Sales Charge

Wealthbuilder Growth

Balanced Composite

1.89

3.58

1.58

6.58

5.88

–

–

–

Blend1

Lipper Mixed-Asset

Target Allocation Growth

1.77

2.33

-1.02

6.35

5.06

–

–

–

Funds2

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may

pay on a fund. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth

more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance

may be lower or higher than the performance data quoted and assumes the reinvestment of dividends and capital gains. Current month-end

performance is available at the funds’ website, wellsfargofunds.com.

The advisor has contractually committed, through 9-30-16, to waive fees and/or reimburse expenses to the extent necessary to cap the fund's total

annual fund operating expenses after fee waiver, excluding brokerage commissions, interest, taxes, extraordinary expenses, and the expenses of any

money market fund or other fund held by the fund, at 1.50%. After this time, such cap may be changed or the commitment to maintain the cap may

be terminated only with the approval of the Board of Trustees. Without this cap, the Fund’s returns would have been lower.

As of June 30, 2016

Fact sheet

wellsfargofunds.com

WealthBuilder Growth Balanced Portfolio

Asset class: Asset Allocation

MORNINGSTAR OWNERSHIP ZONE3

INVESTMENT STYLE

Value Blend Growth

Portfolio

characteristics

MARKET CAPITALIZATION

Large Medium Small

Portfolio turnover

Number of holdings

Fund

94.03%

34

Fund information

Advisor: Wells Fargo Funds Management, LLC

Sub-Advisor: Wells Capital Management Incorporated

Fund managers/years of experience: Christian L. Chan, CFA (19); Kandarp Acharya, CFA, FRM (17)

Inception Date: 10-1-97

WealthBuilder share

FIXED-INCOME STYLE BOX4

Ltd

DURATION

Mod

Ext

Distribution frequency

Fiscal year-end

CREDIT QUALITY

High Medium Low

Maximum sales charge

Minimum initial/subsequent purchase

Annually

May 31

1.50%

$1,000/$100

Net asset value

$13.21

Fund assets ($M)

$951.33

Balanced funds may invest in stocks and bonds. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to

the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened

volatility in the bond market and reduced liquidity for certain bonds held by the fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest-rate changes and

their impact on the fund and its share price can be sudden and unpredictable. The use of derivatives may reduce returns and/or increase volatility. The fund will indirectly be exposed to all of the risks of an

investment in the underlying funds and will indirectly bear expenses of the underlying funds. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). This

fund is exposed to alternative investment risk, foreign investment risk, high-yield securities risk, mortgage- and asset-backed securities risk, and smaller-company investment risk. Consult the fund’s

prospectus for additional information on these and other risks.

1. Source: Wells Fargo Funds Management, LLC. The WealthBuilder Growth Balanced Composite Index is comprised of the following indexes: Russell 3000® Index (42%), MSCI ACWI ex US Index (18%), and Barclays

Aggregate Bond Index (40%). You cannot invest directly in a composite index.2. The Lipper averages are compiled by Lipper, Inc., an independent mutual fund research and rating service. Each Lipper average represents a

universe of funds that are similar in investment objective. You cannot invest directly in a Lipper average. 3. Placement within the Morningstar Equity Style Box™ is based on two variables: relative median market

capitalization and relative price valuations (price-to-book and price-to-earnings) of the fund’s portfolio holdings. These numbers are drawn from the fund’s portfolio holdings figures most recently entered into

Morningstar’s database and the corresponding market conditions. The Ownership Zone is represented by a shaded area surrounding the centroid. This zone encompasses 75% of a portfolio’s holdings on an asset-weighted

basis, and is designed to be a visual measure of how wide-ranging the portfolio is. 4. Placement within the Morningstar Fixed-Income Style Box™ is based on two variables: the vertical axis shows the credit quality of the

long bonds owned and the horizontal axis shows interest-rate sensitivity as measured by a bond's effective duration. For credit quality, Morningstar combines the credit rating information provided by the fund companies

with an average default rate calculation to come up with a weighted-average credit quality. The weighted-average credit quality is currently a letter that roughly corresponds to the scale used by a leading NRSRO. Bond

funds are assigned a style box placement of low, medium, or high based on their average credit quality. Funds with a low credit quality are those whose weighted-average credit quality is determined to be less than BBB-,

medium are those less than AA- but greater or equal to BBB-, and high are those with a weighted average credit quality of AA- or higher. When classifying a bond portfolio, Morningstar first maps the NRSRO credit ratings

of the underlying holdings to their respective default rates (as determined by Morningstar’s analysis of actual historical default rates). Morningstar then averages these default rates to determine the average default rate

for the entire bond fund. Finally, Morningstar maps this average default rate to its corresponding credit rating along a convex curve. For interest-rate sensitivity, Morningstar obtains from fund companies the average

effective duration. Generally, Morningstar classifies a fixed-income fund’s interest-rate sensitivity based on the effective duration of the Morningstar Core Bond Index (MCBI), which is currently three years. The

classification of limited will be assigned to those funds whose average effective duration is between 25% and 75% of MCBI’s average effective duration; funds whose average effective duration is between 75% and 125%

of the MCBI will be classified as moderate; and those that are at 125% or greater of the average effective duration of the MCBI will be classified as extensive.

Carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. For a current prospectus and, if available, a summary prospectus, containing this and other information,

visit wellsfargofunds.com. Read it carefully before investing.

Wells Fargo Asset Management (WFAM) is a trade name used by the asset management businesses of Wells Fargo & Company. Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company,

provides investment advisory and administrative services for Wells Fargo Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the funds. The funds are distributed by Wells Fargo

Funds Distributor, LLC, Member FINRA, an affiliate of Wells Fargo & Company. 244614-FAFS041 07-16

© 2016 Wells Fargo Funds Management, LLC. All rights reserved.